Introduction

Every business, no matter how small, faces risks and liabilities that could potentially damage its financial well-being. From customer injuries to property damage, unexpected events can strike at any time, leaving businesses vulnerable to costly lawsuits and claims.

Basic business liability insurance is a crucial tool for protecting businesses from such financial disasters. This type of insurance provides coverage for a wide range of liabilities that businesses may encounter, offering peace of mind and financial security.

In this comprehensive guide, we will delve into the intricacies of basic business liability insurance, exploring its benefits, limitations, and essential coverage details. We will also provide practical tips on how to choose the right policy for your business and ensure adequate protection.

Understanding Basic Business Liability Insurance

Basic business liability insurance, also known as general liability insurance, is a type of insurance that provides coverage for damages and injuries caused by the business’s operations, products, or services.

This insurance protects businesses from financial liability in the event of lawsuits or claims arising from:

- Bodily injuries to customers, employees, or other third parties

- Property damage to customers’ or third parties’ property

- Products liability claims due to defective products

- Advertising injuries, such as defamation, invasion of privacy, or copyright infringement

Strengths of Basic Business Liability Insurance

Basic business liability insurance offers several key benefits for businesses:

- Financial Protection: This insurance provides businesses with financial protection from costly lawsuits and claims, potentially saving them from financial ruin.

- Peace of Mind: Basic business liability insurance gives business owners peace of mind, knowing that they are protected against unexpected events.

- Improved Customer Confidence: Having business liability insurance demonstrates to customers that the business is financially responsible and takes their safety seriously.

Weaknesses of Basic Business Liability Insurance

While basic business liability insurance offers many benefits, it also has certain limitations:

- Limited Coverage: Basic business liability insurance only covers certain types of liabilities. It does not provide coverage for all potential risks a business may face, such as cyber liability or professional liability.

- Deductibles: Most business liability insurance policies have deductibles, which is the amount the business must pay out of pocket before the insurance coverage kicks in.

- Policy Limits: Business liability insurance policies have policy limits, which represent the maximum amount the insurance company will pay for covered claims.

Table: Coverage and Exclusions of Basic Business Liability Insurance

Coverage and Exclusions of Basic Business Liability Insurance

| Coverage |

Exclusions |

| Bodily injuries to customers, employees, or other third parties |

Intentional acts |

| Property damage to customers’ or third parties’ property |

Damage caused by employees |

| Products liability claims due to defective products |

Expected or intended damage |

| Advertising injuries, such as defamation, invasion of privacy, or copyright infringement |

Exclusions specified in policy |

FAQs About Basic Business Liability Insurance

- What is the difference between general liability insurance and professional liability insurance? General liability insurance covers claims arising from the business’s operations, while professional liability insurance covers claims against professionals for errors or omissions in their work.

- Do I need business liability insurance even if I have homeowner’s or renter’s insurance? Yes, business liability insurance provides coverage specifically for business-related risks, which may not be covered under personal insurance policies.

- What is a deductible in business liability insurance? A deductible is the amount the business must pay out of pocket before the insurance coverage kicks in.

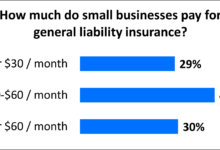

- What factors affect the cost of business liability insurance? The cost of insurance depends on factors such as the nature of the business, the number of employees, the business’s claims history, and the policy limits.

- How can I find the right business liability insurance policy for my business? You can consult with an insurance agent or broker to compare policies and find the one that best meets your specific needs and budget.

Choosing the Right Basic Business Liability Insurance Policy

Choosing the right basic business liability insurance policy for your business is essential to ensure adequate protection. Here are some key considerations:

- Assess Your Risks: Identify the potential liabilities your business faces and prioritize them based on their likelihood and severity.

- Determine Coverage Limits: Determine the maximum amount of coverage you need to protect your business from financial ruin.

- Consider Your Deductible: Choose a deductible that you can afford to pay out of pocket while still maintaining sufficient coverage.

