As a business owner, you are responsible for providing a safe environment for your customers, employees, and visitors. If someone is injured or their property is damaged due to your negligence, you could be held liable for the costs. This is where public liability insurance comes in. Public liability insurance provides financial protection for your business in the event of a covered claim.

In this article, we will discuss the importance of public liability insurance, the different types of coverage available, and how to choose the right policy for your business.

What is Public Liability Insurance?

Public liability insurance is a type of liability insurance that protects businesses from third-party claims for bodily injury or property damage. This coverage is essential for any business that interacts with the public, such as retailers, restaurants, and construction companies. Public liability insurance can help you cover the costs of medical expenses, legal fees, and damages awarded to the injured party in the event of a covered claim.

Why Do I Need Public Liability Insurance?

There are several reasons why you should consider purchasing public liability insurance for your business:

- To protect your assets. If you are found liable for a third-party claim, you could be ordered to pay damages that could amount to hundreds of thousands of dollars. Public liability insurance can help you protect your assets from these costs.

- To protect your reputation. A successful third-party claim can damage your business’s reputation and make it difficult to attract new customers. Public liability insurance can help you protect your reputation by covering the costs of legal fees and damages.

- To comply with the law. In some states, it is a legal requirement for businesses to carry public liability insurance. Even if it is not a legal requirement in your state, it is a good idea to purchase this coverage to protect your business from financial ruin.

What Types of Coverage Are Available?

There are several different types of public liability insurance coverage available:

- General liability insurance is the most common type of public liability insurance. It covers bodily injury and property damage caused by your business’s operations, products, or services.

- Professional liability insurance protects businesses from claims of negligence or errors and omissions. This type of coverage is important for businesses that provide professional services, such as accountants, lawyers, and doctors.

- Product liability insurance protects businesses from claims of injury or damage caused by their products. This type of coverage is important for businesses that manufacture or sell products.

How to Choose the Right Policy

When choosing a public liability insurance policy, it is important to consider the following factors:

- The size of your business. The larger your business, the greater your potential liability. You should purchase a policy that provides enough coverage to protect your assets.

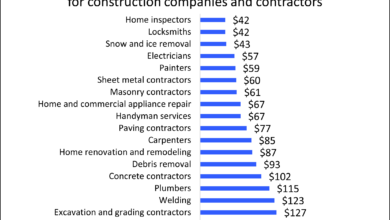

- The nature of your business. Some businesses are more likely to face public liability claims than others. For example, businesses that interact with the public on a regular basis, such as retailers and restaurants, are more likely to face claims than businesses that do not interact with the public as much, such as manufacturers.

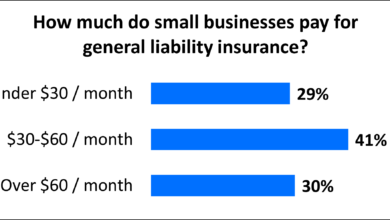

- Your budget. Public liability insurance can be expensive, so it is important to budget for this cost. The cost of your policy will vary depending on the factors listed above.

Strengths and Weaknesses of Public Liability Insurance

Public liability insurance has a number of strengths, including:

- It provides financial protection for your business. If you are found liable for a third-party claim, public liability insurance can help you cover the costs of medical expenses, legal fees, and damages.

- It protects your reputation. A successful third-party claim can damage your business’s reputation and make it difficult to attract new customers. Public liability insurance can help you protect your reputation by covering the costs of legal fees and damages.

- It is a legal requirement in some states. In some states, it is a legal requirement for businesses to carry public liability insurance. Even if it is not a legal requirement in your state, it is a good idea to purchase this coverage to protect your business from financial ruin.

However, public liability insurance also has some weaknesses, including:

- It can be expensive. The cost of public liability insurance can vary depending on the factors listed above. However, it is important to remember that this coverage is essential for protecting your business from financial ruin.

- It does not cover all types of claims. Public liability insurance only covers bodily injury and property damage caused by your business’s operations, products, or services. It does not cover claims for other types of damages, such as emotional distress or defamation.

- It is not a substitute for good risk management. Public liability insurance is not a substitute for good risk management practices. You should still take steps to minimize the risk of accidents and injuries on your property.

Conclusion

Public liability insurance is an important type of insurance for any business that interacts with the public. This coverage can provide financial protection for your business in the event of a covered claim. When choosing a public liability insurance policy, it is important to consider the factors listed above to ensure that you have the right coverage for your business.

Checkout These Recommendations:

- Liability Insurance for Consulting Businesses:… Introduction In today's competitive business landscape, it is imperative for consulting businesses to protect their interests by obtaining comprehensive liability insurance. As consultants provide professional advice and guidance to clients,…

- GEICO Cyber Insurance: Protection for Your Digital Life Hey there, folks! Have you ever had that sinking feeling when you realize your precious personal information has been compromised online? It's like a virtual nightmare, right? But fear not,…

- Cheap General Liability Insurance For Contractors Hello Contractors! Readers, are you a contractor looking for some of the most affordable general liability insurance on the market? Look no further! In this article, we will be discussing…

- Mastering the Art of Finance and Accounting: A… In today's rapidly evolving financial landscape, a Master's Degree in Finance and Accounting equips individuals with the cutting-edge knowledge and skills to navigate complex financial environments and drive business success.…

- Cybersecurity Insurance: Protecting Your Business in… The digital age has brought with it a host of new risks, and cyber security is one of the most pressing. Businesses of all sizes are vulnerable to cyber attacks,…

