What is General Liability Insurance?

General liability insurance is a type of business insurance that protects businesses from financial liability for bodily injury or property damage that occurs as a result of their operations. It can also cover legal fees and other expenses associated with defending against lawsuits.

Why Do I Need General Liability Insurance?

General liability insurance is essential for any business, regardless of its size or industry. It can protect your business from financial ruin if someone is injured or their property is damaged as a result of your business’s activities. Even if you are not at fault, you could be held liable for damages, and legal fees can be expensive.

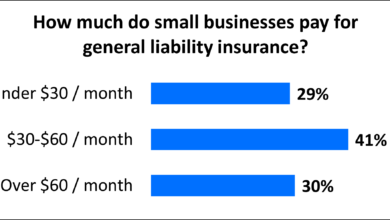

How Much Does General Liability Insurance Cost?

The cost of general liability insurance varies depending on a number of factors, including the size of your business, the industry you are in, and your claims history. However, there are a number of ways to save money on your insurance premiums, such as bundling your insurance policies or increasing your deductible.

Where Can I Find Cheap General Liability Insurance Near Me?

There are a number of ways to find cheap general liability insurance near you. You can shop around online, compare quotes from different insurance companies, or work with an insurance broker. You can also save money by bundling your insurance policies or increasing your deductible.

What are the Benefits of Cheap General Liability Insurance?

There are a number of benefits to having cheap general liability insurance, including:

Financial protection from lawsuits

Peace of mind knowing that your business is protected

Increased credibility with customers and clients

How Do I Get Cheap General Liability Insurance?

There are a number of things you can do to get cheap general liability insurance, including:

Shop around and compare quotes from different insurance companies

Bundle your insurance policies

Increase your deductible

Work with an insurance broker

Strengths and Weaknesses of Cheap General Liability Insurance

Strengths:

There are a number of strengths to cheap general liability insurance, including:

It is affordable, even for small businesses

It can provide peace of mind

It can help you attract and retain customers

Weaknesses:

There are also some weaknesses to cheap general liability insurance, including:

It may not provide enough coverage for your business

It may not cover all types of claims

It may not be available from all insurance companies

Table of Cheap General Liability Insurance Providers

| Provider |

Average Annual Premium |

Coverage Limits |

Deductible |

| Progressive |

$500 |

$1 million |

$500 |

| State Farm |

$600 |

$2 million |

$1,000 |

| Farmers |

$700 |

$3 million |

$1,500 |

| Travelers |

$800 |

$4 million |

$2,000 |

| Chubb |

$900 |

$5 million |

$2,500 |

FAQs about Cheap General Liability Insurance

What is the difference between general liability insurance and professional liability insurance?

General liability insurance protects businesses from financial liability for bodily injury or property damage that occurs as a result of their operations. Professional liability insurance, on the other hand, protects businesses from financial liability for errors or omissions in their professional services.

Do I need general liability insurance if I work from home?

Yes, you need general liability insurance even if you work from home. If someone is injured or their property is damaged as a result of your business activities, you could be held liable for damages.

How much general liability insurance do I need?

The amount of general liability insurance you need depends on a number of factors, including the size of your business, the industry you are in, and your claims history. However, most businesses should have at least $1 million in coverage.

What are the benefits of bundling my insurance policies?

Bundling your insurance policies can save you money on your premiums. When you bundle your policies, you are essentially buying multiple policies from the same insurance company. This can result in a discount on your overall premium.

What is a deductible?

A deductible is the amount of money you have to pay out of pocket before your insurance coverage kicks in. A higher deductible will result in a lower premium, but it will also mean that you have to pay more out of pocket if you file a claim.

What types of claims are covered by general liability insurance?

General liability insurance covers a wide range of claims, including:

- Bodily injury

- Property damage

- Libel and slander

- False advertising

- Malicious prosecution

What are the exclusions to general liability insurance?

General liability insurance does not cover all types of claims. Some common exclusions include:

- Intentional acts

- Criminal acts

- Acts committed by employees outside the scope of their employment

- Pollution

- Workers’ compensation claims

How do I file a general liability insurance claim?

If you need to file a general liability insurance claim, you should contact your insurance company as soon as possible. Your insurance company will provide you with a claim form and instructions on how to file your claim.

Checkout These Recommendations:

- Basic General Liability Insurance: Protecting Your… Understanding General Liability Insurance: An Overview As a business owner, you face numerous risks that could lead to lawsuits and substantial financial losses. Basic general liability insurance is a fundamental…

- Cheap General Liability Insurance For Llc The Ultimate Guide Looking for cheap general liability insurance for your LLC? You're in the right place. In this guide, we'll explain everything you need to know about general liability…

- General Liability Insurance For Small Business Near… Introductory Words: Unveiling the Significance of General Liability Insurance for Small Businesses In the labyrinthine landscape of commerce, every small business owner embarks on a perilous journey fraught with unforeseen…

- Electrical Contractors Insurance: A Comprehensive Guide Hello, Readers! Welcome to our comprehensive guide on electrical contractors insurance. This essential insurance policy is tailored to protect electrical contractors like you from financial risks and liabilities associated with…

- Small Business Liability Insurance: Protect Your… Introduction As an entrepreneur in Georgia, protecting your business from potential liabilities is crucial. Small business liability insurance provides a safety net against financial losses resulting from accidents, lawsuits, and…

- Cheap General Liability Insurance For Handyman Protecting Your Business and Assets As a handyman, you provide essential services to your clients, but you also face unique risks every day. Accidents can happen, and if someone is…

