Introduction: The Importance of Auto Accidents Insurance

When you get behind the wheel of a car, you open yourself up to a variety of risks. From minor fender benders to major accidents, there’s always the potential for something to go wrong. That’s why it’s so important to have auto accidents insurance. In this article, we’ll provide you with everything you need to know about auto accidents insurance, from how it works to how much it costs. We’ll also discuss the benefits of having insurance and the different types of coverage you can choose from.

Auto accidents insurance is a contract between you and an insurance company. In exchange for paying a monthly premium, the insurance company agrees to cover the costs of damages and injuries that result from an accident that you cause. This can include the cost of repairing or replacing your vehicle, as well as the cost of medical bills and lost wages for you and your passengers.

There are many different types of auto accidents insurance, each with its own set of benefits and drawbacks. The most common type of insurance is liability insurance. Liability insurance covers the costs of damages and injuries that you cause to others, but it does not cover the costs of damages to your own vehicle. Collision insurance covers the costs of damages to your own vehicle, regardless of who caused the accident. Comprehensive insurance covers the costs of damages to your vehicle from non-collision events, such as theft or vandalism.

The cost of auto accidents insurance varies depending on a number of factors, including your age, driving history, and the type of coverage you choose. However, it’s important to remember that auto accidents insurance is a valuable investment. In the event of an accident, it can save you thousands of dollars in out-of-pocket costs.

The Benefits of Auto Accidents Insurance

There are many benefits to having auto accidents insurance. Some of the most important benefits include:

- Financial protection: Auto accidents insurance can provide you with financial protection in the event of an accident. It can cover the costs of damages to your vehicle, as well as the cost of medical bills and lost wages for you and your passengers.

- Peace of mind: Having auto accidents insurance can give you peace of mind knowing that you’re protected in the event of an accident. You won’t have to worry about how you’re going to pay for damages or injuries.

- Legal protection: Auto accidents insurance can provide you with legal protection in the event of an accident. If you’re sued by someone who was injured in an accident that you caused, your insurance company will defend you and pay for any damages that you’re ordered to pay.

The Different Types of Auto Accidents Insurance

There are many different types of auto accidents insurance, each with its own set of benefits and drawbacks. The most common type of insurance is liability insurance. Liability insurance covers the costs of damages and injuries that you cause to others, but it does not cover the costs of damages to your own vehicle. Collision insurance covers the costs of damages to your own vehicle, regardless of who caused the accident. Comprehensive insurance covers the costs of damages to your vehicle from non-collision events, such as theft or vandalism.

In addition to these three basic types of insurance, there are a number of other types of coverage that you can purchase, such as:

- Uninsured motorist coverage: Uninsured motorist coverage protects you in the event that you’re in an accident with a driver who doesn’t have insurance.

- Underinsured motorist coverage: Underinsured motorist coverage protects you in the event that you’re in an accident with a driver who doesn’t have enough insurance to cover your damages.

- Medical payments coverage: Medical payments coverage covers the costs of medical expenses for you and your passengers, regardless of who caused the accident.

- Personal injury protection (PIP): Personal injury protection (PIP) covers the costs of medical expenses, lost wages, and other expenses that you incur as a result of an accident, regardless of who caused the accident.

How to Choose the Right Auto Accidents Insurance Policy

Choosing the right auto accidents insurance policy can be a daunting task. There are a number of factors to consider, such as the amount of coverage you need, the type of coverage you want, and the cost of the policy. It’s important to compare quotes from multiple insurance companies before making a decision. You should also read the policy carefully to make sure that you understand what is and is not covered.

Here are some tips for choosing the right auto accidents insurance policy:

- Determine the amount of coverage you need. The amount of coverage you need will depend on a number of factors, such as the value of your vehicle, the amount of debt you have, and the number of people in your household.

- Choose the type of coverage you want. There are a number of different types of auto accidents insurance coverage available. You should choose the type of coverage that best meets your needs and budget.

- Compare quotes from multiple insurance companies. It’s important to compare quotes from multiple insurance companies before making a decision. This will help you find the best deal on the coverage you need.

