Auto Insurance At Fault Accident

Contents

- 1 Pondering the Profundity of Auto Insurance in At-Fault Accidents

- 2 Determining Fault in Auto Accidents: A Journey Through Legal Labyrinth

- 3 Exploring the Depths of Auto Insurance Coverage for At-Fault Drivers: A Comprehensive Overview

- 4 Navigating the Claims Process: A Step-by-Step Guide for At-Fault Drivers

- 5 Understanding the Strengths and Weaknesses of Auto Insurance for At-Fault Accidents

- 6 Comparative Table: Dissecting Auto Insurance Coverage Options for At-Fault Drivers

- 7 FAQs: Unraveling the Mysteries of Auto Insurance for At-Fault Accidents

- 7.1 What if I am partially at fault for an accident?

- 7.2 What happens if the other driver is uninsured?

- 7.3 What should I do if I am injured in an at-fault accident?

- 7.4 Can I sue the other driver if I am at fault?

- 7.5 What is a deductible?

- 7.6 How can I reduce my insurance premiums after an at-fault accident?

- 7.7 What is the statute of limitations for filing an auto insurance claim?

- 7.8 What if I disagree with the settlement offer from my insurance company?

- 7.9 Can I cancel my auto insurance after an at-fault accident?

- 7.10 What are the consequences of failing to report an at-fault accident?

- 7.11 What if I was cited for a traffic violation?

- 7.12 How can I find an affordable auto insurance policy after an at-fault accident?

- 7.13 What if I am unable to work due to injuries sustained in an at-fault accident?

- 8 Conclusion: Empowering At-Fault Drivers to Navigate the Aftermath of an Accident

Pondering the Profundity of Auto Insurance in At-Fault Accidents

In the complex tapestry of modern life, where vehicles seamlessly weave their way into our daily routines, the specter of auto accidents looms as an unfortunate reality. While these incidents can be jarring and unpredictable, understanding the intricacies of auto insurance coverage in at-fault accidents is paramount to mitigating their impact and ensuring financial protection.

In this comprehensive guide, we delve into the nuances of auto insurance policies, exploring their implications for at-fault drivers. By unraveling the complexities of fault determination, policy provisions, and the claims process, we empower you to navigate the aftermath of an accident with confidence and clarity.

Determining Fault in Auto Accidents: A Journey Through Legal Labyrinth

Establishing fault in auto accidents is a critical step in determining liability and insurance coverage. In most jurisdictions, fault is apportioned based on the concept of negligence, which refers to the failure to exercise reasonable care while operating a vehicle. Determining negligence involves examining factors such as:

- Speeding or reckless driving

- Disobeying traffic laws

- Driving under the influence of alcohol or drugs

- Distracted driving

In some cases, multiple parties may share fault for an accident. Comparative negligence laws assign a percentage of fault to each driver, which can affect the amount of compensation they are entitled to.

Exploring the Depths of Auto Insurance Coverage for At-Fault Drivers: A Comprehensive Overview

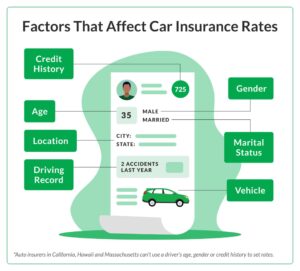

Auto insurance policies provide a safety net for drivers in the event of an accident. However, the extent of coverage available to at-fault drivers varies depending on the policy type and the specific provisions of the contract.

Liability Coverage: A Lifeline for At-Fault Drivers

Liability coverage is the cornerstone of auto insurance, providing protection for at-fault drivers in the event of an accident. It covers bodily injury and property damage caused to others, up to the limits specified in the policy.

In most states, liability coverage is mandatory, ensuring that at-fault drivers have financial recourse to compensate victims for their losses.

Collision Coverage: Safeguarding Your Own Vehicle

Collision coverage provides a layer of protection for the at-fault driver’s own vehicle. It covers damages sustained in an accident, regardless of fault. This coverage is optional but highly recommended, especially for drivers who have financed or leased their vehicle.

Uninsured/Underinsured Motorist Coverage: A Shield Against the Unprepared

Uninsured/underinsured motorist coverage protects at-fault drivers from the financial burden of accidents caused by drivers who are uninsured or underinsured. This coverage can be particularly valuable in states with high rates of uninsured drivers.

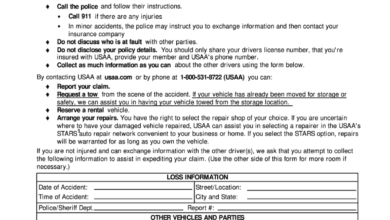

In the aftermath of an at-fault accident, understanding the claims process is essential for recovering compensation and fulfilling insurance obligations. Here is a step-by-step guide to help you navigate this complex system:

- Report the accident to your insurance company promptly.

- Gather evidence, including police reports, medical records, and witness statements.

- Cooperate with your insurance company’s investigation.

- Review the settlement offer carefully and consult with an attorney if necessary.

- Accept or negotiate a settlement that fairly compensates you for your losses.

Understanding the Strengths and Weaknesses of Auto Insurance for At-Fault Accidents

While auto insurance provides a safety net for at-fault drivers, it is important to recognize its limitations:

Strengths:

- Provides financial protection for at-fault drivers and victims.

- Helps to cover medical expenses, property damage, and lost wages.

- Compensates victims for pain and suffering.

Weaknesses:

- Coverage limits may not be sufficient to cover all damages.

- Deductibles can reduce the amount of compensation received.

- At-fault drivers may face increased insurance premiums.

Comparative Table: Dissecting Auto Insurance Coverage Options for At-Fault Drivers

| Coverage Type | Description | Protects Against |

|---|---|---|

| Liability Coverage | Required in most states | Bodily injury and property damage to others |

| Collision Coverage | Optional | Damage to your own vehicle |

| Uninsured/Underinsured Motorist Coverage | Optional | Uninsured or underinsured drivers |

FAQs: Unraveling the Mysteries of Auto Insurance for At-Fault Accidents

-

What if I am partially at fault for an accident?

Comparative negligence laws may reduce your compensation if you share fault for an accident.

-

What happens if the other driver is uninsured?

Uninsured/underinsured motorist coverage can protect you.

-

What should I do if I am injured in an at-fault accident?

Seek medical attention immediately and report the accident to your insurance company.

-

Can I sue the other driver if I am at fault?

Yes, but your damages may be reduced by your percentage of fault.

-

What is a deductible?

A deductible is the amount you pay out of pocket before your insurance coverage begins.

-

Consider defensive driving classes or accident forgiveness programs.

-

What is the statute of limitations for filing an auto insurance claim?

Contact your insurance company or an attorney to determine the time limit for filing a claim.

-

What if I disagree with the settlement offer from my insurance company?

Consult with an attorney to review your options.

-

Can I cancel my auto insurance after an at-fault accident?

No, it is illegal to drive without insurance.

-

What are the consequences of failing to report an at-fault accident?

Your insurance coverage may be canceled, and you could face legal penalties.

-

What if I was cited for a traffic violation?

Your insurance premiums may increase.

-

How can I find an affordable auto insurance policy after an at-fault accident?

Compare quotes from multiple insurance companies and consider increasing your deductible.

-

What if I am unable to work due to injuries sustained in an at-fault accident?

Your auto insurance may provide coverage for lost wages.

Navigating the aftermath of an at-fault accident can be a daunting task, but understanding your auto insurance coverage can provide a sense of security and financial protection. By carefully considering the nuances of fault determination, policy provisions, and the claims process, you can ensure that you are fairly compensated for your losses and that your financial future is safeguard