Fidelity Brokerage Account

Contents

- 1 Hello Readers,

- 2 Introduction: A Comprehensive Overview

- 3 Strengths of Fidelity Brokerage Account: A Path to Investment Success

- 3.1 1. Comprehensive Investment Options: A World of Opportunities

- 3.2 2. Robust Trading Platform: Precision and Control at Your Fingertips

- 3.3 3. Low Trading Commissions: Unlocking Savings and Maximizing Returns

- 3.4 4. Comprehensive Research and Analysis: Empowering Informed Decisions

- 3.5 5. Personalized Guidance: A Tailored Path to Investment Success

- 3.6 6. Commitment to Security: Protecting Your Investments

- 3.7 7. Award-Winning Service: A Testament to Excellence

- 4 Weaknesses of Fidelity Brokerage Account: Areas for Improvement

- 4.1 1. Occasional Platform Outages: Disruptions in Trading

- 4.2 2. Limited International Investment Options: A Global Reach Yet to Be Fully Realized

- 4.3 3. High Margin Interest Rates: Potential Impact on Returns

- 4.4 4. Limited Fractional Share Trading: A Barrier to Accessibility

- 4.5 5. Complex Fee Structure: Navigating a Multitude of Charges

- 4.6 6. Customer Service Wait Times: Occasional Delays in Support

- 4.7 7. Lack of Physical Branch Network: Limited In-Person Support

- 5 Fidelity Brokerage Account Fees: A Comprehensive Breakdown

- 6 Frequently Asked Questions (FAQs) About Fidelity Brokerage Account

Hello Readers,

Welcome to our in-depth exploration of Fidelity Brokerage Account, a comprehensive and unparalleled financial platform that empowers investors of all levels to achieve their monetary ambitions. As we delve into the intricacies of this remarkable service, we invite you on a journey of discovery, where every aspect of Fidelity Brokerage Account will be revealed, leaving no stone unturned. Prepare to be enlightened as we navigate through its strengths and weaknesses, uncover its multifaceted features, and provide a roadmap to maximize its potential.

Introduction: A Comprehensive Overview

Fidelity Brokerage Account stands as a beacon of innovation, offering a comprehensive suite of financial services that cater to the diverse needs of investors. Its robust trading platform, coupled with an impressive array of investment options, empowers users to craft tailored investment portfolios that align seamlessly with their financial goals. Whether you are a seasoned investor or embarking on your investment journey, Fidelity Brokerage Account provides a welcoming and supportive environment to nurture your financial aspirations.

At the heart of Fidelity Brokerage Account lies a commitment to investor education and empowerment. Through a vast repository of educational resources, webinars, and personalized guidance, Fidelity empowers investors with the knowledge and confidence to make informed decisions. Additionally, the platform’s user-friendly interface and intuitive navigation ensure that every investor, regardless of their experience level, can effortlessly navigate its offerings.

Fidelity Brokerage Account’s unwavering focus on security and regulatory compliance instills peace of mind in its users. Advanced encryption protocols and robust cybersecurity measures safeguard sensitive financial information, ensuring the integrity of your investments and personal data. Moreover, Fidelity’s adherence to industry-leading regulatory standards guarantees that your investments are handled with the utmost care and transparency.

Beyond its core offerings, Fidelity Brokerage Account extends its services to encompass a wide spectrum of financial needs. From retirement planning to estate planning and beyond, Fidelity’s team of financial professionals provides personalized guidance, tailored to your unique circumstances. This holistic approach ensures that your financial journey is meticulously planned and executed, maximizing the likelihood of achieving your long-term objectives.

Whether you seek to build wealth, secure your future, or navigate the complexities of investment markets, Fidelity Brokerage Account stands as an indispensable ally. Its comprehensive platform, unwavering commitment to investor education, and dedication to security and compliance make it the ideal choice for investors of all levels. Join us as we delve deeper into the world of Fidelity Brokerage Account, unlocking the secrets of its strengths and exploring the opportunities it presents.

Strengths of Fidelity Brokerage Account: A Path to Investment Success

Fidelity Brokerage Account’s strengths lie in its unwavering commitment to empowering investors and providing them with the tools and resources they need to achieve their financial aspirations. These strengths include:

1. Comprehensive Investment Options: A World of Opportunities

Fidelity Brokerage Account grants investors access to a vast universe of investment options, empowering them to construct diversified portfolios that align seamlessly with their risk tolerance and financial goals. Stocks, bonds, mutual funds, ETFs, options, and more await your exploration, offering a comprehensive range of investment vehicles to suit every investor’s unique needs.

2. Robust Trading Platform: Precision and Control at Your Fingertips

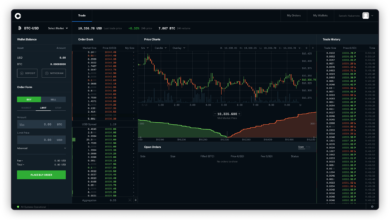

The Fidelity Brokerage Account trading platform is a masterpiece of innovation, designed to provide investors with an unparalleled level of precision and control over their trades. Its user-friendly interface, coupled with advanced charting tools and real-time market data, empowers investors to make informed decisions and execute trades with confidence.

