Your Essential Guide to Protecting Your Business

As a small business owner, you know that protecting your business from the unexpected is essential. That’s where general liability insurance comes in. This type of insurance can help protect your business from financial losses due to claims of bodily injury, property damage, or personal injury arising from your business operations.

Choosing the right general liability insurance company for your small business is important. There are many different companies out there, each with its own strengths and weaknesses. It’s important to do your research and compare quotes before making a decision.

Introductory Words

As the owner of a small business, you face a unique set of risks that can threaten your financial stability and reputation. From customer injuries to property damage, a single incident can have a devastating impact on your business. That’s why it’s essential to have comprehensive general liability insurance in place to protect your business from unforeseen events.

General liability insurance provides coverage for claims of bodily injury, property damage, and personal injury arising from your business operations. This type of insurance can help you cover expenses such as medical bills, legal fees, and settlements, protecting your business from financial ruin.

With so many general liability insurance companies out there, choosing the right one for your small business can be challenging. To help you make an informed decision, this guide will provide an in-depth overview of the strengths and weaknesses of the leading general liability insurance companies for small businesses.

Choosing the Right General Liability Insurance Company

When choosing a general liability insurance company for your small business, it’s important to consider the following factors:

- Coverage: Make sure the policy covers the types of risks your business faces.

- Limits: The limits of your policy will determine how much protection you have.

- Premium: The premium is the cost of your insurance policy.

- Customer service: You want to choose a company with a good reputation for customer service.

It’s also important to get quotes from multiple companies before making a decision. This will help you compare coverage, limits, premiums, and customer service to find the best policy for your business.

Strengths and Weaknesses of General Liability Insurance Companies

To help you make an informed decision about which general liability insurance company is right for your small business, we’ve compiled a table of strengths and weaknesses for the leading providers in the market.

| Company |

Strengths |

Weaknesses |

| The Hartford |

Strengths:

- A+ financial strength rating from A.M. Best

- Wide range of coverage options

- Excellent customer service

Weaknesses:

- Higher premiums than some competitors

- Limited online options

|

Strengths:

- Excellent customer service

- Strong financial ratings

- Variety of coverage options

Weaknesses:

- Higher premiums than some competitors

- Limited online tools

|

| Hiscox |

Strengths:

- Specializes in small business insurance

- Tailored coverage options

- Excellent customer reviews

Weaknesses:

- Higher premiums than some competitors

- Not all coverage options available in all states

|

Strengths:

- A+ financial strength rating from A.M. Best

- Specializes in small business insurance

- Tailored coverage options

Weaknesses:

- Higher premiums than some competitors

- Not all coverage options available in all states

|

| Travelers |

Strengths:

- Large network of agents

- Competitive premiums

- Good customer service

Weaknesses:

- Limited online options

- Some complaints about claim handling

|

Strengths:

- A++ financial strength rating from A.M. Best

- Large network of agents

- Competitive premiums

Weaknesses:

- Limited online options

- Some complaints about claim handling

|

| Liberty Mutual |

Strengths:

- A+ financial strength rating from A.M. Best

- Wide range of coverage options

- Good customer reviews

Weaknesses:

- Higher premiums than some competitors

- Not all coverage options available in all states

|

Strengths:

- A+ financial strength rating from A.M. Best

- Wide range of coverage options

- Good customer reviews

Weaknesses:

- Higher premiums than some competitors

- Not all coverage options available in all states

|

| Progressive |

Strengths:

- Competitive premiums

- Easy-to-use website

- Good customer service

Weaknesses:

- Limited range of coverage options

- Not all coverage options available in all states

|

Strengths:

- Excellent customer service

- Competitive premiums

- Easy-to-use website

Weaknesses:

- Limited range of coverage options

- Not all coverage options available in all states

|

FAQs About General Liability Insurance for Small Businesses

-

What is general liability insurance?

General liability insurance protects small businesses against claims related to bodily injury, property damage, or personal injury caused by their business operations. This type of insurance can help cover expenses such as medical bills, legal fees, and settlements, protecting your business from financial ruin.

