Hello, Readers!

Welcome to the realm of cryptocurrency, where fluctuations in prices and market trends reign supreme. Among the many tools and techniques used to navigate this dynamic landscape, crypto patterns hold a significant place. In this comprehensive guide, we will delve into the intricacies of these patterns, exploring their strengths and weaknesses, and empowering you with the knowledge to make informed trading decisions.

Introduction

Crypto patterns are repeating formations in the price charts of cryptocurrencies. These patterns emerge due to the collective behavior of market participants, and they provide valuable insights into potential price movements. By recognizing and interpreting these patterns, traders can gain an edge in predicting future price trends and positioning themselves accordingly.

Types of Crypto Patterns

There are numerous crypto patterns, classified into two main categories: reversal patterns and continuation patterns.

Reversal Patterns

- Double Top

- Double Bottom

- Head and Shoulders

- Inverse Head and Shoulders

- Cup and Handle

Continuation Patterns

- Triangle

- Pennant

- Flag

- Wedge

- Channel

How to Identify Crypto Patterns

Identifying crypto patterns requires careful observation of price movements and candlestick formations. Each pattern has its own unique characteristics, which must be recognized to make accurate predictions.

Strengths and Weaknesses of Crypto Patterns

Strengths

- Increased trading opportunities

- Improved risk management

- Enhanced technical analysis

- Trend identification

Weaknesses

- Can be subjective

- May not always be reliable

- Require experience and skill to interpret

- Market conditions can affect pattern accuracy

Table: Common Crypto Patterns

| Pattern |

Type |

Characteristics |

| Double Top |

Reversal |

Two consecutive peaks of similar height, with a dip in between |

| Double Bottom |

Reversal |

Two consecutive troughs of similar depth, with a rise in between |

| Head and Shoulders |

Reversal |

A peak (head) followed by two lower peaks (shoulders), with a neckline connecting the troughs |

| Inverse Head and Shoulders |

Reversal |

A trough (head) followed by two higher troughs (shoulders), with a neckline connecting the peaks |

| Cup and Handle |

Reversal |

A U-shaped base (cup) followed by a small rally (handle) |

| Triangle |

Continuation |

A converging trendline connecting the highs and lows |

| Pennant |

Continuation |

A series of highs and lows that form a triangular shape |

| Flag |

Continuation |

A series of highs and lows that form a rectangular shape |

| Wedge |

Continuation |

A diverging trendline connecting the highs and lows |

| Channel |

Continuation |

Two parallel trendlines, one connecting highs and one connecting lows |

FAQs

-

What are the most common crypto patterns?

Double Top, Double Bottom, Head and Shoulders, Inverse Head and Shoulders, Cup and Handle

-

How can I identify crypto patterns?

Observe price movements and candlestick formations, look for repeating shapes and formations

-

Are crypto patterns reliable?

They can be useful, but not always accurate; require experience and skill to interpret

-

What is the best way to use crypto patterns?

Combine with other technical analysis tools, risk management strategies, and market conditions

Checkout These Recommendations:

- Buy Cryptocurrency Introduction Fellow Readers, Welcome to the realm of cryptocurrency, where the digital future unfolds. As the world embraces the decentralized revolution, buying cryptocurrency has become an increasingly popular endeavor. This…

- Workers' Compensation and General Liability… Navigating the Labyrinth of Business Risks In today's competitive business landscape, protecting your company from unforeseen events is paramount. Workers' compensation and general liability insurance are essential tools that provide…

- Electrical Contractor Insurance: Protect Your… Hello Readers, Greetings, readers! In the realm of electrical contracting, safeguarding your business and customers is paramount. Electrical Contractor Insurance (ECI) serves as a safety net, providing financial protection from…

- Small Business Hazard Insurance: A Lifeline for… Hello, Readers! As a small business owner, you've poured your heart and soul into your venture. But what would happen if a disaster struck, threatening to destroy everything you've worked…

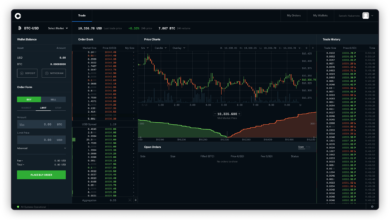

- Margin Trading Margin Trading: A Risky but Potentially Rewarding Strategy Hello, readers! Are you interested in maximizing your returns on cryptocurrency investments but also curious about the potential risks involved? If so,…

- Apex Trader Funding In the ever-evolving financial landscape, the advent of proprietary trading firms has opened up a world of opportunities for aspiring traders. Among the most reputable names in the industry stands…

- Toptier Trader Toptier Trader: The Ultimate Trading Platform for Beginners and Professionals Alike Hello, readers! Welcome to our comprehensive exploration of Toptier Trader, the revolutionary trading platform that is taking the financial…

- Coinbase Advanced Trading Hello, Readers! Welcome to the ultimate guide to Coinbase Advanced Trading, the platform designed to empower experienced traders with an unparalleled trading experience. In this comprehensive article, we'll delve into…

