Hello Readers,

Welcome and thank you for taking the time to read this comprehensive guide to business auto insurance quotes. If you own or operate a business that utilizes vehicles, securing adequate insurance coverage is paramount to safeguarding your assets, employees, and reputation. This article delves into the intricacies of business auto insurance quotes, empowering you with the knowledge and understanding to make informed decisions.

Navigating the complex landscape of business auto insurance can be daunting, but it is essential to approach this task with due diligence. By gathering quotes from multiple reputable insurers and carefully assessing your coverage needs, you can obtain the optimal protection at a competitive price.

This article will provide you with a thorough understanding of business auto insurance quotes, including:

Let’s begin by exploring the different types of coverage that business auto insurance quotes typically include:

Types of Coverage

Liability Coverage

Liability coverage protects your business from financial responsibility if your vehicle causes injury or property damage to others. It is a cornerstone of business auto insurance and is typically required by law in most jurisdictions.

Collision Coverage

Collision coverage protects your business vehicle from damage in the event of a collision with another vehicle or object. This coverage is optional but highly recommended if you own or lease a valuable vehicle.

Comprehensive Coverage

Comprehensive coverage protects your business vehicle from damage or loss due to events other than collisions, such as theft, vandalism, or natural disasters. Like collision coverage, comprehensive coverage is optional but offers valuable peace of mind.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects your business from financial losses if you are involved in an accident with a driver who is either uninsured or underinsured. This coverage is becoming increasingly important as the number of uninsured drivers on the road continues to rise.

Medical Payments Coverage

Medical payments coverage provides reimbursement for medical expenses incurred by you or your employees in the event of an accident, regardless of who is at fault. This coverage is typically included in business auto insurance policies but can also be purchased as a separate rider.

Factors that Influence Premiums

The cost of your business auto insurance quote will be determined by a number of factors, including:

Type of Business

The type of business you operate will have a significant impact on your insurance premiums. Businesses that pose a higher risk, such as construction or transportation companies, will typically pay higher premiums than less risky businesses, such as office-based businesses.

Number of Vehicles

The number of vehicles you own or lease will also affect your premiums. The more vehicles you have, the higher your insurance costs will be.

Drivers

The age, driving history, and location of your drivers will all be considered when calculating your insurance premiums. Younger drivers, drivers with poor driving records, and drivers who live in urban areas will typically pay higher premiums than older drivers, drivers with clean driving records, and drivers who live in rural areas.

Coverage Limits

The higher the coverage limits you choose, the higher your premiums will be. It is important to carefully consider your coverage needs and choose limits that provide adequate protection without breaking the bank.

Deductible

The deductible is the amount of money you are responsible for paying out of pocket before your insurance coverage kicks in. Choosing a higher deductible will lower your premiums, but it will also mean that you will have to pay more out of pocket in the event of a claim.

How to Compare Quotes

Once you have gathered quotes from multiple insurers, it is important to carefully compare them before making a decision. Here are some tips for comparing business auto insurance quotes:

Compare Coverage

Make sure that you are comparing apples to apples. Ensure that each quote provides the same level of coverage and limits. It is also important to read the fine print of each policy to understand any exclusions or limitations.

Compare Premiums

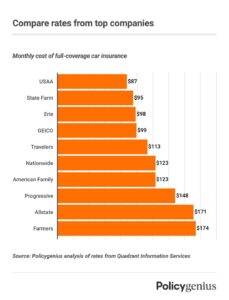

Of course, you will want to compare the premiums quoted by different insurers. However, it is important to remember that the lowest premium is not always the best deal. Consider the coverage being offered and the financial strength of the insurer before making a decision.

Compare Discounts

Many insurers offer discounts for things like bundling your business auto insurance with other policies, installing safety devices in your vehicles, and having good driving records. Be sure to ask about any discounts that you may be eligible for.

Tips for Saving Money on Insurance

There are a number of things you can do to save money on business auto insurance, including:

Shop Around

Don’t just go with the first insurer that you contact. Get quotes from multiple insurers to find the best deal.

Increase Your Deductible

Choosing a higher deductible will lower your premiums. However, be sure to choose a deductible that you can afford to pay in the event of a claim.

Take Advantage of Discounts

Ask your insurer about any discounts that you may be eligible for. Many insurers offer discounts for things like bundling your business auto insurance with other policies, installing safety devices in your vehicles, and having good driving records.

Maintain a Good Driving Record

Drivers with clean driving records will typically pay lower insurance premiums than drivers with poor driving records. Avoid getting tickets and accidents to keep your driving record clean.

Conclusion

Securing adequate business auto insurance coverage is essential for protecting your business from financial ruin. By understanding the different types of coverage available, the factors that influence premiums, and how to compare quotes, you can make informed decisions about your insurance needs. By following the tips outlined in this article, you can also save money on your insurance premiums.

We encourage you to take action today and get quotes from multiple insurers. By comparing quotes and choosing the right coverage, you can protect your business on the road.

Thank you for reading!

