Introduction

Greetings, Readers!

In the vibrant business landscape of California, safeguarding your enterprise from potential risks is paramount. General Liability Insurance (GLI) emerges as an indispensable tool to shield your company against a myriad of unforeseen circumstances that could jeopardize its stability and reputation. This article delves into the intricacies of California GLI, shedding light on its strengths, weaknesses, and all-encompassing coverage.

Understanding General Liability Insurance

General Liability Insurance serves as a safety net for businesses by providing financial protection against claims alleging bodily injury, property damage, or personal injury arising from your operations, products, or services. It safeguards against legal expenses, settlements, and judgments, ensuring continuity and financial stability amidst adversity.

Strengths of California General Liability Insurance

1. Broad Coverage:

California GLI offers extensive coverage for a wide range of potential liabilities, including bodily injury, property damage, personal injury, advertising injury, and more. This comprehensive protection provides peace of mind and minimizes financial exposure.

2. Legal Defense Costs:

Beyond financial compensation, GLI covers the legal costs incurred in defending against claims, such as attorney fees, court costs, and expert witness expenses. This invaluable protection ensures access to quality legal representation, safeguarding your interests.

3. Third-Party Claims:

GLI primarily protects businesses against claims brought by third parties, such as customers, vendors, or members of the public. It provides a shield against financial ruin resulting from lawsuits or settlements.

Weaknesses of California General Liability Insurance

1. Exclusions:

While GLI offers broad coverage, certain exclusions apply, such as intentional acts, criminal behavior, and contractual liabilities. It’s crucial to understand these limitations to ensure your policy meets your specific needs.

2. Inadequate Limits:

Basic GLI policies may not provide sufficient coverage for businesses facing high-risk activities or potential large-scale claims. It’s essential to assess your risk exposure and consider purchasing additional limits to ensure adequate protection.

3. Deductible Expenses:

GLI policies typically involve a deductible, which is the amount you pay out of pocket before coverage takes effect. A higher deductible lowers your insurance premiums but increases your initial financial responsibility in the event of a claim.

Coverage Details of California General Liability Insurance

| Coverage |

Description |

| Bodily Injury |

Covers expenses related to injuries sustained by third parties due to your business operations, products, or services. |

| Property Damage |

Provides compensation for damage to third-party property caused by your business activities. |

| Personal Injury |

Protects against claims alleging defamation, false arrest, malicious prosecution, or other reputational damage. |

| Advertising Injury |

Covers expenses associated with claims alleging copyright infringement, trademark infringement, or other advertising-related disputes. |

| Medical Payments |

Provides immediate medical coverage for injured third parties, regardless of fault or liability. |

FAQs about California General Liability Insurance

1. What are the mandatory GLI requirements in California?

While GLI is not mandatory in California, it is highly recommended for most businesses to protect against potential liabilities and financial losses.

2. How much GLI coverage do I need?

The appropriate amount of GLI coverage depends on your business activities, size, and risk exposure. It’s advisable to consult with an insurance professional to determine your specific needs.

3. What is the cost of GLI in California?

GLI premiums vary based on factors such as industry, claims history, coverage limits, and deductibles. It’s essential to compare quotes from different insurers to find the most competitive rates.

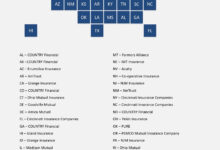

4. How can I obtain GLI in California?

GLI can be purchased through insurance agents, brokers, or directly from insurance companies. It’s recommended to work with licensed and reputable providers to ensure coverage and peace of mind.

5. What are the benefits of having GLI?

GLI provides numerous benefits, including financial protection against claims, coverage for legal expenses, safeguarding of assets, enhanced credibility, and compliance with contractual requirements.

6. What are the consequences of not having GLI?

Operating without GLI leaves your business vulnerable to substantial financial risks. In the event of a claim, you may be personally liable for damages and legal expenses, jeopardizing your business’s stability.

7. Can I add additional coverage to my GLI policy?

Yes, you can enhance your GLI coverage with endorsements or riders that provide protection for specific risks, such as professional liability, cyber liability, or pollution liability.

Conclusion

In today’s competitive business environment, California General Liability Insurance stands as an indispensable tool for protecting your enterprise from a multitude of potential risks. Understanding its strengths, weaknesses, and comprehensive coverage options is paramount in making informed decisions about your insurance needs.

By partnering with a reputable insurance provider and tailoring your GLI policy to your specific requirements, you can safeguard your business, mitigate financial risks, and pave the way for sustainable growth. The peace of mind and enhanced credibility that GLI offers are invaluable assets in the competitive landscape of California.

Disclaimer

This article provides general information about California General Liability Insurance and is not intended as legal or professional advice. It’s recommended to consult with a licensed insurance professional for personalized guidance and to determine the most appropriate coverage for your specific business needs.

Checkout These Recommendations:

- Buy Liability Insurance For Business Protect Your Business from Financial Devastation Introductory Words: Liability insurance is a crucial investment for any business, regardless of its size or industry. It protects the company from financial responsibility…

- General Liability Insurance Vs. Professional… In today's litigious business environment, protecting your assets and reputation is of paramount importance. Two essential insurance policies that can help you achieve this are general liability insurance and professional…

- Nj Small Business Insurance: A Comprehensive Guide Introduction Greetings, esteemed readers! Welcome to our in-depth exploration of New Jersey Small Business Insurance, an essential tool for safeguarding your enterprise against financial risks and unforeseen events. In today's…

- Business Liability and Workers' Compensation… Introduction: In today's competitive business environment, it is crucial for organizations to safeguard themselves and their employees against financial risks and legal liabilities. Business Liability and Workers' Compensation Insurance play…

