Car accidents are a common occurrence, and they can be incredibly stressful and expensive. If you’re involved in a car accident, having the right auto insurance coverage can help you protect yourself financially from the costs of repairs, medical bills, and lost wages. In this article, we’ll provide a comprehensive overview of car accident auto insurance, including what it covers, how much it costs, and how to choose the right policy for you.

What Is Car Accident Auto Insurance?

Car accident auto insurance is a type of auto insurance that provides coverage for damages and injuries resulting from a car accident. It can cover the costs of repairs to your vehicle, medical bills for you and your passengers, and lost wages if you’re unable to work due to your injuries. Car accident auto insurance is a legal requirement in most states, and it’s essential for protecting yourself and your finances in the event of an accident.

What Does Car Accident Auto Insurance Cover?

Car accident auto insurance typically covers the following:

Property Damage: This coverage pays for the cost of repairing or replacing your vehicle if it’s damaged in an accident.

Bodily Injury: This coverage pays for medical bills and other expenses related to injuries sustained in an accident, regardless of who is at fault.

Uninsured/Underinsured Motorist Coverage: This coverage provides protection if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient insurance to cover your damages.

Collision Coverage: This coverage pays for the cost of repairing or replacing your vehicle if it’s damaged in a collision with another object, such as a tree or a building.

Comprehensive Coverage: This coverage pays for the cost of repairing or replacing your vehicle if it’s damaged by something other than a collision, such as theft, vandalism, or weather-related events.

How Much Does Car Accident Auto Insurance Cost?

The cost of car accident auto insurance varies depending on a number of factors, including your age, driving history, location, and the type of coverage you choose. The average cost of car insurance in the United States is around $1,500 per year, but it can range from as low as $500 per year to as high as $3,000 per year or more. You can save money on car insurance by shopping around for the best rates and by taking advantage of discounts, such as those for good drivers, multiple policies, and safe vehicles.

How to Choose the Right Car Accident Auto Insurance Policy

When choosing a car accident auto insurance policy, it’s important to consider the following factors:

Coverage Limits: The coverage limits on your policy determine how much money you’re covered for in the event of an accident. It’s important to choose limits that are high enough to protect you from the full cost of damages and injuries.

Deductible: The deductible is the amount of money you have to pay out of pocket before your insurance policy starts to cover the costs of an accident. A higher deductible can lower your monthly premiums, but it also means you’ll have to pay more out of pocket in the event of an accident.

Insurance Company: Choose an insurance company that is financially stable and has a good reputation for customer service. You can read online reviews and talk to your friends and family to get recommendations for insurance companies.

Strengths of Car Accident Auto Insurance

There are many benefits to having car accident auto insurance, including:

Financial Protection: Car accident auto insurance can help you protect yourself from the costs of repairs, medical bills, and lost wages in the event of an accident.

Peace of Mind: Knowing that you have car accident auto insurance can give you peace of mind in the event of an accident. You’ll know that you’re protected financially, and you can focus on getting your life back to normal.

Legal Protection: Car accident auto insurance can help you protect yourself from legal liability in the event of an accident. If you’re found to be at fault for an accident, your insurance company will defend you in court and pay for any damages awarded to the other party.

Weaknesses of Car Accident Auto Insurance

There are also some potential drawbacks to having car accident auto insurance, including:

Cost: Car accident auto insurance can be expensive, especially if you have a high-risk profile.

Limited Coverage: Car accident auto insurance typically doesn’t cover all types of damages and injuries. For example, it doesn’t usually cover damages caused by mechanical failures or acts of nature.

Deductible: You may have to pay a deductible before your insurance coverage kicks in. This can be a significant expense if you’re involved in a minor accident.

