Protect Your Livelihood, Safeguard Your Assets: The Imperative of CGL Insurance

In the labyrinthine world of business, where unforeseen events lurk like hidden perils, protecting your enterprise from financial ruin is paramount. Commercial General Liability (CGL) insurance emerges as an essential bulwark against the myriad risks that threaten your livelihood. CGL insurance acts as a financial safety net, mitigating the potentially devastating consequences of legal claims, bodily injury, or property damage arising from your business operations.

A Comprehensive Shield: The Scope of CGL Coverage

CGL insurance provides a comprehensive shield for your business, extending coverage across a wide spectrum of common risks:

Bodily Injury: If a customer, vendor, or any third party sustains bodily harm due to your business operations, CGL insurance covers the medical expenses, lost wages, and pain & suffering claims.

Property Damage: Accidents can occur on the job, potentially causing damage to property belonging to others. CGL insurance safeguards your business against claims for repair or replacement costs.

Products and Completed Operations: If your products or services cause injury or damage after you have completed the job, CGL insurance provides coverage for these post-sale liabilities.

Personal and Advertising Injury: CGL insurance protects your business from claims of libel, slander, copyright infringement, or other personal injury to reputation or advertising.

The Strength of CGL Insurance: A Resilient Shield for Your Business

The strength of CGL insurance lies in its comprehensive coverage and financial protection. Here are its key strengths:

Financial Security: CGL insurance ensures that your business has the financial resources to cover legal expenses, settlements, and damages, shielding your assets and preserving your financial stability.

Legal Protection: CGL insurance provides legal representation and defense against lawsuits, ensuring that your business is protected from frivolous claims and costly litigation.

Peace of Mind: Knowing that your business is protected against unforeseen risks gives you peace of mind, allowing you to focus on growing your enterprise without the burden of constant worry.

Potential Weaknesses: Exclusions to Consider

While CGL insurance offers robust coverage, it is essential to be aware of its exclusions:

Intentional Acts: CGL insurance does not cover injuries or damages resulting from intentional acts or criminal conduct.

Employee Injuries: CGL insurance does not cover injuries sustained by your employees; workers’ compensation insurance is required for this purpose.

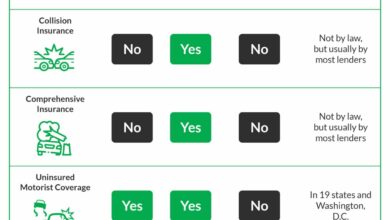

Vehicle Accidents: CGL insurance does not cover accidents involving company vehicles: commercial auto insurance is necessary for such coverage.

A Comparative Analysis: Balancing Strengths and Weaknesses

The strengths of CGL insurance far outweigh its weaknesses. Its comprehensive coverage, financial protection, and peace of mind make it an indispensable tool for businesses of all sizes. However, it is crucial to be aware of its exclusions and supplement your insurance portfolio accordingly.

The CGL Insurance Landscape: Understanding Coverage Options

CGL insurance policies come with varying coverage limits and deductibles. Choosing the right policy depends on the size, nature, and risk profile of your business.

Coverage Limits: Coverage limits determine the maximum amount your insurance company will pay in the event of a claim. Higher limits provide greater protection but come with higher premiums.

Deductibles: Deductibles represent the out-of-pocket expenses you must pay before your insurance coverage kicks in. Lower deductibles mean lower premiums but require you to assume more financial risk.

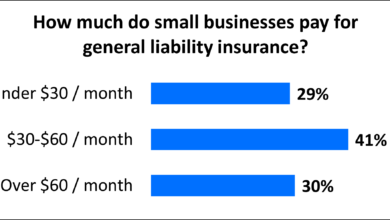

The Cost of Protection: Premiums and Factors Influencing Them

CGL insurance premiums vary depending on several factors, including:

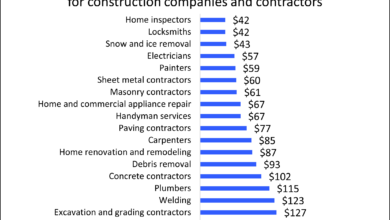

Industry: Certain industries pose higher risks, resulting in higher premiums.

Business Size: Larger businesses typically have more employees and assets, which can increase premiums.

Claims History: Businesses with a history of claims may face higher premiums to offset the elevated risk.

