General Liability Insurance Delaware: Protecting Your Business from Unexpected Risks

Contents

- 1 Introduction: The Significance of General Liability Insurance for Delaware Businesses

- 2 Understanding General Liability Insurance: Comprehensive Coverage for Business Risks

- 3 Benefits of General Liability Insurance for Delaware Businesses

- 4 Choosing the Right General Liability Insurance Policy for Your Delaware Business

- 5 General Liability Insurance Delaware: Key Considerations

- 6 General Liability Insurance Delaware: Strengths and Weaknesses

- 7 Table: General Liability Insurance Delaware – Summary

- 8 Frequently Asked Questions about General Liability Insurance Delaware

- 8.1 1. Is general liability insurance required by law in Delaware?

- 8.2 2. What is the average cost of general liability insurance in Delaware?

- 8.3 3. What is the maximum coverage limit available for general liability insurance in Delaware?

- 8.4 4. Can I get additional coverage for specific risks, such as product liability?

- 8.5 5. What should I do if I have a liability claim?

- 8.6 6. Is general liability insurance the same as business insurance?

- 8.7 7. Can I cancel my general liability insurance policy at any time?

- 9 Conclusion: Safeguarding Your Delaware Business with General Liability Insurance

- 10 Closing Words: Empowering Delaware Businesses with Peace of Mind

Introduction: The Significance of General Liability Insurance for Delaware Businesses

Operating a business in Delaware, known for its thriving corporate environment, entails inherent risks that can potentially jeopardize the financial stability and reputation of your enterprise. General liability insurance emerges as a crucial safeguard, providing a safety net against various unforeseen events that can have far-reaching consequences for your company.

This comprehensive guide will delve into the intricacies of general liability insurance in Delaware, equipping you with the knowledge and insights necessary to make informed decisions that protect your business from potential liabilities.

Understanding General Liability Insurance: Comprehensive Coverage for Business Risks

Definition and Purpose

General liability insurance is a type of business insurance designed to protect companies from third-party claims alleging bodily injury, property damage, or other losses resulting from their operations, products, or services. It serves as a financial safety net, covering legal defense costs and settlements or judgments arising from such claims.

Essential Coverage Areas

General liability insurance policies typically provide coverage for the following key areas:

- Bodily injury

- Property damage

- Personal injury (e.g., slander, libel, wrongful arrest)

- Advertising injury

Exclusions and Limitations

It’s important to note that general liability insurance policies may include certain exclusions and limitations. Common exclusions include:

- Intentional acts

- Criminal activities

- Employee injuries

- Contractual liabilities

Benefits of General Liability Insurance for Delaware Businesses

Financial Protection from Liability Claims

General liability insurance provides a financial safety net for your business, ensuring that you won’t be held personally liable for covered claims. It covers legal defense costs and settlements or judgments, mitigating the risk of financial ruin.

Enhanced Customer Confidence

Possessing general liability insurance demonstrates to clients and customers that your business prioritizes their well-being and takes responsibility for its actions. This can boost their confidence in your company, fostering stronger relationships and driving business growth.

Legal Compliance

Certain industries or municipalities in Delaware may require businesses to carry general liability insurance. By complying with these regulations, you avoid potential fines or penalties and demonstrate your commitment to operating within the legal framework.

Choosing the Right General Liability Insurance Policy for Your Delaware Business

Assess Your Business Risks

The first step in obtaining general liability insurance is to conduct a thorough assessment of the potential risks facing your business. Consider the nature of your operations, products or services, and interactions with the public.

Determine Coverage Limits

Coverage limits refer to the maximum amount that the insurance policy will pay for a covered claim. Determine appropriate limits based on your business’s specific needs and financial capacity.

Compare Insurance Providers

Research and compare different insurance providers in Delaware. Consider factors such as premiums, coverage options, exclusions, and customer service. Seek recommendations from trusted sources and read online reviews.

General Liability Insurance Delaware: Key Considerations

Delaware-Specific Regulations

It’s essential to be aware of any Delaware-specific regulations or laws that may impact general liability insurance coverage. Consult with an experienced insurance professional to ensure compliance.

