In today’s increasingly litigious society, protecting yourself and your business from potential legal liabilities is paramount. Liability and indemnity insurance policies play a crucial role in providing financial protection against claims of negligence, property damage, and personal injuries.

Liability insurance safeguards individuals or organizations from legal claims alleging that their actions or omissions caused harm to others. Indemnity insurance, on the other hand, extends coverage to cover the costs and expenses incurred in defending and settling such claims.

Understanding the intricacies of liability and indemnity insurance is essential for making informed decisions about your insurance needs. This comprehensive guide will delve into the key aspects of these policies, highlighting their advantages and limitations, and providing invaluable insights for navigating the complexities of today’s insurance landscape.

Introduction

Liability and indemnity insurance provide a crucial safety net for individuals and businesses facing potential legal exposure. These policies offer financial protection against claims of negligence, property damage, and personal injuries, shielding policyholders from crippling financial burdens and preserving their assets.

In an era marked by increased litigation and escalating legal costs, liability and indemnity insurance have become indispensable risk management tools. They provide peace of mind, allowing individuals and organizations to pursue their activities with confidence, knowing that they have a financial backstop in place to mitigate the financial consequences of unforeseen events.

However, it is essential to recognize that liability and indemnity insurance are not a panacea. They possess inherent strengths and weaknesses, and their applicability varies depending on the specific risks and circumstances.

Strengths and Weaknesses of Liability and Indemnity Insurance

Strengths:

1. Financial Protection: Liability and indemnity insurance provide a substantial financial cushion against legal liabilities. They cover the costs of defending and settling claims, including legal fees, court costs, and settlements or judgments.

2. Peace of Mind: These policies offer peace of mind by mitigating the financial risks associated with potential legal claims. Individuals and businesses can operate with greater confidence, knowing that they have a safety net in place to safeguard their assets.

3. Risk Management: Liability and indemnity insurance are integral components of effective risk management strategies. They help organizations identify and manage potential liabilities, reducing the likelihood of costly legal disputes.

Weaknesses:

1. Limited Coverage: Liability and indemnity insurance policies have limitations and exclusions, meaning certain types of claims may not be covered. It is crucial to carefully review the policy terms and seek professional advice to ensure adequate coverage.

2. Defense Costs: Even if a claim is ultimately dismissed or won, the costs of defending the suit can be substantial. Liability and indemnity insurance may not cover all defense costs, and policyholders may be required to contribute financially.

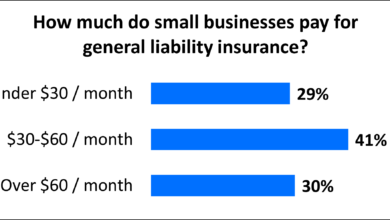

3. Premium Costs: Liability and indemnity insurance can be expensive, especially for high-risk businesses or individuals. Premiums can vary significantly based on factors such as the level of coverage, industry, and claims history.

Comprehensive Table of Liability and Indemnity Insurance

| Policy Type |

Coverage |

Exclusions |

Benefits |

Limitations |

| General Liability Insurance |

Bodily injury, property damage, personal injury |

Intentional acts, criminal acts, pollution |

Broad coverage, cost-effective |

Exclusions, limited coverage for certain risks |

| Professional Liability Insurance |

Errors and omissions, negligence |

Intentional misconduct, criminal acts |

Protects professionals from claims of malpractice |

Specific to certain professions, higher premiums |

| Product Liability Insurance |

Defects in products causing injury or damage |

Intentional acts, product recalls |

Covers manufacturers, distributors, retailers |

High premiums, complex coverage |

| Directors and Officers Liability Insurance |

Acts or omissions of directors and officers |

Fraud, criminal acts, intentional misconduct |

Protects corporate leadership from personal liability |

High premiums, limited coverage for certain acts |

| Indemnity Insurance |

Reimburses costs incurred in defending or settling claims |

Contractual obligations, third-party claims |

Provides additional protection beyond liability insurance |

Limited coverage, may not cover all expenses |

FAQs on Liability and Indemnity Insurance

1. What is the difference between liability and indemnity insurance?

Liability insurance covers legal claims made against you, while indemnity insurance reimburses you for costs incurred in defending or settling those claims.

2. Do I need both liability and indemnity insurance?

It depends on your specific risks and circumstances. Liability insurance is often considered a basic necessity, while indemnity insurance provides additional protection.

3. What are common exclusions in liability insurance policies?

Typical exclusions include intentional acts, criminal acts, and pollution. It is crucial to carefully review your policy for a complete list of exclusions.

