Cheapest General Liability Insurance for Small Businesses: A Comprehensive Guide

Contents

- 1 Introduction: Navigating the Insurance Landscape for Entrepreneurs

- 2 Understanding General Liability Insurance: A Primer

- 3 Strengths and Weaknesses of Cheapest General Liability Insurance

- 4 Table of Cheapest General Liability Insurance Providers

- 5 FAQs on Cheapest General Liability Insurance

- 5.1 What factors affect the cost of general liability insurance?

- 5.2 Is it worth it to purchase cheap general liability insurance?

- 5.3 What is the difference between general liability insurance and professional liability insurance?

- 5.4 What should I look for when comparing general liability insurance policies?

- 5.5 Is there a minimum coverage amount required for general liability insurance?

- 5.6 What are some tips for reducing general liability insurance premiums?

- 5.7 How can I file a claim under my general liability insurance policy?

- 5.8 What are the consequences of not having general liability insurance?

- 5.9 Is general liability insurance tax-deductible?

- 5.10 Can I purchase general liability insurance online?

- 5.11 What is the best general liability insurance company for small businesses?

- 5.12 How often should I review my general liability insurance policy?

- 5.13 Can I increase my general liability insurance coverage limits over time?

- 6 Conclusion: Securing Peace of Mind for Your Business

- 7 Closing Words: A Disclaimer

As a small business owner, protecting your enterprise from unforeseen liabilities is crucial. General liability insurance serves as a safety net, mitigating potential financial losses stemming from claims of bodily injury, property damage, or personal injury. With numerous insurance providers offering varying coverage options, selecting the cheapest general liability insurance for your business can be a daunting task.

This comprehensive guide will delve into the intricacies of general liability insurance, exploring its strengths and weaknesses. We will provide detailed explanations of the coverage limits, deductibles, and exclusions to empower you in making an informed decision. Furthermore, we will present a comprehensive table summarizing the offerings of leading insurance providers, enabling you to compare coverage and pricing with ease.

Understanding General Liability Insurance: A Primer

Coverage and Benefits

General liability insurance safeguards your business against financial liabilities arising from third-party claims of bodily injury, property damage, or personal injury. It covers expenses such as legal fees, medical expenses, and court costs. Additionally, it provides coverage for advertising injuries, such as defamation or slander.

Limitations and Exclusions

While general liability insurance offers extensive protection, it is essential to be aware of its limitations and exclusions. It does not cover employee injuries, intentional acts, or damages arising from professional negligence. It is crucial to carefully review the policy’s exclusions to ensure that your business is adequately protected.

Strengths and Weaknesses of Cheapest General Liability Insurance

Advantages

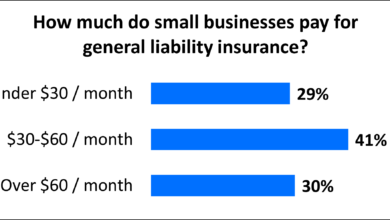

Cost-Effective: Cheapest general liability insurance offers a budget-friendly way to protect your business from unforeseen liabilities. Premiums are typically lower, making it more accessible for small businesses with limited resources.

Legal Compliance: Many states and localities require businesses to carry general liability insurance. Meeting this legal requirement can protect your business from fines or penalties.

Peace of Mind: Knowing that your business is financially protected against potential liabilities can provide peace of mind, allowing you to focus on growing your enterprise without undue worry.

Disadvantages

Lower Coverage Limits: Cheapest general liability insurance policies often have lower coverage limits, which may not be sufficient to cover all potential liabilities faced by your business.

Limited Coverage: Cheapest policies may exclude certain types of coverage, such as professional liability or employee injuries. It is important to carefully review the policy to ensure that it meets your business’s specific needs.

Higher Deductibles: To offset lower premiums, cheapest policies may have higher deductibles. This means that you will be responsible for paying a larger amount out-of-pocket before coverage kicks in.

