Greetings, Readers:

In the dynamic and ever-evolving business landscape, seamless operations and proactive risk management are paramount. Business Office Insurance (BOI) emerges as an indispensable tool to safeguard your enterprise, mitigate potential liabilities, and ensure uninterrupted operations. This comprehensive guide will delve into the intricacies of BOI, outlining its coverage, benefits, limitations, and essential considerations.

Introduction:

Operating a business office entails inherent risks and exposures that can jeopardize the stability and financial well-being of your enterprise. Unforeseen events, employee errors, property damage, and legal disputes can disrupt operations, damage reputation, and deplete financial resources. BOI acts as a safety net, providing a comprehensive layer of protection against these potential calamities.

The coverage provided by BOI extends beyond traditional property and liability insurance. It includes specialized coverages tailored to the unique risks associated with office environments, such as data breaches, cyberattacks, and employment practices liability.

By proactively securing BOI, businesses can minimize financial losses, mitigate legal risks, and ensure the continuity of their operations in the face of unexpected events.

Strengths of Business Office Insurance:

1. Comprehensive Coverage: BOI provides a wide array of coverage options, including property damage, business interruption, liability, and crime insurance. This comprehensive approach ensures that your business is protected from a broad spectrum of potential risks.

2. Peace of Mind: Operating a business without adequate insurance can create a constant state of worry and uncertainty. BOI alleviates these concerns, providing peace of mind and allowing you to focus on growing your business.

3. Legal Compliance: In many jurisdictions, certain types of business insurance, such as workers’ compensation insurance, are mandatory. By securing BOI, you can ensure compliance with applicable laws and avoid potential fines or penalties.

Weaknesses of Business Office Insurance:

1. Potential Exclusions: While BOI provides comprehensive coverage, it may not cover all potential risks. It is important to carefully review the policy to identify any exclusions and consider additional coverage if necessary.

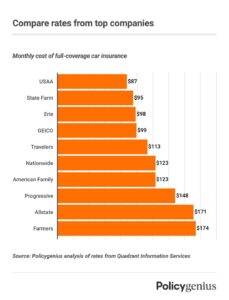

2. Cost: The cost of BOI can vary depending on the size and nature of your business, as well as the level of coverage desired. It is essential to compare quotes from multiple insurers to secure the most cost-effective policy.

3. Complexity: Understanding the intricacies of BOI policies can be challenging. It is advisable to consult with an experienced insurance broker or agent to ensure that you fully understand the coverage and make informed decisions.

Types of Business Office Insurance Coverage:

| Coverage Type |

Description |

| Property Insurance |

Covers physical damage or loss to your office building, equipment, and inventory due to events such as fire, theft, or natural disasters.

|

| Liability Insurance |

Protects your business against claims for bodily injury or property damage caused to third parties due to your business operations.

|

| Business Interruption Insurance |

Provides coverage for lost income and expenses incurred if your business is forced to close due to a covered event.

|

| Crime Insurance |

Covers losses resulting from theft, robbery, or fraud committed by employees or third parties.

|

| Data Breach Insurance |

Protects against financial losses and legal expenses associated with data breaches and cyberattacks.

|

| Employment Practices Liability Insurance |

Covers claims related to wrongful termination, discrimination, and other employment-related matters.

Frequently Asked Questions (FAQs)

1. What is the difference between business office insurance and general liability insurance?

Business office insurance provides comprehensive coverage tailored to the specific risks associated with office environments, while general liability insurance primarily covers bodily injury and property damage claims caused by your business operations.

2. Are there any risks that are not covered by business office insurance?

While BOI provides extensive coverage, certain exclusions may apply. These exclusions typically include intentional acts, war, nuclear events, and acts of terrorism.

3. How much does business office insurance cost?

The cost of BOI varies depending on factors such as the size of your business, location, industry, and level of coverage desired. Obtaining quotes from multiple insurers is essential to find the most cost-effective policy.

4. What are the benefits of having business office insurance?

The benefits of BOI include peace of mind, legal compliance, and financial protection against potential risks. It allows businesses to operate with confidence and focus on growth and profitability.

