Protecting Your Business from Financial Risks

Every business faces potential risks that could threaten its financial stability. From lawsuits to data breaches, there are a myriad of events that can lead to costly liabilities. Professional Business Liability Insurance (PBLI) is a critical tool that can help protect your company from these potential financial disasters.

Introduction

PBLI is a type of insurance that provides coverage for businesses in the event that they are sued by a client or other party for alleged negligence, errors, or omissions in the performance of their professional services. This coverage can help to protect your business from the costs of defending a lawsuit, as well as any damages or settlements that may be awarded to the plaintiff.

It is important to note that PBLI is not the same as general liability insurance, which covers businesses for bodily injury and property damage. PBLI is specifically designed to protect businesses from the financial risks associated with professional services, such as legal advice, financial planning, or consulting.

Strengths of Professional Business Liability Insurance

There are several key strengths to consider when it comes to PBLI:

Broad Coverage: PBLI policies provide broad coverage for a wide range of professional services, including legal advice, financial planning, consulting, and many others. This coverage can help to protect your business from a variety of potential lawsuits.

Cost-Effective Protection: PBLI is a relatively inexpensive way to protect your business from the potentially devastating costs of a lawsuit. The premiums for PBLI are typically much lower than the potential costs of defending a lawsuit and paying damages.

Peace of Mind: PBLI can provide peace of mind to business owners by knowing that they are financially protected in the event of a lawsuit. This can allow you to focus on running your business without having to worry about the financial consequences of a potential lawsuit.

Weaknesses of Professional Business Liability Insurance

While PBLI offers many benefits, it is important to be aware of its potential weaknesses:

Exclusions: PBLI policies typically contain a number of exclusions, which are events or circumstances that are not covered by the policy. It is important to carefully review the policy exclusions before purchasing a policy to make sure that your business is adequately protected.

Limits of Coverage: PBLI policies have limits of coverage, which are the maximum amount of money that the insurer will pay out in the event of a claim. It is important to choose a policy with a limit of coverage that is sufficient to protect your business from the potential risks that it faces.

Defense Costs: PBLI policies typically cover the costs of defending a lawsuit, but they do not cover the costs of any settlements or damages that may be awarded to the plaintiff. It is important to be aware of this potential financial exposure before purchasing a PBLI policy.

Table: Professional Business Liability Insurance Coverage

The following table provides a summary of the key coverage provided by PBLI policies:

| Coverage |

Description |

| Errors and Omissions |

Coverage for claims of negligence, errors, or omissions in the performance of professional services |

| Breach of Contract |

Coverage for claims that the business has breached a contract with a client |

| Misrepresentation |

Coverage for claims that the business has made false or misleading statements to a client |

| Libel and Slander |

Coverage for claims that the business has made defamatory statements about a client or third party |

| Defense Costs |

Coverage for the costs of defending a lawsuit, including attorney fees, court costs, and expert witness fees |

FAQs about Professional Business Liability Insurance

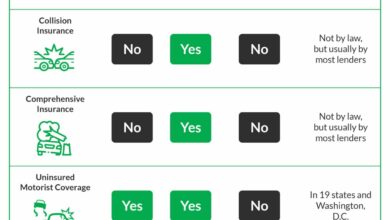

What is the difference between PBLI and general liability insurance?

General liability insurance covers businesses for bodily injury and property damage, while PBLI covers businesses for professional errors, omissions, and negligence.

Do I need PBLI if I have general liability insurance?

Yes, you may still need PBLI even if you have general liability insurance. PBLI provides coverage for specific risks associated with professional services that are not covered by general liability insurance.

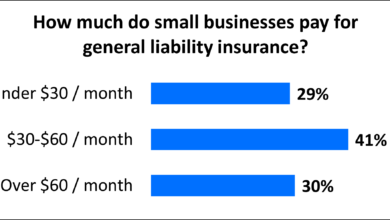

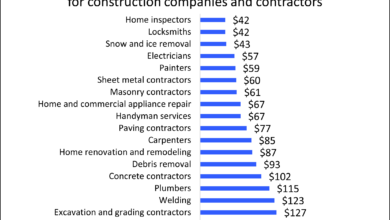

How much does PBLI cost?

