In today’s high-tech realm, protecting against cyber threats is crucial for businesses of all sizes. Cyber liability insurance offers a safety net, safeguarding companies from costly consequences of data breaches, ransomware attacks, and other cyber mishaps. Understanding the factors that influence cyber liability insurance costs is essential for making informed decisions. This article delves into the variables that determine the price tag associated with this type of coverage, empowering businesses to navigate the cyber insurance landscape with confidence.

Factors Affecting Cyber Liability Insurance Costs

The cost of cyber liability insurance can vary significantly depending on several factors. Understanding these factors can help you tailor your policy to meet your specific needs and budget:

1. Business Size and Revenue

Larger businesses with higher revenues typically face higher premiums due to increased exposure to cyber threats. Insurance companies assess the potential financial impact of a data breach based on the company’s size and revenue.

2. Industry

Certain industries, such as healthcare, finance, and technology, are more prone to cyber attacks due to the sensitive data they handle. Higher premiums are often associated with these industries to reflect the increased risk.

3. Data Volume and Type

The amount and sensitivity of data stored by a business can significantly impact insurance costs. Companies that store large amounts of personal or financial information face higher premiums because a data breach could have severe consequences.

4. Cybersecurity Measures

Strong cybersecurity measures can reduce the likelihood and severity of cyber attacks, which can lead to lower premiums. Insurance companies may offer discounts for businesses that implement comprehensive security protocols.

5. Loss History

Businesses with a history of cyber incidents or breaches may face higher premiums. Insurance companies view these events as indicators of increased risk and adjust premiums accordingly.

6. Coverage Limits

The amount of coverage you choose will directly impact the cost of your policy. Higher coverage limits provide wider protection but also result in higher premiums.

7. Deductibles

The deductible is the amount you pay out-of-pocket in the event of a covered cyber incident. Higher deductibles lead to lower premiums but require you to承担 more financial responsibility in the event of a breach.

8. Location

The geographic location of your business can also affect your insurance costs. Areas with higher rates of cybercrime may experience higher premiums.

9. Credit Rating

Insurance companies may consider your business’s credit rating when determining your premium. A strong credit rating can indicate financial stability and lower the likelihood of significant losses.

10. Insurance Carrier

Different insurance carriers have varying risk assessment models and pricing strategies. Comparing quotes from multiple carriers can help you find the most competitive rates for your specific business needs.

Factors Determining Cyber Liability Insurance Costs

The cost of cyber liability insurance varies widely depending on several factors, including:

1. Industry and Size of Business

Businesses in high-risk industries, such as healthcare, finance, and technology, typically pay higher premiums. The size of a business also affects the cost, with larger organizations requiring more extensive coverage.

2. Revenue

Insurance companies often use annual revenue as a proxy for the potential financial impact of a cyberattack. Businesses with higher revenue face higher premiums, as they have more to lose in the event of a breach.

3. Data Sensitivity

Businesses that handle sensitive data, such as customer financial information or medical records, are at greater risk for costly data breaches. As a result, they need more comprehensive coverage, which drives up insurance costs.

4. Security Measures

Businesses that have implemented robust cybersecurity measures, such as encryption, firewalls, and intrusion detection systems, can reduce their insurance premiums. Insurance companies view these measures as mitigating the risk of a breach.

5. Claims History

Businesses with a history of cyberattacks or data breaches may face higher premiums, as insurance companies perceive them as being at higher risk.

6. Deductible

The deductible is the amount the business is responsible for paying before the insurance kicks in. A higher deductible typically lowers the premium, while a lower deductible raises it.

7. Coverage Limits

The amount of coverage a business purchases also affects the cost. Businesses with higher coverage limits, which provide greater financial protection, will pay higher premiums.

8. Endorsements and Riders

Businesses can purchase additional endorsements or riders to enhance their coverage, such as coverage for extortion threats or cyber defamation. These additions increase the cost of the insurance.

9. Location

The location of a business can impact the cost of cyber liability insurance. Businesses in areas with high cybercrime rates or strict data protection laws may face higher premiums.

10. Market Conditions

The availability and pricing of cyber liability insurance can fluctuate based on market conditions, such as the frequency and severity of cyberattacks. When cyberattacks become more prevalent, premiums tend to rise.