Frequently Asked Questions: Demystifying CGL Insurance

Below are answers to common questions regarding CGL insurance:

How much CGL insurance do I need?

The appropriate amount of CGL insurance depends on your business’s size, industry, and risk profile. A qualified insurance professional can guide you in determining the optimal coverage level.

What types of businesses need CGL insurance?

All businesses, regardless of their size or industry, can benefit from CGL insurance. It provides a comprehensive safety net against common risks that can jeopardize financial stability.

What is the difference between CGL and other types of business insurance?

CGL insurance primarily covers third-party claims for bodily injury, property damage, and personal or advertising injury. Other business insurance policies, such as workers’ compensation or commercial auto insurance, provide protection in specialized areas.

How do I choose a CGL insurance provider?

Consider factors such as the provider’s financial stability, reputation, customer service, and coverage options when choosing a CGL insurance provider.

What are the common exclusions in CGL insurance policies?

Common exclusions include intentional acts, employee injuries, and vehicle accidents.

Can I customize my CGL insurance policy?

Yes, many insurance providers offer customizable CGL policies that allow you to tailor the coverage to meet your specific business needs.

How often should I review my CGL insurance policy?

Review your CGL insurance policy annually or whenever there are significant changes to your business operations or risk profile.

A Call to Action: Protect Your Business, Secure Your Future

Do not leave your business exposed to the perils of unforeseen events. Get CGL insurance today and secure your livelihood against the financial consequences of legal claims, bodily injury, or property damage. Safeguarding your business is an investment in its future, ensuring that you can continue to grow and prosper.

Closing Words: A Guiding Light for Business Success

Protecting your business with CGL insurance is a wise and prudent decision. By shielding yourself from financial ruin, you create a solid foundation for growth and success. Remember, every successful business is built on a foundation of resilience and preparedness. Invest in CGL insurance today and embark on a path of entrepreneurial excellence.

Checkout These Recommendations:

- Plumbing Liability Insurance: Safeguarding Your… Introduction Greetings, esteemed readers, Welcome to this comprehensive guide to Plumbing Liability Insurance, a crucial safeguard for your plumbing business and its reputation. In an industry where unforeseen risks and…

- Business Liability Insurance Quotes: Safeguarding… Hello Readers, In today's fast-paced business environment, protecting your company against potential liabilities is paramount. Business liability insurance quotes provide you with peace of mind by offering comprehensive coverage that…

- Discover the Ultimate Guide to General Liability… Unraveling the intricacies of Comprehensive Protection In the realm of risk management, General Liability Insurance (GLI) emerges as an indispensable safeguard for businesses of all sizes in Florida. It shields…

- Cheapest General Liability Insurance for Small… Introduction: Navigating the Insurance Landscape for Entrepreneurs As a small business owner, protecting your enterprise from unforeseen liabilities is crucial. General liability insurance serves as a safety net, mitigating potential…

- Small Business Liability Insurance: Protect Your… Introduction As an entrepreneur in Georgia, protecting your business from potential liabilities is crucial. Small business liability insurance provides a safety net against financial losses resulting from accidents, lawsuits, and…

- General Liability and Errors and Omissions… Preamble: Understanding the Importance of Insurance in Today's Business Environment In the modern business landscape, navigating the complexities of legal liabilities and professional responsibilities is paramount. As businesses grow and…

- Construction Liability Insurance: Protecting Your… Hello, Readers! In the realm of construction, where monumental structures rise and ambitious projects unfold, the risks are as multifaceted as the projects themselves. Unexpected events, accidents, and unforeseen liabilities…

- Lowest General Liability Insurance: Affordable… General liability insurance (GLI) is a crucial form of coverage that protects businesses from financial losses arising from lawsuits alleging bodily injury, property damage, or personal injury. While GLI is…

- Buy Business Liability Insurance Online A Comprehensive Guide to Protecting Your Business Introduction In today's highly competitive business environment, protecting your assets and safeguarding your company's reputation is paramount. One essential tool in this endeavor…

- Commercial Insurance Auto: Safeguard Your Business… Hello, Readers! Welcome, dear readers, to our in-depth exploration of commercial insurance auto. In today's dynamic business landscape, safeguarding your vehicles and drivers is paramount for ensuring seamless operations and…

