Workers Comp Insurance Quote: A Comprehensive Guide

Contents

- 1 Introduction

- 2 Understanding Workers Comp Insurance Quotes

- 3 Factors Influencing Workers Comp Insurance Quotes

- 4 How to Obtain Workers Comp Insurance Quotes

- 5 Comparing Workers Comp Insurance Quotes

- 6 Frequently Asked Questions (FAQs)

- 6.1 1. What is workers’ compensation insurance?

- 6.2 2. What does workers’ compensation insurance cover?

- 6.3 3. Who is required to have workers’ compensation insurance?

- 6.4 4. How much does workers’ compensation insurance cost?

- 6.5 5. How do I obtain workers’ compensation insurance quotes?

- 6.6 6. What information do I need to provide when requesting quotes?

- 6.7 7. How do I compare workers’ compensation insurance quotes?

- 6.8 8. What are some tips for reducing workers’ compensation insurance costs?

- 6.9 9. What happens if I don’t have workers’ compensation insurance?

- 6.10 10. What are the benefits of having workers’ compensation insurance?

- 6.11 11. What are the common exclusions in workers’ compensation insurance policies?

- 6.12 12. What is the difference between workers’ compensation insurance and disability insurance?

- 6.13 13. How can I file a workers’ compensation claim?

- 7 Conclusion

- 8 Disclaimer

Introduction

Hello, Readers! Workers’ compensation insurance is an essential coverage for businesses to protect their employees and themselves from financial liability in the event of a workplace injury or illness. Obtaining a competitive workers’ comp insurance quote is crucial for any business to ensure adequate protection at an affordable cost. This article will provide a comprehensive overview of workers’ comp insurance quotes, explaining their importance, factors influencing them, and how to obtain and compare quotes to make informed decisions.

Workers’ compensation insurance covers medical expenses, lost wages, and rehabilitation costs for employees injured or sickened due to their work. It also provides employers with legal protection against lawsuits from injured employees. Without workers’ comp insurance, businesses could face significant financial risks and potential legal liabilities.

The cost of workers’ comp insurance varies depending on several factors, including the industry, payroll, number of employees, claims history, and location. Obtaining multiple quotes from different insurance providers allows businesses to compare coverage options and rates to secure the best deal.

Understanding Workers Comp Insurance Quotes

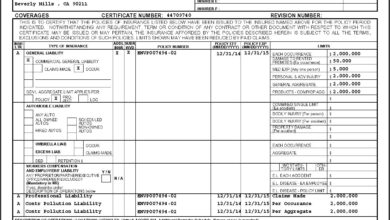

A workers’ comp insurance quote is a document that outlines the coverage and premium costs offered by an insurance provider. It includes essential details such as the policy limits, deductible, coverage exclusions, and premium amount. Understanding the different components of a quote is crucial for businesses to make informed decisions.

The policy limits determine the maximum amount the insurance company will pay for medical expenses, lost wages, and other covered costs. The deductible is the amount the business pays out-of-pocket before the insurance coverage kicks in. Coverage exclusions specify any injuries, illnesses, or situations not covered by the policy.

Factors Influencing Workers Comp Insurance Quotes

Several factors influence the cost of workers’ comp insurance quotes, including:

Industry

Businesses in high-risk industries, such as construction or manufacturing, typically face higher premiums due to the increased likelihood of workplace accidents or illnesses.

Payroll

The total amount of employee wages paid by a business is a significant factor in determining premium costs. Higher payroll results in higher premiums.

Number of Employees

Businesses with a larger workforce generally pay more for workers’ comp insurance as the risk of claims increases with the number of employees.

Claims History

Businesses with a history of frequent or costly claims may face higher premiums as insurance providers assess the potential risk based on past experience.

Location

Workers’ comp insurance rates vary by state, with some states having higher costs due to factors such as medical costs and labor laws.

How to Obtain Workers Comp Insurance Quotes

Obtaining workers’ comp insurance quotes is a straightforward process. Businesses can contact insurance brokers or агенты, who can provide quotes from multiple insurance carriers. Alternatively, businesses can directly reach out to insurance companies to request quotes.

