Introduction

As a business owner, protecting your company against potential risks is crucial. Inadequate insurance coverage can leave you vulnerable to substantial financial losses and legal liabilities. Among the essential insurance policies for businesses are general liability and workers’ compensation insurance. While seeking affordable coverage, it’s equally important to ensure adequate protection. This article will delve into the key aspects of cheap general liability and workers’ compensation insurance, providing a comprehensive guide to help you make informed decisions.

General Liability Insurance: A Shield Against Third-Party Claims

What is General Liability Insurance?

General liability insurance protects your business from financial losses resulting from accidental bodily injury or property damage caused to third parties during the course of your business operations. This coverage extends to claims arising from products or services provided by your business.

Benefits of General Liability Insurance

Securing general liability insurance offers numerous benefits, including:

Workers’ Compensation Insurance: Protecting Your Employees

Understanding Workers’ Compensation Insurance

Workers’ compensation insurance provides financial assistance to employees who suffer job-related injuries or illnesses. It covers medical expenses, lost wages, and disability benefits, ensuring the well-being of your workforce.

Benefits of Workers’ Compensation Insurance

Enrolling in workers’ compensation insurance safeguards your business from:

- Costly legal battles and lawsuits

- Financial burdens associated with employee injuries

- Improved employee morale and loyalty

Striking the Balance: Cheap vs. Adequate Coverage

Weighing the Risks

While seeking affordable insurance options is understandable, it’s essential to prioritize adequate coverage. Inadequate coverage may leave you exposed to significant financial risks in the event of a claim.

Choosing Affordable Coverage Options

Finding cheap general liability and workers’ compensation insurance without compromising on coverage is possible. Explore the following strategies:

- Comparing quotes from multiple insurance providers

- Raising deductibles to reduce premiums

- Implementing safety measures to minimize risk

The Strengths and Weaknesses of Cheap General Liability and Workers’ Compensation Insurance

Strengths

Affordability: Cheap general liability and workers’ compensation insurance offers financial relief to businesses on a budget.

Basic Protection: These policies provide a level of protection against third-party claims and employee injuries, offering peace of mind.

Weaknesses

Limited Coverage: Cheap insurance policies may have lower coverage limits, potentially leaving you vulnerable to substantial losses in the event of a major claim.

Exclusions: These policies often come with exclusions for certain types of claims, such as intentional acts or professional negligence.

Comparing Cheap and Standard General Liability and Workers’ Compensation Insurance

| Characteristic |

Cheap Insurance |

Standard Insurance |

| Coverage Limits |

Lower limits, reducing financial protection |

Higher limits, providing broader coverage |

| Exclusions |

More exclusions, limiting coverage |

Fewer exclusions, providing more comprehensive protection |

| Premiums |

Lower premiums due to reduced coverage |

Higher premiums due to increased coverage |

FAQs on Cheap General Liability and Workers’ Compensation Insurance

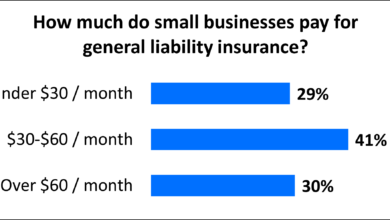

- What is the average cost of cheap general liability and workers’ compensation insurance?

- Is it possible to get cheap insurance without compromising on protection?

- What are the benefits of choosing a reputable insurance provider?

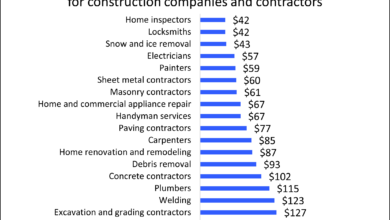

- What factors influence the cost of general liability and workers’ compensation insurance?

- How can I lower my insurance premiums without sacrificing coverage?

- What happens if my insurance policy doesn’t provide enough coverage?

- What are the consequences of operating without general liability and workers’ compensation insurance?

- How can I find the best insurance coverage for my business?

- What are the differences between general liability and workers’ compensation insurance?

- What should I do if I have a claim against my general liability or workers’ compensation insurance policy?

