General liability insurance (GLI) is a crucial form of coverage that protects businesses from financial losses arising from lawsuits alleging bodily injury, property damage, or personal injury. While GLI is essential, it can be costly, especially for small businesses with limited budgets. In such cases, low-cost general liability insurance emerges as a viable option, providing essential protection without breaking the bank.

This article delves into the world of lowest general liability insurance, exploring its benefits, limitations, and considerations to help you make an informed decision for your business.

Introduction: The Importance of General Liability Insurance

General liability insurance serves as a safety net for businesses, protecting them from financial ruin caused by lawsuits. It covers a wide range of incidents, including:

- Injuries sustained by customers on your premises

- Damage to property caused by your services or products

- False advertising or defamation

- Bodily injuries caused by your employees

Without GLI, businesses face the risk of crippling legal expenses, judgments, and settlements, which can lead to bankruptcy. It provides peace of mind, allowing business owners to focus on their operations without the fear of financial catastrophe.

Strengths of the Lowest General Liability Insurance

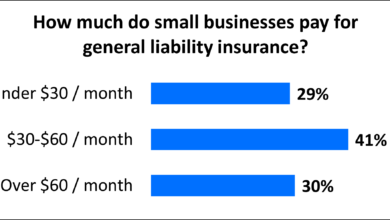

Affordability

The primary strength of lowest general liability insurance is its affordability. This type of coverage is tailored to small businesses with limited budgets, offering a practical way to mitigate financial risks without excessive premiums.

Flexibility

Lowest general liability insurance is highly flexible, allowing businesses to customize their coverage based on specific needs and risks. This flexibility ensures that businesses can obtain the protection they require without paying for unnecessary coverage.

Ease of Access

Low-cost general liability insurance is readily available through insurance companies and online marketplaces. The application process is typically straightforward, making it easy for businesses to secure coverage quickly and efficiently.

Weaknesses of the Lowest General Liability Insurance

Coverage Limits

The limitations of lowest general liability insurance primarily lie in its coverage limits. These policies typically offer lower limits of liability, which may not be sufficient to fully protect businesses from all potential risks.

Exclusions

Lowest general liability insurance policies may have more exclusions than higher-priced policies. These exclusions can limit coverage for certain incidents, such as intentional acts or professional negligence.

Higher Deductibles

Low-cost general liability insurance policies often come with higher deductibles. This means that businesses will have to pay a larger out-of-pocket expense in the event of a claim.

Considerations When Choosing Low-Cost General Liability Insurance

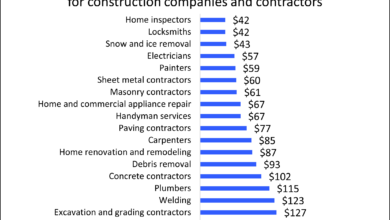

Business Size and Industry

The size and industry of your business will influence the type and amount of general liability insurance you require. Consider the potential risks associated with your operations and the coverage limits required to adequately protect your business.

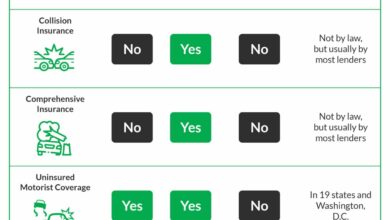

State Regulations

General liability insurance laws vary from state to state. Ensure that the policy you choose complies with the requirements in your state and provides adequate coverage for the risks you face.

Insurance Company Reputation

Choose an insurance company with a strong reputation, financial stability, and excellent customer service. This will provide you with peace of mind and ensure that your claims will be handled promptly and fairly.

FAQs about Lowest General Liability Insurance

What is the minimum amount of GLI coverage I need?

The minimum amount of coverage will depend on your business size and industry. It is advisable to consult with an insurance agent to determine the appropriate limits for your specific needs.

What types of businesses can benefit from lowest general liability insurance?

Low-cost general liability insurance is suitable for small businesses with limited budgets and low-risk operations, such as retail stores, office-based businesses, and service providers.