5. How can I find the right business office insurance policy for my business?

To find the right BOI policy, it is advisable to consult with an experienced insurance broker or agent. They can assess your specific needs, compare quotes, and recommend the most suitable coverage options.

Conclusion:

Business Office Insurance (BOI) is an indispensable tool for businesses of all sizes, providing comprehensive protection against a wide range of risks. By carefully considering the coverage options, strengths, and weaknesses of BOI, businesses can make informed decisions to safeguard their operations and mitigate potential liabilities. Investing in BOI is an act of prudence that can empower businesses to navigate the challenges of the modern business landscape with confidence and resilience.

Call to Action:

Protect your business from unforeseen events and ensure uninterrupted operations with tailored Business Office Insurance. Contact an experienced insurance broker or agent today to discuss your specific needs and find the most cost-effective policy for your enterprise. Take the necessary steps to safeguard your financial well-being and secure the future of your business.

Disclaimer:

The information provided in this article is for general informational purposes only and does not constitute professional advice. It is advisable to seek guidance from qualified professionals before making any decisions regarding business insurance.

|

Checkout These Recommendations:

- Liability and Indemnity Insurance: A Comprehensive Guide In today's increasingly litigious society, protecting yourself and your business from potential legal liabilities is paramount. Liability and indemnity insurance policies play a crucial role in providing financial protection against…

- General Liability Insurance for Startups: A… Introduction In the dynamic and competitive world of startups, where innovation and risk-taking are inherent, protecting your business from potential liabilities is crucial. General liability insurance (GLI) serves as an…

- Business Liability Insurance Providers: A… Introduction In the fast-paced world of business, unforeseen events and potential liabilities can strike at any moment. Business liability insurance plays a crucial role in safeguarding businesses against financial losses…

- Basic General Liability Insurance: Protecting Your… Understanding General Liability Insurance: An Overview As a business owner, you face numerous risks that could lead to lawsuits and substantial financial losses. Basic general liability insurance is a fundamental…

- General Liability Insurance Online: A Comprehensive Guide Introducing General Liability Insurance Online In a rapidly evolving business landscape, safeguarding your company against potential liabilities is paramount. General liability insurance serves as a crucial protective measure, providing a…

- Best Professional Liability Insurance Navigating the Complexities of Professional Protection Greetings, esteemed Readers, As professionals in various disciplines, your reputation and financial well-being are of paramount importance. Unexpected legal claims and lawsuits can threaten…

- Architect Professional Liability Insurance:… Hello, Readers: As architects shape the built environment, their expertise and creativity are invaluable assets. However, the nature of their work exposes them to potential risks and liabilities that can…

- Insurance for LLC Business: Protect Your Enterprise… Greetings, Readers! In today's competitive business landscape, it is imperative for Limited Liability Companies (LLCs) to shield themselves against various risks and financial liabilities. Insurance for LLCs plays a crucial…

- Llc Liability Insurance: The Ultimate Guide to… Hello Readers, Welcome to our comprehensive guide to LLC liability insurance. In this article, we'll delve into the nuances of this essential form of business protection, empowering you to make…

- Cheap Liability Business Insurance: Protect Your… Introductory Words In today's competitive business environment, protecting your company from financial risks is crucial. One essential aspect of this protection is liability insurance, which safeguards your business from legal…

- Electrical Contractor Insurance: Protect Your… Hello Readers, Greetings, readers! In the realm of electrical contracting, safeguarding your business and customers is paramount. Electrical Contractor Insurance (ECI) serves as a safety net, providing financial protection from…

- Understanding Business General Liability Insurance… Introduction Navigating the complexities of running a business in California requires a comprehensive understanding of insurance policies to safeguard against potential risks. Business General Liability Insurance (BGLI) plays a crucial…

- Lawyers Professional Liability Insurance: Protecting… Prelude Greetings, esteemed readers! Welcome to this comprehensive guide on Lawyers Professional Liability Insurance (LPLI), an indispensable tool in safeguarding your legal practice from unforeseen risks and financial liabilities. This…

