Cheap General Liability Insurance For Llc

Contents

- 1 The Ultimate Guide

- 2 What is General Liability Insurance?

- 3 Why Do I Need General Liability Insurance?

- 4 How Do I Find the Best Coverage for My Business?

- 5 Strengths of Cheap General Liability Insurance For Llc

- 6 Weaknesses of Cheap General Liability Insurance For Llc

- 7 Table: Comparing Cheap General Liability Insurance For Llc

- 8 FAQs About Cheap General Liability Insurance For Llc

- 8.1 What is the average cost of general liability insurance for an LLC?

- 8.2 What are the different types of general liability insurance coverage available?

- 8.3 Do I need general liability insurance if I’m a sole proprietor?

- 8.4 What are the benefits of having general liability insurance?

- 8.5 What are the risks of not having general liability insurance?

- 8.6 How can I find the best general liability insurance for my LLC?

- 8.7 What should I do if I’m sued?

- 9 Conclusion

- 10 Call to Action

The Ultimate Guide

Looking for cheap general liability insurance for your LLC? You’re in the right place. In this guide, we’ll explain everything you need to know about general liability insurance, including what it is, why you need it, and how to find the best coverage for your business.

What is General Liability Insurance?

General liability insurance is a type of business insurance that protects your company from financial losses due to claims of bodily injury or property damage. These claims can arise from a variety of incidents, such as:

- Customer injuries on your premises

- Damage to property caused by your employees

- Libel, slander, or defamation

Why Do I Need General Liability Insurance?

General liability insurance is essential for any business, regardless of its size or industry. Here are a few reasons why:

- It protects your business from financial ruin. A single lawsuit can cost hundreds of thousands of dollars to defend, even if you’re ultimately found not liable. General liability insurance can help you cover these costs, so you can focus on running your business.

- It gives your customers peace of mind. When customers know that you have general liability insurance, they’re more likely to do business with you. It shows them that you’re a responsible business owner who cares about their safety.

- It can help you get financing. Some lenders require businesses to have general liability insurance before they’ll approve a loan. This is because general liability insurance can protect the lender from financial losses if you’re sued.

How Do I Find the Best Coverage for My Business?

When shopping for general liability insurance, there are a few things you should keep in mind:

- The amount of coverage you need. The amount of coverage you need will depend on the size of your business and the level of risk you face. A small business with a low risk of lawsuits may only need a policy with a limit of $1 million, while a large business with a high risk of lawsuits may need a policy with a limit of $5 million or more.

- The deductible you’re willing to pay. The deductible is the amount of money you have to pay out of pocket before your insurance coverage kicks in. A higher deductible will result in a lower premium, but it will also leave you with more financial responsibility in the event of a claim.

- The type of coverage you need. There are a variety of different types of general liability insurance coverage available, each with its own unique benefits and exclusions. You should work with an insurance agent to find a policy that meets your specific needs.

Strengths of Cheap General Liability Insurance For Llc

There are a number of strengths to cheap general liability insurance for LLCs, including:

- It’s affordable. Cheap general liability insurance can be very affordable, especially for small businesses with a low risk of lawsuits.

- It’s easy to get. Cheap general liability insurance is typically available from a variety of insurance companies, and it’s easy to apply for and get approved.

- It can protect your business. Cheap general liability insurance can protect your business from financial losses due to claims of bodily injury or property damage.

Weaknesses of Cheap General Liability Insurance For Llc

However, there are also some weaknesses to cheap general liability insurance for LLCs, including:

- It may not provide enough coverage. Cheap general liability insurance policies typically have lower coverage limits than more expensive policies. This may not be enough coverage to protect your business from all potential risks.

- It may not cover all types of risks. Cheap general liability insurance policies typically have a number of exclusions, which means they may not cover all types of risks that your business faces.

- It may not be available to all businesses. Cheap general liability insurance may not be available to all businesses, especially those with a high risk of lawsuits.

Table: Comparing Cheap General Liability Insurance For Llc

The following table compares the strengths and weaknesses of cheap general liability insurance for LLCs:

| Strength | Weakness |

|---|---|

| Affordable | May not provide enough coverage |

| Easy to get | May not cover all types of risks |

| Can protect your business | May not be available to all businesses |

FAQs About Cheap General Liability Insurance For Llc

Here are some of the most frequently asked questions about cheap general liability insurance for LLCs:

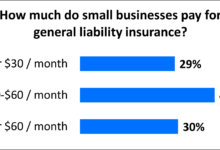

What is the average cost of general liability insurance for an LLC?

The average cost of general liability insurance for an LLC is $500 to $1,000 per year. However, the cost will vary depending on the size of your business, the level of risk you face, and the amount of coverage you need.

What are the different types of general liability insurance coverage available?

There are a variety of different types of general liability insurance coverage available, including:

- Commercial general liability insurance (CGL)

- Professional liability insurance

- Product liability insurance

- Errors and omissions insurance (E&O)

Do I need general liability insurance if I’m a sole proprietor?

Yes, you need general liability insurance even if you’re a sole proprietor. Sole proprietors are personally liable for any debts or liabilities incurred by their business. This means that if someone sues your business, they can come after your personal assets.

What are the benefits of having general liability insurance?

General liability insurance can provide a number of benefits for your business, including:

- Protection from financial losses due to claims of bodily injury or property damage

- Peace of mind knowing that your business is protected

- The ability to get financing

What are the risks of not having general liability insurance?

If you don’t have general liability insurance, you’re putting your business at risk. If someone sues your business and you’re found liable, you could be responsible for paying out a large sum of money. This could bankrupt your business and ruin your financial future.

How can I find the best general liability insurance for my LLC?

The best way to find the best general liability insurance for your LLC is to work with an insurance agent. An agent can help you compare policies from different insurance companies and find a policy that meets your specific needs and budget.

What should I do if I’m sued?

If you’re sued, you should immediately contact your insurance company. Your insurance company will assign you an attorney to defend you in court. You should also provide your insurance company with all of the documents related to the lawsuit.

Conclusion

Cheap general liability insurance for LLCs can be a great way to protect your business from financial losses due to claims of bodily injury or property damage. However, it’s important to understand the strengths and weaknesses of cheap general liability insurance before you purchase a policy. By working with an insurance agent, you can find a policy that meets your specific needs and budget.

Call to Action

Don’t wait until it’s too late to protect your business. Contact an insurance agent today to get a quote on cheap general liability insurance for your LLC.