Introduction

Navigating the complexities of running a business in California requires a comprehensive understanding of insurance policies to safeguard against potential risks. Business General Liability Insurance (BGLI) plays a crucial role in protecting companies from legal liabilities arising from accidents, injuries, or property damage involving third parties. This article delves into the details of BGLI in California, exploring its strengths, weaknesses, coverage options, and essential considerations for businesses to make informed decisions.

In today’s fast-paced business environment, businesses face numerous risks that can severely impact their operations and financial stability. BGLI serves as a safety net, providing coverage for a wide range of liability claims, including bodily injury, property damage, and advertising injury. By understanding the intricacies of BGLI, businesses can mitigate risks and ensure their continued success.

California’s robust economy and complex legal landscape make BGLI particularly important for businesses operating within the state. The article examines the specific benefits and challenges associated with BGLI in California, enabling businesses to make informed choices based on their individual needs and risk profiles.

This comprehensive guide provides valuable insights into:

- The types of coverage offered by BGLI

- The strengths and weaknesses of BGLI in California

- The key considerations for obtaining and maintaining BGLI

- The legal requirements and regulations surrounding BGLI in California

- The steps businesses can take to mitigate risks and enhance BGLI coverage

- The potential benefits of additional coverage options

- The resources available to businesses seeking BGLI in California

By gaining a clear understanding of BGLI, businesses in California can confidently navigate the legal and financial risks associated with their operations, ensuring their long-term success and resilience.

Overview of Business General Liability Insurance

Business General Liability Insurance (BGLI) is a cornerstone of commercial insurance policies, providing businesses with financial protection against legal claims alleging negligence or fault that result in bodily injury, property damage, or advertising injury to third parties.

BGLI policies typically include coverage for the following types of claims:

- Bodily injury: Injuries sustained by individuals due to the business’s operations, products, or premises.

- Property damage: Damage caused to third-party property as a result of the business’s activities.

- Advertising injury: Claims alleging damage to a third party’s reputation or business due to the business’s advertising.

BGLI acts as a safeguard for businesses by covering legal expenses, including court costs, settlements, and judgments, up to the policy limits. This comprehensive protection allows businesses to focus on their core operations without facing financial ruin due to unforeseen circumstances.

Strengths of Business General Liability Insurance in California

BGLI in California offers several key strengths that make it an essential insurance product for businesses operating within the state.

1. Comprehensive Coverage: BGLI provides broad coverage for various types of third-party claims, including bodily injury, property damage, and advertising injury. This comprehensive protection ensures that businesses are financially protected against a wide range of potential risks.

2. Financial Protection: BGLI acts as a financial safety net, covering legal expenses and potential settlements, up to the policy limits. This coverage safeguards businesses from financial losses that could cripple their operations or even lead to bankruptcy.

3. Peace of Mind: Knowing that they have BGLI in place provides businesses with peace of mind, allowing them to operate confidently and focus on their primary objectives without being overly concerned about potential legal liabilities.

Weaknesses of Business General Liability Insurance in California

While Business General Liability Insurance offers significant benefits, there are a few weaknesses that businesses should be aware of.

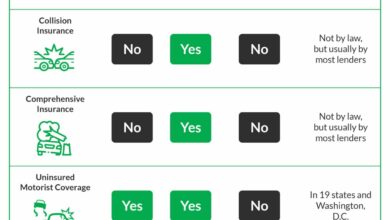

1. Policy Exclusions: BGLI policies generally exclude coverage for certain types of claims, such as intentional acts, pollution-related incidents, and workers’ compensation claims. Businesses may need to purchase additional coverage to address these specific risks.

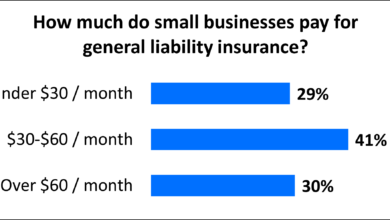

2. Policy Limits: BGLI policies have coverage limits that may not be sufficient to cover all potential liabilities, especially for larger businesses facing high-value claims. Businesses should carefully assess their risk exposure and consider purchasing higher policy limits.

3. Deductible: BGLI policies may have a deductible, which is the out-of-pocket expense that a business must pay before the insurance coverage kicks in. High deductibles can impact a business’s cash flow during a time of financial stress.

Additional Coverage Options

Businesses may consider adding additional coverage options to their BGLI policies to enhance their protection.

1. Commercial Umbrella Insurance: This policy extends liability coverage beyond the limits of the BGLI policy, providing an extra layer of protection against catastrophic events.

2. Professional Liability Insurance: This policy covers businesses against claims alleging negligence or errors and omissions in the provision of professional services.

3. Directors and Officers Insurance: This policy protects the personal assets of directors and officers against claims alleging mismanagement or breach of fiduciary duty.

Conclusion

Business General Liability Insurance is an indispensable insurance product for businesses operating in California, providing essential protection against third-party liability claims.

