Delving into the World of Professional Liability Insurance

In today’s litigious society, professionals face an ever-increasing risk of being sued for alleged negligence or errors in their work. Professional liability insurance, also known as errors and omissions (E&O) insurance, provides a crucial safety net for professionals by protecting them against financial losses and reputational damage resulting from such claims.

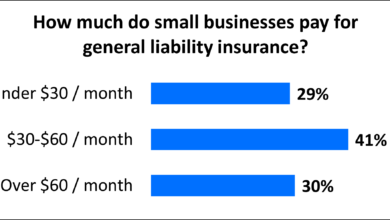

However, the cost of professional liability insurance can vary significantly depending on several factors, including the profession, the size of the business, and the coverage limits. For professionals operating on a budget, low-cost professional liability insurance can be an attractive option. This article explores the strengths and weaknesses of low-cost professional liability insurance, providing valuable insights for professionals seeking affordable protection.

Introduction

Understanding Professional Liability Insurance

Professional liability insurance is a type of insurance designed specifically for professionals who provide services to clients. It covers claims alleging negligence, errors, or omissions in the professional’s work. This coverage extends to legal defense costs, settlements, and damages awarded to the claimant.

Importance of Professional Liability Insurance

Professional liability insurance is essential for protecting professionals against financial risks and reputational damage. Without adequate coverage, a single lawsuit can result in substantial expenses and potentially jeopardize the professional’s business. Even if the professional is ultimately found not liable, the legal costs alone can be financially crippling.

Benefits of Low-Cost Professional Liability Insurance

Low-cost professional liability insurance offers several benefits for professionals on a budget. It provides peace of mind by protecting against financial losses in the event of a lawsuit. Additionally, it can enhance the professional’s credibility and competitiveness in the marketplace.

Strengths of Low-Cost Professional Liability Insurance

Affordability

The primary strength of low-cost professional liability insurance is its affordability. Compared to traditional policies, these policies offer lower premiums, making them more accessible for professionals with limited financial resources.

Tailored Coverage Options

Low-cost professional liability insurance policies can be tailored to meet the specific needs of the professional. This customization ensures that the coverage provided aligns with the professional’s risk profile and budget.

Coverage Limits

Despite the lower premiums, low-cost professional liability insurance policies often provide adequate coverage limits. These limits may not be as high as traditional policies, but they are typically sufficient to protect against most claims.

Weaknesses of Low-Cost Professional Liability Insurance

Limited Coverage

One potential drawback of low-cost professional liability insurance is that it may provide more limited coverage compared to traditional policies. Coverage exclusions and limitations may apply, which could leave the professional exposed to certain risks.

Exclusions and Limitations

Low-cost professional liability insurance policies may include exclusions for certain types of claims, such as intentional acts or gross negligence. Additionally, coverage limits may be capped at a certain amount, which could be insufficient to cover all damages in the event of a large claim.

Insufficient Defense Costs

Low-cost professional liability insurance policies may provide lower limits for defense costs, which could limit the professional’s ability to mount a strong legal defense. This could increase the likelihood of an unfavorable outcome and higher financial exposure.

Table: Comparison of Low-Cost Professional Liability Insurance Policies

| Feature |

Policy A |

Policy B |

| Premium |

$500 annually |

$750 annually |

| Coverage Limits |

$1 million per claim/$2 million aggregate |

$2 million per claim/$4 million aggregate |

| Deductibles |

$1,000 |

$500 |

| Exclusions |

Willful misconduct, intentional acts |

Willful misconduct, intentional acts, bodily injury |

FAQs

Q: What is the difference between low-cost and traditional professional liability insurance?

Low-cost professional liability insurance typically offers lower premiums but may have more limited coverage, exclusions, and lower coverage limits compared to traditional policies.

Q: How do I determine if low-cost professional liability insurance is right for me?

Consider your risk profile, budget, and coverage needs. If you operate a low-risk business and have limited financial resources, low-cost professional liability insurance may be a suitable option.