4. How much liability insurance do I need?

The amount of liability insurance you need varies based on factors such as your industry, the size of your business, and your potential exposure to risks.

5. What are the key terms to understand in an indemnity insurance policy?

Important terms include “indemnify,” “hold harmless,” and “defense costs.” Consulting an insurance professional is recommended for a thorough understanding.

Conclusion

Liability and indemnity insurance are essential risk management tools that provide financial protection against the potentially devastating consequences of legal liabilities. Understanding their strengths and weaknesses, as well as the different types of coverage available, is crucial for making informed decisions about your insurance needs.

Carefully evaluate your specific risks and consult with an experienced insurance professional to determine the most appropriate coverage for your situation. By implementing a comprehensive insurance plan, you can mitigate financial risks, preserve your assets, and operate with greater confidence in today’s increasingly litigious environment.

Remember, liability and indemnity insurance are not mere commodities but essential investments in your financial well-being. They provide peace of mind, allowing you to focus on your core activities and pursue your goals without the constant worry of potential legal liabilities.

Taking proactive steps to protect yourself and your business from financial ruin is a wise investment in your future. Embrace the power of liability and indemnity insurance, and secure your financial stability against unforeseen events.

Closing Words: A Disclaimer

This guide provides general information about liability and indemnity insurance and should not be construed as professional advice. Insurance policies and coverage vary significantly, and it is highly recommended to consult with an experienced insurance professional to obtain personalized advice tailored to your specific needs.

By understanding the intricacies of liability and indemnity insurance, you can make informed decisions about your coverage and protect yourself against potential financial risks. Remember, these policies are an essential component of a comprehensive risk management strategy, providing peace of mind and safeguarding your financial well-being.

Checkout These Recommendations:

- General Liability and Errors and Omissions… Preamble: Understanding the Importance of Insurance in Today's Business Environment In the modern business landscape, navigating the complexities of legal liabilities and professional responsibilities is paramount. As businesses grow and…

- USAA General Liability Insurance: Comprehensive… Introduction: A Comprehensive Guide to USAA General Liability Insurance In today's increasingly litigious society, protecting oneself and one's assets from potential lawsuits is paramount. General liability insurance serves as a…

- Photography Liability Insurance: Shielding Your… A Comprehensive Guide for Photographers Hello, esteemed readers! Photography is an art form that captures the beauty of moments and preserves them for eternity. However, as photographers, we often find…

- New York Professional Liability Insurance: A… In the bustling metropolis of New York City, where countless professionals navigate the complexities of business, the need for robust professional liability insurance cannot be overstated. This specialized insurance policy…

- Workers' Compensation and General Liability… Introduction Navigating the complexities of business insurance can be a daunting task, especially when it comes to understanding the differences between workers' compensation and general liability insurance. Both policies play…

- Nj Small Business Insurance: A Comprehensive Guide Introduction Greetings, esteemed readers! Welcome to our in-depth exploration of New Jersey Small Business Insurance, an essential tool for safeguarding your enterprise against financial risks and unforeseen events. In today's…

- Cyber Insurance Liability: Mitigating Risks in the… In today's digital landscape, where cyberattacks lurk around every virtual corner, protecting your business from the crippling consequences of a data breach is paramount. Cyber insurance serves as a vital…

- Retail Business Insurance: A Comprehensive Guide to… Hello, Readers, In today's competitive business landscape, protecting your retail enterprise from unforeseen events is crucial for long-term success. Retail business insurance provides a safety net to mitigate risks and…

- Cheap General Liability and Workers' Compensation… Introduction As a business owner, protecting your company against potential risks is crucial. Inadequate insurance coverage can leave you vulnerable to substantial financial losses and legal liabilities. Among the essential…

- Business Liability Insurance: A Comprehensive Guide… Introduction: Understanding the Importance of Business Liability Insurance In today's business landscape, where unexpected events can arise at any moment, having adequate liability insurance is crucial for protecting your business…

- Protect Your Online Presence: A Comprehensive Guide… In this digital age, businesses are increasingly vulnerable to cyber threats, from data breaches to ransomware attacks, leaving them facing financial losses, reputational damage, and legal liability. Msp Cyber Insurance…

- Buy Liability Insurance for Small Business: Protect… Introduction: The Importance of Liability Insurance for Small Businesses As a small business owner, it is crucial to understand the significance of liability insurance, which acts as a financial shield…

