In today’s rapidly evolving digital world, protecting your health goes beyond traditional check-ups and doctor’s appointments. With the rise of interconnected medical devices, electronic health records, and remote health monitoring, a new type of insurance has emerged: Cyber Healthcare Insurance. This essential coverage safeguards you from the growing threats lurking in the digital realm, ensuring peace of mind and protection against the financial burdens associated with cyber attacks on your healthcare information.

Types of Cyber Healthcare Insurance

Cyber healthcare insurance policies vary in their coverage and benefits, but they typically fall into one or more of the following categories:

1. Cyber Liability Insurance

This type of insurance covers third-party claims arising from data breaches or other cyberattacks. It can protect healthcare providers from legal liability, including defense costs, settlements, and judgments.

2. Privacy Breach Notification and Response Insurance

This insurance covers the costs associated with complying with data breach notification laws. It can reimburse healthcare providers for expenses related to notifying patients, conducting investigations, and mitigating the impact of the breach.

3. Data Breach Expense Reimbursement

This type of insurance covers the costs of responding to a data breach, such as hiring forensic investigators, implementing security enhancements, and providing credit monitoring services to affected individuals.

4. Business Interruption Insurance

This insurance covers lost revenue and other expenses incurred due to a cyberattack that disrupts healthcare operations.

5. Electronic Health Record (EHR) Loss or Damage Insurance

This type of insurance covers the costs of recovering or replacing EHRs that are lost or damaged due to a cyberattack.

6. Ransomware Insurance

This insurance covers the costs associated with responding to a ransomware attack, including negotiating with attackers and paying ransoms.

7. Regulatory Investigation and Defense Insurance

This type of insurance covers the costs of defending against regulatory investigations and enforcement actions related to data breaches.

8. Cyber Extortion Insurance

This insurance covers the costs associated with responding to cyber extortion demands, such as paying ransoms or deleting data.

9. Breach Response Cost Insurance

This type of insurance covers the costs of hiring a breach response team, conducting forensic investigations, and implementing security enhancements after a data breach.

10. Network Security Insurance

This insurance covers the costs of repairing or replacing network infrastructure that is damaged or destroyed by a cyberattack.

Types of Cyber Healthcare Insurance Coverage

Cyber healthcare insurance policies can offer a comprehensive suite of coverage options to protect healthcare organizations from a wide range of cyber threats. Here are some common types of coverage included in these policies:

-

Network security liability coverage: This coverage protects against claims arising from network security breaches, including data breaches, denial of service attacks, and unauthorized access to protected health information (PHI).

-

Data breach expense coverage: This coverage reimburses expenses incurred in responding to a data breach, such as legal fees, forensic investigations, and credit monitoring services for affected individuals.

-

Business interruption coverage: This coverage compensates healthcare organizations for lost revenue and expenses incurred due to business interruptions caused by cyber attacks.

-

Cyber extortion coverage: This coverage protects against financial losses incurred due to extortion threats made by cybercriminals who demand payment in exchange for not releasing sensitive data or disrupting operations.

-

Regulatory investigation and defense coverage: This coverage provides legal defense costs and expenses associated with regulatory investigations and enforcement actions related to cyber breaches.

-

Reputational harm coverage: This coverage reimburses expenses incurred in restoring the organization’s reputation following a cyber attack.

-

Third-party liability coverage: This coverage protects against claims made by patients, business partners, or other third parties who have suffered harm as a result of a cyber breach at the insured healthcare organization.

-

Cybercrime coverage: This coverage provides coverage for financial losses and expenses incurred due to cybercrimes, such as identity theft, online fraud, and phishing attacks.

-

Social engineering coverage: This coverage protects against financial losses and expenses incurred due to social engineering attacks, where cybercriminals use deception to trick individuals into giving up confidential information or access to systems.

-

Cloud coverage: This coverage extends protection to healthcare organizations that utilize cloud-based services, such as electronic health record (EHR) systems and data storage.

5 Key Types of Cyber Healthcare Insurance Coverage

Cyber healthcare insurance offers various types of coverage tailored to the specific needs of healthcare organizations. Here are five key types of coverage to consider:

1. Data Breach Coverage

Data breach coverage protects healthcare organizations against financial losses and expenses resulting from a data breach incident involving patient data. This can include costs associated with notifying affected individuals, providing credit monitoring services, investigating the breach, and implementing corrective measures.