Factors Affecting Cyber Liability Insurance Costs

The cost of cyber liability insurance varies depending on several factors, including:

1. Business Size

Larger businesses face a higher risk of cyberattacks due to having more sensitive data and a wider attack surface. As a result, they require more comprehensive coverage, which increases the cost of their premiums.

2. Industry

Businesses in certain industries, such as healthcare and finance, handle highly sensitive data that can be particularly valuable to cybercriminals. These industries typically have higher insurance premiums to cover the potential financial losses and reputational damage associated with a data breach.

3. Revenue

Insurance companies consider a business’s revenue when calculating premiums. Higher revenue generally indicates a larger potential financial impact from a cyberattack, leading to higher insurance costs.

4. Cyber Security Measures

Businesses that have implemented robust cybersecurity measures, such as firewalls, intrusion detection systems, and employee training, may qualify for lower premiums. Insurance companies view these measures as reducing the risk of a cyberattack.

5. Claims History

Businesses with a history of cyberattacks or data breaches may face higher premiums. Insurance companies consider this factor as an indicator of increased risk.

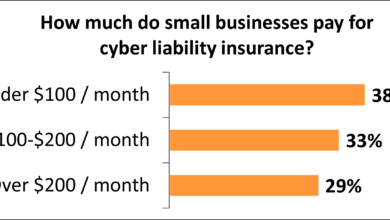

Conclusion: Protection at a Reasonable Price

Cyber liability insurance provides an essential layer of protection for businesses in today’s digital landscape. While its cost may vary, it’s an investment worth making to safeguard your reputation, finances, and overall well-being. By comparing quotes from multiple providers, you can find a policy that fits both your coverage needs and budget.

Thanks for taking the time to read this article. Remember to check back later for updates and new insights on the ever-evolving world of cybersecurity and insurance.

Checkout These Recommendations:

- Cyber Insurance: A Lifeline for Municipalities in… In today's technologically driven world, municipalities are facing a growing threat from cyberattacks. These attacks can disrupt critical infrastructure, compromise sensitive data, and drain financial resources. To protect themselves from…

- Cybersecurity Insurance: Protecting Your Digital… In the ever-evolving digital landscape, cybersecurity has become paramount to safeguard our online presence and protect sensitive data. With the rise of cyberattacks and data breaches, businesses and individuals alike…

- Navigating the Maze of Cyber Security Insurance: A… In today's digital landscape, where cyber threats relentlessly evolve, protecting your business and personal assets from online vulnerabilities has become paramount. Cyber Security Insurance Agencies are stepping up to the…

- Vouch: The Cyber Insurance Innovator for Modern Businesses In today's digital landscape, the threats lurking in the virtual realm are as real as ever. Your sensitive data, including customer information, trade secrets, and financial records, are constantly under…

- Fifth Wall Cyber Insurance: Safeguarding the Digital… In today's increasingly digital world, businesses face a growing threat from cyberattacks. These attacks can cause significant financial losses, disrupt operations, and damage reputations. Fifth Wall Cyber Insurance offers a…

- Cyber Liability Insurance Costs: A Rising Tide for… In today's interconnected digital landscape, businesses of all sizes face an ever-growing threat from cyberattacks. These attacks can cause significant financial losses, reputational damage, and legal liabilities. As a result,…

- Cyber Liability Insurance Quotes: Protect Your… In this digital age, safeguarding your business from cyber threats is crucial. Cyber liability insurance offers a safety net against potential financial losses resulting from data breaches, hacking, malware attacks,…

- Third Party Cyber Insurance: Protecting Your… In the ever-evolving digital landscape, where cybercrime looms like a persistent shadow, protecting your business from costly online threats has become paramount. While cyber insurance plays a crucial role in…

- Hiscox Cyber Security Insurance: Protecting… In today's ever-evolving digital landscape, our online presence and data have become an invaluable asset. However, with this increased digitalisation comes a heightened risk of cyber threats, making it crucial…

- Cyber Security Risk Insurance: Protecting Businesses… In today's digital age, where businesses and individuals rely heavily on technology, the threat of cyberattacks looms large. From data breaches and ransomware attacks to malware infections and phishing scams,…

- Protect Your Online Presence: A Comprehensive Guide… In this digital age, businesses are increasingly vulnerable to cyber threats, from data breaches to ransomware attacks, leaving them facing financial losses, reputational damage, and legal liability. Msp Cyber Insurance…