- Get General Liability Insurance: Protect Your… Introduction General liability insurance is a key component of any business's risk management strategy. It provides protection against third-party lawsuits alleging bodily injury, property damage, or personal injury arising from…

- Professional Liability Insurance Florida: Protect… Introduction Readers, within the competitive business landscape of Florida, professional liability insurance serves as an indispensable safeguard against potential financial disasters. This specialized insurance policy shields professionals and their businesses…

- Get Commercial General Liability Insurance:… Protect Your Livelihood, Safeguard Your Assets: The Imperative of CGL Insurance In the labyrinthine world of business, where unforeseen events lurk like hidden perils, protecting your enterprise from financial ruin…

- Business General Liability Insurance Online: A… Introduction In today's competitive business landscape, protecting your company against potential liabilities is paramount. Business general liability insurance (BGLI) serves as a critical safeguard, providing coverage for a wide range…

- Employee Liability Insurance Quote: Protect Your… Embrace Comprehensive Protection for Employee-Related Incidents Navigating the complexities of business operations demands a proactive approach to risk management. Among the essential safeguards for employers is Employee Liability Insurance, a…

- Liability Contractor Insurance: A Comprehensive… Hello, Readers! In today's dynamic and demanding construction industry, protecting your business and safeguarding your assets is paramount. One crucial aspect of this protection is Liability Contractor Insurance, a specialized…

- General Liability Insurance: A Lifeline for Businesses A Comprehensive Guide to Protecting Your Business from Unforeseen Incidents Greetings, dear readers! Welcome to this in-depth exploration of General Liability Insurance, an essential component of any business's risk management…

- Company Liability Insurance Plans: Protecting Your… Introductory Words: Operating a business comes with inherent risks, and one of the most significant is the potential for lawsuits. Unforeseen events, accidents, or allegations of negligence can lead to…

- Carpenter General Liability Insurance: Safeguarding… As a skilled craftsperson, your carpentry business deserves the utmost protection against potential risks and liabilities. Carpenter General Liability Insurance (GL) serves as a vital safety net, safeguarding you and…

- General Liability Insurance Delaware: Protecting… Introduction: The Significance of General Liability Insurance for Delaware Businesses Operating a business in Delaware, known for its thriving corporate environment, entails inherent risks that can potentially jeopardize the financial…

- Business Insurance for Contractors: Safeguard Your… Introduction Dear Readers, As a contractor, you are entrusted with building, repairing, or maintaining valuable structures and properties. However, unforeseen accidents, property damage, and lawsuits can jeopardize your business and…

- Business Liability and Workers' Compensation… Introduction: In today's competitive business environment, it is crucial for organizations to safeguard themselves and their employees against financial risks and legal liabilities. Business Liability and Workers' Compensation Insurance play…

- Architect Insurance: Protection for Your Visionary Designs Hello, esteemed readers! Welcome to our in-depth exploration of architect insurance, a crucial component for safeguarding your architectural endeavors and mitigating potential risks. This comprehensive guide delves into the intricacies…

- Cheap General Liability Insurance for Small Businesses Navigating the Maze of Coverage Options for Financial Protection As a small business owner, securing comprehensive insurance coverage is paramount to safeguarding your enterprise against potential liabilities and financial losses.…

- Commercial Auto Insurance Quotes: Essential Guide… Introduction Hello, Readers! Embark on a comprehensive exploration of Commercial Auto Insurance Quotes. With the ever-evolving transportation landscape, businesses of all sizes must navigate the complexities of protecting their valuable…

- Munich Re Cyber Insurance: Shielding Businesses from… In today's digital age, where cyber threats lurk around every click and keystroke, having a robust safety net to protect your business is paramount. Enter Munich Re Cyber Insurance, a…

- Liability Insurance for Painting Companies: Protect… Introductory Words Owning a painting company involves inherent risks that can lead to financial losses or legal liabilities. Liability insurance serves as a vital safeguard for painting businesses, providing protection…