Additional Coverage Options

In addition to standard general liability coverage, consider purchasing additional riders or endorsements to enhance your protection. These may include:

- Product liability insurance

- Professional liability insurance

- Cyber liability insurance

General Liability Insurance Delaware: Strengths and Weaknesses

Strengths

- Provides financial protection from liability claims

- Enhances customer confidence

- Ensures legal compliance

- Customizable coverage options

Weaknesses

- May not cover all potential liabilities

- Premiums can be costly for high-risk businesses

- Exclusions and limitations may restrict coverage

Table: General Liability Insurance Delaware – Summary

| Coverage | Description |

|---|---|

| Bodily Injury | Covers claims for physical injuries sustained by individuals due to your business operations. |

| Property Damage | Covers claims for damage to property resulting from your business operations. |

| Personal Injury | Covers claims for non-physical injuries, such as slander, libel, and wrongful arrest. |

| Advertising Injury | Covers claims for damages resulting from false or misleading advertising by your business. |

Frequently Asked Questions about General Liability Insurance Delaware

1. Is general liability insurance required by law in Delaware?

While not universally required by law, certain industries or municipalities may have specific requirements. It’s advisable to verify the regulations applicable to your business.

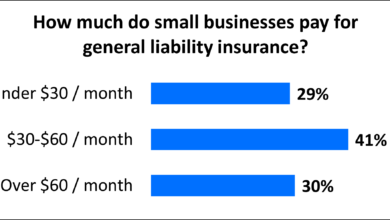

2. What is the average cost of general liability insurance in Delaware?

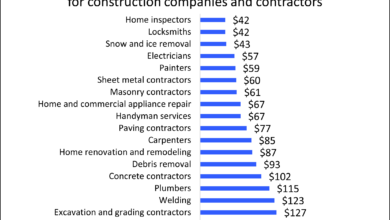

Premiums vary depending on factors such as industry, business size, and coverage limits. Contact insurance providers for personalized quotes.

3. What is the maximum coverage limit available for general liability insurance in Delaware?

Coverage limits can vary widely, but most policies offer limits up to several million dollars. Determine appropriate limits based on your business’s specific risks.

4. Can I get additional coverage for specific risks, such as product liability?

Yes, you can purchase additional riders or endorsements to enhance your coverage and protect against specific risks facing your business.

5. What should I do if I have a liability claim?

Notify your insurance provider promptly and provide detailed information about the incident. The insurance company will investigate the claim and determine coverage.

6. Is general liability insurance the same as business insurance?

No, general liability insurance is a specific type of business insurance that covers third-party liability claims. Business insurance is a broader term that encompasses various types of coverage, such as property insurance, workers’ compensation, and business interruption insurance.

7. Can I cancel my general liability insurance policy at any time?

Typically, you can cancel your policy at any time but may be subject to cancellation fees or penalties. It’s advisable to review your policy terms and consult with your insurance provider.

Conclusion: Safeguarding Your Delaware Business with General Liability Insurance

Protect Your Assets and Reputation

General liability insurance serves as a vital safeguard, protecting your business’s financial assets and reputation from unforeseen liability claims. By mitigating the risk of financial ruin, you can focus on growing your business and providing exceptional customer service without the worry of potential lawsuits.

Enhance Customer Confidence and Foster Growth

Possessing general liability insurance demonstrates to customers that you’re committed to their well-being and take responsibility for your actions. This enhanced confidence translates into stronger customer relationships, fostering business growth and longevity.

Ensure Compliance and Avoid Penalties

Compliance with Delaware-specific regulations and industry standards is crucial for all businesses. General liability insurance helps you meet these requirements, avoiding potential fines or penalties and demonstrating your commitment to operating within the legal framework.

Closing Words: Empowering Delaware Businesses with Peace of Mind

In the dynamic and ever-evolving business landscape of Delaware, general liability insurance emerges as an indispensable tool for protecting your enterprise from unforeseen risks. By carefully assessing your business’s specific needs, choosing the right insurance policy, and understanding the coverage options available to you, you can empower your business to thrive with peace of mind, knowing that you’re protected from potential liabilities.

Remember, general liability insurance is not just a financial safeguard; it’s an investment in the future of your business, ensuring its long-term success and resilience in the face of unexpected challenges.