Checkout These Recommendations:

- Auto Accident Insurance Coverage Introductory Words In the United States, driving a vehicle is a common necessity for everyday life. With over 280 million registered vehicles on the roads, the chances of being involved…

- Best Auto Insurance For Drivers With Accidents Navigating the Turmoil After an Accident: A Comprehensive Guide for Insurance Coverage In the aftermath of an unexpected car accident, the road ahead can seem daunting. Amidst the physical and…

- Cheap Auto Insurance After Accident Introduction If you've been involved in a car accident, you know that the costs can add up quickly. Between medical bills, property damage, and lost wages, you could be facing…

- Allstate Quotes For Car Insurance Discover the Best Allstate Quotes for Car Insurance Hello Readers, Welcome to your comprehensive guide to Allstate Quotes for Car Insurance. In today's ever-evolving insurance landscape, finding the perfect coverage…

- Cheap General Liability Insurance For Small Business An In-depth Guide to Protecting Your Business In the competitive world of small business, having adequate insurance coverage is paramount to safeguard your financial well-being. Among the various types of…

- Auto Accident Insurance Attorney Engulfed by the harrowing aftermath of an auto accident, where disarray and uncertainty prevail, the prospect of seeking legal recourse can seem like an overwhelming burden. However, amidst the chaos,…

- Business Office Insurance: A Vital Shield for Your… Greetings, Readers: In the dynamic and ever-evolving business landscape, seamless operations and proactive risk management are paramount. Business Office Insurance (BOI) emerges as an indispensable tool to safeguard your enterprise,…

- Buy Workers Compensation Insurance Online Get Covered Today! Hello, Readers! In today's competitive business landscape, protecting your most valuable assets – your employees – is crucial for the success and longevity of your organization. Workers'…

- Workers Comp Insurance Quote: A Comprehensive Guide Introduction Hello, Readers! Workers' compensation insurance is an essential coverage for businesses to protect their employees and themselves from financial liability in the event of a workplace injury or illness.…

- Auto Insurance Lawyers: Navigating the Legal Labyrinth Introduction: A Journey into the World of Auto Insurance Law Hello, esteemed readers. In the realm of personal injury, auto insurance law emerges as a cornerstone of legal advocacy, safeguarding…

- Change Auto Insurance After Accident Introduction: Navigating the Complexities of Post-Accident Insurance In the aftermath of a car accident, navigating the insurance process can be a daunting task. One crucial decision that drivers may face…

- Can I Switch Auto Insurance After An Accident Navigating the Complexities of Post-Accident Insurance Changes In the aftermath of a car accident, amidst the shock and disarray, one question that may linger in your mind is whether you…

- Full Coverage Car Insurance: Essential Protection… An Introductory Overview of the Comprehensive Coverage for Your Vehicle In the realm of automotive ownership, navigating the labyrinth of insurance options can be a daunting task. Full coverage car…

- Toyota Auto Insurance: The Ultimate Guide for Peace of Mind Introduction In today's fast-paced world, owning a vehicle is not merely a luxury but an essential part of modern life. It grants us the freedom to explore, commute, and transport…

- Changing Auto Insurance After Accident Introduction: Understanding the Post-Accident Insurance Landscape An automobile accident can be a harrowing experience, leaving you grappling with both physical and financial repercussions. One of the critical decisions you must…

- General Liability Insurance Instant Quote: Protect… An Overview of General Liability Insurance Instant Quote General liability insurance is a type of business insurance policy that protects businesses from claims of bodily injury or property damage caused…

- Business Liability Insurance Quotes: Safeguarding… Hello Readers, In today's fast-paced business environment, protecting your company against potential liabilities is paramount. Business liability insurance quotes provide you with peace of mind by offering comprehensive coverage that…

- Best Auto Insurance With Accidents An In-Depth Guide to Navigating Insurance After a Collision In the aftermath of a car accident, navigating the complexities of auto insurance can be a daunting task. Understanding the intricacies…

- Commercial Car Insurance Quotes: A Comprehensive… Hello, Readers! In today's fast-paced business environment, having adequate commercial car insurance is crucial. It not only protects your vehicles and drivers but also ensures your financial well-being in the…

- Cheap Auto Insurance With Accident Pondering the Paradigms of Cheap Auto Insurance With Accident The realm of auto insurance can be a labyrinth of complexities, particularly for those who have unfortunately encountered accidents on the…

- No Auto Insurance Accident Introduction In the realm of vehicular mishaps, nothing could be more daunting than the prospect of a no auto insurance accident. This unfortunate scenario, marked by the absence of financial…

- Nj Small Business Insurance: A Comprehensive Guide Introduction Greetings, esteemed readers! Welcome to our in-depth exploration of New Jersey Small Business Insurance, an essential tool for safeguarding your enterprise against financial risks and unforeseen events. In today's…

- Can You Change Auto Insurance After An Accident Insurance Implications and Considerations Navigating the aftermath of an auto accident can be daunting, and one crucial aspect to address is the potential impact on your auto insurance. Understanding your…

- Auto Accident Insurance Navigating the Complexities of Auto Accident Insurance In today's fast-paced and unpredictable world, the prospect of being involved in an auto accident is a sobering reality. The aftermath of such…

- The Best Auto Insurance for Seniors A Comprehensive Guide to Finding the Right Coverage As we age, our driving needs and habits change. We may drive less frequently, commute shorter distances, and have fewer risky behaviors…

- Instant Life Insurance Quotes: A Comprehensive Guide Introduction Hello, readers! In today's fast-paced world, obtaining life insurance is no longer a lengthy and tedious process. Instant life insurance quotes have revolutionized the industry, providing individuals with quick…

- Accident Auto Insurance Preamble: Understanding the Importance of Auto Insurance In the fast-paced world of today, driving has become an indispensable part of our daily lives. However, with the increased number of vehicles…

- Cheapest Auto Insurance In Florida With Accidents An Expert Guide To Finding The Best Coverage For Your Needs Florida is known for its beautiful beaches, sunny weather, and unfortunately, high auto insurance rates. If you have an…

- Auto Insurance First Accident Forgiveness Introduction Navigating the complexities of auto insurance can be a daunting task. One crucial aspect that often sparks confusion is first accident forgiveness. This feature can have a significant impact…

- Auto Insurance For Multiple Accidents **Before the Introduction:** Before delving into the complexities of auto insurance and multiple accidents, it is imperative to establish a comprehensive understanding of the subject matter. This article will provide…