Cybersecurity in the Digital Age: Essential Protection with Cyber Insurance

In our increasingly digital world, it’s no longer just our physical assets that are at risk. Our online presence, from social media profiles to financial accounts, is just as vulnerable to cyber threats. That’s why cyber insurance has become an essential safeguard for individuals and businesses alike. This comprehensive coverage can provide peace of mind by protecting you from the financial consequences of a cyberattack, such as data breaches, ransomware, and identity theft. In this article, we’ll dive into the world of cyber insurance, exploring what it covers, who needs it, and how to find the best policy for your specific needs.

Contents

- 1 1. Understanding Cyber Insurance: A Shield for Digital Assets

- 2 2. Types of Cyber Insurance Coverage

- 3 3. Benefits of Cyber Insurance

- 4 4. Assessing Cyber Insurance Needs

- 5 5. Choosing a Cyber Insurance Provider

- 6 6. Managing Cyber Insurance Costs

- 7 7. Filing a Cyber Insurance Claim

- 8 8. Cyber Insurance Claim Timeline

- 9 9. Cyber Insurance as a Component of Risk Management

- 10 10. Emerging Trends in Cyber Insurance

- 11 Types of Cyber Insurance Coverage

- 12 5 Tips for Choosing the Right Cyber Insurance Policy

- 13 Thanks for Reading

1. Understanding Cyber Insurance: A Shield for Digital Assets

Cyber insurance protects businesses and individuals from financial losses resulting from cyber attacks. This highly specialized form of insurance provides coverage for a wide range of cyber threats, including data breaches, ransomware attacks, and business interruption due to cyber incidents.

2. Types of Cyber Insurance Coverage

Cyber insurance policies vary in their coverage, but common types include:

* First-party coverage: Covers expenses incurred by the policyholder, such as data restoration, ransom payments, and business interruption costs.

* Third-party coverage: Compensates victims of cyber attacks for financial losses caused by the policyholder’s breach.

* Cyber extortion coverage: Protects against extortion attempts by cybercriminals who threaten to release stolen data or disrupt operations.

3. Benefits of Cyber Insurance

Investing in cyber insurance offers several significant benefits:

* Financial protection: Reimburses policyholders for costs associated with cyber incidents, reducing the financial burden.

* Business continuity: Covers expenses to restore business operations after a cyber attack, minimizing downtime and maximizing revenue.

* Legal defense: Provides coverage for legal fees and expenses related to cyber attacks and privacy breaches.

4. Assessing Cyber Insurance Needs

The type and amount of cyber insurance coverage required depends on several factors:

* Industry: Healthcare, finance, and technology companies face higher cyber risks.

* Data sensitivity: Businesses that handle sensitive customer data need more extensive coverage.

* Company size: Larger companies have more targets and assets at risk.

* Cybersecurity posture: Strong cybersecurity measures can reduce the likelihood of a breach and lower insurance premiums.

5. Choosing a Cyber Insurance Provider

Selecting a reputable and reliable cyber insurance provider is crucial:

* Financial stability: Ensure the insurer has a strong financial footing to cover potential claims.

* Industry expertise: Look for providers that specialize in cyber insurance and understand the unique risks of different industries.

* Claims history: Research the insurer’s claims settlement history to assess their responsiveness and fairness.

6. Managing Cyber Insurance Costs

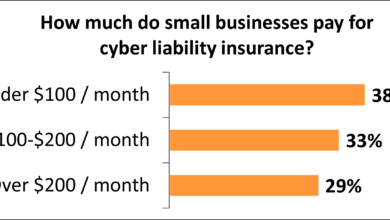

Cyber insurance premiums vary depending on factors such as coverage, company size, and industry. To manage costs:

* Implement strong cybersecurity measures: Reduce the likelihood of a breach and lower insurance premiums.

* Bundle coverages: Combine cyber insurance with other policies, such as general liability or professional liability, to save money.

* Negotiate with insurers: Discuss deductibles, limits, and premiums to find the best deal.

7. Filing a Cyber Insurance Claim

In the event of a cyber attack, promptly notify the insurance company and provide all relevant documentation:

* Incident report: Describe the nature and extent of the breach.

* Expense records: Keep track of all costs incurred as a result of the attack.

* Legal documents: Submit any legal proceedings or correspondence related to the incident.