- Review Exclusions: Carefully review the policy exclusions to ensure that the coverage meets your specific needs.

- Compare Quotes: Obtain quotes from multiple insurance providers to compare coverage and pricing.

Conclusion

Basic business liability insurance is a cornerstone of risk management for businesses of all sizes. This insurance provides financial protection against unexpected events, offering peace of mind and safeguarding businesses from financial disasters.

By understanding the strengths, weaknesses, and coverage details of basic business liability insurance, businesses can make informed decisions about the appropriate level of protection for their unique needs.

Investing in comprehensive business liability insurance is a wise move that can protect your business from unforeseen risks and secure its financial future.

Disclaimer

The information provided in this article is for educational purposes only and does not constitute legal or financial advice. It is recommended to consult with a qualified insurance professional or legal counsel for specific guidance tailored to your business’s needs.

Checkout These Recommendations:

- Business Insurance Agents Near Me: A Comprehensive… Introduction Protecting your business from unforeseen events is crucial for its longevity and success. Securing the right business insurance can safeguard your company against financial losses, legal liabilities, and operational…

- Workers' Compensation and General Liability… Introduction Navigating the complexities of business insurance can be a daunting task, especially when it comes to understanding the differences between workers' compensation and general liability insurance. Both policies play…

- Pressure Washing Insurance: A Comprehensive Guide… Hello Readers, In the competitive world of pressure washing, protecting your business from unforeseen risks is paramount. Pressure washing insurance, a specialized form of coverage, provides a safety net against…

- General Liability Insurance Delaware: Protecting… Introduction: The Significance of General Liability Insurance for Delaware Businesses Operating a business in Delaware, known for its thriving corporate environment, entails inherent risks that can potentially jeopardize the financial…

- Photography Business Insurance: The Ultimate Guide… Welcome to our comprehensive guide to Photography Business Insurance. In the rapidly evolving digital landscape, where visual content reigns supreme, photographers face unique risks and liabilities. Photography Business Insurance is…

- Business Liability Insurance: A Comprehensive Guide… Introduction: Understanding the Importance of Business Liability Insurance In today's business landscape, where unexpected events can arise at any moment, having adequate liability insurance is crucial for protecting your business…

- General Liability Insurance vs. Workers'… Introductory Words: In today's business world, savvy entrepreneurs and risk managers recognize the paramount importance of safeguarding their ventures against unforeseen events that could jeopardize their financial well-being. Two essential…

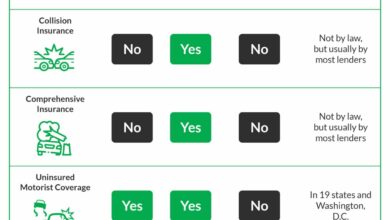

- Full Coverage Car Insurance: Essential Protection… An Introductory Overview of the Comprehensive Coverage for Your Vehicle In the realm of automotive ownership, navigating the labyrinth of insurance options can be a daunting task. Full coverage car…

- Small Business Hazard Insurance: A Lifeline for… Hello, Readers! As a small business owner, you've poured your heart and soul into your venture. But what would happen if a disaster struck, threatening to destroy everything you've worked…

- General Liability Insurance For Online Business:… Introduction In today's digital world, running an online business has become more accessible than ever. However, just like any other type of business, online ventures face their unique set of…

- Cheap Business Liability Insurance: Protect Your… A Comprehensive Guide to Securing Essential Coverage Without Breaking the Bank Hello, readers. In the competitive landscape of today's business world, protecting your enterprise from potential risks is paramount. Liability…

- Get Professional Liability Insurance: Protect… Protect Your Business from Financial Risks Professional Liability Insurance provides vital financial protection for your business against claims of negligence or errors and omissions. As a business owner, you are…

- Understanding Business General Liability Insurance… Introduction Navigating the complexities of running a business in California requires a comprehensive understanding of insurance policies to safeguard against potential risks. Business General Liability Insurance (BGLI) plays a crucial…

