A Comprehensive Guide for Consultants

Introduction

Welcome, esteemed readers, to an in-depth exploration of Consultant Liability Insurance. In today’s competitive business landscape, consultants play a crucial role in providing expert guidance to organizations across industries. However, with this elevated responsibility comes the potential for financial and legal risks. Consultant Liability Insurance serves as a vital tool to mitigate these risks, protecting your practice, your assets, and your reputation.

This comprehensive guide delves into the intricacies of Consultant Liability Insurance, empowering you with the knowledge to make informed decisions. We will examine its strengths and weaknesses, delineate its coverage and exclusions, and provide practical guidance on how to secure the most suitable policy for your specific needs. By the end of this article, you will be equipped to safeguard your practice and ensure its continued success.

The Importance of Consultant Liability Insurance

Consultant Liability Insurance is an indispensable safeguard for any consulting firm. It provides comprehensive protection against claims arising from errors and omissions in your services, protecting your business from financial ruin and reputational damage.

Without adequate liability insurance, you could be held personally liable for any damages or losses incurred by your clients. This could include legal fees, compensation settlements, and even the loss of your professional license. Consultant Liability Insurance acts as a safety net, ensuring that you are financially shielded from these potential risks.

Strengths of Consultant Liability Insurance

Consultant Liability Insurance offers numerous strengths that make it essential for any consulting practice:

Financial Protection

Consultant Liability Insurance provides a financial lifeline in the event of a covered claim. It covers legal defense costs, settlements, and damages, ensuring that you do not have to bear the full financial burden of a lawsuit.

Peace of Mind

Knowing that your practice is insured gives you invaluable peace of mind. You can confidently focus on delivering exceptional services to your clients, without worrying about potential legal challenges.

Enhanced Credibility

Consultant Liability Insurance demonstrates your professionalism and commitment to providing high-quality services. It serves as a testament to your confidence in your abilities and your willingness to stand behind your work.

Weaknesses of Consultant Liability Insurance

While Consultant Liability Insurance is a powerful tool, it also has some limitations to consider:

Limited Coverage

Consultant Liability Insurance does not cover all types of risks. It is important to carefully review the policy’s coverage and exclusions to ensure that it meets your specific needs.

Deductibles and Limits

Most Consultant Liability Insurance policies come with deductibles and policy limits. The deductible is the amount you pay out-of-pocket before the insurance coverage kicks in. The policy limit is the maximum amount the insurer will pay for covered claims.

Potential Exclusions

Consultant Liability Insurance policies often contain exclusions for specific types of claims, such as intentional acts or gross negligence. It is important to understand these exclusions and make sure they do not conflict with your risk profile.

Coverage and Exclusions of Consultant Liability Insurance

Consultant Liability Insurance typically includes the following coverage:

- Errors and omissions

- Breach of contract

- Negligence

- Misrepresentation

The following are common exclusions in Consultant Liability Insurance policies:

- Intentional acts

- Criminal acts

- Gross negligence

- Dishonest or fraudulent acts

Consultant Liability Insurance Coverage and Exclusions

| Coverage |

Exclusions |

| Errors and omissions |

Intentional acts |

| Breach of contract |

Criminal acts |

| Negligence |

Gross negligence |

| Misrepresentation |

Dishonest or fraudulent acts |

FAQs about Consultant Liability Insurance

Here are some frequently asked questions about Consultant Liability Insurance:

1. What is Consultant Liability Insurance?

Consultant Liability Insurance is a type of professional liability insurance designed specifically for consultants. It protects consultants from financial and legal risks arising from errors, omissions, or negligence in their services.

2. Do I need Consultant Liability Insurance?

Yes, Consultant Liability Insurance is essential for any consulting practice. It protects you from financial ruin and reputational damage in the event of a lawsuit.

3. What are the benefits of Consultant Liability Insurance?

Consultant Liability Insurance offers numerous benefits, including financial protection, peace of mind, enhanced credibility, and more.

Checkout These Recommendations:

- Workers' Compensation Insurance for Small… Introduction Hello, esteemed readers! Welcome to our in-depth exploration of workers' compensation insurance for small businesses. In today's competitive business landscape, safeguarding your workforce and ensuring their well-being is paramount.…

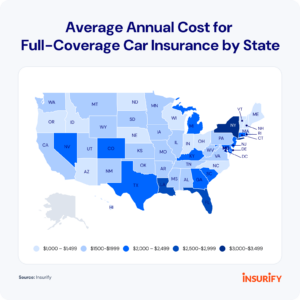

- Full Coverage Car Insurance: Essential Protection… An Introductory Overview of the Comprehensive Coverage for Your Vehicle In the realm of automotive ownership, navigating the labyrinth of insurance options can be a daunting task. Full coverage car…

- Navigating the Cyber Landscape: Top Brokers for… In the ever-evolving digital landscape, the importance of protecting your business against cyber threats has never been greater. One crucial aspect of this protection is securing top-notch cyber insurance, and…

- Professional Liability Insurance for Sole… Introduction: The Importance of Professional Liability Coverage As a sole proprietor, your business's success is intricately tied to your professional reputation. Clients trust you to provide exceptional services, relying on…

- Determining the Optimal Cyber Liability Insurance… Navigating the digital landscape in today's interconnected world can expose businesses of all sizes to a myriad of cyber threats. From data breaches to ransomware attacks, the potential consequences can…