- Read the policy carefully. Before you sign up for an auto accidents insurance policy, it’s important to read the policy carefully to make sure that you understand what is and is not covered.

The Strengths and Weaknesses of Auto Accidents Insurance

Auto accidents insurance is a valuable investment, but it’s important to be aware of both the strengths and weaknesses of this type of insurance. Some of the strengths of auto accidents insurance include:

- Financial protection: Auto accidents insurance can provide you with financial protection in the event of an accident. It can cover the costs of damages to your vehicle, as well as the cost of medical bills and lost wages for you and your passengers.

- Peace of mind: Having auto accidents insurance can give you peace of mind knowing that you’re protected in the event of an accident. You won’t have to worry about how you’re going to pay for damages or injuries.

- Legal protection: Auto accidents insurance can provide you with legal protection in the event of an accident. If you’re sued by someone who was injured in an accident that you caused, your insurance company will defend you and pay for any damages that you’re ordered to pay.

Some of the weaknesses of auto accidents insurance include:

- Cost: Auto accidents insurance can be expensive, especially if you have a high-risk driving record. The cost of insurance will also vary depending on the type of coverage you choose and the amount of coverage you need.

- Coverage limits: Auto accidents insurance policies have coverage limits. This means that there is a maximum amount of money that the insurance company will pay for damages or injuries

Checkout These Recommendations:

- Best Rate Auto Insurance: Comprehensive Coverage at… Introduction In a world where financial security and peace of mind are paramount, securing reliable auto insurance is essential. Best Rate Auto Insurance stands out as an exceptional provider, offering…

- Accident Forgiveness Auto Insurance Introductory Words Life on the road is unpredictable, and even the most cautious drivers can find themselves in an accident. When the unexpected happens, it's crucial to have auto insurance…

- Best Auto Insurance After Accident Preamble Having an auto accident can be a traumatic experience, both physically and financially. If you are involved in an accident, it is important to make sure you have the…

- Auto Insurance For Drivers With Accidents Introductory Words Accidents happen, and when they do, it's crucial to have auto insurance to protect yourself financially. However, drivers with accidents face unique challenges when obtaining insurance, as they…

- Auto Insurance At Fault Accident Pondering the Profundity of Auto Insurance in At-Fault Accidents In the complex tapestry of modern life, where vehicles seamlessly weave their way into our daily routines, the specter of auto…

- Insurance For Contractor: A Comprehensive Guide to… Hello Readers, As a contractor, you know that your business is your livelihood. You've worked hard to build it up, and you want to protect it from unexpected events. That's…

- Do Auto Insurance Rates Go Up After An Accident An in-depth look at the impact of car accidents on insurance premiums Introduction In the aftermath of a car accident, dealing with insurance claims and repairs can be a stressful…

- The Best Auto Insurance for Seniors A Comprehensive Guide to Finding the Right Coverage As we age, our driving needs and habits change. We may drive less frequently, commute shorter distances, and have fewer risky behaviors…

- Building Contractor Liability Insurance: The Ultimate Guide As a building contractor, you're responsible for ensuring the safety of your workers and clients. However, even the most careful contractors can face accidents and lawsuits. That's where building contractor…

- Auto Accident Insurance Attorneys Introduction The aftermath of an auto accident can be overwhelming and stressful, with physical injuries, property damage, and emotional trauma. Amidst the chaos, finding the right legal representation is crucial…

- Car Insurance Attorney: Navigating the Complexities… Introduction Hello, esteemed readers! The realm of car insurance can be a labyrinthine maze, fraught with complexities and potential pitfalls. In the unfortunate event of an auto accident, understanding your…

- Commercial Auto Insurance Near Me: A Comprehensive Guide Introduction Hello, Readers, In today's fast-paced business environment, protecting your commercial vehicles is paramount. Commercial auto insurance plays a crucial role in safeguarding your company's assets and ensuring the well-being…

