Introductory Words

In today’s competitive business landscape, professionals face an array of risks that can jeopardize their livelihoods. From errors and omissions to negligence and malpractice, these risks can lead to costly lawsuits and financial ruin. Professional liability insurance (PLI) serves as a crucial safeguard for professionals, providing financial protection against such claims and safeguarding their assets and reputation.

Affordable PLI is essential for professionals in various industries, including accountants, lawyers, doctors, architects, engineers, consultants, and more. By shielding these individuals and businesses from financial liability, PLI empowers them to focus on their expertise and deliver exceptional services without the fear of catastrophic financial consequences.

This comprehensive guide will delve into the ins and outs of affordable professional liability insurance, empowering professionals with the knowledge they need to make informed decisions and protect their businesses effectively. We will explore the strengths and weaknesses of PLI, its various forms, coverage options, and key considerations when selecting the right policy.

What is Professional Liability Insurance?

Definition

Professional liability insurance, also known as errors and omissions (E&O) insurance, is a type of liability insurance designed to protect professionals from financial losses resulting from claims of negligence, errors, or omissions in their professional services.

Coverage

PLI typically covers legal defense costs, settlements, and judgments arising from claims of:

- Errors or omissions in services

- Negligence or breach of duty

- Misrepresentation or misadvice

li>Defamation or slander

Benefits of Affordable Professional Liability Insurance

Protection from Lawsuits

The primary benefit of affordable PLI is the financial protection it provides against costly lawsuits. Without PLI, professionals would be personally liable for any damages awarded in lawsuits, which could potentially bankrupt them and their businesses.

Defense Costs

Even if a professional is found not liable, the legal costs associated with defending against lawsuits can be substantial. PLI covers these expenses, ensuring that professionals can focus on their work without the financial burden of legal battles.

Reputation Protection

Lawsuits, even frivolous ones, can damage a professional’s reputation. PLI helps mitigate this by providing defense and crisis management services, protecting the professional’s reputation and credibility.

Peace of Mind

Knowing that they have adequate PLI coverage gives professionals peace of mind. They can conduct their work with confidence, knowing that they are protected financially in the event of an unforeseen incident.

Limitations of Affordable Professional Liability Insurance

Coverage Exclusions

PLI policies typically exclude coverage for certain types of claims, such as intentional misconduct, fraud, or criminal acts. It is crucial to carefully review the policy to understand what is and is not covered.

Policy Limits

PLI policies have coverage limits, which determine the maximum amount the insurance company will pay out in the event of a claim. Professionals should ensure that the limits are sufficient to protect their assets and business.

Premium Costs

The cost of PLI premiums can vary depending on factors such as the industry, level of risk, and policy limits. Professionals should consider the cost relative to the potential financial risks they face.

Other Considerations

Before selecting an affordable PLI policy, professionals should consider the following factors:

- Deductible: The amount that the professional is responsible for paying before the insurance coverage kicks in.

- Endorsements: Additional coverage options that can extend the policy’s coverage to specific risks.

- Claims History: The insurance company may consider the professional’s claims history when determining rates and coverage.

Types of Professional Liability Insurance

Occurrence vs. Claims-Made Policies

PLI policies can be either occurrence-based or claims-made. Occurrence-based policies cover claims arising from incidents that occur during the policy period, regardless of when the claim is filed. Claims-made policies only cover claims that are made and reported to the insurer during the policy period.

Individual vs. Business Policies

Professionals can purchase individual PLI policies or business policies that cover the entire business entity. Business policies may provide broader coverage, including protection for employees and contractors.

Choosing the Right Affordable Professional Liability Insurance Policy

Assess Your Risk

The first step is to assess the professional’s risk exposure by considering the nature of the services they provide, their industry, and the potential for claims. This will help determine the appropriate level and type of coverage needed.

Compare Quotes

Obtain quotes from multiple insurers to compare coverage options, premiums, and policy details. Professionals should also consider the reputation and financial stability of each insurer.

