Cyber Security Insurance for Today’s Digital Landscape: Protection from Cybercrime

In the ever-evolving digital landscape, cybersecurity has become paramount. Businesses and individuals alike are increasingly vulnerable to malicious attacks that can compromise sensitive data, disrupt operations, and tarnish reputations. To mitigate these risks, cybersecurity insurance policies have emerged as a crucial tool. These policies provide financial protection against the unforeseen financial consequences of cyber incidents, empowering organizations to navigate the complexities of the cybersecurity landscape with greater confidence.

Contents

- 1 1. Coverage for Cyber Attacks and Data Breaches

- 2 2. Third-Party Liability Coverage

- 3 3. Privacy Breach Coverage

- 4 4. Business Interruption Coverage

- 5 5. Extortion Coverage

- 6 6. Cybercrime Coverage

- 7 7. Reputation Protection Coverage

- 8 8. Social Engineering Coverage

- 9 9. Cloud Computing Coverage

- 10 10. Mobile Device Coverage

- 11 What Cyber Security Insurance Policies Cover

- 11.1 1. Data Breach Coverage

- 11.2 2. Business Interruption Coverage

- 11.3 3. Cyber Extortion Coverage

- 11.4 4. Cyber Liability Coverage

- 11.5 5. Errors and Omissions Coverage

- 11.6 6. Network Security Coverage

- 11.7 7. Cloud Security Coverage

- 11.8 8. Mobile Device Security Coverage

- 11.9 9. Social Engineering Coverage

- 11.10 10. Cyber Crime Investigation Coverage

- 12 Benefits of Cyber Security Insurance

- 13 Thanks for Reading!

1. Coverage for Cyber Attacks and Data Breaches

Cyber security insurance policies typically provide coverage for financial losses and expenses incurred as a result of cyber attacks and data breaches. This includes costs such as:

- Data recovery and restoration

- Forensic investigation

- Legal expenses

- Regulatory fines and penalties

2. Third-Party Liability Coverage

Cyber security insurance policies can also provide coverage for third-party liability claims arising from a data breach. This means that the policy can cover the costs of defending and settling lawsuits filed by individuals whose personal or financial information was compromised.

3. Privacy Breach Coverage

Privacy breach coverage is designed to protect businesses against the costs associated with responding to and mitigating privacy breaches. This includes expenses such as:

- Notification costs

- Credit monitoring

- Identity theft resolution

- Public relations

4. Business Interruption Coverage

Cyber security insurance policies can provide coverage for lost income and expenses incurred due to business interruption caused by a cyber attack. This includes coverage for:

- Lost revenue

- Extra expenses incurred to continue operations

- Loss of productivity

5. Extortion Coverage

Extortion coverage is designed to protect businesses against extortion demands by cyber criminals. This coverage can provide reimbursement for expenses such as:

- Ransom payments

- Legal expenses

- Negotiation costs

6. Cybercrime Coverage

Cybercrime coverage is designed to protect businesses against financial losses and expenses incurred as a result of cybercrime activities, such as:

- Identity theft

- Phishing attacks

- Malware infections

7. Reputation Protection Coverage

Reputation protection coverage is designed to protect businesses against the reputational damage that can result from a cyber attack or data breach. This coverage can provide reimbursement for expenses such as:

- Public relations

- Marketing and advertising

- Customer outreach

8. Social Engineering Coverage

Social engineering coverage is designed to protect businesses against financial losses and expenses incurred as a result of social engineering attacks. This includes coverage for:

- Phishing attacks

- Vishing attacks

- Smishing attacks

9. Cloud Computing Coverage

Cloud computing coverage is designed to protect businesses against financial losses and expenses incurred as a result of cyber attacks or data breaches involving cloud computing services. This includes coverage for:

- Data loss or corruption

- Service outages

- Security breaches

10. Mobile Device Coverage

Mobile device coverage is designed to protect businesses against financial losses and expenses incurred as a result of cyber attacks or data breaches involving mobile devices. This includes coverage for:

