As a skilled craftsperson, your carpentry business deserves the utmost protection against potential risks and liabilities. Carpenter General Liability Insurance (GL) serves as a vital safety net, safeguarding you and your enterprise from unforeseen accidents, property damage, and claims of negligence.

With GL insurance, you can confidently navigate the complexities of carpentry work, knowing that you’re covered in the event of unexpected incidents. This insurance provides comprehensive protection for:

- Bodily injury to third parties

- Property damage to others

- Allegations of negligence

Understanding Carpenter General Liability Insurance

Carpenter GL insurance is an essential component of your business strategy, offering tailored coverage specific to the risks inherent in carpentry work. By securing this insurance, you can protect your assets, reputation, and financial well-being in the face of potential liabilities.

Benefits of Carpenter General Liability Insurance

The benefits of Carpenter GL insurance are multifaceted, empowering you to operate your business with confidence and peace of mind:

- Protection from financial loss: GL insurance acts as a financial safety net, covering legal expenses, settlements, and damages arising from covered incidents.

- Defense against lawsuits: In the event of a claim or lawsuit, GL insurance provides legal representation and coverage for defense costs.

- Peace of mind: With GL insurance, you can focus on your craft without the constant worry of financial repercussions from potential liabilities.

Strengths and Weaknesses of Carpenter General Liability Insurance

Like any insurance product, Carpenter GL insurance comes with both strengths and weaknesses that should be carefully considered:

Strengths:

- Comprehensive coverage: GL insurance offers comprehensive protection against a wide range of liabilities, providing peace of mind and financial security.

- Tailored to carpentry risks: The coverage is specifically designed to address the unique risks associated with carpentry work.

- Legal defense coverage: GL insurance includes coverage for legal defense costs, ensuring you have access to legal representation in the event of a claim or lawsuit.

Weaknesses:

- Exclusions: GL insurance may have certain exclusions, such as coverage for intentional acts or damage caused by faulty workmanship.

- Limits of coverage: GL insurance policies typically have limits on the amount of coverage provided, which may require additional coverage to fully protect your business.

- Premiums: GL insurance premiums can vary based on factors such as the size of your business, claims history, and the level of coverage required.

| Feature |

Carpenter General Liability Insurance |

| Coverage |

Bodily injury, property damage, negligence |

| Tailored |

Yes, for carpentry businesses |

| Legal defense |

Included |

| Exclusions |

May include intentional acts and faulty workmanship |

| Limits of coverage |

Varies by policy |

| Premiums |

Varies based on business factors |

FAQs about Carpenter General Liability Insurance

- What types of claims are covered by GL insurance?

GL insurance typically covers claims for bodily injury, property damage, and negligence.

- What are the limits of coverage for GL insurance?

Limits of coverage vary by policy, and you can typically choose the level of coverage that best meets your business needs.

- What are the common exclusions in GL insurance?

Common exclusions include intentional acts, damage caused by faulty workmanship, and acts of terrorism.

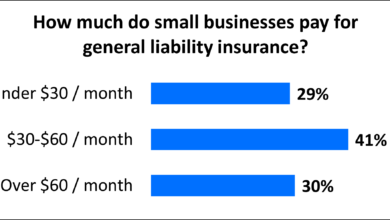

- How much does GL insurance cost?

Premiums for GL insurance vary based on factors such as the size of your business, claims history, and the level of coverage required.

- Do I need GL insurance if I am a sole proprietor?

Yes, GL insurance is recommended for all carpentry businesses, regardless of size or structure.

- What is the difference between occurrence-based and claims-made GL insurance?

Occurrence-based insurance covers claims for incidents that occur during the policy period, regardless of when the claim is filed. Claims-made insurance only covers claims that are filed during the policy period.

- Can I add additional coverage to my GL insurance policy?

Yes, you can typically add additional coverage, such as commercial auto insurance or workers’ compensation insurance, to your GL insurance policy.

- How can I find the right GL insurance policy for my business?

Contact an insurance broker or agent to discuss your business needs and find the policy that best suits you.

- What are the benefits of working with an insurance broker or agent?