- How can I prevent costly lawsuits and claims against my business?

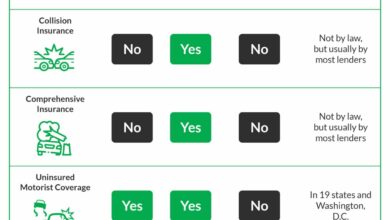

- What are the legal requirements for general liability and workers’ compensation insurance?

- What are some common exclusions in cheap general liability and workers’ compensation insurance policies?

Taking the Next Steps

Protecting your business with adequate general liability and workers’ compensation insurance is crucial. Take the following steps:

- Assess your risk exposure and determine the appropriate level of coverage.

- Compare quotes from reputable insurance providers to find the best combination of price and protection.

- Review your insurance policy carefully to ensure it meets your specific needs.

Conclusion

Finding cheap general liability and workers’ compensation insurance without compromising on protection is achievable with careful planning and research. By weighing the strengths, weaknesses, and costs of various insurance options, you can tailor a coverage strategy that safeguards your business and employees without breaking the bank. Remember that adequate insurance coverage is an investment in your business’s future, protecting you from financial disasters and ensuring the well-being of your workforce.

Disclaimer

The information provided in this article is for general knowledge and informational purposes only and should not be construed as professional advice. It is recommended to consult with a licensed insurance professional for personalized guidance and to determine the specific insurance needs and coverage options that are most appropriate for your business.

Checkout These Recommendations:

- General Liability Insurance For Small Business Near… Introductory Words: Unveiling the Significance of General Liability Insurance for Small Businesses In the labyrinthine landscape of commerce, every small business owner embarks on a perilous journey fraught with unforeseen…

- Understanding Business General Liability Insurance… Introduction Navigating the complexities of running a business in California requires a comprehensive understanding of insurance policies to safeguard against potential risks. Business General Liability Insurance (BGLI) plays a crucial…

- Landscaping Business Insurance: A Comprehensive… Prelude to the Importance of Insurance for Landscapers Hello, Readers! Welcome to the definitive guide to landscaping business insurance. Whether you're a seasoned horticulturalist or just starting your entrepreneurial journey,…

- Contractor Business Insurance: A Comprehensive Guide… Hello Readers, As a contractor, you know the importance of protecting your business against unforeseen events. Contractor business insurance is an essential tool for mitigating risks and ensuring the continuity…

- Cheap Auto Insurance For Accidents Your best guide on everything you need to know In the event of an accident, having the right auto insurance coverage can make a significant difference in your financial well-being.…

- General Liability Insurance for Carpenters:… Introduction Carpentry is a skilled trade that requires years of experience and training. While the work is rewarding, it also comes with inherent risks. Accidents can happen at any time,…

- Insurance For Contractor: A Comprehensive Guide to… Hello Readers, As a contractor, you know that your business is your livelihood. You've worked hard to build it up, and you want to protect it from unexpected events. That's…

- Buy Business Liability Insurance: Protect Your… Introductory Words In the dynamic and often unforgiving world of business, protecting your enterprise from potential liabilities is paramount. Unexpected events, accidents, or lawsuits can arise at any moment, threatening…

- Business Liability and Workers' Compensation… Introduction: In today's competitive business environment, it is crucial for organizations to safeguard themselves and their employees against financial risks and legal liabilities. Business Liability and Workers' Compensation Insurance play…

- Cleaning Company Insurance: A Comprehensive Guide Hello, Readers! Welcome to this comprehensive guide on cleaning company insurance. As a business owner, it's imperative to secure adequate insurance coverage to protect your assets, employees, and customers. This…

- General Liability Insurance vs. Workers'… Introductory Words: In today's business world, savvy entrepreneurs and risk managers recognize the paramount importance of safeguarding their ventures against unforeseen events that could jeopardize their financial well-being. Two essential…

- Instant General Liability Insurance: A Comprehensive Guide General liability insurance is a cornerstone of risk management for businesses of all sizes. It provides financial protection against claims of bodily injury, property damage, or personal injury arising from…

