A comprehensive guide to reducing your premiums after an at-fault crash

Getting into a car accident can be a stressful and expensive experience. In addition to the immediate costs of property damage and medical bills, you may also see your car insurance rates go up. However, there are several things you can do to lower your car insurance after an accident, such as:

• Filing an accident report with your insurance company as soon as possible

• Getting a copy of the police report, if one was filed

• Taking photos of the damage to your car and the other vehicle(s) involved

• Getting estimates for the repairs

• Negotiating with the other driver’s insurance company

• Hiring an attorney

If you are at fault for the accident, you will likely see your rates go up. However, the amount of the increase will vary depending on your driving history, the severity of the accident, and the amount of damage caused.

Strengths of Lowering Auto Insurance After Accident

There are several benefits to lowering your car insurance after an accident. First, it can help you save money on your monthly premiums. Second, it can make it easier to budget for your other expenses. Third, it can help you improve your credit score, which can lead to lower interest rates on loans and other financial products.

Weaknesses of Lowering Auto Insurance After Accident

There are also some potential drawbacks to lowering your car insurance after an accident. First, it may mean that you have less coverage in the event of another accident. Second, it may make it more difficult to get approved for a loan or other financial product. Third, it could increase your out-of-pocket costs if you are involved in an accident.

| Factor |

Impact on Insurance Rates |

| Fault for the accident |

At-fault drivers will typically see their rates go up. |

| Severity of the accident |

More severe accidents will typically result in higher rate increases. |

| Amount of damage caused |

More extensive damage will typically lead to higher rate increases. |

| Driving history |

Drivers with good driving records will typically see smaller rate increases. |

| Age |

Younger drivers typically pay higher rates than older drivers. |

| Gender |

In some states, male drivers pay higher rates than female drivers. |

| Location |

Drivers in urban areas typically pay higher rates than drivers in rural areas. |

FAQs

Q: How much will my insurance rates go up after an accident?

A: The amount of the increase will vary depending on the factors listed above.

Q: How long will my rates stay elevated after an accident?

A: Typically, rates will stay elevated for three to five years.

Q: What can I do to lower my rates after an accident?

A: There are several things you can do, such as:

• Filing an accident report with your insurance company as soon as possible

• Getting a copy of the police report, if one was filed

• Taking photos of the damage to your car and the other vehicle(s) involved

• Getting estimates for the repairs

• Negotiating with the other driver’s insurance company

• Hiring an attorney

Q: What if I can’t afford my higher insurance rates?

A: There are several options available to you, such as:

• Asking your insurance company for a payment plan

• Shopping around for a new insurance company

• Getting a loan to cover the cost of the higher rates

Q: What if I was not at fault for the accident?

A: If you were not at fault for the accident, your insurance rates should not go up. However, you may still need to file an accident report with your insurance company.

Q: What if the other driver was uninsured?

A: If the other driver was uninsured, you may be able to file a claim with your own insurance company under your uninsured motorist coverage.

Q: What if I have multiple accidents?

A: If you have multiple accidents, your insurance rates will likely go up even more. However, there are still several things you can do to lower your rates, such as:

• Taking a defensive driving course

• Installing a dash cam in your car

• Getting a good driving record

Q: What if I have a lapse in coverage?

A: If you have a lapse in coverage, your insurance rates will likely go up when you get new insurance. However, there are several things you can do to lower your rates, such as:

• Getting a good driving record

• Taking a defensive driving course

• Shopping around for a new insurance company

Q: What if I get a speeding ticket?

A: If you get a speeding ticket, your insurance rates will likely go up. However, there are several things you can do to lower your rates, such as:

• Taking a defensive driving course

• Getting a good driving record

• Shopping around for a new insurance company

Q: What if I get a DUI?

A: If you get a DUI, your insurance rates will likely go up significantly. However, there are several things you can do to lower your rates, such as:

• Taking a DUI education course

• Getting a good driving record

• Shopping around for a new insurance company

Conclusion

Getting into a car accident can be a stressful and expensive experience. However, there are several things you can do to lower your car insurance rates after an accident. By following the tips in this guide, you can save money on your monthly premiums and improve your financial situation.

If you have any questions about lowering your car insurance rates after an accident, please contact your insurance company or an independent insurance agent.

Disclaimer: This article is for informational purposes only and should not be considered legal or financial advice. Please consult with a qualified professional before making any decisions about your car insurance coverage.

Checkout These Recommendations:

- Accident Auto Insurance Preamble: Understanding the Importance of Auto Insurance In the fast-paced world of today, driving has become an indispensable part of our daily lives. However, with the increased number of vehicles…

- Full Coverage Car Insurance: Essential Protection… An Introductory Overview of the Comprehensive Coverage for Your Vehicle In the realm of automotive ownership, navigating the labyrinth of insurance options can be a daunting task. Full coverage car…

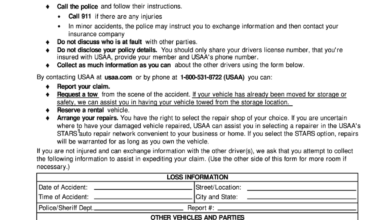

- Usaa Auto Insurance Report An Accident Introduction USAA is a leading provider of insurance products and services for military members, veterans, and their families. With a commitment to serving those who serve, USAA offers comprehensive auto…

- Auto Insurance for Businesses: A Comprehensive Guide Introduction Hello, readers! Auto insurance is an essential component of any business operation that involves the use of vehicles. It provides financial protection against various risks and liabilities associated with…