3. Low Trading Commissions: Unlocking Savings and Maximizing Returns

Fidelity Brokerage Account’s commitment to affordability shines through its low trading commissions, enabling investors to minimize their trading costs and maximize their returns. This cost-effective approach allows investors to retain more of their hard-earned capital, fostering long-term investment growth.

4. Comprehensive Research and Analysis: Empowering Informed Decisions

Fidelity Brokerage Account’s dedication to investor education extends beyond its vast educational resources. The platform provides access to in-depth research reports, market analysis, and expert insights, empowering investors with the knowledge they need to make well-informed investment decisions.

5. Personalized Guidance: A Tailored Path to Investment Success

Fidelity Brokerage Account recognizes that every investor’s journey is unique. That’s why it offers personalized guidance and support, tailored to your individual needs and aspirations. Whether you seek advice on portfolio construction, retirement planning, or any other financial matter, Fidelity’s team of experts is at your disposal.

6. Commitment to Security: Protecting Your Investments

Fidelity Brokerage Account places the utmost importance on the security of your investments. Advanced encryption protocols, robust cybersecurity measures, and adherence to industry-leading regulatory standards ensure that your sensitive financial information and investments are safeguarded against unauthorized access and fraud.

7. Award-Winning Service: A Testament to Excellence

Fidelity Brokerage Account’s unwavering commitment to customer satisfaction has earned it numerous industry accolades and awards. These accolades serve as a testament to the platform’s exceptional service, dedication to investor education, and unwavering focus on providing a superior user experience.

Weaknesses of Fidelity Brokerage Account: Areas for Improvement

While Fidelity Brokerage Account excels in many areas, it is not without its weaknesses. These areas present opportunities for improvement and further enhancement of the platform:

1. Occasional Platform Outages: Disruptions in Trading

Fidelity Brokerage Account has experienced occasional platform outages, which can be frustrating for investors who rely on uninterrupted access to their accounts. These outages can disrupt trading activities and cause inconvenience, especially during critical market moments.

2. Limited International Investment Options: A Global Reach Yet to Be Fully Realized

Fidelity Brokerage Account’s investment options primarily focus on U.S.-based securities. While it offers some international exposure, the range of international investment options is limited compared to some competitors. This limitation may hinder investors seeking to diversify their portfolios globally.

3. High Margin Interest Rates: Potential Impact on Returns

Fidelity Brokerage Account’s margin interest rates may be higher compared to some other brokerages. This can impact investors who utilize margin trading, as higher interest rates can eat into their potential returns.

Fidelity Brokerage Account does not currently offer fractional share trading. This limitation may hinder investors who wish to invest smaller amounts in high-priced stocks or build diversified portfolios with limited capital.

Fidelity Brokerage Account’s fee structure can be complex, with various fees applicable to different account types and transactions. This complexity may make it challenging for investors to fully understand their costs and make informed decisions about their investment strategies.

6. Customer Service Wait Times: Occasional Delays in Support

Fidelity Brokerage Account has experienced occasional delays in customer service response times. This can be frustrating for investors who require prompt assistance with their accounts or have urgent inquiries.

7. Lack of Physical Branch Network: Limited In-Person Support

Unlike some other brokerages, Fidelity Brokerage Account does not have a physical branch network. This may be a drawback for investors who prefer face-to-face interactions with financial professionals or require in-person assistance with their accounts.

Fidelity Brokerage Account Fees: A Comprehensive Breakdown

Fidelity Brokerage Account offers a tiered fee structure based on account type and trading volume. Here is a detailed breakdown of the fees associated with the platform:

| Account Type | Trading Fees | Margin Interest Rates | Other Fees |

|---|---|---|---|

| Fidelity Go Account | $0 per trade | Variable, starting at 8.325% | $5 monthly account fee (waived with $500 minimum balance) |

| Fidelity Zero Account | $0 per trade for online stock and ETF trades | Variable, starting at 8.325% | $4.95 per trade for options trades |

| Fidelity Cash Management Account | N/A | N/A | No monthly maintenance fees |

| Fidelity Traditional Brokerage Account | Varies based on trading volume (from $0 to $0.0065 per share) | Variable, starting at 8.325% | $75 annual account fee (waived with $250,000 in combined balances) |

Please note that this is a general overview of the fees associated with Fidelity Brokerage Account. Additional fees may apply depending on specific account features, transactions, and services utilized. It is recommended to consult Fidelity’s website or contact customer service for a personalized fee analysis.

Frequently Asked Questions (FAQs) About Fidelity Brokerage Account

To further clarify any lingering questions, we address some of the most commonly asked questions regarding Fidelity Brokerage Account:

1. What types of accounts does Fidelity Brokerage Account offer?

Fidelity Brokerage Account offers a range of account types to cater to diverse investor needs