Checkout These Recommendations:

- Cheap Liability Business Insurance: Protect Your… Introductory Words In today's competitive business environment, protecting your company from financial risks is crucial. One essential aspect of this protection is liability insurance, which safeguards your business from legal…

- Commercial Vehicle Insurance: The Essential Guide to… Hello, Readers! Commercial vehicles are a crucial part of many businesses, enabling the transportation of goods and services. However, operating these vehicles comes with inherent risks, which is why commercial…

- Public Liability and Workers Compensation Insurance:… Introduction In the complex world of business, it is essential to have the proper insurance coverage in place to mitigate risks and protect your assets. Among the most crucial types…

- Inexpensive Business Liability Insurance: Protect… An Introduction to Essential Coverage for Small Businesses As a small business owner, you're faced with countless challenges. One of the most pressing is protecting your business from unexpected events…

- Lawyers Professional Liability Insurance: Protecting… Prelude Greetings, esteemed readers! Welcome to this comprehensive guide on Lawyers Professional Liability Insurance (LPLI), an indispensable tool in safeguarding your legal practice from unforeseen risks and financial liabilities. This…

- General Liability Insurance Companies For Small Business Your Essential Guide to Protecting Your Business As a small business owner, you know that protecting your business from the unexpected is essential. That's where general liability insurance comes in.…

- Cleaning Company Insurance: A Comprehensive Guide Hello, Readers! Welcome to this comprehensive guide on cleaning company insurance. As a business owner, it's imperative to secure adequate insurance coverage to protect your assets, employees, and customers. This…

- Llc Liability Insurance: The Ultimate Guide to… Hello Readers, Welcome to our comprehensive guide to LLC liability insurance. In this article, we'll delve into the nuances of this essential form of business protection, empowering you to make…

- Get General Liability Insurance: Protect Your… Introduction General liability insurance is a key component of any business's risk management strategy. It provides protection against third-party lawsuits alleging bodily injury, property damage, or personal injury arising from…

- Best General Liability Insurance For Small Business:… Securing your small business against unexpected liabilities is crucial for its financial stability and reputation. General liability insurance acts as a safety net, protecting you from third-party claims related to…

- Small Business Workers' Comp Insurance: A… Introduction Hello, Readers, In today's business landscape, safeguarding your employees against occupational hazards is paramount. Workers' compensation insurance plays a vital role in protecting small businesses and their employees from…

- Public Liability Insurance and Workers'… Introduction In the intricate tapestry of business operations, managing risk is paramount to safeguarding the welfare of both your enterprise and its employees. Public liability insurance and workers' compensation insurance…

- California General Liability Insurance:… Introduction Greetings, Readers! In the vibrant business landscape of California, safeguarding your enterprise from potential risks is paramount. General Liability Insurance (GLI) emerges as an indispensable tool to shield your…

- Lowest General Liability Insurance: Affordable… General liability insurance (GLI) is a crucial form of coverage that protects businesses from financial losses arising from lawsuits alleging bodily injury, property damage, or personal injury. While GLI is…

- Company Liability Insurance Plans: Protecting Your… Introductory Words: Operating a business comes with inherent risks, and one of the most significant is the potential for lawsuits. Unforeseen events, accidents, or allegations of negligence can lead to…

- Does Auto Insurance Cover Dui Accidents An In-Depth Analysis of Coverage and Consequences Introduction Driving under the influence (DUI) is a grave offense that endangers both the driver and others sharing the road. The financial repercussions…

- Architect Professional Liability Insurance:… Hello, Readers: As architects shape the built environment, their expertise and creativity are invaluable assets. However, the nature of their work exposes them to potential risks and liabilities that can…

- Unlocking the Cost of Workers' Compensation Insurance Greetings, Readers: In the intricate tapestry of business operations, the cost of workers' compensation insurance stands as a pivotal consideration. This comprehensive guide delves into the intricacies of this crucial…

- Small Business Liability Insurance: Protect Your… Introduction As an entrepreneur in Georgia, protecting your business from potential liabilities is crucial. Small business liability insurance provides a safety net against financial losses resulting from accidents, lawsuits, and…

- Auto Insurance For People With Accidents Introduction: Understanding Your Options Getting into an accident can be a traumatic and financially draining experience. The aftermath involves not only physical and emotional recovery but also the burden of…

- Cheap General Liability Insurance For Handyman Protecting Your Business and Assets As a handyman, you provide essential services to your clients, but you also face unique risks every day. Accidents can happen, and if someone is…

- Commercial General Liability Insurance Oklahoma: A… Introduction: Understanding Commercial General Liability Insurance Operating a business in Oklahoma exposes you to various risks that can lead to financial losses and legal complications. Commercial General Liability (CGL) insurance…

- Workers' Compensation and General Liability… Introduction Navigating the complexities of business insurance can be a daunting task, especially when it comes to understanding the differences between workers' compensation and general liability insurance. Both policies play…

- Cheapest General Liability Insurance for Small… Introduction: Navigating the Insurance Landscape for Entrepreneurs As a small business owner, protecting your enterprise from unforeseen liabilities is crucial. General liability insurance serves as a safety net, mitigating potential…

- Electrical Contractor Insurance: Protect Your… Hello Readers, Greetings, readers! In the realm of electrical contracting, safeguarding your business and customers is paramount. Electrical Contractor Insurance (ECI) serves as a safety net, providing financial protection from…

- Nj Small Business Insurance: A Comprehensive Guide Introduction Greetings, esteemed readers! Welcome to our in-depth exploration of New Jersey Small Business Insurance, an essential tool for safeguarding your enterprise against financial risks and unforeseen events. In today's…

- Insurance for LLC Business: Protect Your Enterprise… Greetings, Readers! In today's competitive business landscape, it is imperative for Limited Liability Companies (LLCs) to shield themselves against various risks and financial liabilities. Insurance for LLCs plays a crucial…

- USAA General Liability Insurance: Comprehensive… Introduction: A Comprehensive Guide to USAA General Liability Insurance In today's increasingly litigious society, protecting oneself and one's assets from potential lawsuits is paramount. General liability insurance serves as a…

- Commercial Auto Insurance Quotes: Essential Guide… Introduction Hello, Readers! Embark on a comprehensive exploration of Commercial Auto Insurance Quotes. With the ever-evolving transportation landscape, businesses of all sizes must navigate the complexities of protecting their valuable…

- Basic General Liability Insurance: Protecting Your… Understanding General Liability Insurance: An Overview As a business owner, you face numerous risks that could lead to lawsuits and substantial financial losses. Basic general liability insurance is a fundamental…