Introduction

Every business, no matter how small, faces risks and liabilities that could potentially damage its financial well-being. From customer injuries to property damage, unexpected events can strike at any time, leaving businesses vulnerable to costly lawsuits and claims.

Basic business liability insurance is a crucial tool for protecting businesses from such financial disasters. This type of insurance provides coverage for a wide range of liabilities that businesses may encounter, offering peace of mind and financial security.

In this comprehensive guide, we will delve into the intricacies of basic business liability insurance, exploring its benefits, limitations, and essential coverage details. We will also provide practical tips on how to choose the right policy for your business and ensure adequate protection.

Understanding Basic Business Liability Insurance

Basic business liability insurance, also known as general liability insurance, is a type of insurance that provides coverage for damages and injuries caused by the business’s operations, products, or services.

This insurance protects businesses from financial liability in the event of lawsuits or claims arising from:

- Bodily injuries to customers, employees, or other third parties

- Property damage to customers’ or third parties’ property

- Products liability claims due to defective products

- Advertising injuries, such as defamation, invasion of privacy, or copyright infringement

Strengths of Basic Business Liability Insurance

Basic business liability insurance offers several key benefits for businesses:

- Financial Protection: This insurance provides businesses with financial protection from costly lawsuits and claims, potentially saving them from financial ruin.

- Peace of Mind: Basic business liability insurance gives business owners peace of mind, knowing that they are protected against unexpected events.

- Improved Customer Confidence: Having business liability insurance demonstrates to customers that the business is financially responsible and takes their safety seriously.

Weaknesses of Basic Business Liability Insurance

While basic business liability insurance offers many benefits, it also has certain limitations:

- Limited Coverage: Basic business liability insurance only covers certain types of liabilities. It does not provide coverage for all potential risks a business may face, such as cyber liability or professional liability.

- Deductibles: Most business liability insurance policies have deductibles, which is the amount the business must pay out of pocket before the insurance coverage kicks in.

- Policy Limits: Business liability insurance policies have policy limits, which represent the maximum amount the insurance company will pay for covered claims.

Table: Coverage and Exclusions of Basic Business Liability Insurance

Coverage and Exclusions of Basic Business Liability Insurance

| Coverage |

Exclusions |

| Bodily injuries to customers, employees, or other third parties |

Intentional acts |

| Property damage to customers’ or third parties’ property |

Damage caused by employees |

| Products liability claims due to defective products |

Expected or intended damage |

| Advertising injuries, such as defamation, invasion of privacy, or copyright infringement |

Exclusions specified in policy |

FAQs About Basic Business Liability Insurance

- What is the difference between general liability insurance and professional liability insurance? General liability insurance covers claims arising from the business’s operations, while professional liability insurance covers claims against professionals for errors or omissions in their work.

- Do I need business liability insurance even if I have homeowner’s or renter’s insurance? Yes, business liability insurance provides coverage specifically for business-related risks, which may not be covered under personal insurance policies.

- What is a deductible in business liability insurance? A deductible is the amount the business must pay out of pocket before the insurance coverage kicks in.

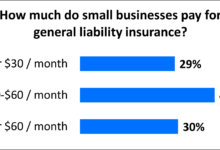

- What factors affect the cost of business liability insurance? The cost of insurance depends on factors such as the nature of the business, the number of employees, the business’s claims history, and the policy limits.

- How can I find the right business liability insurance policy for my business? You can consult with an insurance agent or broker to compare policies and find the one that best meets your specific needs and budget.

Choosing the Right Basic Business Liability Insurance Policy

Choosing the right basic business liability insurance policy for your business is essential to ensure adequate protection. Here are some key considerations:

- Assess Your Risks: Identify the potential liabilities your business faces and prioritize them based on their likelihood and severity.

- Determine Coverage Limits: Determine the maximum amount of coverage you need to protect your business from financial ruin.

- Consider Your Deductible: Choose a deductible that you can afford to pay out of pocket while still maintaining sufficient coverage.

- Review Exclusions: Carefully review the policy exclusions to ensure that the coverage meets your specific needs.

- Compare Quotes: Obtain quotes from multiple insurance providers to compare coverage and pricing.

Conclusion

Basic business liability insurance is a cornerstone of risk management for businesses of all sizes. This insurance provides financial protection against unexpected events, offering peace of mind and safeguarding businesses from financial disasters.

By understanding the strengths, weaknesses, and coverage details of basic business liability insurance, businesses can make informed decisions about the appropriate level of protection for their unique needs.

Investing in comprehensive business liability insurance is a wise move that can protect your business from unforeseen risks and secure its financial future.

Disclaimer

The information provided in this article is for educational purposes only and does not constitute legal or financial advice. It is recommended to consult with a qualified insurance professional or legal counsel for specific guidance tailored to your business’s needs.

Checkout These Recommendations:

- Lawyers Professional Liability Insurance: Protecting… Prelude Greetings, esteemed readers! Welcome to this comprehensive guide on Lawyers Professional Liability Insurance (LPLI), an indispensable tool in safeguarding your legal practice from unforeseen risks and financial liabilities. This…

- Workers' Compensation and General Liability… Introduction Navigating the complexities of business insurance can be a daunting task, especially when it comes to understanding the differences between workers' compensation and general liability insurance. Both policies play…

- Get Professional Liability Insurance: Protect… Protect Your Business from Financial Risks Professional Liability Insurance provides vital financial protection for your business against claims of negligence or errors and omissions. As a business owner, you are…

- Cheap Liability Insurance for Small Businesses Protecting Your Business with Affordable Coverage Liability insurance is essential for small businesses, providing financial protection against claims of negligence or wrongdoing. However, finding affordable coverage can be challenging. This…

