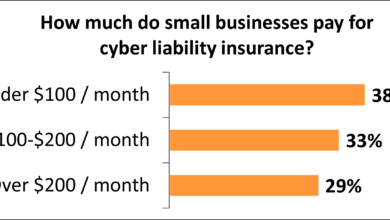

In today’s digital world, small businesses face an ever-increasing threat from cyberattacks. From ransomware to data breaches, the consequences of a cyber incident can be devastating, costing businesses time, money, and reputation. That’s why cyber insurance has become essential for any small business that relies on technology to operate. In this article, we’ll explore the cost of cyber insurance for small businesses, examining factors that influence premiums and offering tips for finding affordable coverage.

Factors Affecting Cyber Insurance Costs for Small Businesses

-

Business Size and Revenue: The size and revenue of your business can significantly impact your insurance premiums. Larger businesses with higher revenues typically face higher risks and therefore pay more for coverage.

-

Industry: The industry in which your business operates plays a crucial role in determining your cyber insurance costs. Businesses in high-risk industries such as healthcare, finance, and technology typically pay more due to the increased likelihood of data breaches and cyberattacks.

-

Number of Employees and Devices: The number of employees and devices connected to your network can increase your exposure to cyber threats. More employees and devices mean more potential entry points for hackers, leading to higher premiums.

-

Data Sensitivity: The sensitivity of the data you store and process can significantly affect your insurance costs. Businesses that handle sensitive information such as personal health records or financial data are more likely to be targeted by cybercriminals, resulting in higher premiums.

-

Previous Breaches: A history of cyber breaches can make it more difficult to obtain cyber insurance or result in higher premiums. Insurance companies view businesses with a history of breaches as being at higher risk and may charge more to cover them.

-

Security Measures: The strength of your cybersecurity measures can influence your insurance costs. Businesses with robust security measures, such as firewalls, intrusion detection systems, and employee training, may qualify for lower premiums.

-

Deductible: The deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can reduce your premiums, but it also means you will bear more of the financial burden in the event of a breach.

-

Limits of Coverage: The limits of coverage determine the maximum amount your insurance company will pay in the event of a cyberattack. Higher limits of coverage typically result in higher premiums.

-

Location: The location of your business can also affect your insurance costs. Businesses in areas with a higher incidence of cybercrime or natural disasters may face higher premiums.

-

Insurance Market: The availability and cost of cyber insurance can vary depending on market conditions. Factors such as the frequency and severity of cyberattacks, as well as the overall demand for insurance, can influence pricing.

Factors Influencing Cyber Insurance Costs

The cost of cyber insurance for small businesses can vary based on several factors. Understanding these factors can help you make informed decisions and negotiate the best possible premium.

Industry and Business Size:

Businesses operating in high-risk industries, such as healthcare or finance, typically pay higher premiums due to the increased risk of cyberattacks. Similarly, larger businesses with more employees and data may face higher costs as they have a wider attack surface.

Revenue and Coverage Limits:

The amount of cyber coverage you need is directly related to your potential financial losses in the event of a breach. Higher coverage limits result in higher premiums, as they provide more financial protection for your business.

Data Sensitivity:

Businesses storing or handling sensitive personal or financial data face increased risk and thus pay higher premiums. The type of data you collect and process can significantly influence your insurance costs.

Cybersecurity Measures:

Strong cybersecurity measures, such as firewalls, intrusion detection systems, and employee training programs, can reduce the likelihood of a breach and lower insurance premiums. Implementing robust security protocols demonstrates a commitment to protection and mitigates risk for insurers.

Claims History:

Businesses with a history of cyber claims may face higher premiums as they pose a greater risk to insurers. Insurers assess past claims to gauge the potential for future incidents.

Location:

The geographic location of your business can also affect your insurance costs. Areas with higher rates of cybercrime or data breaches may result in higher premiums. Insurers consider local threat landscapes when setting rates.

Credit Score:

Your business’s credit score may be a factor in determining your insurance premium. A higher credit score indicates financial stability, which can translate into lower insurance rates as insurers perceive you as a more reliable risk.

Deductibles:

The deductible on your cyber insurance policy is the amount you agree to pay out of pocket in the event of a covered claim. Higher deductibles lower your premiums, but they also shift more of the financial burden onto you in the event of a breach.