8. Cyber Insurance Claim Timeline

The timeframe for a cyber insurance claim varies depending on the severity of the incident and the insurer’s processes:

* Initial investigation: The insurer will review the claim and gather information.

* Negotiations: The insurer and policyholder will negotiate the amount of the settlement.

* Payment: Once the settlement is agreed upon, the insurer will issue payment.

9. Cyber Insurance as a Component of Risk Management

Cyber insurance is not a substitute for strong cybersecurity measures but rather an essential complement:

* Preventative measures: Implement firewalls, intrusion detection systems, and other cybersecurity controls to reduce risks.

* Incident response plan: Establish a clear plan for responding to and mitigating cyber attacks.

* Cybersecurity training: Educate employees about cybersecurity best practices to prevent human errors.

10. Emerging Trends in Cyber Insurance

The cyber insurance landscape is constantly evolving:

* Cyber-physical convergence: Insurance policies are expanding to cover risks at the intersection of physical and digital assets.

* Data privacy: Regulations like the EU’s GDPR and the CCPA are driving demand for insurance against privacy breaches.

* Supply chain vulnerabilities: Cyber attacks on third-party vendors can lead to indirect losses for businesses; insurance is adapting to cover these risks.

Types of Cyber Insurance Coverage

When considering purchasing cyber insurance, there are several types of coverage to choose from to meet your specific needs:

First-Party Coverage:

- Data Breach Coverage: Covers costs associated with a data breach, such as legal fees, notification expenses, and credit monitoring for affected individuals.

- Network Security Coverage: Protects against financial losses resulting from network intrusions or denial-of-service attacks.

- Business Interruption Coverage: Compensates for lost income and expenses incurred due to a cyberattack that disrupts business operations.

Third-Party Coverage:

- Privacy Liability Coverage: Covers legal liability for violations of privacy laws, such as the unauthorized disclosure of sensitive information.

- Cyber Extortion Coverage: Protects against financial extortion threats, such as ransomware attacks, where hackers demand payment to release stolen data.

- Cybercrime Coverage: Covers financial losses resulting from cybercrimes such as fraud, identity theft, and social engineering scams.

Additional Coverage:

- Reputation Management Coverage: Helps restore a company’s reputation after a cyberattack that damages its brand or image.

- Regulatory Compliance Coverage: Covers costs associated with complying with data protection regulations, such as HIPAA and GDPR.

- Cyber Terrorism Coverage: Protects against cyberattacks that are motivated by political or ideological reasons.

- Media Liability Coverage: Covers legal liability for cybersecurity incidents involving public relations, advertising, or social media management.

5 Tips for Choosing the Right Cyber Insurance Policy

1. Understand Your Business’s Cyber Risks

The first step in choosing a cyber insurance policy is to understand your business’s specific cyber risks. This includes identifying the types of data you store and process, the potential threats to that data, and the potential financial impact of a cyber attack. You can use a risk assessment tool to help you identify your business’s cyber risks.

2. Choose a Policy with Adequate Coverage

Once you understand your business’s cyber risks, you can start shopping for a cyber insurance policy. When choosing a policy, it’s important to make sure that the policy provides adequate coverage for your business. This includes coverage for the following:

* Data breaches

* Cyber extortion

* Business interruption

* Third-party liability

3. Compare Premiums and Deductibles

The cost of cyber insurance premiums can vary depending on the type of business, the size of the business, and the amount of coverage you need. It’s important to compare premiums from multiple insurers before choosing a policy. You should also consider the deductible, which is the amount you will have to pay out of pocket before the insurance policy kicks in.

4. Read the Policy Carefully

Before you sign up for a cyber insurance policy, read the policy carefully. Make sure you understand the terms and conditions of the policy, including the exclusions and limitations. You should also review the policy with your legal counsel to make sure you understand your rights and obligations under the policy.

5. Seek Professional Advice

If you’re not sure how to choose the right cyber insurance policy, you can seek professional advice from an insurance broker or agent. An insurance broker or agent can help you assess your business’s cyber risks, compare policies from multiple insurers, and choose the policy that’s right for your business.

Thanks for Reading

Thanks for taking the time to read our article about why you should buy cyber insurance. We hope it’s been helpful. If you have any questions, please don’t hesitate to contact us.

We’ll be back soon with more tips and advice on how to protect your business from cyber threats. In the meantime, be sure to check out our other articles on our website.