Auto Insurance For People With Accidents

Contents

- 1 Introduction: Understanding Your Options

- 2 Understanding Auto Insurance for People with Accidents: Strengths and Weaknesses

- 3 FAQs on Auto Insurance for People with Accidents

- 3.1 1. How much will my insurance premiums increase after an accident?

- 3.2 2. Can I get a discount on my premiums after a certain period of accident-free driving?

- 3.3 3. What is a surcharge penalty?

- 3.4 4. What is SR-22 insurance?

- 3.5 5. What is non-owner car insurance?

- 3.6 6. What is usage-based insurance?

- 3.7 7. How can I find affordable auto insurance after an accident?

- 4 Conclusion: Empowering Your Future

Introduction: Understanding Your Options

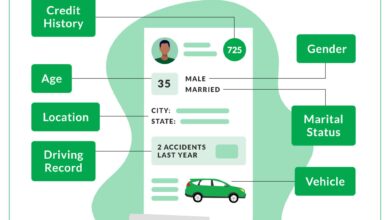

Getting into an accident can be a traumatic and financially draining experience. The aftermath involves not only physical and emotional recovery but also the burden of dealing with vehicle repairs, medical expenses, and potential legal liabilities. For drivers with a history of accidents, securing auto insurance can be particularly challenging and expensive. This article aims to provide a comprehensive guide to auto insurance for people with accidents, addressing key considerations, exploring coverage options, and empowering individuals to make informed decisions.

Navigating the complexities of auto insurance after an accident can be daunting. This article serves as a beacon of guidance, illuminating the path towards financial protection and peace of mind. We delve into the strengths and weaknesses of various insurance options, empowering you to choose the policy that best aligns with your specific needs and circumstances.

This comprehensive guide equips you with essential knowledge and empowers you to navigate the insurance landscape with confidence. We decipher the intricacies of deductibles, coverage limits, and exclusions, ensuring you make well-informed decisions that safeguard your financial well-being.

Understand the intricacies of high-risk insurance policies and the factors that influence their costs. We unravel the complexities of surcharge penalties and explore strategies to mitigate their financial impact.

Discover the nuances of SR-22 insurance, a mandatory requirement for drivers with serious traffic violations. We clarify its purpose, eligibility criteria, and the implications for your insurance coverage.

Penetrate the complexities of non-owner car insurance, an option for individuals who drive borrowed or rented vehicles. We elucidate its coverage parameters and delve into the unique considerations for this type of policy.

Navigate the intricacies of usage-based insurance, a pay-as-you-drive option that rewards responsible driving habits. We decipher its potential benefits and limitations, empowering you to make informed choices.

Understanding Auto Insurance for People with Accidents: Strengths and Weaknesses

Advantages:

Despite the challenges, auto insurance for people with accidents offers several advantages:

Protection from Liability: Insurance safeguards you from financial ruin in the event of an accident where you are deemed responsible for damages or injuries to others. It covers legal expenses, medical bills, and property damage.

Peace of Mind: Knowing that you are financially protected in case of an accident provides peace of mind and allows you to focus on recovery without the added stress of financial worries.

Compliance with the Law: Most states require drivers to carry a minimum level of auto insurance, and having a history of accidents does not exempt you from this requirement.

Drawbacks:

While auto insurance offers protection, it also comes with some drawbacks:

Higher Premiums: Drivers with accidents typically pay higher insurance premiums due to the increased risk they pose to insurance companies. These surcharges can be substantial and may vary depending on the severity and frequency of the accidents.

Limited Coverage: Standard auto insurance policies may not provide sufficient coverage for all potential expenses, especially in cases of major accidents or injuries. Additional coverage options may be necessary but can further increase premiums.

Cancellation or Non-Renewal: In some cases, insurance companies may cancel or refuse to renew policies for drivers with a history of accidents, leaving them uninsured and facing potential legal consequences.

| Coverage Type | What It Covers | Limitations |

|---|---|---|

| Liability | Damages caused to others in an accident | May not cover all damages or injuries |

| Collision | Damages to your own vehicle in an accident | May have a deductible |

| Comprehensive | Damages caused by non-collision events (e.g., theft, vandalism) | May have a deductible |

| Uninsured/Underinsured Motorist | Damages caused by drivers without insurance or with insufficient coverage | May have limits or exclusions |

| Personal Injury Protection (PIP) | Medical expenses and lost wages regardless of fault | May have limits or exclusions |

FAQs on Auto Insurance for People with Accidents

The increase in premiums varies depending on the severity and frequency of the accidents, as well as the insurance company’s underwriting guidelines. Expect a significant increase, particularly for major or multiple accidents.

Yes, most insurance companies offer accident forgiveness programs that remove or reduce surcharges after a period of safe driving. The eligibility criteria and waiting period vary.

3. What is a surcharge penalty?

A surcharge penalty is an additional premium charged to drivers with accidents or traffic violations. The amount and duration of the penalty depend on the severity of the offense.

4. What is SR-22 insurance?

SR-22 insurance is a high-risk auto insurance policy required for drivers convicted of serious traffic violations, such as DUI or reckless driving. It provides proof of financial responsibility and helps reinstate driving privileges.

5. What is non-owner car insurance?

Non-owner car insurance covers individuals who do not own a vehicle but regularly drive borrowed or rented vehicles. It provides liability protection but may have limitations on coverage for physical damage.

6. What is usage-based insurance?

Usage-based insurance (UBI) is a pay-as-you-drive option that monitors driving habits using a device installed in the vehicle. Safe drivers may qualify for lower premiums based on their driving behavior.

7. How can I find affordable auto insurance after an accident?

Consider high-risk insurance providers, compare quotes from multiple companies, bundle insurance policies, and explore usage-based insurance options to potentially lower your premiums.

Conclusion: Empowering Your Future

Securing auto insurance after an accident can be a daunting task, but it is essential for protecting your financial well-being and meeting legal requirements. By understanding the strengths and weaknesses of various insurance options, you can make informed decisions and choose the policy that best suits your needs.

Remember, accidents do not define you. They are learning experiences that can shape your driving habits and make you a more responsible driver. Take advantage of accident forgiveness programs, explore usage-based insurance, and demonstrate your commitment to safe driving.

Navigating the insurance landscape after an accident requires patience, determination, and a willingness to advocate for yourself. By staying informed, comparing options, and seeking professional guidance when needed, you can find affordable and reliable auto insurance that protects your financial future.

Remember, you are not alone. Numerous resources are available to assist you on this journey. Consult with insurance agents, seek legal advice if necessary, and leverage online tools to research and compare insurance options. With perseverance and a proactive approach, you can emerge from this experience stronger and more financially secure.

As you move forward, prioritize safe driving practices, obey traffic laws, and avoid distractions while behind the wheel. Your commitment to responsible driving will not only reduce your risk of future accidents but also lower your insurance premiums over time.

Embrace the opportunity to learn from your experience, grow as a driver, and secure your financial future with comprehensive auto insurance tailored to your specific needs. By taking the necessary steps, you can navigate the road ahead with confidence and peace of mind.

Disclaimer: The information provided in this article is for general knowledge purposes only and should not be construed as professional advice. It is recommended to consult with an insurance professional or licensed attorney for personalized guidance and to ensure compliance with applicable laws and regulations.