Online General Liability Insurance: The Ultimate Guide for Businesses

Contents

- 1 Part 1: Introduction

- 2 Part 2: Understanding Online General Liability Insurance

- 3 Part 3: Benefits of Online General Liability Insurance

- 4 Part 4: Limitations of Online General Liability Insurance

- 5 Part 5: Key Considerations for Online General Liability Insurance

- 6 Part 6: Online General Liability Insurance Table

- 7 Online General Liability Insurance Policy Comparison

- 8 Part 7: FAQs about Online General Liability Insurance

- 9 Part 8: Conclusion

- 10 Part 9: Call to Action

- 11 Part 10: Closing Words

Part 1: Introduction

Online general liability insurance is a vital tool for small businesses seeking to safeguard themselves against a myriad of legal risks. In today’s increasingly digitalized business landscape, the importance of robust online coverage cannot be overstated. This comprehensive guide will provide a detailed overview of online general liability insurance, highlighting its benefits, limitations, and key considerations.

In the realm of business, unforeseen legal challenges can arise at any moment, posing a significant threat to financial stability and reputation. General liability insurance offers a lifeline, acting as a safety net against potential lawsuits related to bodily injury, property damage, or other third-party claims.

With the advent of the digital age, businesses are increasingly operating online, exposing themselves to a novel set of risks and liabilities. Online general liability insurance has emerged as an essential tool, tailored specifically to address these emerging threats.

Part 2: Understanding Online General Liability Insurance

Online general liability insurance is a specialized form of general liability insurance designed to protect businesses from legal liabilities arising from their online operations. It provides coverage for a wide range of scenarios, including:

- Copyright infringement

- Defamation

- Product liability

- Data breaches

- Cyberbullying

Part 3: Benefits of Online General Liability Insurance

Online general liability insurance offers several tangible benefits for businesses, including:

- Financial Protection: It safeguards businesses from the financial burden of legal expenses, damages, and settlements.

- Reputation Management: It assists businesses in managing their reputation in the event of a damaging legal incident.

- Customer Confidence: It demonstrates to customers that the business takes its legal responsibilities seriously and is committed to protecting their interests.

- Competitive Advantage: In competitive markets, online general liability insurance can provide a competitive advantage.

Part 4: Limitations of Online General Liability Insurance

It is important to note that while online general liability insurance provides comprehensive coverage, it has certain limitations:

- Coverage Exclusions: Some activities are not covered by online general liability insurance, such as intentional wrongdoing or criminal acts.

- Coverage Limits: Insurance policies have coverage limits, which determine the maximum amount of coverage provided.

- Policy Conditions: Businesses must adhere to the terms and conditions of the policy to maintain coverage.

Part 5: Key Considerations for Online General Liability Insurance

When purchasing online general liability insurance, businesses should carefully consider the following factors:

- Coverage Amount: Determine the appropriate coverage amount based on the specific risks faced by the business.

- Policy Exclusions: Familiarize yourself with the exclusions in the policy to ensure adequate protection.

- Insurance Company Reputation: Choose an insurance carrier with a strong reputation and financial stability.

- Customer Service: Consider the quality of customer service offered by the insurance company.

Part 6: Online General Liability Insurance Table

Online General Liability Insurance Policy Comparison

| Provider | Coverage | Premium | Customer Service |

|---|---|---|---|

| Company A | Up to $2 million | $500/year | Excellent |

| Company B | Up to $1 million | $300/year | Good |

| Company C | Up to $5 million | $800/year | Fair |

Part 7: FAQs about Online General Liability Insurance

- What is the purpose of online general liability insurance?

Online general liability insurance protects businesses from legal liabilities arising from their online operations.

- What types of risks does online general liability insurance cover?

It covers a range of risks, including copyright infringement, defamation, product liability, and data breaches.

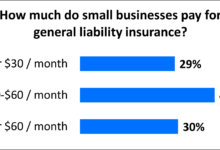

- How much does online general liability insurance cost?

The cost varies depending on the coverage amount, policy exclusions, and insurance company.

- How do I choose the right online general liability insurance policy?

Consider factors such as coverage amount, policy exclusions, insurance company reputation, and customer service.

- Is online general liability insurance required by law?

It is not typically required by law, but it is strongly recommended for businesses operating online.

- What are the benefits of online general liability insurance?

It provides financial protection, reputation management, customer confidence, and a competitive advantage.

- What are the limitations of online general liability insurance?

It has coverage exclusions, coverage limits, and policy conditions that must be adhered to.

- What should I do if I receive a claim against my business?

Notify your insurance company immediately and cooperate fully with their investigation.

- How can I reduce my online liability risks?

Use clear and concise language on your website, obtain appropriate licenses and permissions, and regularly monitor your online presence.

- What is the difference between online general liability insurance and traditional general liability insurance?

Online general liability insurance is tailored specifically to cover the unique risks faced by businesses operating online.

- Do I need online general liability insurance if I use social media for my business?

Yes, social media platforms pose unique risks, including defamation and copyright infringement.

- How do I find a reputable online general liability insurance provider?

Research different providers, read reviews, and contact brokers for guidance.

- Can I purchase online general liability insurance online?

Yes, many insurance companies offer online purchasing options.

Part 8: Conclusion

In today’s digital landscape, online general liability insurance is an indispensable tool for businesses of all sizes. By safeguarding against a wide range of potential legal risks, it provides financial protection, reputation management, and customer confidence. Businesses that invest in online general liability insurance can operate with greater peace of mind, knowing that they are prepared for the challenges that the online world presents.

Failure to secure adequate coverage can have severe consequences for businesses. Legal expenses, damages, and settlements can be financially crippling, damage reputation, and erode customer trust. By taking proactive steps to purchase online general liability insurance, businesses can mitigate these risks and ensure the long-term success of their online operations.

Part 9: Call to Action

Protect your business from the unknown. Contact an insurance company today to obtain a customized online general liability insurance policy tailored to your specific needs. Do not gamble with the future of your business. Invest in peace of mind and safeguard your reputation. The benefits of online general liability insurance far outweigh the costs, making it an essential investment for any business operating in the digital age.

Part 10: Closing Words

The legal landscape is constantly evolving, and businesses must adapt to meet the challenges of the digital era. Online general liability insurance is a proactive measure that demonstrates your commitment to legal compliance, customer protection, and the long-term success of your business. By partnering with a reputable insurance provider, you can rest assured that your online operations are fully protected, allowing you to focus on growing your business and achieving your entrepreneurial dreams.