The Ultimate Guide to Best Workers Comp Insurance for Comprehensive Protection

Contents

Hello, Valued Readers,

Welcome to this comprehensive guide on Best Workers Comp Insurance. As a business owner, you understand the paramount importance of safeguarding your workforce through robust workers’ compensation insurance. This article delves into the strengths, weaknesses, and essential details of Best Workers Comp Insurance, empowering you to make informed decisions.

Introduction

Workers’ compensation insurance provides crucial protection for businesses and their employees in the event of work-related injuries or illnesses. Best Workers Comp Insurance stands out among its peers with a reputation for exceptional coverage, personalized service, and competitive premiums. This guide will explore the nuances of Best Workers Comp Insurance, enabling you to assess its suitability for your unique business needs.

Understanding Best Workers Comp Insurance

Best Workers Comp Insurance offers a comprehensive suite of benefits that safeguard your employees’ well-being and financial security in the event of on-the-job accidents or illnesses. These benefits include:

- Medical coverage for treatment and rehabilitation

- Wage replacement during temporary disability

- Permanent disability benefits for long-term impairments

- Death benefits for dependents in the event of a fatal accident

Strengths of Best Workers Comp Insurance

Best Workers Comp Insurance excels in providing:

Exceptional Coverage

Best Workers Comp Insurance offers a wide range of coverage options to cater to the specific needs of various industries and businesses. Their policies are designed to provide comprehensive protection, minimizing potential gaps in coverage.

Personalized Service

Best Workers Comp Insurance representatives are dedicated to providing tailored solutions for each client. They work closely with businesses to understand their unique risks and develop customized plans that meet their specific requirements.

Competitive Premiums

Despite the exceptional coverage and personalized service, Best Workers Comp Insurance offers competitive premiums. They leverage their expertise in risk assessment to provide affordable pricing that fits within various budgets.

Additional Benefits

Best Workers Comp Insurance goes beyond standard coverage by offering additional benefits such as:

- Safety and risk management programs

- Return-to-work assistance

- Employee wellness initiatives

Weaknesses of Best Workers Comp Insurance

While Best Workers Comp Insurance offers numerous strengths, there are a few potential drawbacks to consider:

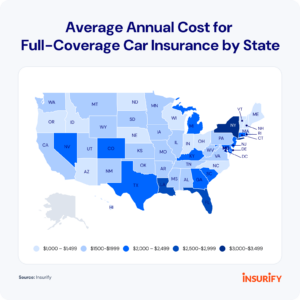

Limited Availability

Best Workers Comp Insurance is not available in all states. It is essential to verify whether their services are offered in your specific jurisdiction before making a decision.

Higher Deductibles

In some cases, Best Workers Comp Insurance may offer higher deductibles than comparable insurers. It is important to weigh the potential savings on premiums against the increased out-of-pocket costs associated with a higher deductible.

Claims Processing Time

The claims processing time for Best Workers Comp Insurance can sometimes be longer than average. This factor should be taken into consideration when evaluating the insurer’s overall service levels.

Table: Best Workers Comp Insurance Coverage Details

| Coverage Type | Coverage Details |

|—|—|

| Medical Coverage | Covers the costs of medical treatment, including hospitalization, surgery, and rehabilitation |

| Wage Replacement | Provides a portion of the employee’s wages during periods of temporary disability |

| Permanent Disability | Provides financial compensation for long-term impairments that limit an employee’s ability to work |

| Death Benefits | Provides financial support to the dependents of an employee who dies as a result of a work-related accident or illness |

FAQs on Best Workers Comp Insurance

**Q1: What industries are eligible for Best Workers Comp Insurance?**

**A:** Best Workers Comp Insurance caters to a wide range of industries, including construction, manufacturing, healthcare, and retail.

**Q2: How do I determine the right level of coverage for my business?**

**A:** Best Workers Comp Insurance representatives conduct a thorough risk assessment to determine the appropriate coverage limits for your specific business needs.

**Q3: What is the minimum premium for Best Workers Comp Insurance?**

**A:** The minimum premium varies depending on the industry, payroll, and other factors. Contact Best Workers Comp Insurance for a personalized quote.

**Q4: What is the deductible for Best Workers Comp Insurance?**

**A:** The deductible varies depending on the policy and the state in which the coverage is written. Contact Best Workers Comp Insurance for specific details.

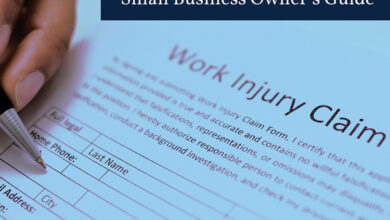

**Q5: How do I file a claim with Best Workers Comp Insurance?**

**A:** You can file a claim online, by phone, or through the Best Workers Comp Insurance mobile app.

**Q6: What are the benefits of having Best Workers Comp Insurance?**

**A:** Benefits include comprehensive coverage, personalized service, and competitive premiums.

**Q7: What are the potential drawbacks of Best Workers Comp Insurance?**

**A:** Potential drawbacks include limited availability in some states, higher deductibles in some cases, and a potentially longer claims processing time.

**Q8: How do I contact Best Workers Comp Insurance?**

**A:** You can contact Best Workers Comp Insurance by phone, email, or through their website.

**Q9: What is the financial stability rating of Best Workers Comp Insurance?**

**A:** Best Workers Comp Insurance maintains a high financial stability rating, indicating their ability to meet claims obligations.

**Q10: What is the claims satisfaction rate of Best Workers Comp Insurance?**

**A:** Best Workers Comp Insurance consistently receives high claims satisfaction ratings from its customers.

**Q11: What is the Better Business Bureau (BBB) rating of Best Workers Comp Insurance?**

**A:** Best Workers Comp Insurance has an excellent BBB rating, demonstrating their commitment to customer satisfaction.

**Q12: What are the payment options for Best Workers Comp Insurance?**

**A:** Best Workers Comp Insurance accepts a variety of payment options, including monthly and quarterly installments.

**Q13: What is the cancellation policy for Best Workers Comp Insurance?**

**A:** Best Workers Comp Insurance provides clear cancellation guidelines, allowing you to terminate your policy with appropriate notice.

Conclusion

Best Workers Comp Insurance offers a comprehensive and reliable solution for protecting your business and your employees from the financial consequences of work-related accidents and illnesses. While it may not be the best fit for every business, its strengths in exceptional coverage, personalized service, and competitive premiums make it a compelling choice for many. By carefully considering the strengths, weaknesses, and coverage details outlined in this guide, you can make an informed decision about whether Best Workers Comp Insurance is the right choice for your organization.

Choosing the right workers’ compensation insurance is essential for protecting your business and your employees. We encourage you to explore the various options available and consult with reputable insurance professionals to find the best coverage for your specific needs. Protecting your workforce is not only a legal requirement but also an investment in the well-being and productivity of your business.

Disclaimer

The information provided in this article is for general knowledge purposes only and does not constitute professional advice. It is recommended that you seek professional counsel from an insurance agent or broker to determine the most appropriate workers’ compensation insurance coverage for your particular business.