Indispensable Information for Consumers

Obtaining an auto insurance quote is a crucial step toward securing your financial well-being. A thorough understanding of the process and the variables involved can empower you to make informed decisions that protect your assets and safeguard your future. This comprehensive article will guide you through the intricate landscape of free auto insurance quotes, providing invaluable insights and actionable advice to help you navigate the complexities of this essential service.

Introduction

In today’s fast-paced and interconnected world, owning a vehicle is often a necessity rather than a luxury. With personal transportation becoming an indispensable part of our daily lives, safeguarding our vehicles against potential risks and liabilities is paramount. Auto insurance serves as our financial shield, providing protection against unforeseen circumstances such as accidents, thefts, and natural disasters. By insuring our vehicles, we can secure our financial stability and ensure that we are not left vulnerable to unexpected expenses.

Obtaining an accurate and competitive auto insurance quote is the first step toward ensuring comprehensive coverage for your vehicle. A free auto insurance quote provides you with an estimate of the cost of your insurance premium based on your unique circumstances and the level of coverage you desire. Understanding the factors that influence your quote and carefully comparing multiple options can help you secure the most affordable and tailored coverage for your needs.

This guide will delve into the intricacies of free auto insurance quotes, empowering you with the knowledge and tools necessary to make informed decisions. We will explore the benefits and drawbacks of obtaining a free quote, provide a detailed analysis of the factors that impact your insurance premium, and offer practical tips to help you secure the best possible rate.

Benefits of a Free Auto Insurance Quote

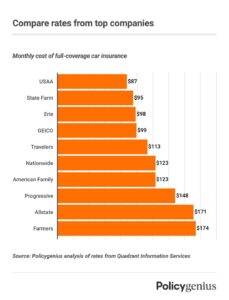

The benefits of obtaining a free auto insurance quote are numerous and undeniable. Firstly, it allows you to compare multiple quotes from different insurance providers, giving you a clear understanding of the market rates and enabling you to choose the most competitive option that fits your budget.

Secondly, a free auto insurance quote provides you with a detailed breakdown of the coverage options available, empowering you to customize your policy and select the level of protection that meets your specific needs. By understanding the different types of coverage and their respective costs, you can tailor your policy to suit your individual circumstances and financial constraints.

Finally, obtaining a free auto insurance quote is a quick and convenient way to gather information about your insurance options without any commitment or obligation. You can shop around for the best rates, compare policies, and make an informed decision without any financial risk or hassle.

Drawbacks of a Free Auto Insurance Quote

While free auto insurance quotes offer numerous advantages, it is essential to be aware of some potential drawbacks. Firstly, some insurance providers may use free quotes to gather personal information from potential customers, which can be used for marketing or other purposes.

Secondly, it is important to note that a free auto insurance quote is only an estimate and may not reflect the final cost of your policy. The actual premium you pay may vary based on additional factors that are not considered in the initial quote, such as your driving history or claims experience.

Finally, free auto insurance quotes do not guarantee coverage or policy issuance. You will need to complete the application process and undergo underwriting to finalize your policy and secure coverage.

Factors Impacting Auto Insurance Premiums

Numerous factors influence the cost of your auto insurance premium, including your age, gender, driving history, vehicle type, and location. Understanding these factors and their impact on your premium can help you make informed decisions to minimize your insurance costs.

Younger drivers, particularly those under the age of 25, typically pay higher insurance premiums due to their perceived higher risk of accidents. Similarly, male drivers tend to pay more for insurance than female drivers, as statistical data indicates that they are more likely to be involved in accidents.

Your driving history is a significant factor in determining your insurance premium. Drivers with clean driving records, free of accidents or violations, typically qualify for lower premiums. Conversely, drivers with poor driving records, including accidents, traffic violations, or DUIs, can expect to pay higher premiums.

The type of vehicle you drive also impacts your insurance premium. High-performance vehicles, sports cars, and luxury vehicles often carry higher premiums due to their greater potential for accidents and repair costs.

Finally, your location plays a significant role in determining your auto insurance premium. Drivers in urban areas typically pay higher premiums than drivers in rural areas due to the increased risk of accidents and theft in urban environments.

