Cheap Small Business Liability Insurance

Contents

- 1 Everything You Need to Know

- 2 What is Liability Insurance?

- 3 The Benefits of Liability Insurance

- 4 How to Find Cheap Small Business Liability Insurance

- 5 The Pros and Cons of Cheap Small Business Liability Insurance

- 6 Table of Cheap Small Business Liability Insurance Providers

- 7 FAQs About Cheap Small Business Liability Insurance

- 8 Conclusion

- 9 Closing Words

Everything You Need to Know

Introduction

As a small business owner, you’re always looking for ways to save money. But when it comes to liability insurance, you shouldn’t cut corners. Liability insurance is essential for protecting your business from financial ruin in the event of a lawsuit. Cheap small business liability insurance is available, but it’s important to compare policies carefully to make sure you’re getting the coverage you need at a price you can afford.

In this article, we’ll discuss the different types of liability insurance available to small businesses, the benefits of having liability insurance, and how to find cheap small business liability insurance.

What is Liability Insurance?

Liability insurance protects your business from financial losses if you are sued for bodily injury, property damage, or other harm caused by your business operations. There are two main types of liability insurance: general liability insurance and professional liability insurance.

General liability insurance covers your business for claims arising from bodily injury, property damage, or other harm caused by your business operations. This type of insurance is essential for all businesses, regardless of their size or industry.

Professional liability insurance covers your business for claims arising from errors or omissions in your professional services. This type of insurance is important for businesses that provide professional services, such as accountants, lawyers, and doctors.

The Benefits of Liability Insurance

There are many benefits to having liability insurance for your small business.

1. Liability insurance can protect your business from financial ruin in the event of a lawsuit.

2. Liability insurance can help you attract and retain customers.

3. Liability insurance can give you peace of mind knowing that your business is protected.

How to Find Cheap Small Business Liability Insurance

There are a few things you can do to find cheap small business liability insurance.

1. Shop around and compare quotes from different insurance companies.

2. Look for discounts and special offers.

3. Increase your deductible.

4. Choose a higher liability limit.

The Pros and Cons of Cheap Small Business Liability Insurance

There are both pros and cons to purchasing cheap small business liability insurance.

Pros

1. Cheap small business liability insurance can save you money on your insurance premiums.

2. Cheap small business liability insurance can be easy to find and purchase.

3. Cheap small business liability insurance can give you peace of mind knowing that your business is protected.

Cons

1. Cheap small business liability insurance may not provide you with the coverage you need.

2. Cheap small business liability insurance may have high deductibles or other limitations.

3. Cheap small business liability insurance may not be available from all insurance companies.

Table of Cheap Small Business Liability Insurance Providers

| Provider | Cost | Coverage | Deductible |

|---|---|---|---|

| Progressive | $20-$50 per month | $1 million per occurrence/$2 million aggregate | $500 |

| State Farm | $25-$60 per month | $1 million per occurrence/$2 million aggregate | $1,000 |

| The Hartford | $30-$70 per month | $1 million per occurrence/$2 million aggregate | $1,500 |

FAQs About Cheap Small Business Liability Insurance

Here are some of the most frequently asked questions about cheap small business liability insurance.

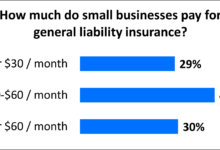

1. How much does cheap small business liability insurance cost?

The cost of cheap small business liability insurance varies depending on the provider, the coverage you choose, and the deductible you select. However, you can expect to pay between $20 and $70 per month for cheap small business liability insurance.

2. What is the best cheap small business liability insurance policy?

The best cheap small business liability insurance policy for you will depend on your individual needs and budget. However, some of the best cheap small business liability insurance policies include Progressive’s Business Owner’s Policy, State Farm’s Business Liability Insurance, and The Hartford’s Small Business Advantage Policy.

3. Can I get cheap small business liability insurance online?

Yes, you can get cheap small business liability insurance online from a variety of providers. However, it’s important to compare quotes from different providers to make sure you’re getting the best deal.

4. How do I choose the right deductible for my cheap small business liability insurance policy?

The deductible is the amount of money you will have to pay out of pocket before your insurance policy kicks in. A higher deductible will lower your insurance premiums, but it will also increase the amount of money you will have to pay out of pocket if you file a claim. When choosing a deductible, it’s important to consider your budget and the likelihood of you filing a claim.

5. What are the benefits of having cheap small business liability insurance?

There are many benefits to having cheap small business liability insurance, including:

1. Protection from financial ruin in the event of a lawsuit

2. Increased customer confidence

3. Peace of mind

6. What are the risks of not having cheap small business liability insurance?

There are a number of risks associated with not having cheap small business liability insurance, including:

1. Financial ruin in the event of a lawsuit

2. Loss of customers

3. Damage to your business’s reputation

7. How can I get a quote for cheap small business liability insurance?

You can get a quote for cheap small business liability insurance online or by contacting an insurance agent. When getting a quote, be sure to provide the insurance company with information about your business, including your industry, number of employees, and annual revenue.

Conclusion

Liability insurance is essential for protecting your small business from financial ruin in the event of a lawsuit. Cheap small business liability insurance is available, but it’s important to compare policies carefully to make sure you’re getting the coverage you need at a price you can afford.

By following the tips in this article, you can find cheap small business liability insurance that meets your needs and budget.

Don’t wait until it’s too late to protect your business. Get liability insurance today.

Closing Words

I hope this article has been helpful in providing you with information about cheap small business liability insurance. If you have any questions, please don’t hesitate to contact an insurance agent. They can help you find the right policy for your business.

Protecting your business is important. Liability insurance is one way to do that. Get liability insurance today and give yourself peace of mind knowing that your business is protected.