- Construction Liability Insurance: Protecting Your… Hello, Readers! In the realm of construction, where monumental structures rise and ambitious projects unfold, the risks are as multifaceted as the projects themselves. Unexpected events, accidents, and unforeseen liabilities…

- Cheap Liability Business Insurance: Protect Your… Introductory Words In today's competitive business environment, protecting your company from financial risks is crucial. One essential aspect of this protection is liability insurance, which safeguards your business from legal…

- Professional Liability Insurance: Protecting Your… A Comprehensive Guide to Safeguarding Your Enterprise from Third-Party Claims An Introduction to Professional Liability Insurance: An Essential Shield for Your Business The realm of business is an ever-evolving landscape,…

- Cheap General Liability and Workers' Compensation… Introduction As a business owner, protecting your company against potential risks is crucial. Inadequate insurance coverage can leave you vulnerable to substantial financial losses and legal liabilities. Among the essential…

- Plumbing Liability Insurance: Safeguarding Your… Introduction Greetings, esteemed readers, Welcome to this comprehensive guide to Plumbing Liability Insurance, a crucial safeguard for your plumbing business and its reputation. In an industry where unforeseen risks and…

- General Liability Insurance Online: A Comprehensive Guide Introducing General Liability Insurance Online In a rapidly evolving business landscape, safeguarding your company against potential liabilities is paramount. General liability insurance serves as a crucial protective measure, providing a…

- Lawyers Professional Liability Insurance: Protecting… Prelude Greetings, esteemed readers! Welcome to this comprehensive guide on Lawyers Professional Liability Insurance (LPLI), an indispensable tool in safeguarding your legal practice from unforeseen risks and financial liabilities. This…

- Obtain General Liability Insurance: Protect Your… Introductory Words As a business owner, you face countless risks that could jeopardize your financial stability and reputation. One of the most significant threats is the possibility of being sued…

- Business Liability Insurance: A Comprehensive Guide… Introduction: Understanding the Importance of Business Liability Insurance In today's business landscape, where unexpected events can arise at any moment, having adequate liability insurance is crucial for protecting your business…

- Workers' Compensation and General Liability… Introduction Navigating the complexities of business insurance can be a daunting task, especially when it comes to understanding the differences between workers' compensation and general liability insurance. Both policies play…

- Cheap General Liability Insurance for Small Businesses Navigating the Maze of Coverage Options for Financial Protection As a small business owner, securing comprehensive insurance coverage is paramount to safeguarding your enterprise against potential liabilities and financial losses.…

- Business Liability Insurance Quotes: Safeguarding… Hello Readers, In today's fast-paced business environment, protecting your company against potential liabilities is paramount. Business liability insurance quotes provide you with peace of mind by offering comprehensive coverage that…

- Professional Liability Insurance for Consultants: A… Hello Readers, As consultants, you play a critical role in advising and guiding businesses to success. However, unforeseen incidents or mistakes can arise, exposing you to potential financial liabilities. Professional…

- Cheapest General Liability Insurance for Small Businesses Introduction: Protecting your small business from potential risks is crucial for ensuring its success and longevity. General liability insurance is an indispensable component of any comprehensive business insurance plan, providing…

- General Liability Insurance Companies For Small Business Your Essential Guide to Protecting Your Business As a small business owner, you know that protecting your business from the unexpected is essential. That's where general liability insurance comes in.…

- Company Liability Insurance Plans: Protecting Your… Introductory Words: Operating a business comes with inherent risks, and one of the most significant is the potential for lawsuits. Unforeseen events, accidents, or allegations of negligence can lead to…

- Buy Commercial General Liability Insurance An Essential Protection for Businesses In today's competitive business environment, protecting your enterprise against potential risks is paramount. Commercial General Liability (CGL) insurance is a comprehensive coverage that safeguards businesses…

- Buy Liability Insurance for Small Business: Protect… Introduction: The Importance of Liability Insurance for Small Businesses As a small business owner, it is crucial to understand the significance of liability insurance, which acts as a financial shield…

- Best General Liability Insurance For Small Business:… Securing your small business against unexpected liabilities is crucial for its financial stability and reputation. General liability insurance acts as a safety net, protecting you from third-party claims related to…

- General Liability Insurance Delaware: Protecting… Introduction: The Significance of General Liability Insurance for Delaware Businesses Operating a business in Delaware, known for its thriving corporate environment, entails inherent risks that can potentially jeopardize the financial…

- General Liability Business Insurance Quote: Protect… Navigating the Complexities of Business Liability Insurance Before delving into the specifics of general liability business insurance quotes, it is crucial to grasp the fundamental principles underlying business liability. Business…

- Basic Business Liability Insurance: Protect Your… Introduction Every business, no matter how small, faces risks and liabilities that could potentially damage its financial well-being. From customer injuries to property damage, unexpected events can strike at any…

- Liability Insurance for Small Businesses: A… A Precautionary Investment for Entrepreneurs Hello, esteemed readers. Welcome to our in-depth exploration of liability insurance, an essential safeguard for small businesses. In this comprehensive guide, we unravel the intricacies…

- Online General Liability Insurance: The Ultimate… Part 1: Introduction Online general liability insurance is a vital tool for small businesses seeking to safeguard themselves against a myriad of legal risks. In today's increasingly digitalized business landscape,…

- Liability and Indemnity Insurance: A Comprehensive Guide In today's increasingly litigious society, protecting yourself and your business from potential legal liabilities is paramount. Liability and indemnity insurance policies play a crucial role in providing financial protection against…

- Cheap General Liability Insurance For Small Business An In-depth Guide to Protecting Your Business In the competitive world of small business, having adequate insurance coverage is paramount to safeguard your financial well-being. Among the various types of…