Coverage Options:

Different cyber insurance policies offer a range of coverage options, such as data breach expenses, business interruption, and extortion coverage. The combination of coverages you choose affects your overall premium.

Market Availability:

The availability and competitiveness of cyber insurance policies in your market can impact pricing. Insurers assess the level of competition and demand when setting rates.

Factors that Influence the Cost of Cyber Insurance

The cost of cyber insurance for small businesses varies depending on several factors, including:

1. Industry and Business Size

Companies in industries with a higher risk of cyberattacks, such as healthcare or finance, tend to pay higher premiums. Similarly, larger businesses with more data and assets to protect typically pay more than smaller businesses.

2. Location

The cost of cyber insurance can vary based on the location of the business. Companies in areas with a high frequency of cyberattacks or stricter data protection regulations may face higher premiums.

3. Coverage Limits and Deductibles

The amount of coverage a business needs will impact the cost of insurance. Higher coverage limits typically result in higher premiums. Deductibles, which represent the amount the business pays out-of-pocket before the insurance coverage kicks in, can also affect the cost.

4. Security Measures

Businesses with robust cybersecurity measures in place may be eligible for lower premiums. This is because insurers view these companies as having a lower risk of experiencing a cyberattack.

5. Claims History

Businesses with a history of cyber claims may face higher premiums, as insurers consider them to be higher risk. However, maintaining a clean claims history can help reduce the cost of insurance over time.

Know Your Worth

Cyber insurance is an essential protection for businesses of all sizes, especially with the increasing prevalence of cyber threats. By shopping around and comparing quotes from multiple insurers, small businesses can find affordable coverage that fits their needs. Thank you for reading. We hope you found this article informative. If you have any questions or need additional guidance, feel free to visit our website again for more resources and support.

Checkout These Recommendations:

- Protect Your Small Business from Cyber Threats: The… In the ever-evolving digital landscape, small businesses are increasingly vulnerable to cyberattacks. From phishing scams to malware infections, the threats are endless. While it may seem like only large corporations…

- Unlocking Cyber Resilience: A Comprehensive Guide to… In the ever-evolving digital landscape, where cyberattacks loom like digital specters, it's crucial to shield your business from the inevitable. Berkshire Hathaway Specialty Insurance (BHSI) has emerged as a formidable…

- Protect Your Digital Assets: A Comprehensive Guide… In today's interconnected world, businesses of all sizes face an ever-increasing threat of cyberattacks. From data breaches and ransomware to phishing scams and malware, the potential risks to your digital…

- Protecting Your Business with SMB Cyber Insurance: A… In today's digital landscape, where even the smallest businesses rely heavily on technology, cyber threats pose a significant risk. For small and medium-sized businesses (SMBs), the consequences of a cyber…

- Cybersecurity in the Digital Age: Essential… In our increasingly digital world, it's no longer just our physical assets that are at risk. Our online presence, from social media profiles to financial accounts, is just as vulnerable…

- Protecting Your Profits: Cyber Insurance for Tax Preparers In the digital age, tax preparers are more vulnerable than ever to cyber threats. With the rise of identity theft, data breaches, and ransomware attacks, it's more important than ever…

- Protecting Michigan Businesses from Cyber Threats: A… Listen up, folks! The digital age has brought a fantastic world of convenience, but it's also opened the door to a whole new kind of threat: cybercrimes. From phishing scams…

- Cyber Liability Insurance Costs: A Breakdown In today's high-tech realm, protecting against cyber threats is crucial for businesses of all sizes. Cyber liability insurance offers a safety net, safeguarding companies from costly consequences of data breaches,…

- The Growing Cost of Cyber Liability Insurance: A… In the digital age where every click and keystroke leaves a trail, businesses of all sizes are at increasing risk of cyberattacks. Data breaches, ransomware, and other malicious activities can…

- Cyber Liability Insurance: Understanding Costs and Coverage In today's digital landscape, where data breaches and cyberattacks are becoming increasingly common, businesses face a growing need to protect themselves from the financial consequences of these threats. Cyber liability…

- Amtrust Cyber Insurance: Protect Your Digital Assets… In today's ever-evolving cyber landscape, safeguarding your digital assets has become paramount. Amtrust Cyber Insurance steps up to the plate, offering a comprehensive suite of solutions designed to protect you…