Table: Car Accident Auto Insurance Coverage Options

| Coverage | Description |

|—|—|

| Property Damage | Pays for the cost of repairing or replacing your vehicle if it’s damaged in an accident. |

| Bodily Injury | Pays for medical bills and other expenses related to injuries sustained in an accident, regardless of who is at fault. |

| Uninsured/Underinsured Motorist Coverage | Provides protection if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient insurance to cover your damages. |

| Collision Coverage | Pays for the cost of repairing or replacing your vehicle if it’s damaged in a collision with another object, such as a tree or a building. |

| Comprehensive Coverage | Pays for the cost of repairing or replacing your vehicle if it’s damaged by something other than a collision, such as theft, vandalism, or weather-related events. |

FAQs About Car Accident Auto Insurance

1. What happens if I’m involved in an accident and I don’t have car accident auto insurance?

If you’re involved in an accident and you don’t have car accident auto insurance, you could be held financially responsible for the costs of damages and injuries. This could include the cost of repairing or replacing your vehicle, medical bills, and lost wages.

2. What are the penalties for driving without car accident auto insurance?

The penalties for driving without car accident auto insurance vary by state. In most states, you will be fined and your license may be suspended. You may also be required to pay a surcharge to reinstate your license.

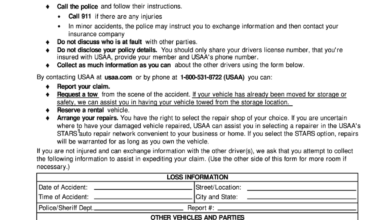

3. What should I do if I’m involved in a car accident?

If you’re involved in a car accident, you should do the following:

Stay calm and check for injuries.

Call the police and report the accident.

Exchange information with the other driver(s) involved in the accident.

Take photos of the accident scene.

Get a copy of the police report.

Contact your insurance company and report the accident.

4. What should I do if I’m injured in a car accident?

If you’re injured in a car accident, you should do the following:

Seek medical attention immediately.

Keep a record of all your medical expenses.

Contact your insurance company and report the accident.

Hire an attorney to help you with your claim.

5. What should I do if I’m being sued after a car accident?

If you’re being sued after a car accident, you should do the following:

Hire an attorney to represent you.

File an answer to the lawsuit.

Gather evidence to support your defense.

Negotiate a settlement with the other party.

6. How can I save money on car accident auto insurance?

There are a number of ways to save money on car accident auto insurance, including:

Shopping around for the best rates.

Taking advantage of discounts, such as those for good drivers, multiple policies, and safe

Checkout These Recommendations:

- How To Lower Auto Insurance After Accident A comprehensive guide to reducing your premiums after an at-fault crash Getting into a car accident can be a stressful and expensive experience. In addition to the immediate costs of…

- Insurance Auto Accident Introduction In the bustling landscape of modern society, where vehicles navigate roads like a ceaseless symphony, the potential for auto accidents looms over us as an ever-present threat. While we…

- Cheap Auto Insurance For Drivers With Accidents Introduction Finding affordable auto insurance after an accident can be a challenge, but it's not impossible. There are a number of insurers who specialize in providing coverage to drivers with…

- Can You Change Auto Insurance After An Accident Insurance Implications and Considerations Navigating the aftermath of an auto accident can be daunting, and one crucial aspect to address is the potential impact on your auto insurance. Understanding your…

- Auto Accident Insurance Attorney Engulfed by the harrowing aftermath of an auto accident, where disarray and uncertainty prevail, the prospect of seeking legal recourse can seem like an overwhelming burden. However, amidst the chaos,…

- Auto Insurance At Fault Accident Pondering the Profundity of Auto Insurance in At-Fault Accidents In the complex tapestry of modern life, where vehicles seamlessly weave their way into our daily routines, the specter of auto…

- Best Auto Insurance For Drivers With Accidents Navigating the Turmoil After an Accident: A Comprehensive Guide for Insurance Coverage In the aftermath of an unexpected car accident, the road ahead can seem daunting. Amidst the physical and…

- Change Auto Insurance After Accident Introduction: Navigating the Complexities of Post-Accident Insurance In the aftermath of a car accident, navigating the insurance process can be a daunting task. One crucial decision that drivers may face…

- Commercial Van Insurance: A Comprehensive Guide for… Introduction Greetings, Readers. In today's competitive business landscape, having a reliable fleet of commercial vans is crucial for efficient operations and customer satisfaction. However, to ensure the safety of your…

- How To Sue An Insurance Company After An Auto Accident Introduction If you've been injured in an auto accident, you may be wondering if you should sue the insurance company. Here's what you need to know about filing a lawsuit…