When requesting quotes, it is important to provide accurate information about the business, including the industry, number of employees, payroll, and claims history. This information will enable insurance providers to assess the risk and provide tailored quotes.

Comparing Workers Comp Insurance Quotes

Once multiple quotes have been obtained, businesses should carefully compare them to identify the most suitable option. It is important to evaluate not only the premium costs but also the coverage limits, deductibles, and exclusions.

Businesses should also consider the reputation and financial stability of the insurance providers. Choosing a financially sound insurance company ensures that claims will be processed and paid promptly.

Frequently Asked Questions (FAQs)

1. What is workers’ compensation insurance?

Workers’ compensation insurance is a legal requirement that provides coverage for employees who suffer work-related injuries or illnesses.

2. What does workers’ compensation insurance cover?

Workers’ compensation insurance covers medical expenses, lost wages, rehabilitation costs, and death benefits in the event of a work-related fatality.

3. Who is required to have workers’ compensation insurance?

Most businesses, regardless of size, are required to have workers’ compensation insurance. The specific requirements vary by state.

4. How much does workers’ compensation insurance cost?

The cost of workers’ compensation insurance varies depending on several factors, including industry, payroll, number of employees, claims history, and location.

5. How do I obtain workers’ compensation insurance quotes?

Businesses can obtain workers’ compensation insurance quotes by contacting insurance brokers or agents or directly reaching out to insurance companies.

6. What information do I need to provide when requesting quotes?

When requesting workers’ compensation insurance quotes, businesses need to provide information about their industry, number of employees, payroll, and claims history.

7. How do I compare workers’ compensation insurance quotes?

When comparing workers’ compensation insurance quotes, businesses should evaluate the premium costs, coverage limits, deductibles, exclusions, and reputation of the insurance providers.

8. What are some tips for reducing workers’ compensation insurance costs?

Some tips for reducing workers’ compensation insurance costs include implementing safety programs, providing employee training, and maintaining a good claims history.

9. What happens if I don’t have workers’ compensation insurance?

Businesses that do not have workers’ compensation insurance may face significant financial and legal liabilities in the event of a workplace injury or illness.

10. What are the benefits of having workers’ compensation insurance?

Workers’ compensation insurance provides financial protection for employees and businesses, promotes workplace safety, and helps businesses comply with legal requirements.

11. What are the common exclusions in workers’ compensation insurance policies?

Common exclusions in workers’ compensation insurance policies include injuries or illnesses caused by intentional self-harm, intoxication, or illegal activities.

12. What is the difference between workers’ compensation insurance and disability insurance?

Workers’ compensation insurance covers work-related injuries or illnesses, while disability insurance provides coverage for non-work-related injuries or illnesses that prevent employees from working.

13. How can I file a workers’ compensation claim?

Employees who suffer work-related injuries or illnesses should promptly report the incident to their employer and follow the established procedures for filing a workers’ compensation claim.

Conclusion

Workers’ comp insurance quotes are essential for businesses to secure adequate coverage and protect their employees and themselves from financial risks. By understanding the factors influencing quotes, carefully comparing options, and considering the benefits of workers’ comp insurance, businesses can make informed decisions and obtain the best possible coverage at an affordable cost.

Remember, having adequate workers’ comp insurance is not only a legal requirement but also a wise investment in the safety and well-being of your employees and the financial stability of your business.

We encourage you to take the necessary steps to obtain competitive workers’ comp insurance quotes and ensure that your business is properly protected. By working with reputable insurance providers and implementing effective safety measures, you can create a safe and secure work environment for your employees.

Thank you for reading and taking the time to understand the importance of workers’ comp insurance quotes. We wish you success in obtaining the best possible coverage for your business.

Disclaimer

The information provided in this article is intended for general knowledge and informational purposes only and should not be construed as professional advice. Laws and regulations governing workers’ compensation insurance vary by state, and it is recommended to consult with legal counsel or a qualified insurance professional for specific guidance.