- Work Comp Insurance Companies: Navigating the… Hello Readers, Welcome to our comprehensive guide to Work Comp Insurance Companies. This article delves into the intricate world of workers' compensation insurance, providing valuable insights to help you make…

- Business Professional Liability Insurance Business Professional Liability Insurance: The Ultimate Protection for Your Business Introduction Greetings, esteemed readers! Welcome to an in-depth exploration of Business Professional Liability Insurance (BPLI), a cornerstone of financial protection…

- Commercial Auto Insurance Quotes: Essential Guide… Introduction Hello, Readers! Embark on a comprehensive exploration of Commercial Auto Insurance Quotes. With the ever-evolving transportation landscape, businesses of all sizes must navigate the complexities of protecting their valuable…

- Navigating the Cybersecurity Landscape: The… Step into the realm of cybersecurity where the ever-evolving threat landscape demands proactive protection. In this digital age, it's no longer a question of if you'll face a cyberattack, but…

- Business Professional Liability Insurance:… Introduction: In the competitive landscape of today's business world, protecting your assets and reputation is paramount. Business Professional Liability Insurance (BPLI) serves as a vital shield for professionals, offering financial…

- Commercial General Liability Insurance Oklahoma: A… Introduction: Understanding Commercial General Liability Insurance Operating a business in Oklahoma exposes you to various risks that can lead to financial losses and legal complications. Commercial General Liability (CGL) insurance…

- Cheap General Liability Insurance For Small Business An In-depth Guide to Protecting Your Business In the competitive world of small business, having adequate insurance coverage is paramount to safeguard your financial well-being. Among the various types of…

- Professional Liability Insurance: A Lifeline for IT… An Overview of Essential Protection for the Tech-Savvy Professional In today's digital age, IT consultants play a pivotal role in shaping the technological landscape. However, with great power comes great…

- Online General Liability Insurance: The Ultimate… Part 1: Introduction Online general liability insurance is a vital tool for small businesses seeking to safeguard themselves against a myriad of legal risks. In today's increasingly digitalized business landscape,…

- Cheap General Liability Insurance for Small Businesses Navigating the Maze of Coverage Options for Financial Protection As a small business owner, securing comprehensive insurance coverage is paramount to safeguarding your enterprise against potential liabilities and financial losses.…

- Life Coach Professional Liability Insurance:… A Comprehensive Guide for Life Coaches As a life coach, you provide guidance and support to your clients as they navigate personal and professional challenges. While your goal is to…

- Small Business Professional Liability Insurance: A… Introduction Hello, readers! In today's competitive market, small businesses face numerous challenges. One often overlooked but critically important area is professional liability insurance. This comprehensive guide will delve into the…

- General Liability Insurance Vs. Professional… In today's litigious business environment, protecting your assets and reputation is of paramount importance. Two essential insurance policies that can help you achieve this are general liability insurance and professional…

- Liability Insurance for Photographers: A Comprehensive Guide Prelude: Greetings and Introduction to the Importance of Liability Insurance Hello, Readers! Welcome to our in-depth exploration of liability insurance for photographers. In today's digital landscape, where your work can…

- Auto Insurance With Accident History Navigating the complexities of auto insurance, particularly after experiencing an accident, can be a daunting task. Understanding the implications of an accident history on insurance premiums, coverage options, and overall…

- Legal Malpractice Insurance: Protect Yourself From… Hello, Readers, In the realm of legal practice, navigating the complexities of the justice system can be both fulfilling and fraught with challenges. One of the most critical considerations for…

- Best Auto Insurance After An Accident Navigating the Aftermath: A Comprehensive Guide to Auto Insurance Post-Accident In the aftermath of a car accident, navigating insurance complexities can be daunting. Choosing the right insurance company is paramount,…

- Allstate Insurance Auto Quote: The Ultimate Guide Hello Readers, In today's fast-paced world, finding the right auto insurance policy is crucial for protecting your vehicle and yourself. Allstate Insurance is a renowned provider offering comprehensive coverage options…

- Liability Insurance for Independent Consultants: A… Preamble: Unveiling the Significance of Liability Insurance for Independent Consultants As an independent consultant, you possess a unique set of skills and expertise that empowers you to provide valuable services…

- General Liability and Errors and Omissions… Preamble: Understanding the Importance of Insurance in Today's Business Environment In the modern business landscape, navigating the complexities of legal liabilities and professional responsibilities is paramount. As businesses grow and…

- Cheap Business Liability Insurance Coverage:… In today's competitive business landscape, protecting your enterprise against potential risks is paramount. Business liability insurance coverage offers a cost-effective solution to mitigate unexpected liabilities, safeguarding your company's financial stability…

- Navigating the Cyber Risk Landscape: The Role of… In today's ever-evolving digital landscape, protecting your organization from cyber threats is paramount. Cyber security insurance brokers have emerged as invaluable partners in the fight against these malicious attacks. Acting…

- Get Professional Liability Insurance: Protect… Protect Your Business from Financial Risks Professional Liability Insurance provides vital financial protection for your business against claims of negligence or errors and omissions. As a business owner, you are…

- Pressure Washing Insurance: A Comprehensive Guide… Hello Readers, In the competitive world of pressure washing, protecting your business from unforeseen risks is paramount. Pressure washing insurance, a specialized form of coverage, provides a safety net against…

- Business Liability Insurance Brokers: Protecting… Introduction In the competitive world of business, protecting your assets and minimizing financial risks is crucial for long-term success. Business liability insurance brokers play a vital role in safeguarding businesses…