Embrace Comprehensive Protection for Employee-Related Incidents

Navigating the complexities of business operations demands a proactive approach to risk management. Among the essential safeguards for employers is Employee Liability Insurance, a specialized policy designed to shield businesses from financial repercussions stemming from employee negligence or misconduct. Securing an accurate and competitive Employee Liability Insurance quote is paramount to ensure adequate coverage at an optimal cost. In this comprehensive guide, we will delve into the intricacies of Employee Liability Insurance quotes, empowering business owners with a thorough understanding of its coverage, benefits, and pricing factors.

Employee Liability Insurance: An Overview

Employee Liability Insurance is a crucial insurance policy that provides financial protection to businesses against legal claims arising from employee actions or omissions that result in bodily injury, property damage, or financial loss to third parties. It safeguards employers from the financial burden of legal fees, settlements, and judgments, ensuring business continuity and financial stability.

Coverage Parameters

Employee Liability Insurance typically covers a wide range of employee-related incidents, including:

- Bodily injury or property damage caused by employee negligence

- Wrongful termination or discrimination claims

- Libel, slander, or defamation allegations

li>Breach of contract or fiduciary duty

The Benefits of Employee Liability Insurance

Procuring Employee Liability Insurance offers numerous advantages for businesses, including:

Financial Protection

Employee Liability Insurance serves as a financial safety net against costly legal expenses and settlements associated with employee misconduct or negligence. It safeguards business assets, ensuring financial stability and protecting against potential bankruptcy.

Legal Defense Coverage

In the event of a lawsuit, Employee Liability Insurance provides coverage for legal defense costs, including attorney fees, court costs, and expert witness expenses. This comprehensive coverage alleviates the financial burden of legal battles, enabling businesses to defend themselves effectively.

Employee Screening and Training

Some Employee Liability Insurance policies offer additional benefits such as employee screening and training programs. These services assist employers in identifying potential risks and implementing measures to mitigate employee misconduct, further minimizing the likelihood of legal claims.

Pricing Factors for Employee Liability Insurance

The cost of Employee Liability Insurance premiums is influenced by several factors, including:

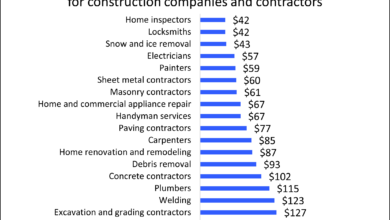

Industry and Business Type

The nature of a business and its industry significantly impact the risk profile and, consequently, insurance premiums. High-risk industries, such as construction or manufacturing, typically incur higher premiums than low-risk industries, such as office-based businesses.

Number of Employees

The number of employees directly correlates with the potential for employee-related incidents. Businesses with a larger workforce face an increased risk of claims, resulting in higher insurance premiums.

Claims History

Insurance companies review a business’s claims history to assess its risk profile. A history of frequent or severe claims can lead to higher premiums, as it indicates a greater likelihood of future claims.

Obtaining an Employee Liability Insurance Quote

Acquiring an accurate and competitive Employee Liability Insurance quote is essential for making an informed decision. To obtain a quote, businesses should:

Contact Insurance Agents

Insurance agents familiar with the specific coverage needs of businesses can provide personalized quotes tailored to their unique requirements. They can guide businesses through the intricacies of Employee Liability Insurance and ensure adequate protection at an optimal cost.

Utilize Online Comparison Tools

Numerous online comparison tools enable businesses to compare quotes from multiple insurance providers. These tools can streamline the process and provide a comprehensive overview of available options.

Understanding the Employee Liability Insurance Quote

When reviewing an Employee Liability Insurance quote, businesses should pay attention to the following key elements:

Coverage Limits

Coverage limits define the maximum amount of insurance coverage available for each claim. Businesses should ensure that coverage limits are sufficient to protect against potential financial losses.

Deductibles

Deductibles represent the portion of claim costs that a business must pay before insurance coverage kicks in. Higher deductibles generally result in lower premiums, but they also increase the out-of-pocket expenses in the event of a claim.