The cost of PBLI varies depending on the size of your business, the type of services you provide, and the limits of coverage you choose. It is important to get quotes from multiple insurers to find the best rate.

What are the benefits of PBLI?

PBLI provides peace of mind, financial protection, and broad coverage for a wide range of professional services.

What are the drawbacks of PBLI?

PBLI can be expensive, and it may not cover all risks associated with your business.

How can I get PBLI?

You can get PBLI from an insurance agent or broker. It is important to compare quotes from multiple insurers to find the best coverage and price.

Conclusion

PBLI is an essential tool that can help to protect your business from the financial risks associated with professional services. By understanding the strengths and weaknesses of PBLI, you can make an informed decision about whether this type of insurance is right for your business.

Call to Action

If you are a business owner, we encourage you to contact an insurance agent or broker today to learn more about PBLI and get a quote. This important coverage can help to protect your business from the financial consequences of a lawsuit and provide you with peace of mind.

Disclaimer

The information provided in this article is for general informational purposes only and should not be construed as legal or financial advice. It is important to consult with a qualified professional before making any decisions about purchasing insurance.

Checkout These Recommendations:

- Small Business Liability Insurance: Protect Your… Introduction As an entrepreneur in Georgia, protecting your business from potential liabilities is crucial. Small business liability insurance provides a safety net against financial losses resulting from accidents, lawsuits, and…

- Buy Professional Liability Insurance: Protect Your… As a professional, you provide valuable services to your clients. But what happens if you make a mistake that causes them financial loss? You could be sued for damages, and…

- Independent Consultant Liability Insurance: Protect… An Essential Safeguard for Independent Professionals As an independent consultant, you are the cornerstone of your business. Your expertise, reputation, and ability to deliver exceptional results are your most valuable…

- Lawyers Professional Liability Insurance: Protecting… Prelude Greetings, esteemed readers! Welcome to this comprehensive guide on Lawyers Professional Liability Insurance (LPLI), an indispensable tool in safeguarding your legal practice from unforeseen risks and financial liabilities. This…

- Life Coach Professional Liability Insurance:… A Comprehensive Guide for Life Coaches As a life coach, you provide guidance and support to your clients as they navigate personal and professional challenges. While your goal is to…

- Florida Business Insurance: A Comprehensive Guide… Hello Readers, In today's competitive business landscape, protecting your enterprise against unforeseen financial risks is paramount. Florida Business Insurance plays a vital role in safeguarding your company's assets, ensuring its…

- Best Professional Liability Insurance Navigating the Complexities of Professional Protection Greetings, esteemed Readers, As professionals in various disciplines, your reputation and financial well-being are of paramount importance. Unexpected legal claims and lawsuits can threaten…

- Get General Liability Insurance: Protect Your… Introduction General liability insurance is a key component of any business's risk management strategy. It provides protection against third-party lawsuits alleging bodily injury, property damage, or personal injury arising from…

- Protecting Michigan Businesses from Cyber Threats: A… Listen up, folks! The digital age has brought a fantastic world of convenience, but it's also opened the door to a whole new kind of threat: cybercrimes. From phishing scams…

- Business Insurance: Protect Your Livelihood with… Introduction In the competitive realm of business, safeguarding your enterprise from unforeseen risks is paramount. Among the most critical risks to consider is professional liability, which can arise from errors,…

- Cheap Professional Liability Insurance: A… Introduction In today's litigious society, it is more important than ever for professionals to protect themselves from potential lawsuits. Professional liability insurance, also known as errors and omissions insurance, can…

- General Liability Insurance for Carpenters:… Introduction Carpentry is a skilled trade that requires years of experience and training. While the work is rewarding, it also comes with inherent risks. Accidents can happen at any time,…