2. Cyber Extortion Coverage

Cyber extortion coverage provides protection against threats from cybercriminals who demand payment in exchange for not releasing sensitive data or disrupting healthcare operations. This coverage can help organizations mitigate the financial impact of extortion attempts and ensure the continuity of their operations.

3. Business Interruption Coverage

Business interruption coverage reimburses healthcare organizations for lost revenue and expenses incurred due to a cyberattack that disrupts their ability to operate. This coverage can help ensure that organizations can continue to provide essential healthcare services and meet their financial obligations in the event of a cyber incident.

4. Network Security Coverage

Network security coverage protects healthcare organizations against financial losses resulting from cyberattacks that target their network infrastructure, such as distributed denial of service (DDoS) attacks or malware infections. This coverage can help organizations maintain the integrity of their network and prevent disruption of their healthcare operations.

5. Miscellaneous Professional Liability Coverage

Miscellaneous professional liability coverage provides protection against claims of negligence or errors and omissions related to the provision of cyber healthcare services. This coverage can help healthcare organizations mitigate the risk of legal liability and protect their reputation.

Thanks for Reading!

Well, there you have it, folks! All the important details you need to know about cyber healthcare insurance. We hope this article has been helpful in understanding this vital coverage. Remember, healthcare is always evolving, and so is the need for protection against cyber threats. Stay updated and visit us again for the latest news and information on this critical topic. In the meantime, take care and stay secure!

Checkout These Recommendations:

- Nationwide Cyber Insurance: Protecting Businesses… In today's digital world, where every aspect of our lives is interconnected, safeguarding our online presence has become imperative. With the constant threat of cyberattacks looming, insurance policies designed to…

- Cyber Privacy Insurance: Safeguarding Your Digital… In today's digital age, our personal information is constantly at risk. From data breaches to identity theft, there are countless ways our privacy can be compromised. That's why it's more…

- Cyber Liability Insurance Quotes: Protect Your… In this digital age, safeguarding your business from cyber threats is crucial. Cyber liability insurance offers a safety net against potential financial losses resulting from data breaches, hacking, malware attacks,…

- Determining the Optimal Cyber Liability Insurance… Navigating the digital landscape in today's interconnected world can expose businesses of all sizes to a myriad of cyber threats. From data breaches to ransomware attacks, the potential consequences can…

- Next Insurance Cyber: Comprehensive Coverage for… In today's digital world, where businesses of all sizes heavily rely on the internet and technology, safeguarding against cyber threats has become paramount. Just as you protect your physical assets…

- Cybersecurity at Your Fingertips: Exploring the Best… In today's increasingly digital world, protecting yourself from cyber threats is paramount. With the constant bombardment of online scams, data breaches, and ransomware attacks, having the right cyber insurance can…

- Cyber Insurance: Essential Protection for Small… In today's digital world, every small business is vulnerable to the ever-growing threat of cyberattacks. From data breaches to ransomware, the consequences can be severe, costing businesses their reputation, data,…

- Protect Your Small Business from Cyber Threats: The… In the ever-evolving digital landscape, small businesses are increasingly vulnerable to cyberattacks. From phishing scams to malware infections, the threats are endless. While it may seem like only large corporations…

- Cybersecurity in the Digital Age: Essential… In our increasingly digital world, it's no longer just our physical assets that are at risk. Our online presence, from social media profiles to financial accounts, is just as vulnerable…

- Protect Your Digital Assets: A Comprehensive Guide… In today's interconnected world, businesses of all sizes face an ever-increasing threat of cyberattacks. From data breaches and ransomware to phishing scams and malware, the potential risks to your digital…

- Best Cyber Security Insurance: Protect Your Business… In an increasingly connected world, where digital threats lurk around every corner, protecting your business against cyberattacks is paramount. If you fall victim to a cyberattack, the financial consequences can…

- Cyber and Privacy Insurance Coverage: Navigating the… In today's digital world, our sensitive data is more vulnerable than ever. Hackers and cybercriminals are constantly lurking, looking for ways to steal our identities, financial information, and other personal…