Exclusions

Exclusions specify incidents or situations that are not covered under the policy. Businesses should carefully review exclusions to ensure they understand the scope of coverage provided.

Conclusion

Employee Liability Insurance is an indispensable risk management tool that safeguards businesses from the financial consequences of employee-related incidents. By understanding the coverage, benefits, and pricing factors involved in Employee Liability Insurance, businesses can make informed decisions that protect their financial stability and ensure the well-being of their employees and customers.

Call to Action

Securing an accurate and competitive Employee Liability Insurance quote is crucial for businesses seeking comprehensive protection. Contact insurance agents or utilize online comparison tools to obtain personalized quotes that meet your specific business needs. Protect your business from potential legal claims and ensure financial peace of mind with the right Employee Liability Insurance coverage.

Disclaimer

This article provides general information about Employee Liability Insurance and should not be considered legal advice. Businesses are advised to consult with qualified insurance professionals and legal counsel to determine the specific coverage and protection requirements.

Checkout These Recommendations:

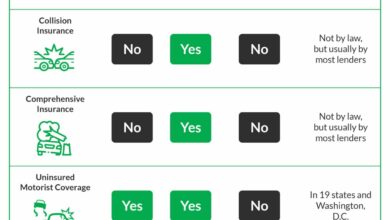

- Commercial Vehicle Insurance: The Essential Guide to… Hello, Readers! Commercial vehicles are a crucial part of many businesses, enabling the transportation of goods and services. However, operating these vehicles comes with inherent risks, which is why commercial…

- Protect Your Assets: A Comprehensive Guide to Cyber… In today's digital landscape, where online activities and threats lurk around every corner, having robust protection for your company's cyberspace is paramount. Cyber liability insurance is a lifeline in this…

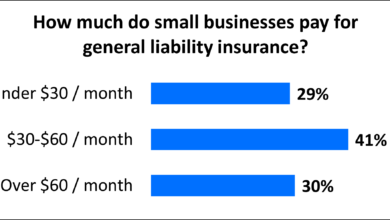

- Cheap General Liability Insurance for Small Businesses Navigating the Maze of Coverage Options for Financial Protection As a small business owner, securing comprehensive insurance coverage is paramount to safeguarding your enterprise against potential liabilities and financial losses.…

- Coalition Cyber Insurance: A Comprehensive Review of… In the ever-evolving digital landscape, protecting your business from cyber threats is paramount. Coalition Cyber Insurance Reviews offer a comprehensive assessment of this leading provider, empowering you to make an…

- Corporate Cyber Insurance: A Shield against Digital… In this age of rampant cyberattacks, businesses of all sizes are facing increasing threats to their digital infrastructure. With the rise of remote work and the proliferation of connected devices,…

- Inexpensive Business Liability Insurance: Protect… An Introduction to Essential Coverage for Small Businesses As a small business owner, you're faced with countless challenges. One of the most pressing is protecting your business from unexpected events…

- Business Liability and Workers' Compensation… Introduction: In today's competitive business environment, it is crucial for organizations to safeguard themselves and their employees against financial risks and legal liabilities. Business Liability and Workers' Compensation Insurance play…

- Convenience Store Insurance: A Comprehensive Guide… Hello, Readers! Welcome to our comprehensive guide to convenience store insurance, an essential tool for safeguarding your business from a wide range of risks and liabilities. This article will delve…

- Nj Small Business Insurance: A Comprehensive Guide Introduction Greetings, esteemed readers! Welcome to our in-depth exploration of New Jersey Small Business Insurance, an essential tool for safeguarding your enterprise against financial risks and unforeseen events. In today's…

- Public Liability Insurance and Workers'… Introduction In the intricate tapestry of business operations, managing risk is paramount to safeguarding the welfare of both your enterprise and its employees. Public liability insurance and workers' compensation insurance…

- Discover the Ultimate Guide to General Liability… Unraveling the intricacies of Comprehensive Protection In the realm of risk management, General Liability Insurance (GLI) emerges as an indispensable safeguard for businesses of all sizes in Florida. It shields…