Understand the Policy

Thoroughly review the policy’s coverage, exclusions, and terms and conditions. Professionals should consult with an insurance agent or attorney if they have any questions or concerns.

Conclusion

Affordable professional liability insurance is an essential investment for professionals seeking financial protection against the risks they face in their daily operations. By understanding the strengths and weaknesses of PLI, carefully considering their options, and choosing the right policy, professionals can mitigate financial risks and safeguard their businesses.

Investing in affordable PLI empowers professionals to conduct their work with confidence and peace of mind, knowing that they are protected against the potential financial consequences of errors, omissions, or negligence. By taking proactive steps to protect their assets and reputation, professionals can focus on delivering exceptional services and growing their businesses without the fear of financial ruin.

Disclaimer: This article is for general informational purposes only and does not constitute professional advice. Professionals should consult with an insurance broker or financial advisor to discuss their specific needs and obtain tailored recommendations.

Checkout These Recommendations:

- Purchase Professional Liability Insurance Understanding Professional Liability Insurance Professional liability insurance, also known as errors and omissions (E&O) insurance, is a type of insurance that protects businesses and professionals from claims of negligence, errors,…

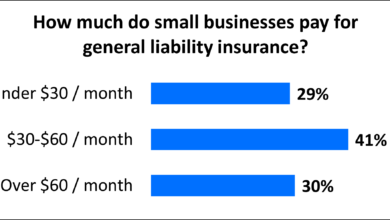

- General Liability Insurance For Small Business Near… Introductory Words: Unveiling the Significance of General Liability Insurance for Small Businesses In the labyrinthine landscape of commerce, every small business owner embarks on a perilous journey fraught with unforeseen…

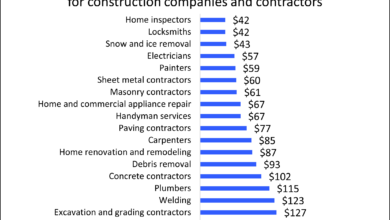

- Liability Insurance for Painting Companies: Protect… Introductory Words Owning a painting company involves inherent risks that can lead to financial losses or legal liabilities. Liability insurance serves as a vital safeguard for painting businesses, providing protection…

- Plumbing Liability Insurance: Safeguarding Your… Introduction Greetings, esteemed readers, Welcome to this comprehensive guide to Plumbing Liability Insurance, a crucial safeguard for your plumbing business and its reputation. In an industry where unforeseen risks and…

- Business Liability Insurance Providers: A… Introduction In the fast-paced world of business, unforeseen events and potential liabilities can strike at any moment. Business liability insurance plays a crucial role in safeguarding businesses against financial losses…

- Cheapest Professional Liability Insurance What is Professional Liability Insurance? Professional liability insurance, also known as errors and omissions insurance (E&O), is a type of insurance that protects businesses from claims of negligence, errors, or…

- Business Insurance: Protect Your Livelihood with… Introduction In the competitive realm of business, safeguarding your enterprise from unforeseen risks is paramount. Among the most critical risks to consider is professional liability, which can arise from errors,…

- Independent Consultant Liability Insurance: Protect… An Essential Safeguard for Independent Professionals As an independent consultant, you are the cornerstone of your business. Your expertise, reputation, and ability to deliver exceptional results are your most valuable…

- Llc Liability Insurance: The Ultimate Guide to… Hello Readers, Welcome to our comprehensive guide to LLC liability insurance. In this article, we'll delve into the nuances of this essential form of business protection, empowering you to make…

- Public Liability Insurance: The Best Protection for… As a business owner, you are responsible for providing a safe environment for your customers, employees, and visitors. If someone is injured or their property is damaged due to your…

- General Liability and Errors and Omissions… Preamble: Understanding the Importance of Insurance in Today's Business Environment In the modern business landscape, navigating the complexities of legal liabilities and professional responsibilities is paramount. As businesses grow and…

- Best Professional Liability Insurance for Small Businesses A Guide to Understanding and Choosing the Right Coverage Introduction Starting and running a small business involves numerous challenges. Small business owners often have to juggle multiple tasks and responsibilities,…