- Protect Your Small Business from Cyber Threats: The… In the ever-evolving digital landscape, small businesses are increasingly vulnerable to cyberattacks. From phishing scams to malware infections, the threats are endless. While it may seem like only large corporations…

- Hiscox Cyber Liability Insurance: Protecting… In today's ever-evolving digital landscape, where technology reigns supreme, protecting your business from the lurking threat of cyber attacks is paramount. Hiscox, a trusted provider of insurance solutions, has meticulously…

- Cyber Liability Insurance: Protecting Your Business… In today's digital age, protecting your business from cyber threats is paramount. With increasing reliance on the internet and vast amounts of sensitive data being stored online, the risk of…

- Cyber Security Insurance for Today's Digital… In the ever-evolving digital landscape, cybersecurity has become paramount. Businesses and individuals alike are increasingly vulnerable to malicious attacks that can compromise sensitive data, disrupt operations, and tarnish reputations. To…

- Navigating the Cybersecurity Insurance Market: Top… In today's digital age, where cyber threats lurk around every corner, protecting your business from malicious attacks is a paramount concern. Cyber Security Insurance Providers step into this crucial role,…

- Coalition Cyber Insurance: A Comprehensive Review of… In the ever-evolving digital landscape, protecting your business from cyber threats is paramount. Coalition Cyber Insurance Reviews offer a comprehensive assessment of this leading provider, empowering you to make an…

- SentinelOne Cyber Insurance: A Comprehensive Guide SentinelOne Cyber Insurance: Empowering Businesses in a Digital Age In today's interconnected world, cyber threats loom large, casting a shadow over businesses of all sizes. From malicious software to data…

- Cyber Insurance Enhanced By Fifthwall In this digital age where technology reigns supreme, protecting ourselves from cyber threats has become paramount. Fifthwall Cyber Insurance steps into the arena, offering a lifeline to businesses and individuals…

- Chubb Cyber Security Insurance: Protect Your… In today's increasingly digital world, safeguarding your business from cyber threats is no longer an option but a paramount necessity. Chubb Cyber Security Insurance offers a comprehensive suite of coverage…

- Cybersecurity at Your Fingertips: Exploring the Best… In today's increasingly digital world, protecting yourself from cyber threats is paramount. With the constant bombardment of online scams, data breaches, and ransomware attacks, having the right cyber insurance can…

- Great American Cyber Insurance: Comprehensive… In the ever-evolving digital landscape, protecting your business from the threats lurking in the cyber realm is paramount. Great American Cyber Insurance steps up to the plate with a tailored…

- Protect Your Digital Assets: The Importance of Cyber… In today's increasingly digital world, our valuable data and systems are constantly at risk from cyberattacks. From malicious malware to phishing scams, these threats can cause significant financial losses and…

- Cyber Insurance: Essential Protection for Small… In today's digital world, every small business is vulnerable to the ever-growing threat of cyberattacks. From data breaches to ransomware, the consequences can be severe, costing businesses their reputation, data,…

- Protecting Your Digital Universe: Allied World Cyber… In the ever-evolving digital landscape, where cyber threats lurk around every corner, businesses need robust protection to safeguard their valuable data and reputation. Allied World Cyber Insurance steps onto the…

- Arctic Wolf Cyber Insurance: Protecting Your… In the ever-evolving digital landscape, the threat of cyberattacks looms large, leaving businesses and organizations vulnerable. Arctic Wolf Cyber Insurance provides a safety net, offering comprehensive protection against the financial…

- Cyber-Risk Liability Insurance: Safeguarding… In today's digital age, our lives are increasingly intertwined with the internet. We use it for everything from banking to shopping to communicating with friends and family. This interconnectedness, however,…

- Protect Your Digital Assets: Buy Cyber Insurance Online Now In today's interconnected world, protecting your digital assets is no longer a luxury but a necessity. Cyber threats lurk around every corner, threatening to compromise your sensitive data, disrupt your…

- Get a Cyber Insurance Quote Online: Protect Your… In today's increasingly digital world, where our online presence and data are constantly exposed to potential threats, cyber insurance has become an essential safeguard to protect against the costly consequences…

- Commercial Cyber Liability Insurance: Protecting… In today's digital realm, where cyber threats lurk at every corner, protecting your business from the perils of the online world is paramount. Commercial Cyber Liability Insurance acts as your…