- Best Cyber Security Insurance: Protect Your Business… In an increasingly connected world, where digital threats lurk around every corner, protecting your business against cyberattacks is paramount. If you fall victim to a cyberattack, the financial consequences can…

- Protecting Your Digital Universe: Allied World Cyber… In the ever-evolving digital landscape, where cyber threats lurk around every corner, businesses need robust protection to safeguard their valuable data and reputation. Allied World Cyber Insurance steps onto the…

- Cyber Security Insurance: A Vital Safeguard for… Imagine waking up to the dreaded news that your business has been hacked and your sensitive data has been compromised. In this digital age, cyber threats are a constant concern…

- Cybersecurity on a Budget: Find Affordable Insurance Options In today's interconnected world, where cyber threats lurk around every corner, protecting your digital assets is paramount. But don't break the bank insuring your virtual realm! Cyber insurance has often…

- Kaseya Cyber Insurance: Protecting Businesses from… In the digital age, cyberattacks have become an unfortunate reality for businesses of all sizes. From ransomware to data breaches, these attacks can cripple operations and cost companies millions of…

- Fifth Wall Cyber Insurance: Safeguarding the Digital… In today's increasingly digital world, businesses face a growing threat from cyberattacks. These attacks can cause significant financial losses, disrupt operations, and damage reputations. Fifth Wall Cyber Insurance offers a…

- Cyber Insurance Enhanced By Fifthwall In this digital age where technology reigns supreme, protecting ourselves from cyber threats has become paramount. Fifthwall Cyber Insurance steps into the arena, offering a lifeline to businesses and individuals…

- Nj Small Business Insurance: A Comprehensive Guide Introduction Greetings, esteemed readers! Welcome to our in-depth exploration of New Jersey Small Business Insurance, an essential tool for safeguarding your enterprise against financial risks and unforeseen events. In today's…

- Protect Your Business from Cyber Threats: Essential… In today's fast-paced digital world, safeguarding your small business from cyberattacks is paramount. With the increasing frequency and sophistication of cyber threats, even the most seasoned businesses can fall victim…

- Cyber Security Liability Insurance: Mitigating the… In today's digital age, protecting your business from cyber threats is more important than ever before. Cybercriminals are constantly devising new ways to attack businesses of all sizes, and the…

- Gallagher Cyber Insurance: Protecting Your Business… In today's digital realm, where cyber threats lurk around every corner, it's crucial to safeguard your business against potential online attacks. Enter Gallagher Cyber Insurance, a comprehensive solution designed specifically…

- Navigating the Cybersecurity Landscape: The… Step into the realm of cybersecurity where the ever-evolving threat landscape demands proactive protection. In this digital age, it's no longer a question of if you'll face a cyberattack, but…

- Cyber Privacy Insurance: Safeguarding Your Digital… In today's digital age, our personal information is constantly at risk. From data breaches to identity theft, there are countless ways our privacy can be compromised. That's why it's more…

- Cybersecurity Insurance: Protecting Your Digital… In the ever-evolving digital landscape, cybersecurity has become paramount to safeguard our online presence and protect sensitive data. With the rise of cyberattacks and data breaches, businesses and individuals alike…

- Navigating the Maze of Cyber Security Insurance: A… In today's digital landscape, where cyber threats relentlessly evolve, protecting your business and personal assets from online vulnerabilities has become paramount. Cyber Security Insurance Agencies are stepping up to the…

- Munich Re Cyber Insurance: Shielding Businesses from… In today's digital age, where cyber threats lurk around every click and keystroke, having a robust safety net to protect your business is paramount. Enter Munich Re Cyber Insurance, a…

- Cybersecurity Insurance Quotes: Protect Your… In today's digital landscape, protecting your business and data from cyberattacks has become paramount. As the frequency and sophistication of cyber threats continue to rise, it's essential to consider securing…

- Cyber Security Insurance for Small Businesses:… In today's digital landscape, small businesses are facing an ever-growing threat from cyberattacks. With limited resources and expertise, they are often the most vulnerable targets for malicious hackers. The consequences…

- Cybersecurity at Your Fingertips: Exploring the Best… In today's increasingly digital world, protecting yourself from cyber threats is paramount. With the constant bombardment of online scams, data breaches, and ransomware attacks, having the right cyber insurance can…