Additional Factors Impacting Auto Insurance Premiums

In addition to the primary factors discussed above, numerous other variables can impact your auto insurance premium. These include your marital status, occupation, credit score, annual mileage, and coverage limits.

Married drivers typically pay lower insurance premiums than single drivers, as they are perceived to be more responsible and have a lower risk of accidents. Occupation can also impact your premium, with certain professions, such as law enforcement officers and firefighters, qualifying for discounts due to their lower risk profile.

Your credit score is another factor that insurance companies consider when determining your premium. Drivers with higher credit scores tend to pay lower premiums, as they are seen as more financially responsible and less likely to file claims.

Annual mileage can also impact your premium, with drivers who drive fewer miles typically paying less for insurance. Finally, the coverage limits you choose will significantly affect your premium. Higher coverage limits result in higher premiums, as they provide more comprehensive protection.

Tips for Lowering Your Auto Insurance Premium

By understanding the factors that impact your auto insurance premium and implementing proactive strategies, you can effectively lower your insurance costs. Here are a few practical tips to help you save money on your auto insurance:

Maintain a clean driving record by avoiding accidents and traffic violations. A clean driving record is one of the most significant factors in qualifying for lower insurance premiums.

Consider raising your deductible. The deductible is the amount you pay out of pocket before your insurance coverage kicks in. Increasing your deductible can significantly lower your premium, but it is essential to choose a deductible that you can afford to pay in the event of an accident.

Shop around for the best rates. Don’t settle for the first quote you receive. Take the time to compare multiple quotes from different insurance providers to ensure you are getting the most competitive rate.

Checkout These Recommendations:

- The Ultimate Guide to Auto Insurance Attorneys Hello Readers! In the event of a car accident, navigating the complexities of auto insurance claims can be a daunting task. That's where auto insurance attorneys step in, providing invaluable…

- Can I Switch Auto Insurance After An Accident Navigating the Complexities of Post-Accident Insurance Changes In the aftermath of a car accident, amidst the shock and disarray, one question that may linger in your mind is whether you…

- Protect Your Assets: A Comprehensive Guide to Cyber… In today's digital landscape, where online activities and threats lurk around every corner, having robust protection for your company's cyberspace is paramount. Cyber liability insurance is a lifeline in this…

- Get A Quote To Insure Your Car Peace of Mind at Your Fingertips In today's fast-paced world, navigating the complexities of car insurance can be a daunting task. With countless providers and policies to choose from, finding…

- Auto Insurance After Accident ## Preamble: A Prelude to Understanding Auto Insurance Post-Accident In the aftermath of a car accident, the journey towards recovery and resolution can be both physically and financially demanding. As…

- Automobile Insurance: A Comprehensive Guide to… In today's fast-paced world, automobiles have become an indispensable part of our daily lives. They provide convenience, mobility, and freedom, enabling us to travel, commute, and fulfill various personal and…

- Commercial Van Insurance: A Comprehensive Guide for… Introduction Greetings, Readers. In today's competitive business landscape, having a reliable fleet of commercial vans is crucial for efficient operations and customer satisfaction. However, to ensure the safety of your…

- Auto Insurance For Accidents Auto Insurance For Accidents An In-Depth Analysis and Comprehensive Guide The realm of auto insurance is a complex web of policies and regulations that can often leave individuals feeling bewildered…

- Workers Compensation Insurance Quote: A Comprehensive Guide Introduction Greetings, readers! Welcome to our in-depth exploration of workers' compensation insurance quotes. Navigating the world of insurance can be daunting, but our comprehensive guide aims to demystify the process,…

- Allstate Insurance Auto Quote: The Ultimate Guide Hello Readers, In today's fast-paced world, finding the right auto insurance policy is crucial for protecting your vehicle and yourself. Allstate Insurance is a renowned provider offering comprehensive coverage options…

- Auto Accident Insurance Coverage Introductory Words In the United States, driving a vehicle is a common necessity for everyday life. With over 280 million registered vehicles on the roads, the chances of being involved…