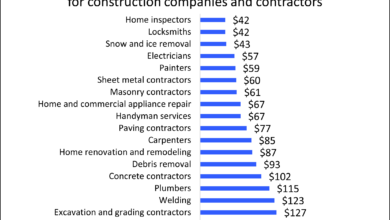

- Home Improvement Contractor Liability Insurance:… Introduction As a home improvement contractor, you face numerous risks that could lead to costly lawsuits. Liability insurance is essential to protect your business from financial ruin in the event…

- Cyber Healthcare Insurance: Protecting Health Data… In today's rapidly evolving digital world, protecting your health goes beyond traditional check-ups and doctor's appointments. With the rise of interconnected medical devices, electronic health records, and remote health monitoring,…

- Business Liability Insurance Providers: A… Introduction In the fast-paced world of business, unforeseen events and potential liabilities can strike at any moment. Business liability insurance plays a crucial role in safeguarding businesses against financial losses…

- Employee Liability Insurance Quote: Protect Your… Embrace Comprehensive Protection for Employee-Related Incidents Navigating the complexities of business operations demands a proactive approach to risk management. Among the essential safeguards for employers is Employee Liability Insurance, a…

- Gallagher Cyber Insurance: Protecting Your Business… In today's digital realm, where cyber threats lurk around every corner, it's crucial to safeguard your business against potential online attacks. Enter Gallagher Cyber Insurance, a comprehensive solution designed specifically…

- Cheap General Liability Insurance For Small Business An In-depth Guide to Protecting Your Business In the competitive world of small business, having adequate insurance coverage is paramount to safeguard your financial well-being. Among the various types of…

- Llc Liability Insurance: The Ultimate Guide to… Hello Readers, Welcome to our comprehensive guide to LLC liability insurance. In this article, we'll delve into the nuances of this essential form of business protection, empowering you to make…

- Business Liability and Workers' Compensation… Introduction: In today's competitive business environment, it is crucial for organizations to safeguard themselves and their employees against financial risks and legal liabilities. Business Liability and Workers' Compensation Insurance play…

- General Liability Insurance For Construction Business A Comprehensive Guide for Protecting Your Company As a construction business owner, you face a wide range of risks that can potentially lead to significant financial losses. General liability insurance…

- Business Professional Liability Insurance Business Professional Liability Insurance: The Ultimate Protection for Your Business Introduction Greetings, esteemed readers! Welcome to an in-depth exploration of Business Professional Liability Insurance (BPLI), a cornerstone of financial protection…

- Commercial Cyber Liability Insurance: Protecting… In today's digital realm, where cyber threats lurk at every corner, protecting your business from the perils of the online world is paramount. Commercial Cyber Liability Insurance acts as your…

- Architect Insurance: Protection for Your Visionary Designs Hello, esteemed readers! Welcome to our in-depth exploration of architect insurance, a crucial component for safeguarding your architectural endeavors and mitigating potential risks. This comprehensive guide delves into the intricacies…

- Buy Business Liability Insurance: Protect Your… Introductory Words In the dynamic and often unforgiving world of business, protecting your enterprise from potential liabilities is paramount. Unexpected events, accidents, or lawsuits can arise at any moment, threatening…

- Insurance for Cyber Security: Protecting Your… In the ever-evolving digital landscape, cybersecurity has become paramount. With the increasing frequency and sophistication of cyberattacks, businesses and individuals alike are facing heightened risks to their data, systems, and…

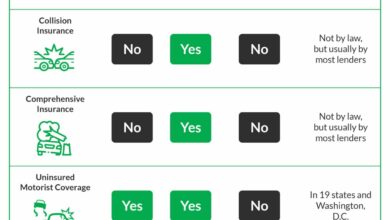

- Commercial Vehicle Insurance: The Essential Guide to… Hello, Readers! Commercial vehicles are a crucial part of many businesses, enabling the transportation of goods and services. However, operating these vehicles comes with inherent risks, which is why commercial…

- Liability Insurance for Small Businesses: A… A Precautionary Investment for Entrepreneurs Hello, esteemed readers. Welcome to our in-depth exploration of liability insurance, an essential safeguard for small businesses. In this comprehensive guide, we unravel the intricacies…

- Automobile Insurance: A Comprehensive Guide to… In today's fast-paced world, automobiles have become an indispensable part of our daily lives. They provide convenience, mobility, and freedom, enabling us to travel, commute, and fulfill various personal and…

- General Liability Insurance: A Lifeline for Businesses A Comprehensive Guide to Protecting Your Business from Unforeseen Incidents Greetings, dear readers! Welcome to this in-depth exploration of General Liability Insurance, an essential component of any business's risk management…