- Get Professional Liability Insurance: Protect… Protect Your Business from Financial Risks Professional Liability Insurance provides vital financial protection for your business against claims of negligence or errors and omissions. As a business owner, you are…

- Small Business General Liability Insurance Near Me:… Introduction Owning a small business is an exciting and rewarding endeavor, but it also comes with potential risks and liabilities. One crucial way to safeguard your business is by obtaining…

- General Liability Insurance Vs. Professional… In today's litigious business environment, protecting your assets and reputation is of paramount importance. Two essential insurance policies that can help you achieve this are general liability insurance and professional…

- Professional Liability Insurance for Paralegals What Is Professional Liability Insurance? As a paralegal, you provide essential support to attorneys and clients, handling various legal tasks. However, even with the utmost care, mistakes and errors can…

- Cheapest Professional Liability Insurance What is Professional Liability Insurance? Professional liability insurance, also known as errors and omissions insurance (E&O), is a type of insurance that protects businesses from claims of negligence, errors, or…

- Photography Business Insurance: The Ultimate Guide… Welcome to our comprehensive guide to Photography Business Insurance. In the rapidly evolving digital landscape, where visual content reigns supreme, photographers face unique risks and liabilities. Photography Business Insurance is…

- Cheap Business Liability Insurance Coverage:… In today's competitive business landscape, protecting your enterprise against potential risks is paramount. Business liability insurance coverage offers a cost-effective solution to mitigate unexpected liabilities, safeguarding your company's financial stability…

- Professional Liability Insurance Law Firm: Your… Navigating the Complexities of Professional Liability: An Introduction In today's litigious society, professionals of all types—from doctors to lawyers to accountants—face an ever-increasing risk of being sued. A single allegation…

- Commercial Cyber Liability Insurance: Protecting… In today's digital realm, where cyber threats lurk at every corner, protecting your business from the perils of the online world is paramount. Commercial Cyber Liability Insurance acts as your…

- Small Business Professional Liability Insurance: A… Introduction Hello, readers! In today's competitive market, small businesses face numerous challenges. One often overlooked but critically important area is professional liability insurance. This comprehensive guide will delve into the…

- Corporate Cyber Insurance: A Shield against Digital… In this age of rampant cyberattacks, businesses of all sizes are facing increasing threats to their digital infrastructure. With the rise of remote work and the proliferation of connected devices,…

- Nj Small Business Insurance: A Comprehensive Guide Introduction Greetings, esteemed readers! Welcome to our in-depth exploration of New Jersey Small Business Insurance, an essential tool for safeguarding your enterprise against financial risks and unforeseen events. In today's…

- Caregiver Liability Insurance: Essential Protection… Introductory Words Caregivers play a vital role in society, providing essential support and assistance to individuals who need help with daily tasks, medical care, or emotional support. However, caregivers often…

- Liability Insurance for Small Businesses: A… A Precautionary Investment for Entrepreneurs Hello, esteemed readers. Welcome to our in-depth exploration of liability insurance, an essential safeguard for small businesses. In this comprehensive guide, we unravel the intricacies…

- Cheap General Liability Insurance For Llc The Ultimate Guide Looking for cheap general liability insurance for your LLC? You're in the right place. In this guide, we'll explain everything you need to know about general liability…

- Great American Cyber Insurance: Comprehensive… In the ever-evolving digital landscape, protecting your business from the threats lurking in the cyber realm is paramount. Great American Cyber Insurance steps up to the plate with a tailored…

- Insurance for LLC Business: Protect Your Enterprise… Greetings, Readers! In today's competitive business landscape, it is imperative for Limited Liability Companies (LLCs) to shield themselves against various risks and financial liabilities. Insurance for LLCs plays a crucial…

- Architect Professional Liability Insurance:… Hello, Readers: As architects shape the built environment, their expertise and creativity are invaluable assets. However, the nature of their work exposes them to potential risks and liabilities that can…