- Auto Insurance For Multiple Accidents **Before the Introduction:** Before delving into the complexities of auto insurance and multiple accidents, it is imperative to establish a comprehensive understanding of the subject matter. This article will provide…

- General Liability Insurance Companies For Small Business Your Essential Guide to Protecting Your Business As a small business owner, you know that protecting your business from the unexpected is essential. That's where general liability insurance comes in.…

- Crypto Arbitrage Scanner Hello, readers! Welcome to our comprehensive guide to crypto arbitrage scanners, your indispensable tool for maximizing profits in the volatile world of cryptocurrency trading. In this article, we will delve…

- Finance App Development: A Comprehensive Guide to… In today's fast-paced digital world, managing our finances seamlessly has become a crucial aspect of modern life. The emergence of finance apps has revolutionized the way we handle our money,…

- Coinbase Pro Hello, readers! In the ever-evolving realm of cryptocurrency, finding a trading platform that aligns with your expertise and aspirations can be a daunting task. As a seasoned investor, you demand…

- Ambient Finance: A Digital Revolution in Financial Services In the ever-evolving landscape of the financial realm, a new paradigm is emerging, one that transcends traditional boundaries and embraces decentralization: ambient finance. Like a gentle breeze that carries the…

- Buy Tesla Stock On Etoro Introduction Greetings, Readers! In the ever-evolving landscape of financial markets, discerning investors are constantly seeking lucrative investment opportunities. Among the most compelling options in the electric vehicle (EV) sector is…

- Commercial Auto Insurance Quotes: Essential Guide… Introduction Hello, Readers! Embark on a comprehensive exploration of Commercial Auto Insurance Quotes. With the ever-evolving transportation landscape, businesses of all sizes must navigate the complexities of protecting their valuable…

- 2025 Summer Finance Internships: A Comprehensive Guide The sun is shining, the birds are chirping, and the smell of fresh-cut grass fills the air. It's the perfect day to start planning your summer 2025 finance internship. Whether…

- General Liability Insurance for Startups: A… Introduction In the dynamic and competitive world of startups, where innovation and risk-taking are inherent, protecting your business from potential liabilities is crucial. General liability insurance (GLI) serves as an…

- Workers Compensation Insurance Quote: A Comprehensive Guide Introduction Greetings, readers! Welcome to our in-depth exploration of workers' compensation insurance quotes. Navigating the world of insurance can be daunting, but our comprehensive guide aims to demystify the process,…

- General Liability Insurance Instant Quote: Protect… An Overview of General Liability Insurance Instant Quote General liability insurance is a type of business insurance policy that protects businesses from claims of bodily injury or property damage caused…

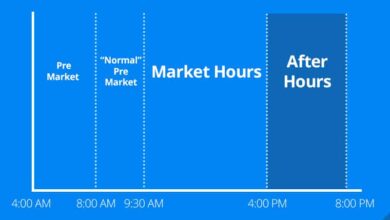

- After Hours Stock Market Unveiling the Secrets of Extended Market Sessions Greetings, esteemed readers! The realm of finance is an ever-evolving tapestry of opportunities and challenges, where conventional boundaries are constantly blurred. One such…

- Best Auto Insurance For Drivers With Accidents Navigating the Turmoil After an Accident: A Comprehensive Guide for Insurance Coverage In the aftermath of an unexpected car accident, the road ahead can seem daunting. Amidst the physical and…

- Commercial Insurance Auto: Safeguard Your Business… Hello, Readers! Welcome, dear readers, to our in-depth exploration of commercial insurance auto. In today's dynamic business landscape, safeguarding your vehicles and drivers is paramount for ensuring seamless operations and…

- The Power of Supply Chain Finance Software:… In today's fast-paced business world, managing supply chains can be a logistical nightmare. With multiple suppliers, manufacturers, and distributors involved, keeping track of inventory, payments, and shipments can be a…

- Plumbing Liability Insurance: Safeguarding Your… Introduction Greetings, esteemed readers, Welcome to this comprehensive guide to Plumbing Liability Insurance, a crucial safeguard for your plumbing business and its reputation. In an industry where unforeseen risks and…

- Free Auto Insurance Quote: A Comprehensive Guide Indispensable Information for Consumers Obtaining an auto insurance quote is a crucial step toward securing your financial well-being. A thorough understanding of the process and the variables involved can empower…

- Surge Trader Hello, Readers! We welcome you to our in-depth exploration of Surge Trader, an innovative trading software that leverages artificial intelligence (AI) to empower traders of all levels. This groundbreaking platform…

- Navigating the Cyber Risk Landscape: The Role of… In today's ever-evolving digital landscape, protecting your organization from cyber threats is paramount. Cyber security insurance brokers have emerged as invaluable partners in the fight against these malicious attacks. Acting…

- Auto Insurance Rates After Accident Consequences, Considerations, and Path Forward An automobile accident can be a traumatic and disruptive event, leaving behind emotional distress and financial burdens. Among the many concerns that follow a collision,…

- Cheapest Rate Car Insurance Quote An Exhaustive Guide to Finding the Most Affordable Car Insurance In the realm of car ownership, insurance serves as a crucial safety net, providing protection against financial burdens in the…