-

Why do small businesses need general liability insurance?

Small businesses need general liability insurance to protect themselves against the financial risks associated with their business operations. Without this type of insurance, your business could be liable for damages resulting from accidents or injuries that occur on your business premises or as a result of your business activities.

-

What are the different types of general liability insurance coverage?

There are different types of general liability insurance coverage available, including bodily injury liability coverage, property damage liability coverage, and personal injury liability coverage. Bodily injury liability coverage protects your business against claims of bodily injury caused by your business operations, while property damage liability coverage protects your business against claims of damage to property caused by your business operations. Personal injury liability coverage protects your business against claims of personal injury, such as defamation or false arrest, caused by your business operations.

-

How much general liability insurance do I need?

The amount of general liability insurance you need will vary depending on the size of your business, the number of employees you have, and the nature of your business activities. It’s important to work with an insurance agent to determine the right amount of coverage for your business.

-

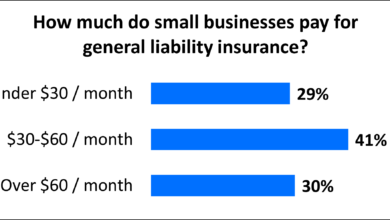

How much does general liability insurance cost?

The cost of general liability insurance will vary depending on the factors mentioned above, as well as the insurance company you choose. It’s important to get quotes from multiple companies to find the best price for your business.

-

What are the best general liability insurance companies for small businesses?

The best general liability insurance companies for small businesses will vary depending on your individual needs. It’s important to research different companies and compare quotes before making a decision.

Checkout These Recommendations:

- Basic Business Liability Insurance: Protect Your… Introduction Every business, no matter how small, faces risks and liabilities that could potentially damage its financial well-being. From customer injuries to property damage, unexpected events can strike at any…

- Business Liability Insurance: A Comprehensive Guide… Introduction: Understanding the Importance of Business Liability Insurance In today's business landscape, where unexpected events can arise at any moment, having adequate liability insurance is crucial for protecting your business…

- Liability Insurance for Painting Companies: Protect… Introductory Words Owning a painting company involves inherent risks that can lead to financial losses or legal liabilities. Liability insurance serves as a vital safeguard for painting businesses, providing protection…

- General Liability Business Insurance Quote: Protect… Navigating the Complexities of Business Liability Insurance Before delving into the specifics of general liability business insurance quotes, it is crucial to grasp the fundamental principles underlying business liability. Business…

- Pressure Washing Insurance: A Comprehensive Guide… Hello Readers, In the competitive world of pressure washing, protecting your business from unforeseen risks is paramount. Pressure washing insurance, a specialized form of coverage, provides a safety net against…

- USAA General Liability Insurance: Comprehensive… Introduction: A Comprehensive Guide to USAA General Liability Insurance In today's increasingly litigious society, protecting oneself and one's assets from potential lawsuits is paramount. General liability insurance serves as a…

- Business General Liability Insurance Online: A… Introduction In today's competitive business landscape, protecting your company against potential liabilities is paramount. Business general liability insurance (BGLI) serves as a critical safeguard, providing coverage for a wide range…

- Construction Liability Insurance: Protecting Your… Hello, Readers! In the realm of construction, where monumental structures rise and ambitious projects unfold, the risks are as multifaceted as the projects themselves. Unexpected events, accidents, and unforeseen liabilities…

- Cheap Small Business Liability Insurance Everything You Need to Know Introduction As a small business owner, you're always looking for ways to save money. But when it comes to liability insurance, you shouldn't cut corners.…

- Nj Small Business Insurance: A Comprehensive Guide Introduction Greetings, esteemed readers! Welcome to our in-depth exploration of New Jersey Small Business Insurance, an essential tool for safeguarding your enterprise against financial risks and unforeseen events. In today's…

- Buy Business Liability Insurance: Protect Your… Introductory Words In the dynamic and often unforgiving world of business, protecting your enterprise from potential liabilities is paramount. Unexpected events, accidents, or lawsuits can arise at any moment, threatening…

