Buckle up, legal eagles! In a digital realm where data breaches lurk like shadows, it’s time to amp up your cybersecurity defense. Cyber insurance for law firms is no longer an optional nice-to-have; it’s an essential safeguard that can shield your practice from the devastating blows of data breaches and cyberattacks. Picture this: a smooth-running firm grinds to a halt as sensitive client information takes a joyride through the dark web. The consequences can be dire, not just for your reputation but also your bottom line. But fear not, for cyber insurance can be your trusty sidekick in this digital battleground. By providing tailored coverage and expert guidance, it can help you mitigate risks, respond to incidents with finesse, and keep your hard-earned reputation shining brightly.

Coverage Options for Cyber Security Insurance Policies

- Data Breach Liability: Covers costs associated with responding to and mitigating data breaches, including legal fees, forensic investigations, and public relations expenses.

- Cyber Extortion: Provides reimbursement for ransoms paid to cybercriminals to prevent the release of sensitive information or disruption of business operations.

- System Damage and Business Interruption: Compensates law firms for financial losses resulting from cyberattacks that damage their computer systems or disrupt business operations.

- Network Security Liability: Covers claims for negligence or errors in network design, maintenance, or security measures that result in data breaches or other cyber incidents.

- Privacy Liability: Protects law firms from legal liability for violations of privacy laws, including unauthorized access to or disclosure of sensitive personal information.

- Cyberbullying and Harassment: Provides coverage for expenses related to addressing cyberbullying or harassment directed at law firm employees or clients.

- Social Engineering Fraud: Reimburses law firms for losses incurred due to social engineering scams, such as phishing attacks, that result in unauthorized access to confidential information or financial theft.

- Reputation Protection: Covers expenses for restoring a law firm’s reputation in the event of a cyber incident that damages its public image.

- Regulatory Compliance: Provides coverage for legal fees and expenses associated with compliance with data protection regulations, such as GDPR or HIPAA.

- Cloud Security: Extends coverage to cloud-based systems and data, protecting law firms from cyber threats that target cloud service providers or their clients.

How Cyber Security Insurance Benefits Law Firms

1. Breach Expense Coverage

Cyber security insurance provides coverage for expenses incurred in response to a data breach, such as forensic investigation, legal defense, and public relations. These expenses can quickly add up, so having this coverage can help law firms mitigate their financial losses.

2. Business Interruption Coverage

A cyber attack can disrupt a law firm’s operations, leading to lost revenue and productivity. Cyber security insurance can provide business interruption coverage to help firms recover these losses.

3. Extortion Loss Coverage

Ransomware and other extortion attacks are becoming increasingly common. Cyber security insurance can provide coverage for extortion payments, reducing the financial impact on law firms.

4. Cyber Crime Liability Coverage

Law firms can be held liable for damages caused by cyber attacks on their clients. Cyber security insurance can provide liability coverage to protect firms from financial losses.

5. Privacy Liability Coverage

Law firms often handle sensitive client data, which makes them targets for privacy breaches. Cyber security insurance can provide coverage for privacy liability claims.

6. Electronic Data Restoration Coverage

In the event of a data breach, law firms may need to restore lost or damaged electronic data. Cyber security insurance can provide coverage for these costs.

7. Cyber Security Assessment Coverage

Cyber security insurance policies often include coverage for cyber security assessments, which can help law firms identify and address vulnerabilities in their systems.

8. Cyber Security Training Coverage

Cyber security insurance policies may also provide coverage for cyber security training programs for employees, helping law firms improve their overall security posture.

9. Regulatory Compliance Assistance

Cyber security insurance providers can offer assistance with regulatory compliance, ensuring that law firms meet industry best practices and legal requirements.

10. Peace of Mind

Cyber security insurance provides law firms with peace of mind knowing that they are financially protected from the increasing threat of cyber attacks.

Types of Cyber Security Insurance Coverage

Cyber security insurance policies offer a range of coverage options to address the specific risks faced by law firms. Here are five common types of coverage:

1. Third-Party Liability Coverage

This coverage protects against claims from clients, third parties, or regulatory agencies alleging that a law firm has failed to protect their data or has caused a data breach. It typically covers expenses such as legal defense costs, damages awarded, and regulatory fines.