- Workers' Compensation Insurance for Small… Introduction Hello, esteemed readers! Welcome to our in-depth exploration of workers' compensation insurance for small businesses. In today's competitive business landscape, safeguarding your workforce and ensuring their well-being is paramount.…

- Florida Business Insurance: A Comprehensive Guide… Hello Readers, In today's competitive business landscape, protecting your enterprise against unforeseen financial risks is paramount. Florida Business Insurance plays a vital role in safeguarding your company's assets, ensuring its…

- Business Liability Insurance: A Comprehensive Guide… Introduction: Understanding the Importance of Business Liability Insurance In today's business landscape, where unexpected events can arise at any moment, having adequate liability insurance is crucial for protecting your business…

- Cheap Liability Insurance for Small Businesses Protecting Your Business with Affordable Coverage Liability insurance is essential for small businesses, providing financial protection against claims of negligence or wrongdoing. However, finding affordable coverage can be challenging. This…

- Cheap General Liability Insurance for Small Businesses Navigating the Maze of Coverage Options for Financial Protection As a small business owner, securing comprehensive insurance coverage is paramount to safeguarding your enterprise against potential liabilities and financial losses.…

- Liability Contractor Insurance: A Comprehensive… Hello, Readers! In today's dynamic and demanding construction industry, protecting your business and safeguarding your assets is paramount. One crucial aspect of this protection is Liability Contractor Insurance, a specialized…

- USAA General Liability Insurance: Comprehensive… Introduction: A Comprehensive Guide to USAA General Liability Insurance In today's increasingly litigious society, protecting oneself and one's assets from potential lawsuits is paramount. General liability insurance serves as a…

- Cheap Small Business Liability Insurance Everything You Need to Know Introduction As a small business owner, you're always looking for ways to save money. But when it comes to liability insurance, you shouldn't cut corners.…

- The Ultimate Guide to Best Workers Comp Insurance… Hello, Valued Readers, Welcome to this comprehensive guide on Best Workers Comp Insurance. As a business owner, you understand the paramount importance of safeguarding your workforce through robust workers' compensation…

- Painting Contractor Insurance: A Comprehensive Guide… A Warm Greeting to Our Respected Readers: Greetings, esteemed readers! As the world of painting contractors becomes increasingly competitive, you must equip yourself with the knowledge and protection to navigate…

- Cheap Business Liability Insurance Coverage:… In today's competitive business landscape, protecting your enterprise against potential risks is paramount. Business liability insurance coverage offers a cost-effective solution to mitigate unexpected liabilities, safeguarding your company's financial stability…

- Cheapest General Liability Insurance for Small… Introduction: Navigating the Insurance Landscape for Entrepreneurs As a small business owner, protecting your enterprise from unforeseen liabilities is crucial. General liability insurance serves as a safety net, mitigating potential…

- What You Need to Know About Cleaners Insurance A Comprehensive Guide for Cleaning Businesses Hello, readers! Are you a cleaning business owner looking for a comprehensive understanding of cleaners insurance? This article will provide you with everything you…

- Cheap Liability Insurance For Business Embrace Financial Protection for Your Business with Cheap Liability Insurance The world of business is a competitive landscape, where unforeseen circumstances can strike at any moment, threatening the stability and…

- Lowest General Liability Insurance: Affordable… General liability insurance (GLI) is a crucial form of coverage that protects businesses from financial losses arising from lawsuits alleging bodily injury, property damage, or personal injury. While GLI is…

- Building Contractor Liability Insurance: The Ultimate Guide As a building contractor, you're responsible for ensuring the safety of your workers and clients. However, even the most careful contractors can face accidents and lawsuits. That's where building contractor…

- Buy Workers Compensation Insurance Online Get Covered Today! Hello, Readers! In today's competitive business landscape, protecting your most valuable assets – your employees – is crucial for the success and longevity of your organization. Workers'…

- Buy Liability Insurance For Business Protect Your Business from Financial Devastation Introductory Words: Liability insurance is a crucial investment for any business, regardless of its size or industry. It protects the company from financial responsibility…