Introduction:

Protecting your small business from potential risks is crucial for ensuring its success and longevity. General liability insurance is an indispensable component of any comprehensive business insurance plan, providing protection against legal liabilities resulting from third-party bodily injuries, property damage, and personal and advertising injuries. With various insurance providers offering general liability coverage, finding the most affordable option tailored to your business needs can be a challenge.

This comprehensive guide delves into the factors influencing the cost of general liability insurance, highlights the key considerations for small businesses, and showcases a detailed comparison of the cheapest general liability insurance providers. By understanding the nuances of general liability insurance and leveraging the insights provided in this article, small businesses can make informed decisions and secure reliable coverage at competitive rates.

Factors Influencing the Cost of General Liability Insurance:

The cost of general liability insurance for small businesses is primarily determined by the following factors:

- Gross Sales Revenue: Insurance providers often use annual gross sales revenue as an indicator of potential risk exposure. Higher gross sales typically lead to higher insurance premiums.

- Industry Classification: The nature of your business operations plays a significant role in determining your insurance rates. Businesses with higher risk profiles, such as construction or manufacturing, generally pay more for liability coverage.

- Number of Employees: The number of employees in your business can influence insurance premiums. More employees increase the likelihood of accidents and claims, leading to higher premiums.

- Claims History: Businesses with a history of claims are more likely to experience higher insurance premiums as they pose a greater risk to the insurance provider.

- Deductible Amount: A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your insurance premiums.

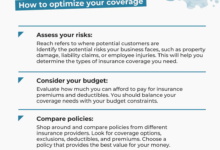

Considerations for Small Businesses:

When selecting general liability insurance for your small business, consider the following points:

- Determine Your Coverage Needs: Assess your business operations and identify potential risks to determine the appropriate level of coverage.

- Shop Around for Quotes: Obtain quotes from multiple insurance providers to compare coverage options and rates.

- Review Policy Details: Carefully review the policy terms and conditions, including coverage limits, exclusions, and deductibles, to ensure they align with your business needs.

- Consider Your Budget: Factor in the cost of insurance premiums into your overall business budget.

- Opt for Risk Management Measures: Implementing safety protocols and employee training programs can reduce the likelihood of accidents and claims, potentially lowering your insurance premiums.

Comparison of Cheapest General Liability Insurance Providers:

Based on a comprehensive analysis, the following insurance providers offer competitive rates for general liability insurance:

| Provider |

Average Annual Premium |

Coverage Limits |

Deductible Options |

| Next Insurance |

$500 – $1,000 |

Up to $2 million per occurrence |

$500, $1,000, or $2,500 |

| Hiscox |

$600 – $1,200 |

Up to $1 million per occurrence |

$500, $1,000, or $2,500 |

| The Hartford |

$700 – $1,400 |

Up to $1 million per occurrence |

$1,000, $2,500, or $5,000 |

| Chubb |

$800 – $1,600 |

Up to $2 million per occurrence |

$500, $1,000, or $2,500 |

| Liberty Mutual |

$900 – $1,800 |

Up to $1 million per occurrence |

$500, $1,000, or $2,500 |

Strengths of General Liability Insurance for Small Businesses:

General liability insurance provides numerous benefits for small businesses:

- Protection from Legal Liability: Protects your business from financial losses arising from third-party claims of bodily injuries, property damage, or personal and advertising injuries.

- Peace of Mind: Gives peace of mind, knowing that your business is covered in the event of unexpected accidents or lawsuits.

- Credibility for Business Reputation: Demonstrates to clients and partners that your business is reputable and takes responsibility for its operations.

- Compliance with Contract Requirements: Many contracts require businesses to carry general liability insurance as a condition of working with them.

- Financial Stability: Helps protect your business from financial ruin in the event of a costly lawsuit.

Weaknesses of General Liability Insurance for Small Businesses:

There are certain limitations and exclusions associated with general liability insurance:

- Limited Coverage: General liability insurance does not cover all types of business risks, such as professional liability or errors and omissions.

- Deductible Expense: You are responsible for paying the deductible amount before your insurance coverage kicks in.

- Premium Increases: Insurance providers may increase premiums based on factors such as claims history or changes in business operations.

- Exclusions and Limitations: Policies may contain exclusions or limitations on coverage for certain types of claims.

- Complex Policy Language: Insurance policies can be complex and difficult to understand, requiring professional guidance for interpretation.

Conclusion:

General liability insurance is a cornerstone of any comprehensive insurance plan for small businesses. By understanding the factors influencing the cost and coverage options available, small business owners can make informed decisions and secure affordable protection against potential risks. The providers showcased in this guide offer competitive rates and customizable coverage, enabling small businesses to choose the plan that best aligns with their unique needs. By investing in general liability insurance, small businesses can safeguard their financial stability and continue operating with confidence.

Closing Words:

Protecting your small business from unforeseen events is paramount for its long-term success. General liability insurance serves as a safety net, mitigating financial liabilities and safeguarding your business against legal claims. By leveraging the insights provided in this article, you can navigate the complexities of insurance and make informed decisions to ensure your business is adequately protected at competitive rates.

