Hello, Readers!

In today’s dynamic and demanding construction industry, protecting your business and safeguarding your assets is paramount. One crucial aspect of this protection is Liability Contractor Insurance, a specialized policy tailored specifically for contractors.

This comprehensive guide will delve into the intricacies of Liability Contractor Insurance, providing you with a deep understanding of its coverage, benefits, limitations, and importance in securing your contracting business.

Introduction: Understanding the Importance of Liability Contractor Insurance

Liability Contractor Insurance acts as a safety net for contractors, shielding them from financial repercussions arising from property damage, bodily injury, or legal claims brought against them by clients, employees, or third parties during the course of their work.

This insurance coverage is not only crucial for safeguarding your business but also meets the requirements of many construction contracts, providing peace of mind and ensuring compliance.

As a contractor, you face various risks and uncertainties on job sites. Liability Contractor Insurance provides a comprehensive financial buffer against these unexpected events, protecting your business from potential liabilities and safeguarding your financial well-being.

In addition, Liability Contractor Insurance enhances your credibility and professionalism, demonstrating to clients and stakeholders that you value safety, quality, and responsible business practices.

By investing in Liability Contractor Insurance, you not only safeguard your business but also demonstrate your commitment to providing a safe and reliable work environment for your employees and all parties involved in your projects.

Strengths of Liability Contractor Insurance

Comprehensive Coverage: Liability Contractor Insurance offers comprehensive coverage against a wide range of risks, including property damage, bodily injury, legal defense costs, and more.

Legal Protection: In the event of a lawsuit, Liability Contractor Insurance provides legal representation and defense costs, protecting you from the financial burden and legal complexities of litigation.

Enhanced Credibility: Liability Contractor Insurance is an indicator of professionalism and credibility, assuring clients of your commitment to safety and quality work standards.

Contract Compliance: Many construction contracts require contractors to carry Liability Contractor Insurance, ensuring compliance and minimizing potential contractual disputes.

Peace of Mind: Knowing that you are financially protected against potential liabilities provides peace of mind, enabling you to focus on your work without undue stress or worry.

Weaknesses of Liability Contractor Insurance

Limited Coverage: While Liability Contractor Insurance offers comprehensive protection, it may not cover all potential risks. Additional insurance coverage may be necessary to mitigate specific exposures.

Claim Exclusions: Policies often exclude coverage for certain intentional acts, criminal behavior, or damages caused by uninsured contractors or subcontractors.

Policy Limits: Liability Contractor Insurance policies have limits of coverage, meaning that the insurance company’s financial liability is capped at a specified amount.

Premiums: Liability Contractor Insurance premiums can vary based on the level of coverage, policy limits, and the contractor’s risk profile, potentially increasing operational costs.

Policy Complexity: Understanding the intricacies of Liability Contractor Insurance policies can be challenging, requiring careful review and professional advice to ensure adequate protection.

Types of Liability Contractor Insurance

| Type of Coverage |

Description |

| General Liability Insurance |

Covers claims of property damage, bodily injury, and other common liabilities arising from daily operations. |

| Professional Liability Insurance |

Protects against claims of negligence or errors in professional services provided by the contractor. |

| Workers’ Compensation Insurance |

Provides coverage for work-related injuries and illnesses sustained by employees. |

| Commercial Auto Insurance |

Covers damages caused by vehicles owned or operated by the contractor in the course of business. |

Factors Affecting Liability Contractor Insurance Premiums

Several factors influence Liability Contractor Insurance premiums, including:

Type and size of the business: Larger contractors with higher risk profiles typically pay higher premiums.

Claims history: Contractors with a history of claims or lawsuits may face higher premiums.

Coverage limits: Higher policy limits result in higher premiums.

Geographic location: Premiums vary based on the location of the contractor’s business operations.

Industry specialization: Contractors working in high-risk industries, such as roofing or electrical work, often pay higher premiums.