An insurance broker or agent can help you compare policies, understand coverage options, and get the best deal on GL insurance.

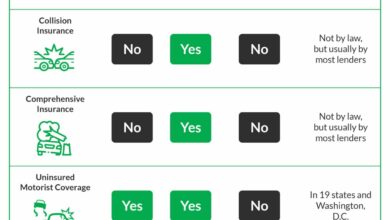

- Is GL insurance required by law?

GL insurance is not required by law in all jurisdictions, but it is highly recommended for all carpentry businesses.

- What are the penalties for operating without GL insurance?

Penalties for operating without GL insurance vary by jurisdiction, and may include fines or legal action.

- How can I reduce the cost of my GL insurance?

You can reduce the cost of your GL insurance by implementing safety measures, maintaining a good claims history, and shopping around for the best rates.

- What should I do if I have a claim?

If you have a claim, contact your insurance company as soon as possible to report the incident and start the claims process.

Conclusion: The Importance of Carpenter General Liability Insurance

In today’s litigious environment, Carpenter GL insurance is an indispensable tool for protecting your carpentry business from unforeseen risks and liabilities. By investing in GL insurance, you can safeguard your assets, maintain your reputation, and operate with peace of mind, knowing that you’re covered in the event of the unexpected.

Do not wait until it’s too late. Contact an insurance broker or agent today to discuss your coverage needs and secure the protection you need to succeed in the carpentry industry.

Disclaimer

This article is intended for informational purposes only and should not be considered legal or financial advice. Please consult with an insurance professional or legal counsel to discuss your specific situation.

Checkout These Recommendations:

- Insurance for LLC Business: Protect Your Enterprise… Greetings, Readers! In today's competitive business landscape, it is imperative for Limited Liability Companies (LLCs) to shield themselves against various risks and financial liabilities. Insurance for LLCs plays a crucial…

- General Liability Insurance Delaware: Protecting… Introduction: The Significance of General Liability Insurance for Delaware Businesses Operating a business in Delaware, known for its thriving corporate environment, entails inherent risks that can potentially jeopardize the financial…

- Cheap General Liability Insurance For Small Business An In-depth Guide to Protecting Your Business In the competitive world of small business, having adequate insurance coverage is paramount to safeguard your financial well-being. Among the various types of…

- Liability Insurance for Small Businesses: A… A Precautionary Investment for Entrepreneurs Hello, esteemed readers. Welcome to our in-depth exploration of liability insurance, an essential safeguard for small businesses. In this comprehensive guide, we unravel the intricacies…

- Construction Liability Insurance: Protecting Your… Hello, Readers! In the realm of construction, where monumental structures rise and ambitious projects unfold, the risks are as multifaceted as the projects themselves. Unexpected events, accidents, and unforeseen liabilities…

- Photography Liability Insurance: Shielding Your… A Comprehensive Guide for Photographers Hello, esteemed readers! Photography is an art form that captures the beauty of moments and preserves them for eternity. However, as photographers, we often find…

- Carpentry General Liability Insurance: A… Introduction: The Importance of Carpentry General Liability Insurance Carpentry is a demanding and hazardous profession that poses a myriad of risks. From accidental property damage to bodily injuries, contractors face…

- General Liability Insurance For Online Business:… Introduction In today's digital world, running an online business has become more accessible than ever. However, just like any other type of business, online ventures face their unique set of…

- Consultant Liability Insurance: Safeguarding Your Practice A Comprehensive Guide for Consultants Introduction Welcome, esteemed readers, to an in-depth exploration of Consultant Liability Insurance. In today's competitive business landscape, consultants play a crucial role in providing expert…

- Liability Insurance for Photographers: A Comprehensive Guide Prelude: Greetings and Introduction to the Importance of Liability Insurance Hello, Readers! Welcome to our in-depth exploration of liability insurance for photographers. In today's digital landscape, where your work can…

- Cheap General Liability Insurance For Contractors Hello Contractors! Readers, are you a contractor looking for some of the most affordable general liability insurance on the market? Look no further! In this article, we will be discussing…