- Accident Forgiveness Auto Insurance Introductory Words Life on the road is unpredictable, and even the most cautious drivers can find themselves in an accident. When the unexpected happens, it's crucial to have auto insurance…

- Auto Insurance For Multiple Accidents **Before the Introduction:** Before delving into the complexities of auto insurance and multiple accidents, it is imperative to establish a comprehensive understanding of the subject matter. This article will provide…

- Best Auto Insurance After An Accident Navigating the Aftermath: A Comprehensive Guide to Auto Insurance Post-Accident In the aftermath of a car accident, navigating insurance complexities can be daunting. Choosing the right insurance company is paramount,…

- The Ultimate Guide to Auto Insurance Attorneys Hello Readers! In the event of a car accident, navigating the complexities of auto insurance claims can be a daunting task. That's where auto insurance attorneys step in, providing invaluable…

- The Ultimate Guide to Best Car Insurance Coverage Introduction: Unveiling Comprehensive Protection for Your Vehicle In the realm of driving, car insurance serves as an indispensable shield, safeguarding you against unforeseen financial burdens resulting from accidents. Navigating the…

- Auto Insurance Accident History **Introductory Words:** Auto insurance is a crucial aspect of vehicle ownership, providing financial protection against potential accidents and damages. One significant factor that insurance companies consider when determining your insurance…

- Auto Insurance At Fault Accident Pondering the Profundity of Auto Insurance in At-Fault Accidents In the complex tapestry of modern life, where vehicles seamlessly weave their way into our daily routines, the specter of auto…

- Usaa Auto Insurance Accident Reporting A Comprehensive Guide to Filing an Accident Claim with USAA Navigating the aftermath of a car accident can be stressful and overwhelming. Reporting the incident promptly and accurately to your…

- Best Auto Insurance After Accident Preamble Having an auto accident can be a traumatic experience, both physically and financially. If you are involved in an accident, it is important to make sure you have the…

- Allstate Insurance Auto Quote: The Ultimate Guide Hello Readers, In today's fast-paced world, finding the right auto insurance policy is crucial for protecting your vehicle and yourself. Allstate Insurance is a renowned provider offering comprehensive coverage options…

- How To Sue An Insurance Company After An Auto Accident Introduction If you've been injured in an auto accident, you may be wondering if you should sue the insurance company. Here's what you need to know about filing a lawsuit…

- Auto Accidents Insurance Introduction: The Importance of Auto Accidents Insurance When you get behind the wheel of a car, you open yourself up to a variety of risks. From minor fender benders to…

- Car Accident Auto Insurance Car accidents are a common occurrence, and they can be incredibly stressful and expensive. If you're involved in a car accident, having the right auto insurance coverage can help you…

- Direct Auto Insurance Report Accident Introduction: Navigating the aftermath of a car accident can be overwhelming, and reporting it to your insurance company is a crucial step. Direct Auto Insurance makes it convenient and streamlined…

- Cheapest Auto Insurance After Accident Cheapest Auto Insurance After Accident: The Ultimate Guide to Finding Affordable Coverage Introduction After a car accident, your insurance rates can skyrocket. This can be a major financial burden, especially…

- Automobile Insurance: A Comprehensive Guide to… In today's fast-paced world, automobiles have become an indispensable part of our daily lives. They provide convenience, mobility, and freedom, enabling us to travel, commute, and fulfill various personal and…

- Auto Accident Without Insurance Introduction Being involved in an automobile accident is a stressful and frightening experience, and it can be even more overwhelming if you don't have insurance. In this article, we'll provide…

- Colorado Car Insurance: The Ultimate Guide for… Hello, Readers! Welcome to our comprehensive guide to Colorado car insurance. In this article, we'll delve into the complexities of Colorado's car insurance laws, coverage options, and insurance companies. Whether…

- First Accident Forgiveness Auto Insurance Introductory Words When it comes to auto insurance, accidents are inevitable. No matter how careful you are behind the wheel, there's always a chance that you'll find yourself in a…

- Auto Accident No Insurance Not At Fault No one expects to be involved in a car accident, but unfortunately, they happen every day. And when you're the victim of an accident that wasn't your fault, it can…

- Cheapest Auto Insurance With Accidents Navigate the Maze: Finding Budget-Friendly Auto Insurance with an Accident History Navigating the complexities of auto insurance after an accident can be a daunting task. The repercussions of an accident…

- General Liability and Workers' Compensation… Every small business needs insurance to protect itself from potential financial risks, and two of the most important types of insurance are general liability insurance and workers' compensation insurance. These…

- Auto Insurance For Accidents Auto Insurance For Accidents An In-Depth Analysis and Comprehensive Guide The realm of auto insurance is a complex web of policies and regulations that can often leave individuals feeling bewildered…

- Auto Insurance With Accidents Auto insurance plays a significant role in protecting individuals from financial liabilities associated with accidents. However, when an accident occurs, navigating the complexities of insurance coverage can be overwhelming. This…

- Auto Accident Insurance Lawyer Introduction: In the aftermath of a car accident, dealing with the physical and emotional trauma can be overwhelming. Amidst the chaos, understanding your legal rights and securing fair compensation is…

- Usaa Auto Insurance Report Accident Reporting an Accident to USAA Auto Insurance: A Comprehensive Guide Introduction In the unfortunate event of an auto accident, promptly reporting it to your insurance company is crucial for ensuring…