2. First-Party Coverage

First-party coverage reimburses law firms for their own financial losses resulting from a cyber attack or data breach. This can include expenses such as data recovery, business interruption, ransomware payments, and reputational damage mitigation.

3. Cyber Extortion Coverage

This coverage protects law firms against extortion demands from cybercriminals who threaten to release sensitive data or disrupt business operations unless a ransom is paid. It covers expenses such as ransom payments, negotiation fees, and crisis management costs.

4. Breach Response Coverage

Breach response coverage provides financial assistance to law firms in the event of a data breach. This can include expenses such as forensic investigation, legal counsel, notification costs, and credit monitoring for affected individuals.

5. Social Engineering Coverage

Social engineering coverage protects law firms against financial losses resulting from fraudulent schemes, such as phishing scams or business email compromise attacks. It can cover expenses such as funds transferred fraudulently, reimbursement for stolen data, and legal defense costs.

Thanks for Reading!

Hey there, thanks for taking the time to read this article. I hope you found it informative and helpful. If you have any more questions, feel free to leave a comment below or visit our website again later. We’re always happy to provide more insights on cybersecurity insurance and help you protect your law firm from cyber threats.

Checkout These Recommendations:

- Cyber Liability Insurance: Protecting Your Business… In today's digital age, protecting your business from cyber threats is paramount. With increasing reliance on the internet and vast amounts of sensitive data being stored online, the risk of…

- Cyber Security Insurance: A Guide to Protecting Your… In today's digitalized era, cybersecurity threats lurk around every cyber corner, posing a constant menace to businesses and individuals alike. Statistics paint a grim picture, with the average cost of…

- Cybersecurity at Your Fingertips: Exploring the Best… In today's increasingly digital world, protecting yourself from cyber threats is paramount. With the constant bombardment of online scams, data breaches, and ransomware attacks, having the right cyber insurance can…

- Cyber Security Insurance for Small Businesses:… In today's digital landscape, small businesses are facing an ever-growing threat from cyberattacks. With limited resources and expertise, they are often the most vulnerable targets for malicious hackers. The consequences…

- Cyber Security Insurance: A Vital Safeguard for… Imagine waking up to the dreaded news that your business has been hacked and your sensitive data has been compromised. In this digital age, cyber threats are a constant concern…

- Atbay: Empowering Businesses with Comprehensive… In today's digital age, cyber threats loom large, menacing businesses and individuals alike. With the rise of ransomware attacks, data breaches, and phishing scams, the need for robust cyber insurance…

- Do I Need Cyber Liability Insurance: Protecting Your… In today's hyperconnected world, you can't afford to be caught without a safety net when it comes to your online presence. Cyberattacks are becoming more frequent and sophisticated, targeting businesses…

- Chubb Cyber Security Insurance: Protect Your… In today's increasingly digital world, safeguarding your business from cyber threats is no longer an option but a paramount necessity. Chubb Cyber Security Insurance offers a comprehensive suite of coverage…

- Protections Against Cyberattacks: The Role of a… In the ever-evolving digital landscape, where technology permeates every aspect of our lives and businesses, the threat of cyberattacks looms large. As a responsible business owner, safeguarding your company's sensitive…

- Fifth Wall Cyber Insurance: Safeguarding the Digital… In today's increasingly digital world, businesses face a growing threat from cyberattacks. These attacks can cause significant financial losses, disrupt operations, and damage reputations. Fifth Wall Cyber Insurance offers a…

- Protecting Your Profits: Cyber Insurance for Tax Preparers In the digital age, tax preparers are more vulnerable than ever to cyber threats. With the rise of identity theft, data breaches, and ransomware attacks, it's more important than ever…

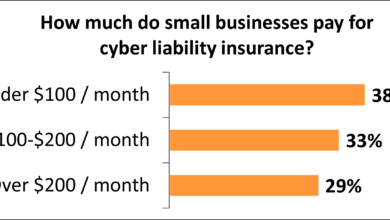

- Cyber Liability Insurance Costs: A Breakdown In today's high-tech realm, protecting against cyber threats is crucial for businesses of all sizes. Cyber liability insurance offers a safety net, safeguarding companies from costly consequences of data breaches,…