- Device theft or loss

- Data loss or corruption

- Malware infections

What Cyber Security Insurance Policies Cover

1. Data Breach Coverage

Data breaches occur when sensitive information is stolen or compromised, such as personal identification numbers (PINs), credit card numbers, and health records. Cyber security insurance policies can cover the costs associated with responding to a data breach, including:

* Legal fees

* Regulatory fines

* Notification costs

* Credit monitoring for affected individuals

2. Business Interruption Coverage

Cyber attacks can disrupt business operations, causing revenue loss and reputational damage. Cyber security insurance policies can provide coverage for business interruption expenses, such as:

* Lost profits

* Extra expenses

* Lease payments

3. Cyber Extortion Coverage

Cyber extortionists threaten to harm or disrupt your business unless you pay a ransom. Cyber security insurance policies can cover the costs associated with responding to a cyber extortion demand, including:

* Ransom payments

* Negotiation expenses

* Legal fees

4. Cyber Liability Coverage

Cyber liability insurance protects businesses from claims alleging that they failed to take adequate measures to protect sensitive data. This coverage can include:

* Defense costs

* Settlement costs

* Judgments

5. Errors and Omissions Coverage

Errors and omissions coverage protects businesses from claims alleging that they made mistakes or omissions in providing cyber security services. This coverage can include:

* Defense costs

* Settlement costs

* Judgments

6. Network Security Coverage

Network security coverage protects businesses from claims alleging that their network was hacked or breached. This coverage can include:

* Defense costs

* Settlement costs

* Judgments

7. Cloud Security Coverage

Cloud security coverage protects businesses from claims alleging that their cloud-based data or systems were compromised. This coverage can include:

* Defense costs

* Settlement costs

* Judgments

8. Mobile Device Security Coverage

Mobile device security coverage protects businesses from claims alleging that their mobile devices were lost or stolen, and that sensitive data was compromised. This coverage can include:

* Defense costs

* Settlement costs

* Judgments

9. Social Engineering Coverage

Social engineering attacks occur when attackers trick employees into revealing sensitive information or accessing unauthorized systems. Cyber security insurance policies can cover the costs associated with responding to a social engineering attack, including:

* Legal fees

* Regulatory fines

* Notification costs

10. Cyber Crime Investigation Coverage

Cyber crime investigation coverage helps businesses investigate cyber attacks and identify the responsible parties. This coverage can include:

* Forensic analysis

* Legal expenses

* Asset recovery

Benefits of Cyber Security Insurance

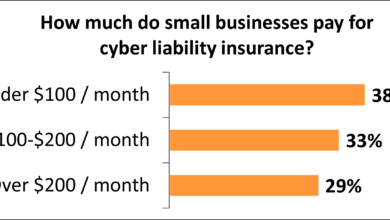

Cyber security insurance policies offer various benefits to businesses and individuals, including:

1. Financial Protection from Cyber Attacks

A cyber attack can result in significant financial losses due to data breaches, extortion, and reputational damage. Cyber security insurance provides coverage for these expenses, minimizing the financial impact of such incidents.

2. Risk Management and Coverage Customization

Insurance policies can be tailored to specific business needs and risks, providing comprehensive coverage for emerging threats. They offer flexibility in selecting coverage limits and deductibles, allowing businesses to balance cost and protection levels.

3. Access to Expert Assistance

Insurance providers often offer access to cybersecurity experts who can assist businesses in preventing and responding to attacks. They provide guidance on cyber security best practices, incident response plans, and threat intelligence.

4. Compliance and Regulatory Support

Many industries have regulations and standards regarding data protection and privacy. Cyber security insurance policies can help businesses comply with these requirements by providing coverage for breach notification, forensic investigations, and legal defense costs.

5. Peace of Mind

Knowing that a business has adequate cyber security protection can provide peace of mind and allow its owners and employees to focus on their core operations without the constant worry of cyber risks.

Thanks for Reading!

That’s all there is to it! I hope this article has given you a good starting point for thinking about whether or not cyber security insurance is right for you and your business. If you have any further questions, please don’t hesitate to contact a qualified insurance professional.

Thanks again for reading, and be sure to check back later for more articles on all things cyber security.