- Auto Insurance Accident Forgiveness Before we dive into the intricacies of auto insurance accident forgiveness, let us set the stage with some thought-provoking questions. Have you ever been involved in a car accident that…

- Auto Insurance Accident Attorney Atlanta Atlanta Car Accident Attorneys Providing Expert Legal Representation In the aftermath of a car accident in Atlanta, navigating the legal landscape can be a daunting task. With insurance companies vying…

- Change Auto Insurance After Accident Introduction: Navigating the Complexities of Post-Accident Insurance In the aftermath of a car accident, navigating the insurance process can be a daunting task. One crucial decision that drivers may face…

- Cheapest Auto Insurance After Accident Cheapest Auto Insurance After Accident: The Ultimate Guide to Finding Affordable Coverage Introduction After a car accident, your insurance rates can skyrocket. This can be a major financial burden, especially…

- Auto Insurance First Accident Forgiveness Introduction Navigating the complexities of auto insurance can be a daunting task. One crucial aspect that often sparks confusion is first accident forgiveness. This feature can have a significant impact…

- Commercial Auto Insurance Quotes: Essential Guide… Introduction Hello, Readers! Embark on a comprehensive exploration of Commercial Auto Insurance Quotes. With the ever-evolving transportation landscape, businesses of all sizes must navigate the complexities of protecting their valuable…

- How To Lower Auto Insurance After Accident A comprehensive guide to reducing your premiums after an at-fault crash Getting into a car accident can be a stressful and expensive experience. In addition to the immediate costs of…

- How To Sue An Insurance Company After An Auto Accident Introduction If you've been injured in an auto accident, you may be wondering if you should sue the insurance company. Here's what you need to know about filing a lawsuit…

- Best Auto Insurance With Accidents An In-Depth Guide to Navigating Insurance After a Collision In the aftermath of a car accident, navigating the complexities of auto insurance can be a daunting task. Understanding the intricacies…

- Auto Insurance Companies With Accident Forgiveness Introduction An accident forgiveness program is a type of auto insurance coverage that allows you to have one at-fault accident forgiven, without it affecting your insurance rates. This can be…

- Cheapest Auto Insurance: A Comprehensive Guide to… Introduction: Navigating the Maze of Auto Insurance Options The search for affordable auto insurance can be a daunting task, especially in today's economic climate. With a myriad of insurance companies…

- Can I Switch Auto Insurance After An Accident Navigating the Complexities of Post-Accident Insurance Changes In the aftermath of a car accident, amidst the shock and disarray, one question that may linger in your mind is whether you…

- Can You Change Auto Insurance After An Accident Insurance Implications and Considerations Navigating the aftermath of an auto accident can be daunting, and one crucial aspect to address is the potential impact on your auto insurance. Understanding your…

- Auto Insurance With Accident History Navigating the complexities of auto insurance, particularly after experiencing an accident, can be a daunting task. Understanding the implications of an accident history on insurance premiums, coverage options, and overall…

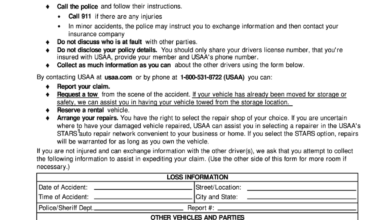

- Usaa Auto Insurance Accident Reporting A Comprehensive Guide to Filing an Accident Claim with USAA Navigating the aftermath of a car accident can be stressful and overwhelming. Reporting the incident promptly and accurately to your…

- Cheapest Auto Insurance In Florida With Accidents An Expert Guide To Finding The Best Coverage For Your Needs Florida is known for its beautiful beaches, sunny weather, and unfortunately, high auto insurance rates. If you have an…

- Auto Accident No Insurance Getting into an auto accident is a stressful experience, and it's even worse if you don't have insurance. If you're involved in an accident with an uninsured driver or you're…

- Business Auto Insurance Quote: Protect Your Business… Hello Readers, Welcome and thank you for taking the time to read this comprehensive guide to business auto insurance quotes. If you own or operate a business that utilizes vehicles,…