Hello, Readers:

In this increasingly litigious world, businesses of all sizes need comprehensive insurance coverage to protect themselves from unforeseen events. General liability and workers’ compensation insurance are two essential policies that provide vital protection against financial risks and legal liabilities.

Introduction

General liability insurance offers protection against third-party claims, including bodily injury, property damage, and personal injury. On the other hand, workers’ compensation insurance provides benefits to employees who suffer work-related injuries or illnesses, regardless of fault.

Understanding the intricacies of these policies is crucial for business owners seeking adequate protection and risk mitigation. This article will delve into the strengths and weaknesses of general liability and workers’ compensation insurance, providing a comprehensive guide to help you make informed decisions about your coverage needs.

Strengths and Weaknesses of General Liability Insurance

Strengths:

- Wide coverage: Protects against various third-party claims, including lawsuits, settlements, and judgments.

- Legal defense costs: Covers expenses associated with defending against legal actions, such as attorney fees and court costs.

- Protection for employees: Provides coverage for bodily injury or property damage caused by employees while acting within the scope of their employment.

Weaknesses:

- Limited coverage: Does not cover certain exclusions, such as intentional acts, criminal offenses, and pollution.

- Limits on policy limits: The maximum amount the insurance company will pay for claims is typically limited by the policy limit.

- Cost: Premiums can vary widely depending on the level of coverage and risk factors associated with the business.

Strengths and Weaknesses of Workers’ Compensation Insurance

Strengths:

- Statutory coverage: Required by law in most states, providing employees with no-fault benefits for work-related injuries or illnesses.

- Medical benefits: Covers medical expenses, including doctor visits, surgeries, and rehabilitation.

- Income replacement benefits: Provides temporary income benefits to injured employees who are unable to work due to their injuries.

Weaknesses:

- Limited coverage: Does not cover injuries or illnesses caused by pre-existing conditions, intentional acts, or intoxication.

- Potential for fraud: Some employees may exaggerate or fabricate claims, increasing costs for employers.

- Increased premiums: Businesses with a history of workplace accidents or injuries may face higher premiums.

Comparison Table

| Feature |

General Liability Insurance |

Workers’ Compensation Insurance |

| Protects against |

Third-party claims |

Work-related injuries or illnesses |

| Statutory requirement |

No |

Yes (in most states) |

| Covers legal defense costs |

Yes |

No |

| Provides income replacement benefits |

No |

Yes |

| Limited coverage exclusions |

Yes |

Yes |

FAQs

1. What is the difference between general liability and commercial liability insurance?

Commercial liability insurance provides broader coverage for businesses, including property damage, business interruption, and product liability.

2. What is an umbrella insurance policy?

An umbrella policy provides additional liability coverage beyond the limits of your primary liability policies.

3. What factors affect the cost of general liability insurance?

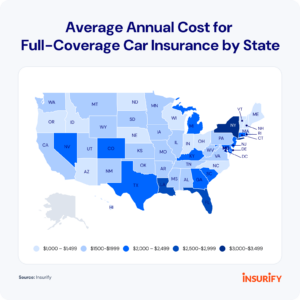

Risk factors, industry, location, and claims history.

4. Who is covered under workers’ compensation insurance?

Employees who suffer work-related injuries or illnesses.

5. What exclusions apply to workers’ compensation insurance?

Pre-existing conditions, intentional acts, and intoxication.

6. What is the difference between statutory benefits and voluntary benefits?

Statutory benefits are required by law, while voluntary benefits are offered by employers.

7. What is experience modification?

A rating factor that adjusts workers’ compensation insurance premiums based on a business’s claims history.

8. What is a deductible?

The amount the insured pays out of pocket before the insurance coverage begins.

9. What is a premium?

The amount paid to the insurance company for coverage.

10. What is a policy limit?

The maximum amount the insurance company will pay for claims.

11. What is an insured?

The person or entity protected by the insurance policy.

12. What is an insurer?

The insurance company that provides coverage.

