Get a Cyber Insurance Quote Online: Protect Your Business from Cyber Threats

In today’s increasingly digital world, where our online presence and data are constantly exposed to potential threats, cyber insurance has become an essential safeguard to protect against the costly consequences of cyberattacks. Finding the right cyber insurance policy that meets your specific needs can be a daunting task, but thankfully, with online quote services, you can easily compare and contrast different policies from reputable providers in just a few clicks. By leveraging these online tools, you can secure comprehensive cyber insurance protection without breaking a sweat.

Contents

Why You Need Cyber Insurance in Today’s Digital World

1. Increased Cybercrime Frequency and Severity: Cybercrime has become increasingly common, with attacks targeting businesses of all sizes. Ransomware, phishing, and other cyber threats can cause significant financial losses and reputational damage.

2. Growing Reliance on Technology: Businesses rely heavily on technology for their operations, making them more vulnerable to cyber attacks. Sensitive data stored and processed on computers, networks, and devices presents a prime target for hackers.

3. Complying with Data Protection Regulations: Governments worldwide have enacted data protection laws to protect individuals’ personal information. Cyber insurance can help businesses meet these regulatory requirements by covering potential data breaches and privacy violations.

4. Protection from Financial Losses: Cyber attacks can lead to significant financial losses due to compromised data, business interruptions, and extortion demands. Cyber insurance provides coverage for expenses associated with these incidents, helping businesses recover and mitigate the financial impact.

5. Protection for Reputational Damage: A cyber attack can severely damage a company’s reputation by exposing sensitive data or disrupting operations. Cyber insurance includes coverage for reputational recovery costs, helping businesses restore their reputation in the wake of an attack.

6. Business Continuity: Cyber attacks can disrupt business operations, leading to lost revenue and productivity. Cyber insurance provides assistance with business continuity, covering costs to restore systems and retrieve lost data, ensuring minimal disruption.

7. Coverage for Third-Party Liability: Cyber attacks can also impact third parties, such as customers or partners. Cyber insurance covers potential liability costs associated with compromised data or privacy breaches involving third parties.

8. Expert Guidance and Support: Most cyber insurance policies include access to specialized cybersecurity experts who can provide guidance on best practices, risk mitigation, and incident response. This support helps businesses stay ahead of emerging threats and improve their cyber resilience.

9. Peace of Mind: Knowing that you have comprehensive cyber insurance coverage provides peace of mind for business owners and managers. It ensures that your organization is financially protected and has the resources to recover from a cyber attack.

10. Competitive Advantage: In today’s digital environment, having cyber insurance is a competitive advantage. It demonstrates your organization’s commitment to data security and cyber resilience, attracting clients and partners who prioritize their information security.

Key Factors Influencing Cyber Insurance Premiums

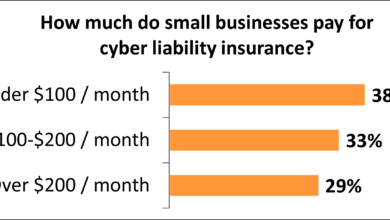

When obtaining a cyber insurance quote online, several key factors influence the cost of your policy. Understanding these factors will help you optimize your coverage and minimize premiums.

1. Business Size and Industry: Larger businesses and those in high-risk industries, such as healthcare and finance, face higher premiums due to their increased exposure to cyberattacks.

2. Revenue and Assets: The value of your business’s revenue and assets plays a role in determining your premiums. Policies designed to protect substantial assets will be more expensive.

3. Data Sensitivity: Businesses handling sensitive customer data, such as medical records or financial information, require more comprehensive coverage, resulting in higher premiums.

4. Security Measures: Implementing strong cybersecurity measures, such as firewalls, encryption, and regular software updates, can reduce your premium by mitigating potential risks.

5. Coverage Limits: The extent of your coverage, including liability limits, data breach response costs, and business interruption expenses, will directly impact your premiums.

6. Prior Claims History: A lack of previous claims can lead to lower premiums, as insurers view businesses with a clean record as less risky.

7. Deductibles: Choosing a higher deductible will lower your premiums, but it also increases your out-of-pocket costs in the event of a claim.

8. Policy Type: Different types of cyber insurance policies, such as first-party only and third-party only, offer varying levels of protection. The broader the coverage, the higher the premium.

9. Endorsements and Riders: Additional coverage options, such as ransomware endorsements and network interruption insurance, can increase your premiums but provide expanded protection.

10. Binding Authority: Brokers with binding authority can negotiate lower premiums on your behalf by leveraging their relationships with multiple insurance carriers.

Factors Affecting Cyber Insurance Quotes

The cost of cyber insurance varies depending on several factors that insurers consider when assessing the risk of a potential policyholder. Some of the key factors that influence cyber insurance quotes include:

1. Industry and Business Size:

Different industries face varying levels of cyber risks, with some being more targeted than others. For instance, businesses in the healthcare, financial, and technology sectors typically face higher premiums due to the sensitive data they handle. Additionally, larger businesses with more employees and assets to protect tend to pay more for cyber insurance coverage.

2. Revenue and Business Value:

The potential financial impact of a cyber incident on a business is a significant factor in determining the cost of cyber insurance. Businesses with higher revenues and valuable assets will need more comprehensive coverage, resulting in higher premiums.

3. Cyber Security Measures:

Insurers assess the applicant’s current cyber security protocols and practices to determine their level of preparedness against cyber threats. Businesses with strong cyber security measures in place, such as firewalls, intrusion detection systems, and employee training, may qualify for lower premiums.

4. Claims History:

Businesses with a history of cyber claims or incidents are more likely to face higher premiums as they pose a greater risk to insurers. The severity and frequency of past claims can significantly impact the cost of future coverage.

5. Deductible and Coverage Limits:

The deductible is the amount the policyholder must pay out of pocket before the insurance coverage takes effect. Higher deductibles result in lower premiums, while lower deductibles lead to higher premiums. Coverage limits, which specify the maximum amount the insurer will pay for covered losses, also affect the cost of the policy.

Thanks for Reading!

Hey there, thanks for taking the time to check out our article on getting cyber insurance quotes online. We hope you found it helpful and informative.

We know that cyber security is a complex and ever-evolving landscape, so we’re always happy to share our knowledge and insights with our readers. If you have any more questions or need additional guidance, don’t hesitate to visit our website again later.

Thank you for reading, and stay safe in the digital world!