- Does Your Business Need Cyber Insurance? Here's What… In the digital age, where businesses are increasingly reliant on technology and data, cyber threats have become a major concern. From data breaches and ransomware attacks to phishing scams and…

- Liability Insurance for Small Businesses: A… A Precautionary Investment for Entrepreneurs Hello, esteemed readers. Welcome to our in-depth exploration of liability insurance, an essential safeguard for small businesses. In this comprehensive guide, we unravel the intricacies…

- Commercial Cyber Insurance: A Comprehensive Guide to… In today's interconnected digital world, businesses of all sizes are increasingly vulnerable to cyber threats, making commercial cyber insurance a crucial safeguard. As technology advances and the threat landscape evolves,…

- Protect Your Business from Cyber Attacks: The… In today's digital realm, where data breaches lurk around every corner and cyber threats are as common as emails, it's no longer just tech giants who face the wrath of…

- General Liability Insurance For Construction Business A Comprehensive Guide for Protecting Your Company As a construction business owner, you face a wide range of risks that can potentially lead to significant financial losses. General liability insurance…

- What You Need to Know About Cleaners Insurance A Comprehensive Guide for Cleaning Businesses Hello, readers! Are you a cleaning business owner looking for a comprehensive understanding of cleaners insurance? This article will provide you with everything you…

- Protecting Your Business in the Digital Age: Cyber… In today's hyper-connected digital world, our personal data and business assets are constantly vulnerable to a myriad of cyber threats. From malicious hacking attacks to data breaches and ransomware scams,…

- Protect Your Digital Assets: A Comprehensive Guide… In today's interconnected world, businesses of all sizes face an ever-increasing threat of cyberattacks. From data breaches and ransomware to phishing scams and malware, the potential risks to your digital…

- Atbay: Empowering Businesses with Comprehensive… In today's digital age, cyber threats loom large, menacing businesses and individuals alike. With the rise of ransomware attacks, data breaches, and phishing scams, the need for robust cyber insurance…

- Cyber Security Business Insurance: Essential… In today's digital realm, cyber threats lurk like unseen predators, poised to pounce on unsuspecting businesses. Cybersecurity breaches can cripple operations, shatter reputations, and inflict substantial financial damage. Faced with…

- Building Contractor Liability Insurance: The Ultimate Guide As a building contractor, you're responsible for ensuring the safety of your workers and clients. However, even the most careful contractors can face accidents and lawsuits. That's where building contractor…

- Cheap General Liability Insurance For Handyman Protecting Your Business and Assets As a handyman, you provide essential services to your clients, but you also face unique risks every day. Accidents can happen, and if someone is…

- Best Workers' Comp Insurance for Small Business A Comprehensive Guide to Protecting Your Business and Employees Hello, Readers! As a small business owner, you know the importance of protecting your employees and your business. Workers' compensation insurance…

- Buying Liability Insurance For A Business When you own a business, you are responsible for the safety of your customers, employees, and property. If someone is injured or their property is damaged due to your negligence,…

- General Liability Insurance Delaware: Protecting… Introduction: The Significance of General Liability Insurance for Delaware Businesses Operating a business in Delaware, known for its thriving corporate environment, entails inherent risks that can potentially jeopardize the financial…

- Cybersecurity Insurance: Protecting Your Digital… In the ever-evolving digital landscape, cybersecurity has become paramount to safeguard our online presence and protect sensitive data. With the rise of cyberattacks and data breaches, businesses and individuals alike…

- Cheap Small Business Liability Insurance Everything You Need to Know Introduction As a small business owner, you're always looking for ways to save money. But when it comes to liability insurance, you shouldn't cut corners.…

- Cyber Privacy Insurance: Safeguarding Your Digital… In today's digital age, our personal information is constantly at risk. From data breaches to identity theft, there are countless ways our privacy can be compromised. That's why it's more…

- Protections Against Cyberattacks: The Role of a… In the ever-evolving digital landscape, where technology permeates every aspect of our lives and businesses, the threat of cyberattacks looms large. As a responsible business owner, safeguarding your company's sensitive…

- Professional Liability Business Insurance:… Introductory Words: In today's litigious business environment, professional liability insurance is becoming increasingly essential for any company that provides services to clients. This type of insurance protects businesses against claims…

- Understanding The Hartford Cyber Insurance:… In today's digital landscape, safeguarding your business from the lurking threats of cybercrime is paramount. The Hartford Cyber Insurance has emerged as a reliable shield, providing robust protection against the…

- Protecting Your Business with SMB Cyber Insurance: A… In today's digital landscape, where even the smallest businesses rely heavily on technology, cyber threats pose a significant risk. For small and medium-sized businesses (SMBs), the consequences of a cyber…

- Determining the Optimal Cyber Liability Insurance… Navigating the digital landscape in today's interconnected world can expose businesses of all sizes to a myriad of cyber threats. From data breaches to ransomware attacks, the potential consequences can…

- Third Party Cyber Insurance: Protecting Your… In the ever-evolving digital landscape, where cybercrime looms like a persistent shadow, protecting your business from costly online threats has become paramount. While cyber insurance plays a crucial role in…

- Professional Liability Insurance Law Firm: Your… Navigating the Complexities of Professional Liability: An Introduction In today's litigious society, professionals of all types—from doctors to lawyers to accountants—face an ever-increasing risk of being sued. A single allegation…