Insurance for Cyber Security: Protecting Your Digital Assets in the Modern Era

In the ever-evolving digital landscape, cybersecurity has become paramount. With the increasing frequency and sophistication of cyberattacks, businesses and individuals alike are facing heightened risks to their data, systems, and reputations. Amidst this cyberthreat landscape, insurance for cybersecurity has emerged as a crucial safeguard, offering businesses and individuals a lifeline to mitigate financial losses and protect their critical digital assets.

Contents

- 1 Types of Cyber Security Insurance Coverage

- 1.1 Data Breach Response Coverage

- 1.2 Cyber Extortion Coverage

- 1.3 Business Interruption Coverage

- 1.4 Network Security Liability Coverage

- 1.5 Network Business Income Coverage

- 1.6 Cyber Security Legal Liability Coverage

- 1.7 First-Party Property Coverage

- 1.8 Third-Party Liability Coverage

- 1.9 Privacy Breach Coverage

- 1.10 Reputation Enhancement Coverage

- 2 Coverage Types in Cyber Insurance

- 2.1 1. Data Breach Coverage

- 2.2 2. Business Interruption Coverage

- 2.3 3. Extortion Coverage

- 2.4 4. Cybercrime Coverage

- 2.5 5. Social Engineering Coverage

- 2.6 6. Cloud Security Coverage

- 2.7 7. Privacy Liability Coverage

- 2.8 8. Regulatory Breach Coverage

- 2.9 9. Cyber Extortion Coverage

- 2.10 10. Reputation Management Coverage

- 3 Types of Cyber Insurance Coverage

- 4 Stay Protected, Stay Cyber-Secure

Types of Cyber Security Insurance Coverage

Data Breach Response Coverage

This coverage reimburses expenses incurred in responding to a cyber data breach, including legal fees, forensic investigations, and public relations costs.

Cyber Extortion Coverage

Protects businesses from financial losses due to cyber extortion attempts, such as ransomware attacks.

Business Interruption Coverage

Covers lost revenue and expenses if a cyberattack results in a business interruption.

Network Security Liability Coverage

Provides coverage for legal liability claims resulting from network security failures that cause damage to third parties.

Network Business Income Coverage

Insures against lost profits and ongoing expenses due to a cyberattack that disrupts network operations.

Cyber Security Legal Liability Coverage

Protects businesses against third-party lawsuits alleging negligence or liability related to cyber security breaches.

First-Party Property Coverage

Covers physical damage to company property caused by a cyberattack, such as hardware failures or data loss.

Third-Party Liability Coverage

Protects against lawsuits by customers, partners, or other third parties who suffer financial or reputational damage due to a cyberattack originating from the business.

Privacy Breach Coverage

Provides coverage for expenses incurred in responding to and investigating a breach of protected personal data.

Reputation Enhancement Coverage

Helps businesses recover from damage to their reputation caused by a cyber security breach or data leak.

Coverage Types in Cyber Insurance

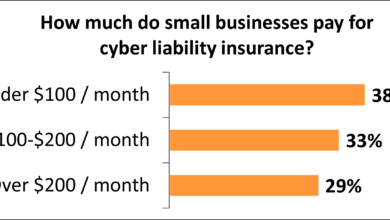

Cyber insurance policies offer a comprehensive range of coverage options to protect businesses from various cyber risks. The specific coverage types included in a policy can vary depending on the provider and the level of coverage purchased. Here are some common types of coverage:

1. Data Breach Coverage

Data breach coverage reimburses expenses incurred in response to a data breach, including notification costs, credit monitoring for affected individuals, and forensic investigations.

2. Business Interruption Coverage

Business interruption coverage provides compensation for lost income and expenses incurred due to a cyber incident that disrupts business operations.

3. Extortion Coverage

Extortion coverage protects businesses from financial losses incurred when a hacker threatens to release sensitive data or disrupt operations unless a ransom is paid.

4. Cybercrime Coverage

Cybercrime coverage reimburses expenses related to cybercrimes such as computer fraud, phishing, and identity theft.

5. Social Engineering Coverage

Social engineering coverage protects businesses from losses caused by employees or third parties being tricked into disclosing sensitive information or making fraudulent transactions.

6. Cloud Security Coverage

Cloud security coverage provides protection for data stored in the cloud in the event of a cyber incident or breach.

7. Privacy Liability Coverage

Privacy liability coverage protects businesses from legal expenses and damages incurred due to violations of privacy laws and regulations.

8. Regulatory Breach Coverage

Regulatory breach coverage provides protection against fines and penalties associated with violations of government regulations related to cybersecurity.

9. Cyber Extortion Coverage

Cyber extortion coverage provides protection against financial losses incurred when a hacker demands payment in exchange for not launching a cyber attack.

10. Reputation Management Coverage

Reputation management coverage provides protection against financial losses incurred due to damage to a business’s reputation resulting from a cyber incident.

Types of Cyber Insurance Coverage

Cybersecurity insurance policies come in various forms, each tailored to cover specific risks. Here are five common types of coverage:

1. First-Party Coverage

First-party coverage protects your business against direct financial losses resulting from a cyberattack. This includes:

- Data breach expenses: Costs incurred in responding to and remediating a data breach, such as forensic investigation, legal fees, and regulatory fines.

- Business interruption: Loss of income or expenses due to downtime caused by a cyberattack.

- Cyber extortion: Payments made to attackers to prevent or stop a cyberattack.

2. Third-Party Coverage

Third-party coverage is for businesses held liable for damages caused by a cyberattack on their customers, partners, or third-party vendors. This includes:

- Privacy liability: Compensation for claims alleging that your company’s actions resulted in personal data breaches or other privacy violations.

- Intellectual property theft: Damages arising from the theft or infringement of intellectual property as a result of a cyberattack.

- Cybercrime: Losses incurred by third parties due to fraud, identity theft, or other cybercrimes perpetrated through your company’s systems.

3. Cybercrime Coverage

Cybercrime coverage offers protection against financial losses resulting from specific types of cybercrimes. These often include:

- Social engineering scams: Losses incurred as a result of phishing, email fraud, or other social engineering techniques used to trick employees into providing sensitive information.

- Ransomware attacks: Damages caused by ransomware attacks, including ransom payments and the cost of restoring compromised systems.

- Credential theft: Losses resulting from the theft or misuse of login credentials and other sensitive information.

4. Cloud-Based Coverage

With the increasing adoption of cloud computing, dedicated cloud-based cyber insurance policies have emerged. These policies provide coverage for:

- Data loss or damage: Compensation for the loss or damage of data stored in cloud infrastructure.

- Cloud service interruptions: Losses incurred due to downtime or outages of cloud services.

- Cloud security breaches: Expenses related to responding to and mitigating security breaches in cloud environments.

5. Comprehensive Coverage

Comprehensive cyber insurance policies combine various types of first-party, third-party, and cybercrime coverage into a single package. These policies provide broad protection against a wide range of cyberattacks and breaches, but they often come with higher premiums.

Stay Protected, Stay Cyber-Secure

Thanks for reading, folks! I hope you found this article informative and helpful. Remember, cybersecurity is not just a techie’s concern; it affects all of us. So, make sure you’re well-protected with the right insurance coverage. Check back with us later for more updates on the latest cyber threats and how to stay secure in this rapidly evolving digital landscape.