- Lowest General Liability Insurance: Affordable… General liability insurance (GLI) is a crucial form of coverage that protects businesses from financial losses arising from lawsuits alleging bodily injury, property damage, or personal injury. While GLI is…

- Online Liability Insurance Coverage: Shielding Your… Introductory Words In an increasingly interconnected digital world, online businesses face a myriad of risks that can jeopardize their reputation and financial well-being. Cyberattacks, data breaches, and third-party lawsuits are…

- California General Liability Insurance:… Introduction Greetings, Readers! In the vibrant business landscape of California, safeguarding your enterprise from potential risks is paramount. General Liability Insurance (GLI) emerges as an indispensable tool to shield your…

- Workers' Compensation and General Liability… Introduction Navigating the complexities of business insurance can be a daunting task, especially when it comes to understanding the differences between workers' compensation and general liability insurance. Both policies play…

- General Liability Insurance For Construction Business A Comprehensive Guide for Protecting Your Company As a construction business owner, you face a wide range of risks that can potentially lead to significant financial losses. General liability insurance…

- Affordable General Liability Insurance For Small Business An Essential Protection for Your Business In today's competitive business landscape, protecting your small business from unforeseen events is paramount. Among the most crucial forms of protection is general liability…

- Obtain General Liability Insurance: Protect Your… Introductory Words As a business owner, you face countless risks that could jeopardize your financial stability and reputation. One of the most significant threats is the possibility of being sued…

- General Liability and Workers' Comp Insurance: A… Hello, Readers: In this increasingly litigious world, businesses of all sizes need comprehensive insurance coverage to protect themselves from unforeseen events. General liability and workers' compensation insurance are two essential…

- Business General Liability Insurance Online: A… Introduction In today's competitive business landscape, protecting your company against potential liabilities is paramount. Business general liability insurance (BGLI) serves as a critical safeguard, providing coverage for a wide range…

- Liability Insurance for Photographers: A Comprehensive Guide Prelude: Greetings and Introduction to the Importance of Liability Insurance Hello, Readers! Welcome to our in-depth exploration of liability insurance for photographers. In today's digital landscape, where your work can…

- General Liability and Errors and Omissions… Preamble: Understanding the Importance of Insurance in Today's Business Environment In the modern business landscape, navigating the complexities of legal liabilities and professional responsibilities is paramount. As businesses grow and…

- Cheap Liability Car Insurance Virginia Finding Affordable Coverage in the Old Dominion Virginia is known for its stunning scenery, vibrant cities, and rich history. However, navigating the roads can be a bit more challenging without…

- Cheap Workers' Comp Insurance: A Comprehensive Guide Introduction Welcome, readers! In today's business landscape, securing affordable workers' compensation insurance is crucial. This comprehensive article delves into the realm of cheap workers' comp insurance, shedding light on its…

- Cheap Liability Car Insurance In Indiana An In-Depth Guide to Finding Affordable Coverage Are you looking for cheap liability car insurance in Indiana? If so, you're not alone. Car insurance is a major expense for many…

- Get Commercial General Liability Insurance:… Protect Your Livelihood, Safeguard Your Assets: The Imperative of CGL Insurance In the labyrinthine world of business, where unforeseen events lurk like hidden perils, protecting your enterprise from financial ruin…

- Cheap General Liability Insurance For Business In this current business environment, it is important for businesses to have the right insurance coverage in place. One of the most important types of insurance for businesses is general…

- Best Workers' Comp Insurance for Small Business A Comprehensive Guide to Protecting Your Business and Employees Hello, Readers! As a small business owner, you know the importance of protecting your employees and your business. Workers' compensation insurance…

- Business Liability Insurance: A Comprehensive Guide… Introduction: Understanding the Importance of Business Liability Insurance In today's business landscape, where unexpected events can arise at any moment, having adequate liability insurance is crucial for protecting your business…

- Small Business General Liability Insurance Near Me:… Introduction Owning a small business is an exciting and rewarding endeavor, but it also comes with potential risks and liabilities. One crucial way to safeguard your business is by obtaining…

- Cheap Liability Business Insurance: Protect Your… Introductory Words In today's competitive business environment, protecting your company from financial risks is crucial. One essential aspect of this protection is liability insurance, which safeguards your business from legal…

- Insurance for LLC Business: Protect Your Enterprise… Greetings, Readers! In today's competitive business landscape, it is imperative for Limited Liability Companies (LLCs) to shield themselves against various risks and financial liabilities. Insurance for LLCs plays a crucial…

- Business Liability and Workers' Compensation… Introduction: In today's competitive business environment, it is crucial for organizations to safeguard themselves and their employees against financial risks and legal liabilities. Business Liability and Workers' Compensation Insurance play…

- Carpenter General Liability Insurance: Safeguarding… As a skilled craftsperson, your carpentry business deserves the utmost protection against potential risks and liabilities. Carpenter General Liability Insurance (GL) serves as a vital safety net, safeguarding you and…

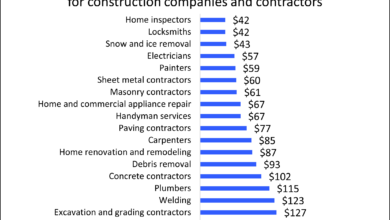

- Cheap General Liability Insurance For Contractors Hello Contractors! Readers, are you a contractor looking for some of the most affordable general liability insurance on the market? Look no further! In this article, we will be discussing…