- Cyber Insurance Costs for Small Businesses:… In today's digital world, small businesses face an ever-increasing threat from cyberattacks. From ransomware to data breaches, the consequences of a cyber incident can be devastating, costing businesses time, money,…

- The Ultimate Guide to Cyber Insurance for Small… In today's digital age, cyber threats loom over small businesses like never before. From sophisticated ransomware attacks to phishing scams, the potential for cyber breaches and data loss is constantly…

- Protecting Your Digital Universe: Allied World Cyber… In the ever-evolving digital landscape, where cyber threats lurk around every corner, businesses need robust protection to safeguard their valuable data and reputation. Allied World Cyber Insurance steps onto the…

- Hartford Cyber Insurance: Protecting Your Business… In the labyrinthine realm of digital piracy and data breaches, businesses of all sizes are vulnerable to cyberattacks. These attacks can have devastating consequences, leading to lost revenue, damaged reputation,…

- Navigating the Cyber Landscape: Top Brokers for… In the ever-evolving digital landscape, the importance of protecting your business against cyber threats has never been greater. One crucial aspect of this protection is securing top-notch cyber insurance, and…

- Navigating the Cybersecurity Insurance Market: Top… In today's digital age, where cyber threats lurk around every corner, protecting your business from malicious attacks is a paramount concern. Cyber Security Insurance Providers step into this crucial role,…

- Cyber Insurance Coverage Cost: Understanding the Factors In the ever-evolving digital landscape, businesses of all sizes face escalating threats from cyberattacks. These attacks can cripple operations, damage reputations, and result in substantial financial losses. While implementing robust…

- Cyber Insurance: Essential Protection for Small… In today's digital world, every small business is vulnerable to the ever-growing threat of cyberattacks. From data breaches to ransomware, the consequences can be severe, costing businesses their reputation, data,…

- Vouch: The Cyber Insurance Innovator for Modern Businesses In today's digital landscape, the threats lurking in the virtual realm are as real as ever. Your sensitive data, including customer information, trade secrets, and financial records, are constantly under…

- Cyber Security Liability Insurance: Mitigating the… In today's digital age, protecting your business from cyber threats is more important than ever before. Cybercriminals are constantly devising new ways to attack businesses of all sizes, and the…

- Protect Your Business from Cyber Threats: Essential… In today's fast-paced digital world, safeguarding your small business from cyberattacks is paramount. With the increasing frequency and sophistication of cyber threats, even the most seasoned businesses can fall victim…

- Navigating the Cybersecurity Landscape: The… Step into the realm of cybersecurity where the ever-evolving threat landscape demands proactive protection. In this digital age, it's no longer a question of if you'll face a cyberattack, but…

- Protecting Your Digital Assets: A Guide to Cyber… In today's digital age, where cyberattacks are becoming increasingly sophisticated and prevalent, businesses and individuals alike find themselves vulnerable to data breaches and cyber threats. As a result, the demand…

- Protect Your Digital Assets: A Comprehensive Guide… In today's interconnected world, businesses of all sizes face an ever-increasing threat of cyberattacks. From data breaches and ransomware to phishing scams and malware, the potential risks to your digital…

- Cybersecurity in the Digital Age: Essential… In our increasingly digital world, it's no longer just our physical assets that are at risk. Our online presence, from social media profiles to financial accounts, is just as vulnerable…

- Cyber Security Insurance for Today's Digital… In the ever-evolving digital landscape, cybersecurity has become paramount. Businesses and individuals alike are increasingly vulnerable to malicious attacks that can compromise sensitive data, disrupt operations, and tarnish reputations. To…

- Nationwide Cyber Insurance: Protecting Businesses… In today's digital world, where every aspect of our lives is interconnected, safeguarding our online presence has become imperative. With the constant threat of cyberattacks looming, insurance policies designed to…

- Protect Your Small Business from Cyber Threats: The… In the ever-evolving digital landscape, small businesses are increasingly vulnerable to cyberattacks. From phishing scams to malware infections, the threats are endless. While it may seem like only large corporations…