Q: What are the key factors that affect the cost of professional liability insurance?

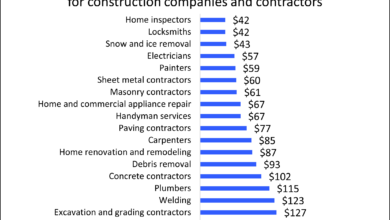

Profession, business size, claims history, coverage limits, and deductibles all influence the cost of professional liability insurance.

Conclusion

Making an Informed Decision

Choosing the right professional liability insurance policy is crucial for protecting your business and your financial well-being. Carefully consider the strengths and weaknesses of low-cost professional liability insurance before making a decision.

Tailoring Coverage to Your Needs

When selecting a policy, it is essential to tailor coverage to your specific risk profile and budget. Consult with an insurance professional to determine the optimal coverage limits, deductibles, and exclusions for your situation.

Protecting Your Business and Reputation

Professional liability insurance, whether low-cost or traditional, is an invaluable asset for professionals. It provides a safety net against financial losses and reputational damage, empowering you to focus on delivering exceptional services to your clients.

Closing Words

In today’s competitive business environment, professionals must prioritize protecting their businesses and reputations against potential liabilities. Low-cost professional liability insurance offers a viable solution for professionals seeking affordable protection. By carefully assessing your needs and selecting an appropriate policy, you can safeguard your financial well-being and continue to operate with confidence.

Checkout These Recommendations:

- Plumbing Liability Insurance: Safeguarding Your… Introduction Greetings, esteemed readers, Welcome to this comprehensive guide to Plumbing Liability Insurance, a crucial safeguard for your plumbing business and its reputation. In an industry where unforeseen risks and…

- The Ultimate Guide to Beauty Salon Insurance Introduction Hello, esteemed readers! Welcome to the comprehensive guide to beauty salon insurance, an indispensable shield for your thriving business. In today's competitive beauty industry, safeguarding your salon and protecting…

- Attorney Professional Liability Insurance:… Introduction As a legal professional, you face unique risks that can threaten your livelihood. From legal malpractice claims to allegations of negligence, even the most reputable attorneys can find themselves…

- Business Professional Liability Insurance:… Introduction: In the competitive landscape of today's business world, protecting your assets and reputation is paramount. Business Professional Liability Insurance (BPLI) serves as a vital shield for professionals, offering financial…

- General Liability Insurance for Carpenters:… Introduction Carpentry is a skilled trade that requires years of experience and training. While the work is rewarding, it also comes with inherent risks. Accidents can happen at any time,…

- Building Contractor Liability Insurance: The Ultimate Guide As a building contractor, you're responsible for ensuring the safety of your workers and clients. However, even the most careful contractors can face accidents and lawsuits. That's where building contractor…

- Professional Liability Insurance Online: A Guide for… Introduction Professional liability insurance, also known as errors and omissions (E&O) insurance, is a critical coverage for professionals who provide services to clients. It protects them against financial losses resulting…

- Small Business General Liability Insurance Near Me:… Introduction Owning a small business is an exciting and rewarding endeavor, but it also comes with potential risks and liabilities. One crucial way to safeguard your business is by obtaining…

- Protect Your Online Presence: A Comprehensive Guide… In this digital age, businesses are increasingly vulnerable to cyber threats, from data breaches to ransomware attacks, leaving them facing financial losses, reputational damage, and legal liability. Msp Cyber Insurance…

- Business Insurance: Protect Your Livelihood with… Introduction In the competitive realm of business, safeguarding your enterprise from unforeseen risks is paramount. Among the most critical risks to consider is professional liability, which can arise from errors,…

- Professional Liability Insurance for Consultants: A… Hello Readers, As consultants, you play a critical role in advising and guiding businesses to success. However, unforeseen incidents or mistakes can arise, exposing you to potential financial liabilities. Professional…

