General Liability Insurance Vs. Professional Liability Insurance: A Comprehensive Guide

In today’s litigious business environment, protecting your assets and reputation is of paramount importance. Two essential insurance policies that can help you achieve this are general liability insurance and professional liability insurance. Understanding the differences between these two policies is crucial to ensure adequate coverage for your specific needs.

Contents

- 1 Introduction: Setting the Foundation

- 2 Understanding General Liability Insurance

- 3 Strengths of General Liability Insurance

- 4 Weaknesses of General Liability Insurance

- 5 Understanding Professional Liability Insurance

- 6 Strengths of Professional Liability Insurance

- 7 Weaknesses of Professional Liability Insurance

- 8 Table Summarizing General Liability Insurance and Professional Liability Insurance

- 9 FAQs Related to General Liability Insurance and Professional Liability Insurance

- 9.1 1. What is the difference between general liability insurance and professional liability insurance?

- 9.2 2. Which types of businesses need general liability insurance?

- 9.3 3. Which types of professionals need professional liability insurance?

- 9.4 4. What are the benefits of having both general liability and professional liability insurance?

- 9.5 5. How much coverage do I need?

- 9.6 6. What are the exclusions to general liability insurance?

- 9.7 7. What are the exclusions to professional liability insurance?

- 9.8 8. How can I compare quotes for general liability insurance?

- 9.9 9. How can I compare quotes for professional liability insurance?

- 9.10 10. What factors affect the cost of general liability insurance?

- 9.11 11. What factors affect the cost of professional liability insurance?

- 9.12 12. Can I get a discount on general liability insurance?

- 9.13 13. Can I get a discount on professional liability insurance?

- 10 Conclusion: The Importance of Comprehensive Coverage

- 11 Closing Remarks: A Disclaimer

Introduction: Setting the Foundation

General liability insurance and professional liability insurance, often referred to as errors and omissions insurance, serve vastly different purposes. General liability insurance protects against third-party claims arising from bodily injury, property damage, or personal injury, such as libel, slander, or defamation. Professional liability insurance, on the other hand, covers claims against professionals for negligence, errors, or omissions in providing professional services.

Both policies are designed to safeguard you from financial liability and protect your business’s reputation. However, it’s essential to recognize their distinct roles in providing comprehensive coverage.

Understanding General Liability Insurance

General liability insurance is a broad policy that provides coverage for a wide range of potential incidents, including:

Bodily injury to others

Covers expenses related to injuries sustained by individuals on your business premises or due to your operations.

Property damage

Provides compensation for damages to third-party property caused by your business activities.

Personal and advertising injury

Protects against claims for libel, slander, defamation, or copyright infringement resulting from your products or services.

General liability insurance is typically purchased as a package policy, providing comprehensive coverage for a variety of common risks.

Strengths of General Liability Insurance

General liability insurance offers several key strengths:

Broad coverage

Provides protection against a wide range of third-party claims, ensuring peace of mind.

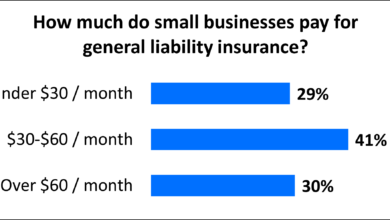

Relatively low premiums compared to other insurance policies, making it accessible for businesses of all sizes.

Easy to obtain

Widely available and easy to acquire through insurance brokers or agents.

Weaknesses of General Liability Insurance

General liability insurance has some limitations:

Exclusions

Does not cover certain specific risks, such as professional negligence or intentional acts.

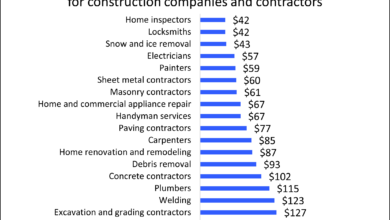

Limited coverage for certain industries

May provide insufficient coverage for businesses that face high-risk exposures, such as healthcare or construction.

Understanding Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, is tailored to protect professionals from claims related to negligent acts, errors, or omissions in providing their services.

Coverage for professional services

Provides financial protection against claims alleging negligence, breach of contract, or misrepresentation in the delivery of professional services.

Defense costs

Covers legal fees and other expenses incurred in defending against claims, even if the claim is ultimately unsuccessful.

