Painting Contractor Insurance: A Comprehensive Guide for Protecting Your Business

Contents

- 1 A Warm Greeting to Our Respected Readers:

- 2 Introduction: Understanding Painting Contractor Insurance

- 3 Strengths of Painting Contractor Insurance

- 4 Weaknesses of Painting Contractor Insurance

- 5 Table: Comprehensive Coverage of Painting Contractor Insurance

- 6 FAQs on Painting Contractor Insurance

- 6.1 What is the most important type of insurance for painting contractors?

- 6.2 How much does painting contractor insurance cost?

- 6.3 What are the coverage limits I should get for painting contractor insurance?

- 6.4 What are the most common exclusions in painting contractor insurance policies?

- 6.5 How can I get a discount on my painting contractor insurance?

- 6.6 What should I do if I have a claim on my painting contractor insurance policy?

- 6.7 How can I find a reputable painting contractor insurance provider?

- 7 Conclusion: Empowering Painting Contractors with Essential Protection

- 8 Closing Words: A Disclaimer for responsible information

A Warm Greeting to Our Respected Readers:

Greetings, esteemed readers! As the world of painting contractors becomes increasingly competitive, you must equip yourself with the knowledge and protection to navigate the complexities of your profession. Painting contractor insurance is paramount in safeguarding your business against financial setbacks and legal liabilities. In this comprehensive article, we will delve into the intricacies of this essential coverage, empowering you to make informed decisions that will secure your business’s future.

Introduction: Understanding Painting Contractor Insurance

Painting contractor insurance is a specialized form of insurance tailored specifically for businesses engaged in painting services. It provides comprehensive coverage against various risks and liabilities that arise from the execution of your professional duties. By obtaining this insurance, you can ensure that your business is financially protected in the event of accidents, property damage, or legal claims.

The coverage provided by painting contractor insurance can vary depending on the policy you choose. However, common coverages typically include:

- General liability insurance: Protects against claims of bodily injury or property damage caused to third parties as a result of your business’s activities.

- Commercial property insurance: Covers the physical assets of your business, such as your painting equipment, tools, and inventory.

- Workers’ compensation insurance: Provides coverage for medical expenses, lost wages, and other benefits to employees who sustain injuries while working for your business.

- Inland marine insurance: Protects your painting equipment and materials while they are being transported.

- Commercial auto insurance: Covers your business-owned vehicles.

Strengths of Painting Contractor Insurance

Enhanced Financial Protection: Painting contractor insurance serves as a financial safety net for your business. It provides coverage for damages and expenses that you might otherwise be liable for, safeguarding your business from potential financial ruin.

Peace of Mind: With painting contractor insurance, you can have peace of mind knowing that your business is protected against unexpected events. This allows you to focus on providing exceptional painting services without the added stress of financial worries.

Legal Compliance: In many jurisdictions, painting contractors are legally required to carry certain types of insurance. Obtaining painting contractor insurance ensures that you are meeting these legal obligations and protecting yourself from potential penalties or lawsuits.

Enhanced Credibility: Having painting contractor insurance demonstrates to potential clients that you are a professional and responsible business. It can enhance your credibility and make you more competitive in the market.

Risk Management: Painting contractor insurance helps you identify and mitigate risks associated with your business. By understanding the coverages provided by your insurance policy, you can take proactive steps to minimize the likelihood of accidents or incidents.

Weaknesses of Painting Contractor Insurance

Premium Costs: Painting contractor insurance can be expensive, especially for businesses with higher-risk profiles. The cost of your premium will vary depending on factors such as the size of your business, the types of coverage you need, and your claims history.

Coverage Gaps: Painting contractor insurance policies may not cover all potential risks associated with your business. It is important to carefully review your policy and identify any potential coverage gaps that may need to be addressed through additional coverage or risk management strategies.

Policy Exclusions: Painting contractor insurance policies typically have certain exclusions, which are situations or events that are not covered by the policy. It is essential to understand these exclusions to avoid unexpected coverage denials.

Claim Disputes: In some cases, insurance companies may deny or dispute claims, especially if they believe the claim is not covered or if they suspect fraud. It is crucial to have a strong understanding of your policy and to work with a reputable insurance provider to minimize the risk of claim disputes.

Policy Complexity: Painting contractor insurance policies can be complex and difficult to understand. It is important to take the time to read and understand your policy or to work with an insurance broker who can explain the coverage to you in plain language.

Table: Comprehensive Coverage of Painting Contractor Insurance

| Coverage Type | Description |

|---|---|

| General Liability Insurance | Protects against claims of bodily injury or property damage caused to third parties as a result of your business’s activities. |

| Commercial Property Insurance | Covers the physical assets of your business, such as your painting equipment, tools, and inventory. |

| Workers’ Compensation Insurance | Provides coverage for medical expenses, lost wages, and other benefits to employees who sustain injuries while working for your business. |

| Inland Marine Insurance | Protects your painting equipment and materials while they are being transported. |

| Commercial Auto Insurance | Covers your business-owned vehicles. |

FAQs on Painting Contractor Insurance

What is the most important type of insurance for painting contractors?

General liability insurance is the most important type of insurance for painting contractors as it protects against claims of bodily injury or property damage caused to third parties as a result of your business’s activities.

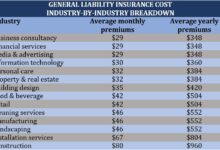

How much does painting contractor insurance cost?

The cost of painting contractor insurance varies depending on factors such as the size of your business, the types of coverage you need, and your claims history. However, you can expect to pay anywhere from a few hundred dollars to several thousand dollars per year.

What are the coverage limits I should get for painting contractor insurance?

The coverage limits you should get for painting contractor insurance depend on the size of your business and the risks you face. However, it is generally recommended to get at least $1 million in general liability coverage.

What are the most common exclusions in painting contractor insurance policies?

The most common exclusions in painting contractor insurance policies include intentional acts, criminal acts, and damages caused by pollution.

How can I get a discount on my painting contractor insurance?

You can get a discount on your painting contractor insurance by bundling your policies, maintaining a good claims history, and taking steps to reduce your risk of accidents and incidents.

What should I do if I have a claim on my painting contractor insurance policy?

If you have a claim on your painting contractor insurance policy, you should immediately notify your insurance company and provide them with all of the relevant details. You should also keep a record of all communication with your insurance company and any expenses you incur as a result of the claim.

How can I find a reputable painting contractor insurance provider?

You can find a reputable painting contractor insurance provider by getting referrals from other contractors, reading online reviews, and comparing quotes from multiple insurance companies.

Conclusion: Empowering Painting Contractors with Essential Protection

Painting contractor insurance is an indispensable tool for protecting your business against financial setbacks and legal liabilities. By understanding the strengths and weaknesses of this coverage, you can make informed decisions that will safeguard your business’s financial future. Remember, investing in painting contractor insurance is an investment in the success of your business.

We encourage you to take proactive steps to secure comprehensive insurance coverage tailored to the specific needs of your painting business. By working with a reputable insurance provider and carefully reviewing your policy, you can minimize risks, protect your assets, and focus on growing your business with confidence.

We extend our gratitude for your time and attention and wish you continued success in all your painting endeavors. As always, we welcome any questions or comments you may have. Please do not hesitate to reach out to us for further assistance or guidance. Together, let us paint a brighter future for the painting contractor industry!

Closing Words: A Disclaimer for responsible information

The information provided in this article is intended for informational purposes only and should not be considered as legal or financial advice. We strongly recommend that you consult with a qualified insurance professional to obtain personalized advice tailored to your specific situation and needs. By accessing this article, you acknowledge that you have read and understood this disclaimer.