- Amtrust Cyber Insurance: Protect Your Digital Assets… In today's ever-evolving cyber landscape, safeguarding your digital assets has become paramount. Amtrust Cyber Insurance steps up to the plate, offering a comprehensive suite of solutions designed to protect you…

- Free Auto Insurance Quote: A Comprehensive Guide Indispensable Information for Consumers Obtaining an auto insurance quote is a crucial step toward securing your financial well-being. A thorough understanding of the process and the variables involved can empower…

- Commercial Car Insurance Quotes: A Comprehensive… Hello, Readers! In today's fast-paced business environment, having adequate commercial car insurance is crucial. It not only protects your vehicles and drivers but also ensures your financial well-being in the…

- General Liability Business Insurance Quote: Protect… Navigating the Complexities of Business Liability Insurance Before delving into the specifics of general liability business insurance quotes, it is crucial to grasp the fundamental principles underlying business liability. Business…

- Workers' Compensation and General Liability… Navigating the Labyrinth of Business Risks In today's competitive business landscape, protecting your company from unforeseen events is paramount. Workers' compensation and general liability insurance are essential tools that provide…

- Cyber Insurance: Safeguarding Your Digital Assets in… In today's digital world, safeguarding our online assets has become paramount. Cyber-attacks are on the rise, and businesses of all sizes are facing increasing threats to their data, systems, and…

- Payroll Financing: The Ultimate Guide for Small… In today's fast-paced business environment, cash flow is king. When unexpected expenses arise or the timing of invoices and payments doesn't align, many businesses find themselves in a bind. That's…

- Professional Liability Insurance for Interior… Introduction As an interior designer, your creativity, expertise, and professionalism are the cornerstones of your business. However, even the most skilled and seasoned designers can face unforeseen circumstances that could…

- Cyber Security Insurance: A Guide to Protecting Your… In today's digitalized era, cybersecurity threats lurk around every cyber corner, posing a constant menace to businesses and individuals alike. Statistics paint a grim picture, with the average cost of…

- Small Business Workers' Comp Insurance: A… Introduction Hello, Readers, In today's business landscape, safeguarding your employees against occupational hazards is paramount. Workers' compensation insurance plays a vital role in protecting small businesses and their employees from…

- Business Liability Insurance Providers: A… Introduction In the fast-paced world of business, unforeseen events and potential liabilities can strike at any moment. Business liability insurance plays a crucial role in safeguarding businesses against financial losses…

- Workers' Compensation and Public Liability… Introductory Words In the realm of business operations and risk management, two fundamental types of insurance play a crucial role in protecting organizations and individuals: workers' compensation insurance and public…

- Business Insurance for Contractors: Safeguard Your… Introduction Dear Readers, As a contractor, you are entrusted with building, repairing, or maintaining valuable structures and properties. However, unforeseen accidents, property damage, and lawsuits can jeopardize your business and…

- General Liability and Workers' Compensation… Every small business needs insurance to protect itself from potential financial risks, and two of the most important types of insurance are general liability insurance and workers' compensation insurance. These…

- Cheap Liability Insurance for Small Businesses Protecting Your Business with Affordable Coverage Liability insurance is essential for small businesses, providing financial protection against claims of negligence or wrongdoing. However, finding affordable coverage can be challenging. This…

- Buy Business Liability Insurance: Protect Your… Introductory Words In the dynamic and often unforgiving world of business, protecting your enterprise from potential liabilities is paramount. Unexpected events, accidents, or lawsuits can arise at any moment, threatening…

- Get a Cyber Insurance Quote Online: Protect Your… In today's increasingly digital world, where our online presence and data are constantly exposed to potential threats, cyber insurance has become an essential safeguard to protect against the costly consequences…

- Legal Malpractice Insurance: Protect Yourself From… Hello, Readers, In the realm of legal practice, navigating the complexities of the justice system can be both fulfilling and fraught with challenges. One of the most critical considerations for…

- Buy Liability Insurance for Small Business: Protect… Introduction: The Importance of Liability Insurance for Small Businesses As a small business owner, it is crucial to understand the significance of liability insurance, which acts as a financial shield…