13. What is a claim?

A request for payment of benefits under an insurance policy.

Conclusion

General liability and workers’ compensation insurance are essential insurance policies for businesses seeking comprehensive protection against financial risks and legal liabilities. Understanding the strengths, weaknesses, and coverage details of these policies empowers business owners to make informed decisions about their coverage needs.

By carefully evaluating your business’s risk profile and consulting with insurance professionals, you can tailor a robust insurance program that meets your specific requirements and provides peace of mind in the event of unforeseen events.

Remember, adequate insurance coverage is not just a legal requirement but also a strategic investment in your business’s long-term success and financial stability.

Closing Words

In the ever-changing landscape of business, protecting your interests and minimizing risks is paramount. General liability and workers’ compensation insurance provide a solid foundation for safeguarding your business against potential liabilities and unforeseen circumstances.

By investing in comprehensive insurance coverage, you not only fulfill your legal obligations but also demonstrate a commitment to protecting your employees, customers, and your business itself. In today’s highly competitive market, businesses that prioritize risk management and proactive protection stand out as responsible and reliable partners, fostering trust and confidence among stakeholders.

Checkout These Recommendations:

- Buy Liability Insurance For Business Protect Your Business from Financial Devastation Introductory Words: Liability insurance is a crucial investment for any business, regardless of its size or industry. It protects the company from financial responsibility…

- Landscaping Business Insurance: A Comprehensive… Prelude to the Importance of Insurance for Landscapers Hello, Readers! Welcome to the definitive guide to landscaping business insurance. Whether you're a seasoned horticulturalist or just starting your entrepreneurial journey,…

- Get Commercial General Liability Insurance:… Protect Your Livelihood, Safeguard Your Assets: The Imperative of CGL Insurance In the labyrinthine world of business, where unforeseen events lurk like hidden perils, protecting your enterprise from financial ruin…

- Cheap General Liability Insurance Near Me What is General Liability Insurance? General liability insurance is a type of business insurance that protects businesses from financial liability for bodily injury or property damage that occurs as a…

- The Ultimate Guide to the Best Insurance for Small… Hello, Readers! Welcome to our comprehensive guide to securing the best insurance protection for your small business. Navigating the complex world of insurance can be daunting, especially for entrepreneurs and…

- Workers' Compensation and Public Liability… Introductory Words In the realm of business operations and risk management, two fundamental types of insurance play a crucial role in protecting organizations and individuals: workers' compensation insurance and public…

- The Ultimate Guide to Best Workers Comp Insurance… Hello, Valued Readers, Welcome to this comprehensive guide on Best Workers Comp Insurance. As a business owner, you understand the paramount importance of safeguarding your workforce through robust workers' compensation…

- What You Need to Know About Cleaners Insurance A Comprehensive Guide for Cleaning Businesses Hello, readers! Are you a cleaning business owner looking for a comprehensive understanding of cleaners insurance? This article will provide you with everything you…

- Insurance for LLC Business: Protect Your Enterprise… Greetings, Readers! In today's competitive business landscape, it is imperative for Limited Liability Companies (LLCs) to shield themselves against various risks and financial liabilities. Insurance for LLCs plays a crucial…

- Public Liability Insurance and Workers'… Introduction In the intricate tapestry of business operations, managing risk is paramount to safeguarding the welfare of both your enterprise and its employees. Public liability insurance and workers' compensation insurance…

- General Liability Insurance For Construction Business A Comprehensive Guide for Protecting Your Company As a construction business owner, you face a wide range of risks that can potentially lead to significant financial losses. General liability insurance…

- Plumbing Liability Insurance: Safeguarding Your… Introduction Greetings, esteemed readers, Welcome to this comprehensive guide to Plumbing Liability Insurance, a crucial safeguard for your plumbing business and its reputation. In an industry where unforeseen risks and…