- Auto Insurance Accidents Introduction Auto insurance accidents can be a stressful and confusing experience. Understanding your rights and responsibilities after an accident can help you navigate the process and protect your interests. This…

- Best Auto Insurance After An Accident Navigating the Aftermath: A Comprehensive Guide to Auto Insurance Post-Accident In the aftermath of a car accident, navigating insurance complexities can be daunting. Choosing the right insurance company is paramount,…

- Usaa Auto Insurance Report An Accident Introduction USAA is a leading provider of insurance products and services for military members, veterans, and their families. With a commitment to serving those who serve, USAA offers comprehensive auto…

- Commercial Auto Insurance Quotes: Essential Guide… Introduction Hello, Readers! Embark on a comprehensive exploration of Commercial Auto Insurance Quotes. With the ever-evolving transportation landscape, businesses of all sizes must navigate the complexities of protecting their valuable…

- Sue Insurance Company Auto Accident Introduction: Unveiling the Hidden Details Auto accidents can be traumatic and overwhelming, leaving victims with physical injuries, emotional distress, and financial burdens. Navigating the aftermath of such an event requires…

- Auto Insurance At Fault Accident Pondering the Profundity of Auto Insurance in At-Fault Accidents In the complex tapestry of modern life, where vehicles seamlessly weave their way into our daily routines, the specter of auto…

- Cheap Auto Insurance After Accident Introduction If you've been involved in a car accident, you know that the costs can add up quickly. Between medical bills, property damage, and lost wages, you could be facing…

- Cheapest Rate Car Insurance Quote An Exhaustive Guide to Finding the Most Affordable Car Insurance In the realm of car ownership, insurance serves as a crucial safety net, providing protection against financial burdens in the…

- Instant Life Insurance Quotes: A Comprehensive Guide Introduction Hello, readers! In today's fast-paced world, obtaining life insurance is no longer a lengthy and tedious process. Instant life insurance quotes have revolutionized the industry, providing individuals with quick…

- Auto Insurance For Multiple Accidents **Before the Introduction:** Before delving into the complexities of auto insurance and multiple accidents, it is imperative to establish a comprehensive understanding of the subject matter. This article will provide…

- General Liability Business Insurance Quote: Protect… Navigating the Complexities of Business Liability Insurance Before delving into the specifics of general liability business insurance quotes, it is crucial to grasp the fundamental principles underlying business liability. Business…

- Best Auto Insurance For Accidents An In-Depth Guide to Protecting Yourself and Your Assets after a Collision In the unfortunate event of an auto accident, having the right insurance coverage is crucial. Not only can…

- Employee Liability Insurance Quote: Protect Your… Embrace Comprehensive Protection for Employee-Related Incidents Navigating the complexities of business operations demands a proactive approach to risk management. Among the essential safeguards for employers is Employee Liability Insurance, a…

- The Impact of Auto Insurance Commercials A Comprehensive Analysis for SEO Optimization Introduction Hello, readers! Welcome to our in-depth exploration of the world of auto insurance commercials. These ubiquitous advertisements have become an integral part of…

- Toyota Auto Insurance: The Ultimate Guide for Peace of Mind Introduction In today's fast-paced world, owning a vehicle is not merely a luxury but an essential part of modern life. It grants us the freedom to explore, commute, and transport…

- Best General Liability Insurance For Small Business:… Securing your small business against unexpected liabilities is crucial for its financial stability and reputation. General liability insurance acts as a safety net, protecting you from third-party claims related to…

- Best Auto Insurance With Accidents An In-Depth Guide to Navigating Insurance After a Collision In the aftermath of a car accident, navigating the complexities of auto insurance can be a daunting task. Understanding the intricacies…

- Changing Auto Insurance After Accident Introduction: Understanding the Post-Accident Insurance Landscape An automobile accident can be a harrowing experience, leaving you grappling with both physical and financial repercussions. One of the critical decisions you must…

- Auto Insurance With Accidents Auto insurance plays a significant role in protecting individuals from financial liabilities associated with accidents. However, when an accident occurs, navigating the complexities of insurance coverage can be overwhelming. This…