Business Cyber Security Insurance: Protect Your Digital Assets

In today’s digital age, businesses of all sizes are increasingly vulnerable to cyberattacks. From sophisticated malware to ransomware that can cripple operations, the threat landscape is constantly evolving. To protect themselves, businesses need to implement robust cybersecurity measures, and one essential component of this is cyber security insurance. This specialized insurance policy provides financial protection against the costs associated with a data breach, including legal fees, notification expenses, and lost business income.

Contents

- 1 1. The Rising Threat of Cyber Attacks

- 2 2. The Impact of Cyber Attacks on Businesses

- 3 3. The Importance of Business Cyber Security Insurance

- 4 4. Types of Cyber Security Insurance Coverage

- 5 5. Benefits of Business Cyber Security Insurance

- 6 6. Choosing the Right Policy

- 7 7. Proactive Measures to Prevent Cyber Attacks

- 8 8. Incident Response Plan

- 9 9. Compliance Considerations

- 10 10. Long-Term Cyber Security Strategy

- 11 Key Considerations When Choosing Business Cyber Security Insurance

- 12 Types of Business Cyber Security Insurance

- 13 Safeguarding Your Business from the Digital Wild West

1. The Rising Threat of Cyber Attacks

Cyber attacks are becoming increasingly sophisticated and frequent, posing a significant threat to businesses of all sizes. With the rise of ransomware, data breaches, and phishing scams, it’s crucial for businesses to take proactive measures to protect their valuable assets.

2. The Impact of Cyber Attacks on Businesses

Cyber attacks can have devastating consequences for businesses, causing financial losses, reputational damage, and legal liability. Ransomware can cripple operations, while data breaches can compromise sensitive customer information and erode trust.

3. The Importance of Business Cyber Security Insurance

Business cyber security insurance provides a safety net against the financial and legal risks associated with cyber attacks. It covers costs related to data recovery, ransom payments, and legal defense, ensuring that businesses can continue operating and protect their customers.

4. Types of Cyber Security Insurance Coverage

Cyber security insurance policies vary in coverage, but typically include:

- Data breach coverage: Protects against costs associated with recovering and notifying victims of stolen or compromised data.

- Cyber extortion coverage: Covers ransom payments and other extortion demands made by cybercriminals.

- Business interruption coverage: Reimburses lost revenue due to cyber attacks that disrupt business operations.

5. Benefits of Business Cyber Security Insurance

Purchasing business cyber security insurance offers several benefits:

- Financial protection: Covers the costs associated with cyber attacks, minimizing financial losses.

- Peace of mind: Provides businesses with the assurance that they are prepared to handle cyber threats.

- Competitive advantage: Demonstrates that a business is committed to protecting its customers’ data and reputation.

6. Choosing the Right Policy

When selecting a cyber security insurance policy, consider the following factors:

- Coverage limits: Determine the appropriate coverage for your business’s size and risk profile.

- Deductibles: Choose a policy with a deductible that aligns with your budget.

- Exclusions: Review the policy’s exclusions carefully to ensure that specific risks are not excluded from coverage.

7. Proactive Measures to Prevent Cyber Attacks

In addition to insurance, businesses should implement robust cyber security measures:

- Strong passwords: Use complex passwords that cannot be easily guessed.

- Multi-factor authentication: Require users to provide multiple forms of identification when logging in.

- Regular software updates: Patch software vulnerabilities promptly to prevent exploitation.

- Employee training: Educate employees on cyber security best practices to minimize risks.

8. Incident Response Plan

Having a well-defined incident response plan in place is crucial for mitigating the impact of cyber attacks. This plan should outline steps to:

- Identify and contain the attack

- Notify relevant parties

- Recover data and restore operations

- Prevent future attacks

9. Compliance Considerations

Businesses operating in certain industries may be subject to cyber security compliance requirements. Cyber security insurance can help demonstrate compliance and protect against fines or penalties.