Choosing the Right Liability Contractor Insurance Policy

Selecting the appropriate Liability Contractor Insurance policy requires careful consideration of the following factors:

Assessing Your Risk Exposure: Determine the specific risks associated with your business operations and the potential for liabilities.

Identifying Coverage Needs: Evaluate the types of coverage that are essential to protect your business, including general liability, professional liability, workers’ compensation, and commercial auto insurance.

Reviewing Policy Exclusions: Carefully review the policy exclusions to ensure that you are aware of any limitations or exceptions to coverage.

Understanding Policy Limits: Determine the appropriate coverage limits based on your risk exposure and financial capacity.

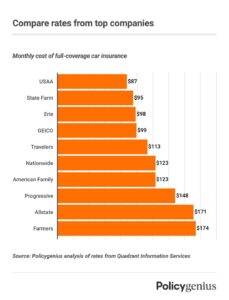

Considering Premium Costs: Compare premiums from different insurance providers to find the most cost-effective option that meets your coverage needs.

FAQs about Liability Contractor Insurance

1. Is Liability Contractor Insurance required by law?

While not universally mandated by law, Liability Contractor Insurance is often required as a condition of construction contracts and is highly recommended to protect your business from financial losses.

2. What does General Liability Insurance cover?

General Liability Insurance protects contractors from claims of property damage, bodily injury, and other common liabilities arising from daily operations.

3. What is the difference between General Liability Insurance

Checkout These Recommendations:

- USAA General Liability Insurance: Comprehensive… Introduction: A Comprehensive Guide to USAA General Liability Insurance In today's increasingly litigious society, protecting oneself and one's assets from potential lawsuits is paramount. General liability insurance serves as a…

- Best General Liability Insurance For Small Business:… Securing your small business against unexpected liabilities is crucial for its financial stability and reputation. General liability insurance acts as a safety net, protecting you from third-party claims related to…

- Best Auto Insurance After An Accident Navigating the Aftermath: A Comprehensive Guide to Auto Insurance Post-Accident In the aftermath of a car accident, navigating insurance complexities can be daunting. Choosing the right insurance company is paramount,…

- General Liability Insurance For Small Business Near… Introductory Words: Unveiling the Significance of General Liability Insurance for Small Businesses In the labyrinthine landscape of commerce, every small business owner embarks on a perilous journey fraught with unforeseen…

- California General Liability Insurance:… Introduction Greetings, Readers! In the vibrant business landscape of California, safeguarding your enterprise from potential risks is paramount. General Liability Insurance (GLI) emerges as an indispensable tool to shield your…

- Liability Insurance for Consulting Businesses:… Introduction In today's competitive business landscape, it is imperative for consulting businesses to protect their interests by obtaining comprehensive liability insurance. As consultants provide professional advice and guidance to clients,…

- Electrical Contractors Insurance: A Comprehensive Guide Hello, Readers! Welcome to our comprehensive guide on electrical contractors insurance. This essential insurance policy is tailored to protect electrical contractors like you from financial risks and liabilities associated with…

- Workers' Compensation and General Liability… Introduction Navigating the complexities of business insurance can be a daunting task, especially when it comes to understanding the differences between workers' compensation and general liability insurance. Both policies play…

- New York Professional Liability Insurance: A… In the bustling metropolis of New York City, where countless professionals navigate the complexities of business, the need for robust professional liability insurance cannot be overstated. This specialized insurance policy…

- Electrical Contractor Insurance: Protect Your… Hello Readers, Greetings, readers! In the realm of electrical contracting, safeguarding your business and customers is paramount. Electrical Contractor Insurance (ECI) serves as a safety net, providing financial protection from…

- Buy Liability Insurance for Small Business: Protect… Introduction: The Importance of Liability Insurance for Small Businesses As a small business owner, it is crucial to understand the significance of liability insurance, which acts as a financial shield…

- Small Business Professional Liability Insurance: A… Introduction Hello, readers! In today's competitive market, small businesses face numerous challenges. One often overlooked but critically important area is professional liability insurance. This comprehensive guide will delve into the…