Reputation protection

Helps protect your business’s reputation by mitigating the potential financial and reputational damage caused by lawsuits.

Strengths of Professional Liability Insurance

Professional liability insurance offers several key strengths:

Tailored coverage

Specifically designed to address the unique risks associated with professional services, providing targeted protection.

Reputation protection

Shields your business’s reputation from damaging claims, preserving your credibility.

Peace of mind

Provides peace of mind in knowing that you are protected against potential lawsuits.

Weaknesses of Professional Liability Insurance

Professional liability insurance has some limitations:

Premiums are typically higher compared to general liability insurance due to the specialized nature of coverage.

Exclusion of certain claims

Does not cover claims arising from intentional acts or gross negligence.

Table Summarizing General Liability Insurance and Professional Liability Insurance

| Feature | General Liability Insurance | Professional Liability Insurance |

|---|---|---|

| Coverage | Bodily injury, property damage, personal injury | Negligence, errors, omissions in professional services |

| Cost | Relatively low premiums | Higher premiums |

| Availability | Widely available | Tailored to specific professions |

| Protects Against | Third-party claims | Claims from clients or customers |

| Exclusions | Intentional acts, specific risks | Intentional acts, gross negligence |

FAQs Related to General Liability Insurance and Professional Liability Insurance

1. What is the difference between general liability insurance and professional liability insurance?

General liability insurance covers third-party claims, while professional liability insurance covers claims related to professional services.

2. Which types of businesses need general liability insurance?

All businesses, regardless of size or industry, need general liability insurance.

3. Which types of professionals need professional liability insurance?

Professionals who provide services that involve giving advice, designing, or implementing solutions, such as accountants, lawyers, and architects.

4. What are the benefits of having both general liability and professional liability insurance?

Having both policies provides comprehensive coverage for a wide range of potential claims.

5. How much coverage do I need?

The amount of coverage you need depends on the size of your business, the risks you face, and your financial resources.

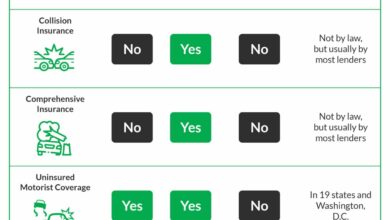

6. What are the exclusions to general liability insurance?

Intentional acts, criminal acts, and certain specific risks, such as pollution.

7. What are the exclusions to professional liability insurance?

Intentional acts, gross negligence, and claims arising from dishonest or fraudulent conduct.

8. How can I compare quotes for general liability insurance?

Compare quotes from multiple insurance providers to find the best coverage and rates.

9. How can I compare quotes for professional liability insurance?

Compare quotes from insurance providers that specialize in professional liability insurance.

10. What factors affect the cost of general liability insurance?

Business size, industry, claims history, and location.

11. What factors affect the cost of professional liability insurance?

Occupation, experience, claims history, and coverage limits.

12. Can I get a discount on general liability insurance?

Yes, discounts may be available for businesses with good safety records, multiple policies, or membership in professional organizations.

13. Can I get a discount on professional liability insurance?

Yes, discounts may be available for professionals with advanced degrees, certifications, or membership in professional organizations.

Conclusion: The Importance of Comprehensive Coverage

Protecting your business from the financial and reputational risks associated with third-party claims and professional negligence is paramount. General liability insurance and professional liability insurance play vital roles in providing comprehensive coverage for a wide range of potential incidents.

By understanding the strengths and weaknesses of each policy, you can make informed decisions about which coverage is right for your business. Remember, investing in adequate insurance protection is an essential step in safeguarding your assets, reputation, and peace of mind.

Discuss your specific insurance needs with an experienced insurance professional to tailor an insurance program that meets your unique requirements. Protect your business and its future by ensuring you have the necessary coverage in place.

Closing Remarks: A Disclaimer

The information provided in this article is intended for general informational purposes only and should not be construed as professional advice. It is essential to consult with an experienced insurance professional to discuss your specific insurance needs and obtain personalized guidance. The coverage provided by specific insurance policies may vary depending on the insurer and the policy terms.

By accessing this article, you acknowledge that you have read and understood this disclaimer and agree to its terms. This article does not create an insurance contract between you and any insurance provider.