10. Long-Term Cyber Security Strategy

Cyber security is an ongoing process, and businesses should develop a long-term strategy to address evolving threats. This strategy should include regular risk assessments, employee training, and continuous monitoring of cyber security measures.

Key Considerations When Choosing Business Cyber Security Insurance

Scope of Coverage:

Ensure the policy covers all critical aspects of your business, including data breaches, ransomware attacks, business interruption, and regulatory fines related to cyber incidents.

Cyber Incident Response Services:

Look for policies that provide access to reputable cybersecurity experts who can assist you with incident response, investigation, and remediation.

Data Breach Notification and Recovery:

Choose a policy that covers the costs associated with notifying affected individuals, conducting privacy impact assessments, and implementing data recovery measures.

Extortion Coverage:

Protect your business from financial losses due to extortion attempts, such as ransomware attacks where cybercriminals demand payment to release your data.

Business Interruption Coverage:

Ensure the policy covers lost revenue, extra expenses, and other financial consequences resulting from a cyber incident that disrupts your operations.

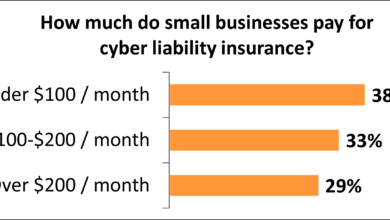

Cost and Coverage Limit:

Determine the appropriate coverage limit based on the potential financial impact of a cyber incident and factor in the premium costs to select a policy that meets your budgetary constraints.

Reputation Management:

Consider policies that include coverage for expenses related to reputation management and public relations efforts to mitigate the impact of a cyber breach on your business’s reputation.

Regulatory Compliance:

Ensure the policy meets the regulatory requirements of your industry and geographic location regarding data protection and breach notification.

Exclusion and Limitations:

Carefully review the policy’s exclusions and limitations to understand the scope of protection and potential gaps in coverage.

Claims Process:

Choose a policy with a clear and streamlined claims process that provides prompt and fair settlement in the event of a cyber incident.

Types of Business Cyber Security Insurance

Businesses face various cyber threats, and each type of threat requires specific insurance coverage. The following are common types of business cyber security insurance:

1. Data Breach Insurance

Data breach insurance protects businesses from financial losses resulting from a breach of sensitive data, such as customer records, financial information, or trade secrets. It covers expenses related to notifying affected individuals, conducting investigations, providing credit monitoring or identity theft protection, and settling lawsuits.

2. Cyber Liability Insurance

Cyber liability insurance covers businesses for legal liability arising from cyberattacks, data breaches, or other cyber incidents. It can provide coverage for lawsuits, regulatory fines, and damages awarded to third parties.

3. Business Interruption Insurance

Business interruption insurance covers losses resulting from a cyberattack that disrupts business operations. It can provide coverage for lost revenue, extra expenses incurred during the interruption, and the costs of restoring business operations.

4. Social Engineering Insurance

Social engineering insurance covers businesses from financial losses resulting from attacks that exploit human error or manipulate employees to gain unauthorized access to systems or data. It can provide coverage for fraud, wire transfer losses, and business email compromise (BEC) scams.

5. Ransomware Insurance

Ransomware insurance covers businesses from financial losses resulting from ransomware attacks. It can provide coverage for ransom payments, data recovery expenses, and business interruption costs.

Safeguarding Your Business from the Digital Wild West

That’s all for now, folks! Thanks for hanging out with us to explore the ins and outs of business cyber security insurance. By protecting your precious business from the digital threats lurking in the shadows, you can sleep a little easier at night knowing you have a safety net in place. If you’ve got any burning questions or want to dive deeper into the world of cyber security, be sure to swing by again soon. We’ll be right here, keeping our eyes peeled for the latest trends and tools to help you stay one step ahead of the cyber cowboys. So, until next time, stay alert, stay protected, and keep your business safe!