- Llc Liability Insurance: The Ultimate Guide to… Hello Readers, Welcome to our comprehensive guide to LLC liability insurance. In this article, we'll delve into the nuances of this essential form of business protection, empowering you to make…

- Business Liability Insurance Providers: A… Introduction In the fast-paced world of business, unforeseen events and potential liabilities can strike at any moment. Business liability insurance plays a crucial role in safeguarding businesses against financial losses…

- Business Liability Insurance Quotes: Safeguarding… Hello Readers, In today's fast-paced business environment, protecting your company against potential liabilities is paramount. Business liability insurance quotes provide you with peace of mind by offering comprehensive coverage that…

- Affordable Professional Liability Insurance: A… Introductory Words In today's competitive business landscape, professionals face an array of risks that can jeopardize their livelihoods. From errors and omissions to negligence and malpractice, these risks can lead…

- Photography Liability Insurance: Shielding Your… A Comprehensive Guide for Photographers Hello, esteemed readers! Photography is an art form that captures the beauty of moments and preserves them for eternity. However, as photographers, we often find…

- Business Liability and Workers' Compensation… Introduction: In today's competitive business environment, it is crucial for organizations to safeguard themselves and their employees against financial risks and legal liabilities. Business Liability and Workers' Compensation Insurance play…

- Business Insurance for Contractors: Safeguard Your… Introduction Dear Readers, As a contractor, you are entrusted with building, repairing, or maintaining valuable structures and properties. However, unforeseen accidents, property damage, and lawsuits can jeopardize your business and…

- Legal Malpractice Insurance: Protect Yourself From… Hello, Readers, In the realm of legal practice, navigating the complexities of the justice system can be both fulfilling and fraught with challenges. One of the most critical considerations for…

- Cheap Business Liability Insurance: Protect Your… A Comprehensive Guide to Securing Essential Coverage Without Breaking the Bank Hello, readers. In the competitive landscape of today's business world, protecting your enterprise from potential risks is paramount. Liability…

- General Liability Insurance Delaware: Protecting… Introduction: The Significance of General Liability Insurance for Delaware Businesses Operating a business in Delaware, known for its thriving corporate environment, entails inherent risks that can potentially jeopardize the financial…

- Life Coach Professional Liability Insurance:… A Comprehensive Guide for Life Coaches As a life coach, you provide guidance and support to your clients as they navigate personal and professional challenges. While your goal is to…

- Unlock the Power of Customer Financing for… As a contractor, you know that financing is an essential part of growing your business. It can help you purchase new equipment, hire more employees, or even take on larger…

- Buy Business Liability Insurance: Protect Your… Introductory Words In the dynamic and often unforgiving world of business, protecting your enterprise from potential liabilities is paramount. Unexpected events, accidents, or lawsuits can arise at any moment, threatening…

- Liability Insurance for Small Businesses: A… A Precautionary Investment for Entrepreneurs Hello, esteemed readers. Welcome to our in-depth exploration of liability insurance, an essential safeguard for small businesses. In this comprehensive guide, we unravel the intricacies…

- Workers' Compensation and General Liability… Navigating the Labyrinth of Business Risks In today's competitive business landscape, protecting your company from unforeseen events is paramount. Workers' compensation and general liability insurance are essential tools that provide…

- Instant General Liability Insurance: A Comprehensive Guide General liability insurance is a cornerstone of risk management for businesses of all sizes. It provides financial protection against claims of bodily injury, property damage, or personal injury arising from…

- Building Contractor Liability Insurance: The Ultimate Guide As a building contractor, you're responsible for ensuring the safety of your workers and clients. However, even the most careful contractors can face accidents and lawsuits. That's where building contractor…

- Liability and Indemnity Insurance: A Comprehensive Guide In today's increasingly litigious society, protecting yourself and your business from potential legal liabilities is paramount. Liability and indemnity insurance policies play a crucial role in providing financial protection against…