Table of Cheapest General Liability Insurance Providers

| Provider | Coverage Limits | Deductibles | Premiums | Additional Features |

|---|---|---|---|---|

| Insureon | $1,000,000/$2,000,000 | $500-$1,000 | Starting at $25/month | Online quoting, easy claims process |

| Next Insurance | $1,000,000/$2,000,000 | $1,000-$2,500 | Starting at $30/month | Tailored coverage options, mobile app |

| Simply Business | $1,000,000/$2,000,000 | $500-$2,000 | Starting at $20/month | Instant online quotes, round-the-clock support |

| Hiscox | Up to $5,000,000 | $1,000-$5,000 | Starting at $50/month | Customized coverage options, industry-specific policies |

| The Hartford | Up to $2,000,000/$4,000,000 | $500-$2,000 | Starting at $25/month | Wide range of insurance products, risk management services |

FAQs on Cheapest General Liability Insurance

-

What factors affect the cost of general liability insurance?

-

Is it worth it to purchase cheap general liability insurance?

-

What is the difference between general liability insurance and professional liability insurance?

-

What should I look for when comparing general liability insurance policies?

-

Is there a minimum coverage amount required for general liability insurance?

-

-

How can I file a claim under my general liability insurance policy?

-

What are the consequences of not having general liability insurance?

-

Is general liability insurance tax-deductible?

-

Can I purchase general liability insurance online?

-

What is the best general liability insurance company for small businesses?

-

How often should I review my general liability insurance policy?

-

Can I increase my general liability insurance coverage limits over time?

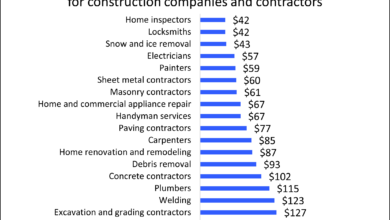

Factors such as industry, business size, revenue, number of employees, and claims history can influence premiums.

While it may be tempting to save money, opting for the cheapest policy may not provide sufficient coverage or leave you exposed to significant financial risk.

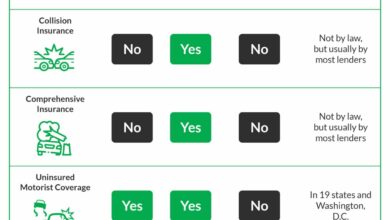

General liability insurance covers third-party claims, while professional liability insurance protects against claims of negligence or errors in professional services.

Consider coverage limits, deductibles, exclusions, and the reputation and financial stability of the insurance company.

Requirements vary by state, but most experts recommend coverage limits of at least $1,000,000 per occurrence and $2,000,000 aggregate.

Implementing risk management measures, such as safety programs and employee training, can help lower premiums.

Contact your insurance company promptly to report any incidents or claims. They will guide you through the process and provide support.

Facing a lawsuit without insurance can result in significant financial losses and potentially jeopardize the future of your business.

Yes, premiums for general liability insurance are typically tax-deductible as business expenses.

Yes, many insurance providers offer online quoting and purchasing options, making it convenient for small businesses.

The best provider depends on your specific needs and budget. It is advisable to compare coverage, premiums, and customer reviews before making a decision.

Regularly review your policy to ensure that it continues to meet your business’s evolving needs and risk profile.

Yes, you can adjust your coverage limits as your business grows and potential liabilities change.

Conclusion: Securing Peace of Mind for Your Business

Choosing the right general liability insurance for your small business is a critical decision. While cheaper policies may offer immediate cost savings, it is crucial to carefully consider the potential risks and limitations. By understanding the coverage, benefits, and exclusions, you can select a policy that provides comprehensive protection at a reasonable cost.

Remember that general liability insurance serves as a safety net, safeguarding your business from unexpected events. It can alleviate financial burdens, protect your reputation, and provide peace of mind as you navigate the challenges of entrepreneurship. By investing in adequate general liability coverage, you lay the foundation for sustained growth and success.

Take the time to research different providers, compare policies, and consult with an insurance professional. The right general liability insurance will not only protect your business but also empower you to operate with confidence and pursue your business goals.

Closing Words: A Disclaimer

The information provided in this article is intended for general informational purposes only and should not be construed as professional advice. It is advisable to seek the guidance of a qualified insurance professional to determine the most appropriate general liability insurance coverage for your specific business needs.