- Business Office Insurance: A Vital Shield for Your… Greetings, Readers: In the dynamic and ever-evolving business landscape, seamless operations and proactive risk management are paramount. Business Office Insurance (BOI) emerges as an indispensable tool to safeguard your enterprise,…

- Workers' Compensation and General Liability… Introduction Navigating the complexities of business insurance can be a daunting task, especially when it comes to understanding the differences between workers' compensation and general liability insurance. Both policies play…

- Cheap Liability Insurance For Business Embrace Financial Protection for Your Business with Cheap Liability Insurance The world of business is a competitive landscape, where unforeseen circumstances can strike at any moment, threatening the stability and…

- Cleaning Company Insurance: A Comprehensive Guide Hello, Readers! Welcome to this comprehensive guide on cleaning company insurance. As a business owner, it's imperative to secure adequate insurance coverage to protect your assets, employees, and customers. This…

- Contractor Business Insurance: A Comprehensive Guide… Hello Readers, As a contractor, you know the importance of protecting your business against unforeseen events. Contractor business insurance is an essential tool for mitigating risks and ensuring the continuity…

- Professional Liability Insurance for Interior… Introduction As an interior designer, your creativity, expertise, and professionalism are the cornerstones of your business. However, even the most skilled and seasoned designers can face unforeseen circumstances that could…

- Professional Liability Insurance for Bookkeepers:… An Essential Guide for Bookkeeping Professionals The realm of bookkeeping is a vital cog in the financial machinery of businesses of all sizes. Bookkeepers are entrusted with the sensitive task…

- Cheap General Liability Insurance Near Me What is General Liability Insurance? General liability insurance is a type of business insurance that protects businesses from financial liability for bodily injury or property damage that occurs as a…

- Buy Liability Insurance for Small Business: Protect… Introduction: The Importance of Liability Insurance for Small Businesses As a small business owner, it is crucial to understand the significance of liability insurance, which acts as a financial shield…

- Company Liability Insurance Plans: Protecting Your… Introductory Words: Operating a business comes with inherent risks, and one of the most significant is the potential for lawsuits. Unforeseen events, accidents, or allegations of negligence can lead to…

- Employee Liability Insurance Quote: Protect Your… Embrace Comprehensive Protection for Employee-Related Incidents Navigating the complexities of business operations demands a proactive approach to risk management. Among the essential safeguards for employers is Employee Liability Insurance, a…

- Basic General Liability Insurance: Protecting Your… Understanding General Liability Insurance: An Overview As a business owner, you face numerous risks that could lead to lawsuits and substantial financial losses. Basic general liability insurance is a fundamental…

- Landscaping Business Insurance: A Comprehensive… Prelude to the Importance of Insurance for Landscapers Hello, Readers! Welcome to the definitive guide to landscaping business insurance. Whether you're a seasoned horticulturalist or just starting your entrepreneurial journey,…

- Liability Insurance for Independent Consultants: A… Preamble: Unveiling the Significance of Liability Insurance for Independent Consultants As an independent consultant, you possess a unique set of skills and expertise that empowers you to provide valuable services…

- General Liability Insurance Companies For Small Business Your Essential Guide to Protecting Your Business As a small business owner, you know that protecting your business from the unexpected is essential. That's where general liability insurance comes in.…

- General Liability and Errors and Omissions… Preamble: Understanding the Importance of Insurance in Today's Business Environment In the modern business landscape, navigating the complexities of legal liabilities and professional responsibilities is paramount. As businesses grow and…

- Plumbers Liability Insurance: Protecting Your… Hello, Readers! Have you considered the financial implications of potential accidents or lawsuits in your plumbing business? Plumbers liability insurance is a crucial investment that can safeguard your company against…

- Cheap Business Liability Insurance: Protect Your… A Comprehensive Guide to Securing Essential Coverage Without Breaking the Bank Hello, readers. In the competitive landscape of today's business world, protecting your enterprise from potential risks is paramount. Liability…

- Obtain General Liability Insurance: Protect Your… Introductory Words As a business owner, you face countless risks that could jeopardize your financial stability and reputation. One of the most significant threats is the possibility of being sued…