- Best Professional Liability Insurance Navigating the Complexities of Professional Protection Greetings, esteemed Readers, As professionals in various disciplines, your reputation and financial well-being are of paramount importance. Unexpected legal claims and lawsuits can threaten…

- Liability Contractor Insurance: A Comprehensive… Hello, Readers! In today's dynamic and demanding construction industry, protecting your business and safeguarding your assets is paramount. One crucial aspect of this protection is Liability Contractor Insurance, a specialized…

- New York Professional Liability Insurance: A… In the bustling metropolis of New York City, where countless professionals navigate the complexities of business, the need for robust professional liability insurance cannot be overstated. This specialized insurance policy…

- Small Business Professional Liability Insurance: A… Introduction Hello, readers! In today's competitive market, small businesses face numerous challenges. One often overlooked but critically important area is professional liability insurance. This comprehensive guide will delve into the…

- Buy Business Liability Insurance: Protect Your… Introductory Words In the dynamic and often unforgiving world of business, protecting your enterprise from potential liabilities is paramount. Unexpected events, accidents, or lawsuits can arise at any moment, threatening…

- Contractor Business Insurance: A Comprehensive Guide… Hello Readers, As a contractor, you know the importance of protecting your business against unforeseen events. Contractor business insurance is an essential tool for mitigating risks and ensuring the continuity…

- Attorney Malpractice Insurance Defining Attorney Malpractice Insurance Attorney malpractice insurance, also known as professional liability insurance, protects lawyers and law firms from financial losses resulting from claims of negligence or errors in their…

- Cheapest Professional Liability Insurance What is Professional Liability Insurance? Professional liability insurance, also known as errors and omissions insurance (E&O), is a type of insurance that protects businesses from claims of negligence, errors, or…

- Professional Indemnity and Liability Insurance:… Welcome to our comprehensive guide to professional indemnity and liability insurance. In today's litigious society, it is more important than ever for businesses to protect themselves from potential claims. This…

- Lawyer Malpractice Insurance: A Vital Safeguard for… Introduction Greetings, Readers, The legal profession demands a high level of integrity, competence, and care. However, even the most skilled attorneys are susceptible to making mistakes that can have severe…

- Company Liability Insurance Plans: Protecting Your… Introductory Words: Operating a business comes with inherent risks, and one of the most significant is the potential for lawsuits. Unforeseen events, accidents, or allegations of negligence can lead to…

- Nj Small Business Insurance: A Comprehensive Guide Introduction Greetings, esteemed readers! Welcome to our in-depth exploration of New Jersey Small Business Insurance, an essential tool for safeguarding your enterprise against financial risks and unforeseen events. In today's…

- Workers' Compensation and General Liability… Introduction Navigating the complexities of business insurance can be a daunting task, especially when it comes to understanding the differences between workers' compensation and general liability insurance. Both policies play…

- Business Liability Insurance Providers: A… Introduction In the fast-paced world of business, unforeseen events and potential liabilities can strike at any moment. Business liability insurance plays a crucial role in safeguarding businesses against financial losses…

- Get General Liability Insurance: Protect Your… Introduction General liability insurance is a key component of any business's risk management strategy. It provides protection against third-party lawsuits alleging bodily injury, property damage, or personal injury arising from…

- Professional Liability Insurance Florida: Protect… Introduction Readers, within the competitive business landscape of Florida, professional liability insurance serves as an indispensable safeguard against potential financial disasters. This specialized insurance policy shields professionals and their businesses…

- Buying Liability Insurance For A Business When you own a business, you are responsible for the safety of your customers, employees, and property. If someone is injured or their property is damaged due to your negligence,…

- Professional Liability Insurance for Paralegals What Is Professional Liability Insurance? As a paralegal, you provide essential support to attorneys and clients, handling various legal tasks. However, even with the utmost care, mistakes and errors can…

- Best Public Liability Insurance In today's increasingly litigious society, it's more important than ever to protect your business from financial ruin in the event of a lawsuit. Public liability insurance is a type of…