Checkout These Recommendations:

- Cheap Business Liability Insurance Coverage:… In today's competitive business landscape, protecting your enterprise against potential risks is paramount. Business liability insurance coverage offers a cost-effective solution to mitigate unexpected liabilities, safeguarding your company's financial stability…

- Cheap Small Business Liability Insurance Everything You Need to Know Introduction As a small business owner, you're always looking for ways to save money. But when it comes to liability insurance, you shouldn't cut corners.…

- General Liability Insurance For Online Business:… Introduction In today's digital world, running an online business has become more accessible than ever. However, just like any other type of business, online ventures face their unique set of…

- General Liability Insurance Instant Quote: Protect… An Overview of General Liability Insurance Instant Quote General liability insurance is a type of business insurance policy that protects businesses from claims of bodily injury or property damage caused…

- Liability Insurance for Independent Consultants: A… Preamble: Unveiling the Significance of Liability Insurance for Independent Consultants As an independent consultant, you possess a unique set of skills and expertise that empowers you to provide valuable services…

- Small Business Professional Liability Insurance: A… Introduction Hello, readers! In today's competitive market, small businesses face numerous challenges. One often overlooked but critically important area is professional liability insurance. This comprehensive guide will delve into the…

- General Liability Insurance: A Lifeline for Businesses A Comprehensive Guide to Protecting Your Business from Unforeseen Incidents Greetings, dear readers! Welcome to this in-depth exploration of General Liability Insurance, an essential component of any business's risk management…

- General Liability and Errors and Omissions… Preamble: Understanding the Importance of Insurance in Today's Business Environment In the modern business landscape, navigating the complexities of legal liabilities and professional responsibilities is paramount. As businesses grow and…

- Inexpensive Business Liability Insurance: Protect… An Introduction to Essential Coverage for Small Businesses As a small business owner, you're faced with countless challenges. One of the most pressing is protecting your business from unexpected events…

- Business Liability Insurance Providers: A… Introduction In the fast-paced world of business, unforeseen events and potential liabilities can strike at any moment. Business liability insurance plays a crucial role in safeguarding businesses against financial losses…

- Company Liability Insurance Plans: Protecting Your… Introductory Words: Operating a business comes with inherent risks, and one of the most significant is the potential for lawsuits. Unforeseen events, accidents, or allegations of negligence can lead to…

- Cheap General Liability Insurance For Business In this current business environment, it is important for businesses to have the right insurance coverage in place. One of the most important types of insurance for businesses is general…

- General Liability Insurance for Startups: A… Introduction In the dynamic and competitive world of startups, where innovation and risk-taking are inherent, protecting your business from potential liabilities is crucial. General liability insurance (GLI) serves as an…

- General Liability Business Insurance Quote: Protect… Navigating the Complexities of Business Liability Insurance Before delving into the specifics of general liability business insurance quotes, it is crucial to grasp the fundamental principles underlying business liability. Business…

- General Liability Insurance vs. Workers'… Introductory Words: In today's business world, savvy entrepreneurs and risk managers recognize the paramount importance of safeguarding their ventures against unforeseen events that could jeopardize their financial well-being. Two essential…

- Cheap Liability Car Insurance Indiana Introduction In the realm of driving, liability insurance stands as a crucial safeguard, protecting Indiana motorists from the financial consequences of at-fault accidents. As a legal requirement in the state,…

- Cheap General Liability Insurance For Handyman Protecting Your Business and Assets As a handyman, you provide essential services to your clients, but you also face unique risks every day. Accidents can happen, and if someone is…

- Basic Business Liability Insurance: Protect Your… Introduction Every business, no matter how small, faces risks and liabilities that could potentially damage its financial well-being. From customer injuries to property damage, unexpected events can strike at any…

- Workers' Compensation and General Liability… Navigating the Labyrinth of Business Risks In today's competitive business landscape, protecting your company from unforeseen events is paramount. Workers' compensation and general liability insurance are essential tools that provide…

- Small Business General Liability Insurance Near Me:… Introduction Owning a small business is an exciting and rewarding endeavor, but it also comes with potential risks and liabilities. One crucial way to safeguard your business is by obtaining…

- Workers' Compensation Insurance for Small… Introduction Hello, esteemed readers! Welcome to our in-depth exploration of workers' compensation insurance for small businesses. In today's competitive business landscape, safeguarding your workforce and ensuring their well-being is paramount.…

- Cheapest Auto Insurance After Accident Cheapest Auto Insurance After Accident: The Ultimate Guide to Finding Affordable Coverage Introduction After a car accident, your insurance rates can skyrocket. This can be a major financial burden, especially…

- Cheap General Liability and Workers' Compensation… Introduction As a business owner, protecting your company against potential risks is crucial. Inadequate insurance coverage can leave you vulnerable to substantial financial losses and legal liabilities. Among the essential…

- Business Liability Insurance: A Comprehensive Guide… Introduction: Understanding the Importance of Business Liability Insurance In today's business landscape, where unexpected events can arise at any moment, having adequate liability insurance is crucial for protecting your business…

- Business Liability Insurance Brokers: Protecting… Introduction In the competitive world of business, protecting your assets and minimizing financial risks is crucial for long-term success. Business liability insurance brokers play a vital role in safeguarding businesses…

- Cheapest Rate Car Insurance Quote An Exhaustive Guide to Finding the Most Affordable Car Insurance In the realm of car ownership, insurance serves as a crucial safety net, providing protection against financial burdens in the…

- Cleaning Company Insurance: A Comprehensive Guide Hello, Readers! Welcome to this comprehensive guide on cleaning company insurance. As a business owner, it's imperative to secure adequate insurance coverage to protect your assets, employees, and customers. This…

- Affordable General Liability Insurance For Small Business An Essential Protection for Your Business In today's competitive business landscape, protecting your small business from unforeseen events is paramount. Among the most crucial forms of protection is general liability…

- Workers' Compensation and General Liability… Introduction Navigating the complexities of business insurance can be a daunting task, especially when it comes to understanding the differences between workers' compensation and general liability insurance. Both policies play…

- Small Business Liability Insurance: Protect Your… Introduction As an entrepreneur in Georgia, protecting your business from potential liabilities is crucial. Small business liability insurance provides a safety net against financial losses resulting from accidents, lawsuits, and…