- General Liability Insurance Online: A Comprehensive Guide Introducing General Liability Insurance Online In a rapidly evolving business landscape, safeguarding your company against potential liabilities is paramount. General liability insurance serves as a crucial protective measure, providing a…

- Get Professional Liability Insurance: Protect… Protect Your Business from Financial Risks Professional Liability Insurance provides vital financial protection for your business against claims of negligence or errors and omissions. As a business owner, you are…

- Professional Business Liability Insurance: Essential… Protecting Your Business from Financial Risks Every business faces potential risks that could threaten its financial stability. From lawsuits to data breaches, there are a myriad of events that can…

- General Liability Insurance For Small Business Near… Introductory Words: Unveiling the Significance of General Liability Insurance for Small Businesses In the labyrinthine landscape of commerce, every small business owner embarks on a perilous journey fraught with unforeseen…

- Llc Liability Insurance: The Ultimate Guide to… Hello Readers, Welcome to our comprehensive guide to LLC liability insurance. In this article, we'll delve into the nuances of this essential form of business protection, empowering you to make…

- Business Insurance For Photographers: Shield Your Craft Howdy, Esteemed Readers! Welcome to our comprehensive guide, where we illuminate the crucial topic of business insurance for photographers. As a photographer, your equipment and creations are your livelihood. We…

- Business Insurance for Contractors: Safeguard Your… Introduction Dear Readers, As a contractor, you are entrusted with building, repairing, or maintaining valuable structures and properties. However, unforeseen accidents, property damage, and lawsuits can jeopardize your business and…

- Liability Insurance for Painting Companies: Protect… Introductory Words Owning a painting company involves inherent risks that can lead to financial losses or legal liabilities. Liability insurance serves as a vital safeguard for painting businesses, providing protection…

- Buying Liability Insurance For A Business When you own a business, you are responsible for the safety of your customers, employees, and property. If someone is injured or their property is damaged due to your negligence,…

- Insurance For Contractor: A Comprehensive Guide to… Hello Readers, As a contractor, you know that your business is your livelihood. You've worked hard to build it up, and you want to protect it from unexpected events. That's…

- Contractors Insurance Near Me: Essential Protection… Introduction Greetings, readers! In the highly competitive world of contracting, securing reliable insurance coverage is not just an option but an imperative. Contractors insurance, often referred to as "contractors insurance…

- Cheap Business Liability Insurance: Protect Your… A Comprehensive Guide to Securing Essential Coverage Without Breaking the Bank Hello, readers. In the competitive landscape of today's business world, protecting your enterprise from potential risks is paramount. Liability…

- Cheap General Liability Insurance for Small Businesses Navigating the Maze of Coverage Options for Financial Protection As a small business owner, securing comprehensive insurance coverage is paramount to safeguarding your enterprise against potential liabilities and financial losses.…

- General Liability Insurance for Carpenters:… Introduction Carpentry is a skilled trade that requires years of experience and training. While the work is rewarding, it also comes with inherent risks. Accidents can happen at any time,…

- Liability Contractor Insurance: A Comprehensive… Hello, Readers! In today's dynamic and demanding construction industry, protecting your business and safeguarding your assets is paramount. One crucial aspect of this protection is Liability Contractor Insurance, a specialized…

- Basic General Liability Insurance: Protecting Your… Understanding General Liability Insurance: An Overview As a business owner, you face numerous risks that could lead to lawsuits and substantial financial losses. Basic general liability insurance is a fundamental…

- Obtain General Liability Insurance: Protect Your… Introductory Words As a business owner, you face countless risks that could jeopardize your financial stability and reputation. One of the most significant threats is the possibility of being sued…

- Business Office Insurance: A Vital Shield for Your… Greetings, Readers: In the dynamic and ever-evolving business landscape, seamless operations and proactive risk management are paramount. Business Office Insurance (BOI) emerges as an indispensable tool to safeguard your enterprise,…

- Business Liability Insurance for Sole Proprietors:… An Introduction to Protecting Your Enterprise In the world of business, it is imperative to safeguard your assets and reputation against potential risks and liabilities. Sole proprietors, in particular, face…

- General Liability Insurance Delaware: Protecting… Introduction: The Significance of General Liability Insurance for Delaware Businesses Operating a business in Delaware, known for its thriving corporate environment, entails inherent risks that can potentially jeopardize the financial…