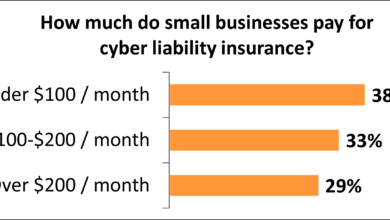

- How Much Does Cyber Liability Insurance Cost? A… Buckle up, folks! In today's digitalized world, cyber threats lurk around every corner, threatening to put your business in a technological chokehold. Cyber liability insurance is your knight in shining…

- Cyber Liability Insurance: Understanding Costs and Coverage In today's digital landscape, where data breaches and cyberattacks are becoming increasingly common, businesses face a growing need to protect themselves from the financial consequences of these threats. Cyber liability…

- Cyber Security Liability Insurance: Mitigating the… In today's digital age, protecting your business from cyber threats is more important than ever before. Cybercriminals are constantly devising new ways to attack businesses of all sizes, and the…

- Navigating the Cybersecurity Landscape: The… Step into the realm of cybersecurity where the ever-evolving threat landscape demands proactive protection. In this digital age, it's no longer a question of if you'll face a cyberattack, but…

- Cyber Liability Insurance Costs: A Breakdown In today's high-tech realm, protecting against cyber threats is crucial for businesses of all sizes. Cyber liability insurance offers a safety net, safeguarding companies from costly consequences of data breaches,…

- Hiscox Cyber Liability Insurance: Protecting… In today's ever-evolving digital landscape, where technology reigns supreme, protecting your business from the lurking threat of cyber attacks is paramount. Hiscox, a trusted provider of insurance solutions, has meticulously…

- Cyber Risk Insurance Companies: Protecting Your… In today's digital landscape, where cyberattacks have become as ubiquitous as the internet, protecting your business from online threats is paramount. That's where cyber risk insurance companies step into the…

- Navigating the Maze of Cyber Security Insurance: A… In today's digital landscape, where cyber threats relentlessly evolve, protecting your business and personal assets from online vulnerabilities has become paramount. Cyber Security Insurance Agencies are stepping up to the…

- Cybersecurity Insurance for Healthcare: Protecting… In today's digitalized healthcare landscape, safeguarding patient data and protecting healthcare organizations from cyber threats has become paramount. Cyber Insurance for Healthcare has emerged as a critical tool to mitigate…

- Cyber Security Insurance for Today's Digital… In the ever-evolving digital landscape, cybersecurity has become paramount. Businesses and individuals alike are increasingly vulnerable to malicious attacks that can compromise sensitive data, disrupt operations, and tarnish reputations. To…

- Unlocking Cyber Resilience: A Comprehensive Guide to… In the ever-evolving digital landscape, where cyberattacks loom like digital specters, it's crucial to shield your business from the inevitable. Berkshire Hathaway Specialty Insurance (BHSI) has emerged as a formidable…

- Navigating the Cybersecurity Insurance Market: Top… In today's digital age, where cyber threats lurk around every corner, protecting your business from malicious attacks is a paramount concern. Cyber Security Insurance Providers step into this crucial role,…

- Commercial Cyber Liability Insurance: Protecting… In today's digital realm, where cyber threats lurk at every corner, protecting your business from the perils of the online world is paramount. Commercial Cyber Liability Insurance acts as your…

- Cyber Liability and Data Breach Insurance: Protect… In today's digitally connected world, protecting your business from cyber threats and data breaches is paramount. Cyber liability and data breach insurance policies provide a crucial safety net to shield…

- Third Party Cyber Insurance: Protecting Your… In the ever-evolving digital landscape, where cybercrime looms like a persistent shadow, protecting your business from costly online threats has become paramount. While cyber insurance plays a crucial role in…

- The Rising Cost of Cybersecurity Insurance: A… In this modern age of digital domination, where our precious data dances through the labyrinthine realms of cyberspace, the fear of cyberattacks looms like a formidable shadow. Businesses and individuals…

- Hartford Cyber Insurance: Protecting Your Business… In the labyrinthine realm of digital piracy and data breaches, businesses of all sizes are vulnerable to cyberattacks. These attacks can have devastating consequences, leading to lost revenue, damaged reputation,…

- Cyber Insurance: Safeguarding Your Digital Assets in… In today's digital world, safeguarding our online assets has become paramount. Cyber-attacks are on the rise, and businesses of all sizes are facing increasing threats to their data, systems, and…