Can I get a discount on my GLI premium?

Insurance companies offer discounts for various reasons, such as having a good safety record or implementing risk management measures. Ask your insurance agent about available discounts.

What if I have a claim under my low-cost GLI policy?

In the event of a claim, you should notify your insurance company promptly. The insurance company will investigate the claim and determine whether it is covered under your policy.

What are the consequences of not having GLI insurance?

Businesses that operate without GLI insurance face significant financial risks. They may be personally liable for legal expenses and judgments, which can lead to bankruptcy.

Conclusion: Protect Your Business with Affordable Coverage

Lowest general liability insurance offers essential protection for small businesses with limited budgets. By understanding its strengths, weaknesses, and considerations, you can make an informed decision about whether it is the right choice for your business.

Remember, general liability insurance is a crucial investment that can save your business from financial ruin. While low-cost GLI may not provide comprehensive coverage, it offers a reasonable level of protection that can give you peace of mind and allow you to focus on growing your business.

Closing Words: A Prudent Investment for Your Business’s Future

Investing in lowest general liability insurance is a prudent decision that can protect your business from financial disasters. By comparing policies, understanding the coverage and cost implications, and considering your unique business needs, you can secure affordable and effective protection that will safeguard your business for years to come.

Remember, general liability insurance is not a luxury but a necessity. Protect your business and your financial well-being with the peace of mind that comes from knowing you have the coverage you need.

Checkout These Recommendations:

- Best General Liability Insurance For Small Business:… Securing your small business against unexpected liabilities is crucial for its financial stability and reputation. General liability insurance acts as a safety net, protecting you from third-party claims related to…

- Business Liability Insurance: A Comprehensive Guide… Introduction: Understanding the Importance of Business Liability Insurance In today's business landscape, where unexpected events can arise at any moment, having adequate liability insurance is crucial for protecting your business…

- Small Business Liability Insurance: Protect Your… Introduction As an entrepreneur in Georgia, protecting your business from potential liabilities is crucial. Small business liability insurance provides a safety net against financial losses resulting from accidents, lawsuits, and…

- General Liability Insurance For Small Business Near… Introductory Words: Unveiling the Significance of General Liability Insurance for Small Businesses In the labyrinthine landscape of commerce, every small business owner embarks on a perilous journey fraught with unforeseen…

- Buy Liability Insurance For Business Protect Your Business from Financial Devastation Introductory Words: Liability insurance is a crucial investment for any business, regardless of its size or industry. It protects the company from financial responsibility…

- General Liability and Workers' Compensation… Every small business needs insurance to protect itself from potential financial risks, and two of the most important types of insurance are general liability insurance and workers' compensation insurance. These…

- Cheap General Liability Insurance For Handyman Protecting Your Business and Assets As a handyman, you provide essential services to your clients, but you also face unique risks every day. Accidents can happen, and if someone is…

- Cheap Small Business Liability Insurance Everything You Need to Know Introduction As a small business owner, you're always looking for ways to save money. But when it comes to liability insurance, you shouldn't cut corners.…

- Purchase Liability Insurance For Small Business Introductory Words A small business owner's life is full of risks and uncertainties. One of the biggest risks is the potential for lawsuits. If someone is injured or their property…

- How Do I Get General Liability Insurance For My Business Introductory Words Before the Introduction or Preamble Every business needs general liability insurance to protect itself from financial losses due to claims of bodily injury, property damage, or personal injury.…

- Business Liability Insurance Brokers: Protecting… Introduction In the competitive world of business, protecting your assets and minimizing financial risks is crucial for long-term success. Business liability insurance brokers play a vital role in safeguarding businesses…

- Carpenter General Liability Insurance: Safeguarding… As a skilled craftsperson, your carpentry business deserves the utmost protection against potential risks and liabilities. Carpenter General Liability Insurance (GL) serves as a vital safety net, safeguarding you and…