- Business Insurance for Contractors: Safeguard Your… Introduction Dear Readers, As a contractor, you are entrusted with building, repairing, or maintaining valuable structures and properties. However, unforeseen accidents, property damage, and lawsuits can jeopardize your business and…

- Workers' Compensation Insurance for Small… Introduction Hello, esteemed readers! Welcome to our in-depth exploration of workers' compensation insurance for small businesses. In today's competitive business landscape, safeguarding your workforce and ensuring their well-being is paramount.…

- USAA General Liability Insurance: Comprehensive… Introduction: A Comprehensive Guide to USAA General Liability Insurance In today's increasingly litigious society, protecting oneself and one's assets from potential lawsuits is paramount. General liability insurance serves as a…

- General Liability Insurance: A Lifeline for Businesses A Comprehensive Guide to Protecting Your Business from Unforeseen Incidents Greetings, dear readers! Welcome to this in-depth exploration of General Liability Insurance, an essential component of any business's risk management…

- Handyman Liability Insurance: Protect Your Business… Introduction Hello, dear readers! Welcome to our comprehensive guide to handyman liability insurance. As a handyman, protecting yourself and your business from potential risks is crucial. Liability insurance provides a…

- Automobile Insurance: A Comprehensive Guide to… In today's fast-paced world, automobiles have become an indispensable part of our daily lives. They provide convenience, mobility, and freedom, enabling us to travel, commute, and fulfill various personal and…

- Nj Small Business Insurance: A Comprehensive Guide Introduction Greetings, esteemed readers! Welcome to our in-depth exploration of New Jersey Small Business Insurance, an essential tool for safeguarding your enterprise against financial risks and unforeseen events. In today's…

- Online General Liability Insurance: The Ultimate… Part 1: Introduction Online general liability insurance is a vital tool for small businesses seeking to safeguard themselves against a myriad of legal risks. In today's increasingly digitalized business landscape,…

- Small Business General Liability Insurance Near Me:… Introduction Owning a small business is an exciting and rewarding endeavor, but it also comes with potential risks and liabilities. One crucial way to safeguard your business is by obtaining…

- Buy Liability Insurance for Small Business: Protect… Introduction: The Importance of Liability Insurance for Small Businesses As a small business owner, it is crucial to understand the significance of liability insurance, which acts as a financial shield…

- Florida Business Insurance: A Comprehensive Guide… Hello Readers, In today's competitive business landscape, protecting your enterprise against unforeseen financial risks is paramount. Florida Business Insurance plays a vital role in safeguarding your company's assets, ensuring its…

- General Liability and Workers' Compensation… Every small business needs insurance to protect itself from potential financial risks, and two of the most important types of insurance are general liability insurance and workers' compensation insurance. These…

- Insurance For Contractor: A Comprehensive Guide to… Hello Readers, As a contractor, you know that your business is your livelihood. You've worked hard to build it up, and you want to protect it from unexpected events. That's…

- Convenience Store Insurance: A Comprehensive Guide… Hello, Readers! Welcome to our comprehensive guide to convenience store insurance, an essential tool for safeguarding your business from a wide range of risks and liabilities. This article will delve…

- General Liability Insurance Vs. Professional… In today's litigious business environment, protecting your assets and reputation is of paramount importance. Two essential insurance policies that can help you achieve this are general liability insurance and professional…

- Liability Contractor Insurance: A Comprehensive… Hello, Readers! In today's dynamic and demanding construction industry, protecting your business and safeguarding your assets is paramount. One crucial aspect of this protection is Liability Contractor Insurance, a specialized…

- Liability Insurance for Small Businesses: A… A Precautionary Investment for Entrepreneurs Hello, esteemed readers. Welcome to our in-depth exploration of liability insurance, an essential safeguard for small businesses. In this comprehensive guide, we unravel the intricacies…

- Cleaning Company Insurance: A Comprehensive Guide Hello, Readers! Welcome to this comprehensive guide on cleaning company insurance. As a business owner, it's imperative to secure adequate insurance coverage to protect your assets, employees, and customers. This…