- Full Coverage Car Insurance: Essential Protection… An Introductory Overview of the Comprehensive Coverage for Your Vehicle In the realm of automotive ownership, navigating the labyrinth of insurance options can be a daunting task. Full coverage car…

- Usaa Auto Insurance Report Accident Reporting an Accident to USAA Auto Insurance: A Comprehensive Guide Introduction In the unfortunate event of an auto accident, promptly reporting it to your insurance company is crucial for ensuring…

- Commercial Auto Insurance Quote: Protect Your… Introduction: The Importance of Securing Commercial Auto Insurance Readers, In today's competitive business environment, it is paramount to prioritize the safety and security of your operations, including your vehicles. Commercial…

- Auto Accident Insurance Coverage Introductory Words In the United States, driving a vehicle is a common necessity for everyday life. With over 280 million registered vehicles on the roads, the chances of being involved…

- Cheap Auto Insurance With Accident Pondering the Paradigms of Cheap Auto Insurance With Accident The realm of auto insurance can be a labyrinth of complexities, particularly for those who have unfortunately encountered accidents on the…

- Auto Insurance Rates After Accident Consequences, Considerations, and Path Forward An automobile accident can be a traumatic and disruptive event, leaving behind emotional distress and financial burdens. Among the many concerns that follow a collision,…

- Accident Forgiveness Auto Insurance Introductory Words Life on the road is unpredictable, and even the most cautious drivers can find themselves in an accident. When the unexpected happens, it's crucial to have auto insurance…

- Auto Insurance With Accidents Auto insurance plays a significant role in protecting individuals from financial liabilities associated with accidents. However, when an accident occurs, navigating the complexities of insurance coverage can be overwhelming. This…

- Best Auto Insurance After An Accident Navigating the Aftermath: A Comprehensive Guide to Auto Insurance Post-Accident In the aftermath of a car accident, navigating insurance complexities can be daunting. Choosing the right insurance company is paramount,…

- Usaa Auto Insurance Accident **Introduction** USAA is a leading provider of auto insurance, offering a comprehensive range of coverage options to meet the needs of its members. In the unfortunate event of an auto…

- Best Auto Insurance After Accident Preamble Having an auto accident can be a traumatic experience, both physically and financially. If you are involved in an accident, it is important to make sure you have the…

- Does Auto Insurance Cover Dui Accidents An In-Depth Analysis of Coverage and Consequences Introduction Driving under the influence (DUI) is a grave offense that endangers both the driver and others sharing the road. The financial repercussions…

- Auto Insurance With Accident Forgiveness An In-Depth Look at One of the Most Important Insurance Coverages Available When it comes to safeguarding yourself and your loved ones on the road, auto insurance is an indispensable…

- Best Auto Insurance For People With Accidents Before You Buy: A Guide to Finding the Right Insurance Finding the right auto insurance can be a daunting task, especially if you have a history of accidents. With so…

- Commercial Box Truck Insurance: A Guide for Business Owners Hello, Readers! Are you an entrepreneur or business owner who relies on commercial box trucks to transport goods, equipment, or materials? If so, obtaining comprehensive commercial box truck insurance is…

- Cheapest Auto Insurance In Florida With Accidents An Expert Guide To Finding The Best Coverage For Your Needs Florida is known for its beautiful beaches, sunny weather, and unfortunately, high auto insurance rates. If you have an…

- Changing Auto Insurance After Accident Introduction: Understanding the Post-Accident Insurance Landscape An automobile accident can be a harrowing experience, leaving you grappling with both physical and financial repercussions. One of the critical decisions you must…

- Best Auto Insurance For Accidents An In-Depth Guide to Protecting Yourself and Your Assets after a Collision In the unfortunate event of an auto accident, having the right insurance coverage is crucial. Not only can…

- Cheap Liability Car Insurance In Indiana An In-Depth Guide to Finding Affordable Coverage Are you looking for cheap liability car insurance in Indiana? If so, you're not alone. Car insurance is a major expense for many…

- First Accident Forgiveness Auto Insurance Introductory Words When it comes to auto insurance, accidents are inevitable. No matter how careful you are behind the wheel, there's always a chance that you'll find yourself in a…