- Life Coach Professional Liability Insurance:… A Comprehensive Guide for Life Coaches As a life coach, you provide guidance and support to your clients as they navigate personal and professional challenges. While your goal is to…

- Small Business General Liability Insurance Near Me:… Introduction Owning a small business is an exciting and rewarding endeavor, but it also comes with potential risks and liabilities. One crucial way to safeguard your business is by obtaining…

- Professional Liability Insurance for Consultants: A… Hello Readers, As consultants, you play a critical role in advising and guiding businesses to success. However, unforeseen incidents or mistakes can arise, exposing you to potential financial liabilities. Professional…

- Buy Business Liability Insurance: Protect Your… Introductory Words In the dynamic and often unforgiving world of business, protecting your enterprise from potential liabilities is paramount. Unexpected events, accidents, or lawsuits can arise at any moment, threatening…

- Cheap Professional Liability Insurance: A… Introduction In today's litigious society, it is more important than ever for professionals to protect themselves from potential lawsuits. Professional liability insurance, also known as errors and omissions insurance, can…

- Best Professional Liability Insurance Navigating the Complexities of Professional Protection Greetings, esteemed Readers, As professionals in various disciplines, your reputation and financial well-being are of paramount importance. Unexpected legal claims and lawsuits can threaten…

- Consultant Liability Insurance: Safeguarding Your Practice A Comprehensive Guide for Consultants Introduction Welcome, esteemed readers, to an in-depth exploration of Consultant Liability Insurance. In today's competitive business landscape, consultants play a crucial role in providing expert…

- Get Commercial General Liability Insurance:… Protect Your Livelihood, Safeguard Your Assets: The Imperative of CGL Insurance In the labyrinthine world of business, where unforeseen events lurk like hidden perils, protecting your enterprise from financial ruin…

- Small Business Liability Insurance: Protect Your… Introduction As an entrepreneur in Georgia, protecting your business from potential liabilities is crucial. Small business liability insurance provides a safety net against financial losses resulting from accidents, lawsuits, and…

- Cheap Small Business Liability Insurance Everything You Need to Know Introduction As a small business owner, you're always looking for ways to save money. But when it comes to liability insurance, you shouldn't cut corners.…

- Low Cost Professional Liability Insurance Delving into the World of Professional Liability Insurance In today's litigious society, professionals face an ever-increasing risk of being sued for alleged negligence or errors in their work. Professional liability…

- Liability Insurance for Independent Consultants: A… Preamble: Unveiling the Significance of Liability Insurance for Independent Consultants As an independent consultant, you possess a unique set of skills and expertise that empowers you to provide valuable services…

- Nj Small Business Insurance: A Comprehensive Guide Introduction Greetings, esteemed readers! Welcome to our in-depth exploration of New Jersey Small Business Insurance, an essential tool for safeguarding your enterprise against financial risks and unforeseen events. In today's…

- Basic General Liability Insurance: Protecting Your… Understanding General Liability Insurance: An Overview As a business owner, you face numerous risks that could lead to lawsuits and substantial financial losses. Basic general liability insurance is a fundamental…

- Buy Professional Liability Insurance: Protect Your… As a professional, you provide valuable services to your clients. But what happens if you make a mistake that causes them financial loss? You could be sued for damages, and…

- Professional Liability Insurance: Protecting Your… A Comprehensive Guide to Safeguarding Your Enterprise from Third-Party Claims An Introduction to Professional Liability Insurance: An Essential Shield for Your Business The realm of business is an ever-evolving landscape,…

- Commercial General Liability Insurance Oklahoma: A… Introduction: Understanding Commercial General Liability Insurance Operating a business in Oklahoma exposes you to various risks that can lead to financial losses and legal complications. Commercial General Liability (CGL) insurance…

- Buy Liability Insurance for Small Business: Protect… Introduction: The Importance of Liability Insurance for Small Businesses As a small business owner, it is crucial to understand the significance of liability insurance, which acts as a financial shield…