- Cheap General Liability Insurance For Llc The Ultimate Guide Looking for cheap general liability insurance for your LLC? You're in the right place. In this guide, we'll explain everything you need to know about general liability…

- Obtain General Liability Insurance: Protect Your… Introductory Words As a business owner, you face countless risks that could jeopardize your financial stability and reputation. One of the most significant threats is the possibility of being sued…

- General Liability and Workers' Comp Insurance: A… Hello, Readers: In this increasingly litigious world, businesses of all sizes need comprehensive insurance coverage to protect themselves from unforeseen events. General liability and workers' compensation insurance are two essential…

- Buy Commercial General Liability Insurance An Essential Protection for Businesses In today's competitive business environment, protecting your enterprise against potential risks is paramount. Commercial General Liability (CGL) insurance is a comprehensive coverage that safeguards businesses…

- Workers' Compensation and General Liability… Introduction Navigating the complexities of business insurance can be a daunting task, especially when it comes to understanding the differences between workers' compensation and general liability insurance. Both policies play…

- Cheap General Liability Insurance Near Me What is General Liability Insurance? General liability insurance is a type of business insurance that protects businesses from financial liability for bodily injury or property damage that occurs as a…

- Liability Insurance for Consulting Businesses:… Introduction In today's competitive business landscape, it is imperative for consulting businesses to protect their interests by obtaining comprehensive liability insurance. As consultants provide professional advice and guidance to clients,…

- Buy Business Liability Insurance: Protect Your… Introductory Words In the dynamic and often unforgiving world of business, protecting your enterprise from potential liabilities is paramount. Unexpected events, accidents, or lawsuits can arise at any moment, threatening…

- Pressure Washing Insurance: A Comprehensive Guide… Hello Readers, In the competitive world of pressure washing, protecting your business from unforeseen risks is paramount. Pressure washing insurance, a specialized form of coverage, provides a safety net against…

- Company Liability Insurance Plans: Protecting Your… Introductory Words: Operating a business comes with inherent risks, and one of the most significant is the potential for lawsuits. Unforeseen events, accidents, or allegations of negligence can lead to…

- Contractor Business Insurance: A Comprehensive Guide… Hello Readers, As a contractor, you know the importance of protecting your business against unforeseen events. Contractor business insurance is an essential tool for mitigating risks and ensuring the continuity…

- General Liability Insurance Delaware: Protecting… Introduction: The Significance of General Liability Insurance for Delaware Businesses Operating a business in Delaware, known for its thriving corporate environment, entails inherent risks that can potentially jeopardize the financial…

- Get Commercial General Liability Insurance:… Protect Your Livelihood, Safeguard Your Assets: The Imperative of CGL Insurance In the labyrinthine world of business, where unforeseen events lurk like hidden perils, protecting your enterprise from financial ruin…

- Online Liability Insurance Coverage: Shielding Your… Introductory Words In an increasingly interconnected digital world, online businesses face a myriad of risks that can jeopardize their reputation and financial well-being. Cyberattacks, data breaches, and third-party lawsuits are…

- Building Contractor Liability Insurance: The Ultimate Guide As a building contractor, you're responsible for ensuring the safety of your workers and clients. However, even the most careful contractors can face accidents and lawsuits. That's where building contractor…

- Contractors Insurance Near Me: Essential Protection… Introduction Greetings, readers! In the highly competitive world of contracting, securing reliable insurance coverage is not just an option but an imperative. Contractors insurance, often referred to as "contractors insurance…

- Liability Contractor Insurance: A Comprehensive… Hello, Readers! In today's dynamic and demanding construction industry, protecting your business and safeguarding your assets is paramount. One crucial aspect of this protection is Liability Contractor Insurance, a specialized…

- General Liability Insurance Online: A Comprehensive Guide Introducing General Liability Insurance Online In a rapidly evolving business landscape, safeguarding your company against potential liabilities is paramount. General liability insurance serves as a crucial protective measure, providing a…