- Pressure Washing Insurance: A Comprehensive Guide… Hello Readers, In the competitive world of pressure washing, protecting your business from unforeseen risks is paramount. Pressure washing insurance, a specialized form of coverage, provides a safety net against…

- Purchase Liability Insurance For Small Business Introductory Words A small business owner's life is full of risks and uncertainties. One of the biggest risks is the potential for lawsuits. If someone is injured or their property…

- Buy Liability Insurance for Small Business: Protect… Introduction: The Importance of Liability Insurance for Small Businesses As a small business owner, it is crucial to understand the significance of liability insurance, which acts as a financial shield…

- Business Office Insurance: A Vital Shield for Your… Greetings, Readers: In the dynamic and ever-evolving business landscape, seamless operations and proactive risk management are paramount. Business Office Insurance (BOI) emerges as an indispensable tool to safeguard your enterprise,…

- General Liability Insurance Instant Quote: Protect… An Overview of General Liability Insurance Instant Quote General liability insurance is a type of business insurance policy that protects businesses from claims of bodily injury or property damage caused…

- Basic General Liability Insurance: Protecting Your… Understanding General Liability Insurance: An Overview As a business owner, you face numerous risks that could lead to lawsuits and substantial financial losses. Basic general liability insurance is a fundamental…

- Get Commercial General Liability Insurance:… Protect Your Livelihood, Safeguard Your Assets: The Imperative of CGL Insurance In the labyrinthine world of business, where unforeseen events lurk like hidden perils, protecting your enterprise from financial ruin…

- Best Workers' Comp Insurance for Small Business A Comprehensive Guide to Protecting Your Business and Employees Hello, Readers! As a small business owner, you know the importance of protecting your employees and your business. Workers' compensation insurance…

- Insurance for LLC Business: Protect Your Enterprise… Greetings, Readers! In today's competitive business landscape, it is imperative for Limited Liability Companies (LLCs) to shield themselves against various risks and financial liabilities. Insurance for LLCs plays a crucial…

- Carpentry General Liability Insurance: A… Introduction: The Importance of Carpentry General Liability Insurance Carpentry is a demanding and hazardous profession that poses a myriad of risks. From accidental property damage to bodily injuries, contractors face…

- Inexpensive Business Liability Insurance: Protect… An Introduction to Essential Coverage for Small Businesses As a small business owner, you're faced with countless challenges. One of the most pressing is protecting your business from unexpected events…

- General Liability and Workers' Comp Insurance: A… Hello, Readers: In this increasingly litigious world, businesses of all sizes need comprehensive insurance coverage to protect themselves from unforeseen events. General liability and workers' compensation insurance are two essential…

- Business Insurance For Photographers: Shield Your Craft Howdy, Esteemed Readers! Welcome to our comprehensive guide, where we illuminate the crucial topic of business insurance for photographers. As a photographer, your equipment and creations are your livelihood. We…

- Retail Business Insurance: A Comprehensive Guide to… Hello, Readers, In today's competitive business landscape, protecting your retail enterprise from unforeseen events is crucial for long-term success. Retail business insurance provides a safety net to mitigate risks and…

- Nj Small Business Insurance: A Comprehensive Guide Introduction Greetings, esteemed readers! Welcome to our in-depth exploration of New Jersey Small Business Insurance, an essential tool for safeguarding your enterprise against financial risks and unforeseen events. In today's…

- Protect Your Small Business from Cyber Threats: The… In the ever-evolving digital landscape, small businesses are increasingly vulnerable to cyberattacks. From phishing scams to malware infections, the threats are endless. While it may seem like only large corporations…

- Small Business Liability Insurance: Protect Your… Introduction As an entrepreneur in Georgia, protecting your business from potential liabilities is crucial. Small business liability insurance provides a safety net against financial losses resulting from accidents, lawsuits, and…

- Lowest General Liability Insurance: Affordable… General liability insurance (GLI) is a crucial form of coverage that protects businesses from financial losses arising from lawsuits alleging bodily injury, property damage, or personal injury. While GLI is…

- Coventry Life Insurance: A Comprehensive Guide Introducing Coventry Life Insurance Hello, esteemed readers! Welcome to our in-depth exploration of Coventry Life Insurance, a renowned provider in the insurance industry. This comprehensive article aims to provide you…

- Understanding Business General Liability Insurance… Introduction Navigating the complexities of running a business in California requires a comprehensive understanding of insurance policies to safeguard against potential risks. Business General Liability Insurance (BGLI) plays a crucial…

- Small Business Professional Liability Insurance: A… Introduction Hello, readers! In today's competitive market, small businesses face numerous challenges. One often overlooked but critically important area is professional liability insurance. This comprehensive guide will delve into the…

- Small Business General Liability Insurance Near Me:… Introduction Owning a small business is an exciting and rewarding endeavor, but it also comes with potential risks and liabilities. One crucial way to safeguard your business is by obtaining…

- General Liability Insurance For Small Business Near… Introductory Words: Unveiling the Significance of General Liability Insurance for Small Businesses In the labyrinthine landscape of commerce, every small business owner embarks on a perilous journey fraught with unforeseen…

- Best Rate Auto Insurance: Comprehensive Coverage at… Introduction In a world where financial security and peace of mind are paramount, securing reliable auto insurance is essential. Best Rate Auto Insurance stands out as an exceptional provider, offering…

- Sue Insurance Company Auto Accident Introduction: Unveiling the Hidden Details Auto accidents can be traumatic and overwhelming, leaving victims with physical injuries, emotional distress, and financial burdens. Navigating the aftermath of such an event requires…

- Workers' Compensation and General Liability… Navigating the Labyrinth of Business Risks In today's competitive business landscape, protecting your company from unforeseen events is paramount. Workers' compensation and general liability insurance are essential tools that provide…