- Affordable General Liability Insurance For Small Business An Essential Protection for Your Business In today's competitive business landscape, protecting your small business from unforeseen events is paramount. Among the most crucial forms of protection is general liability…

- Buy Liability Insurance For Business Protect Your Business from Financial Devastation Introductory Words: Liability insurance is a crucial investment for any business, regardless of its size or industry. It protects the company from financial responsibility…

- How Do I Get General Liability Insurance For My Business Introductory Words Before the Introduction or Preamble Every business needs general liability insurance to protect itself from financial losses due to claims of bodily injury, property damage, or personal injury.…

- Small Business General Liability Insurance Near Me:… Introduction Owning a small business is an exciting and rewarding endeavor, but it also comes with potential risks and liabilities. One crucial way to safeguard your business is by obtaining…

- Public Liability Insurance: The Best Protection for… As a business owner, you are responsible for providing a safe environment for your customers, employees, and visitors. If someone is injured or their property is damaged due to your…

- Commercial Box Truck Insurance: A Guide for Business Owners Hello, Readers! Are you an entrepreneur or business owner who relies on commercial box trucks to transport goods, equipment, or materials? If so, obtaining comprehensive commercial box truck insurance is…

- Get General Liability Insurance: Protect Your… Introduction General liability insurance is a key component of any business's risk management strategy. It provides protection against third-party lawsuits alleging bodily injury, property damage, or personal injury arising from…

- Basic General Liability Insurance: Protecting Your… Understanding General Liability Insurance: An Overview As a business owner, you face numerous risks that could lead to lawsuits and substantial financial losses. Basic general liability insurance is a fundamental…

- Cheap Liability Insurance for Small Businesses Protecting Your Business with Affordable Coverage Liability insurance is essential for small businesses, providing financial protection against claims of negligence or wrongdoing. However, finding affordable coverage can be challenging. This…

- Cheap General Liability Insurance For Llc The Ultimate Guide Looking for cheap general liability insurance for your LLC? You're in the right place. In this guide, we'll explain everything you need to know about general liability…

- Buy Liability Insurance for Small Business: Protect… Introduction: The Importance of Liability Insurance for Small Businesses As a small business owner, it is crucial to understand the significance of liability insurance, which acts as a financial shield…

- Liability Contractor Insurance: A Comprehensive… Hello, Readers! In today's dynamic and demanding construction industry, protecting your business and safeguarding your assets is paramount. One crucial aspect of this protection is Liability Contractor Insurance, a specialized…

- Understanding Business General Liability Insurance… Introduction Navigating the complexities of running a business in California requires a comprehensive understanding of insurance policies to safeguard against potential risks. Business General Liability Insurance (BGLI) plays a crucial…

- Cheap General Liability Insurance For Business In this current business environment, it is important for businesses to have the right insurance coverage in place. One of the most important types of insurance for businesses is general…

- California General Liability Insurance:… Introduction Greetings, Readers! In the vibrant business landscape of California, safeguarding your enterprise from potential risks is paramount. General Liability Insurance (GLI) emerges as an indispensable tool to shield your…

- Best Workers' Comp Insurance for Small Business A Comprehensive Guide to Protecting Your Business and Employees Hello, Readers! As a small business owner, you know the importance of protecting your employees and your business. Workers' compensation insurance…

- Retail Business Insurance: A Comprehensive Guide to… Hello, Readers, In today's competitive business landscape, protecting your retail enterprise from unforeseen events is crucial for long-term success. Retail business insurance provides a safety net to mitigate risks and…

- General Liability Insurance vs. Workers'… Introductory Words: In today's business world, savvy entrepreneurs and risk managers recognize the paramount importance of safeguarding their ventures against unforeseen events that could jeopardize their financial well-being. Two essential…

- Discover the Ultimate Guide to General Liability… Unraveling the intricacies of Comprehensive Protection In the realm of risk management, General Liability Insurance (GLI) emerges as an indispensable safeguard for businesses of all sizes in Florida. It shields…