- Cheapest General Liability Insurance for Small Businesses Introduction: Protecting your small business from potential risks is crucial for ensuring its success and longevity. General liability insurance is an indispensable component of any comprehensive business insurance plan, providing…

- Buy Business Liability Insurance Online A Comprehensive Guide to Protecting Your Business Introduction In today's highly competitive business environment, protecting your assets and safeguarding your company's reputation is paramount. One essential tool in this endeavor…

- Lowest General Liability Insurance: Affordable… General liability insurance (GLI) is a crucial form of coverage that protects businesses from financial losses arising from lawsuits alleging bodily injury, property damage, or personal injury. While GLI is…

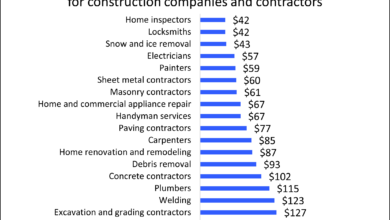

- Liability Contractor Insurance: A Comprehensive… Hello, Readers! In today's dynamic and demanding construction industry, protecting your business and safeguarding your assets is paramount. One crucial aspect of this protection is Liability Contractor Insurance, a specialized…

- Plumbers Liability Insurance: Protecting Your… Hello, Readers! Have you considered the financial implications of potential accidents or lawsuits in your plumbing business? Plumbers liability insurance is a crucial investment that can safeguard your company against…

- The Ultimate Guide to Beauty Salon Insurance Introduction Hello, esteemed readers! Welcome to the comprehensive guide to beauty salon insurance, an indispensable shield for your thriving business. In today's competitive beauty industry, safeguarding your salon and protecting…

- Cheap Business Liability Insurance Coverage:… In today's competitive business landscape, protecting your enterprise against potential risks is paramount. Business liability insurance coverage offers a cost-effective solution to mitigate unexpected liabilities, safeguarding your company's financial stability…

- Business Office Insurance: A Vital Shield for Your… Greetings, Readers: In the dynamic and ever-evolving business landscape, seamless operations and proactive risk management are paramount. Business Office Insurance (BOI) emerges as an indispensable tool to safeguard your enterprise,…

- Buy Commercial General Liability Insurance An Essential Protection for Businesses In today's competitive business environment, protecting your enterprise against potential risks is paramount. Commercial General Liability (CGL) insurance is a comprehensive coverage that safeguards businesses…

- Purchase Liability Insurance For Small Business Introductory Words A small business owner's life is full of risks and uncertainties. One of the biggest risks is the potential for lawsuits. If someone is injured or their property…

- Cleaning Company Insurance: A Comprehensive Guide Hello, Readers! Welcome to this comprehensive guide on cleaning company insurance. As a business owner, it's imperative to secure adequate insurance coverage to protect your assets, employees, and customers. This…

- Company Liability Insurance Plans: Protecting Your… Introductory Words: Operating a business comes with inherent risks, and one of the most significant is the potential for lawsuits. Unforeseen events, accidents, or allegations of negligence can lead to…

- Cheap General Liability and Workers' Compensation… Introduction As a business owner, protecting your company against potential risks is crucial. Inadequate insurance coverage can leave you vulnerable to substantial financial losses and legal liabilities. Among the essential…

- California General Liability Insurance:… Introduction Greetings, Readers! In the vibrant business landscape of California, safeguarding your enterprise from potential risks is paramount. General Liability Insurance (GLI) emerges as an indispensable tool to shield your…

- Liability Insurance for Painting Companies: Protect… Introductory Words Owning a painting company involves inherent risks that can lead to financial losses or legal liabilities. Liability insurance serves as a vital safeguard for painting businesses, providing protection…

- General Liability Insurance for Carpenters:… Introduction Carpentry is a skilled trade that requires years of experience and training. While the work is rewarding, it also comes with inherent risks. Accidents can happen at any time,…

- Carpentry General Liability Insurance: A… Introduction: The Importance of Carpentry General Liability Insurance Carpentry is a demanding and hazardous profession that poses a myriad of risks. From accidental property damage to bodily injuries, contractors face…