Introduction

Hello, Readers,

In today’s business landscape, safeguarding your employees against occupational hazards is paramount. Workers’ compensation insurance plays a vital role in protecting small businesses and their employees from financial burdens resulting from workplace injuries or illnesses. This comprehensive guide will delve into the intricacies of small business workers’ comp insurance, providing employers with a thorough understanding of its benefits, coverage, and compliance requirements.

Workers’ compensation insurance is a legal requirement in most jurisdictions, and it offers several key benefits to businesses and their employees. For businesses, it provides financial protection against costly medical expenses, lost wages, and legal liabilities arising from workplace injuries. For employees, it ensures access to necessary medical care and income replacement during recovery, safeguarding their financial well-being.

Understanding Workers’ Compensation Insurance

Workers’ compensation insurance is a type of insurance that provides financial coverage to employees who suffer injuries or illnesses in the course of their employment. It covers medical expenses, lost wages, and permanent disability benefits. Workers’ compensation insurance is required by law in most states, and it is important for small businesses to understand the requirements and coverage options available to them.

Strengths of Small Business Workers’ Comp Insurance

There are several strengths to small business workers’ comp insurance. First, it provides financial protection for employees who are injured or become ill on the job. This can help to reduce the financial burden on employees and their families, and it can also help to protect the business from lawsuits.

Second, workers’ comp insurance can help to improve employee morale. When employees know that they are protected by workers’ comp insurance, they are more likely to feel comfortable working hard and taking risks. This can lead to increased productivity and profitability for the business.

Third, workers’ comp insurance can help to attract and retain employees. Employees are more likely to want to work for a business that offers workers’ comp insurance. This can help to reduce turnover and create a more stable workforce.

Weaknesses of Small Business Workers’ Comp Insurance

There are also some weaknesses to small business workers’ comp insurance. First, it can be expensive. The cost of workers’ comp insurance varies depending on the size of the business, the industry, and the state in which the business is located. However, the cost of workers’ comp insurance can be a significant expense for small businesses.

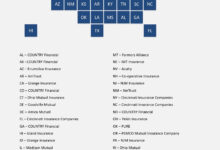

Second, workers’ comp insurance can be complex. The laws and regulations governing workers’ comp insurance vary from state to state. This can make it difficult for small businesses to understand their obligations and to comply with the law.

Third, workers’ comp insurance can be slow to pay. When an employee is injured or becomes ill, it can take time for the workers’ comp insurance company to approve the claim and begin paying benefits. This can put a financial strain on employees and their families.

| Benefit |

Explanation |

| Financial protection for employees |

Workers’ comp insurance provides financial coverage for employees who are injured or become ill on the job. This can help to reduce the financial burden on employees and their families, and it can also help to protect the business from lawsuits. |

| Improved employee morale |

When employees know that they are protected by workers’ comp insurance, they are more likely to feel comfortable working hard and taking risks. This can lead to increased productivity and profitability for the business. |

| Attracts and retains employees |

Employees are more likely to want to work for a business that offers workers’ comp insurance. This can help to reduce turnover and create a more stable workforce. |

FAQs About Small Business Workers’ Comp Insurance

1. What is workers’ compensation insurance?

2. Do I need workers’ compensation insurance?

3. How much does workers’ compensation insurance cost?

4. What are the benefits of workers’ compensation insurance?

5. What are the drawbacks of workers’ compensation insurance?

6. How do I get workers’ compensation insurance?

7. What should I do if I am injured on the job?

8. What are my rights if I am injured on the job?

9. What are my responsibilities as an employer?

10. What are the penalties for not having workers’ compensation insurance?

11. How can I reduce my workers’ compensation insurance costs?

12. What are the different types of workers’ compensation insurance?

13. What is the difference between workers’ compensation insurance and disability insurance?

Conclusion

In conclusion, small business workers’ comp insurance is a complex but essential part of running a business. By understanding the benefits, coverage, and compliance requirements of workers’ compensation insurance, employers can protect their businesses and employees from financial burdens resulting from workplace injuries or illnesses. Taking the time to research and implement a comprehensive workers’ compensation insurance plan is a wise investment that can safeguard the well-being of employees and the financial stability of the business.

Disclaimer

This article is intended to provide general information about small business workers’ comp insurance. It is not intended to provide legal advice. Employers should consult with an insurance professional to discuss their specific needs and to obtain personalized advice.

Checkout These Recommendations:

- Cheap Small Business Liability Insurance Everything You Need to Know Introduction As a small business owner, you're always looking for ways to save money. But when it comes to liability insurance, you shouldn't cut corners.…

- Unlocking the Cost of Workers' Compensation Insurance Greetings, Readers: In the intricate tapestry of business operations, the cost of workers' compensation insurance stands as a pivotal consideration. This comprehensive guide delves into the intricacies of this crucial…

- General Liability and Workers' Comp Insurance: A… Hello, Readers: In this increasingly litigious world, businesses of all sizes need comprehensive insurance coverage to protect themselves from unforeseen events. General liability and workers' compensation insurance are two essential…

- Cheap General Liability and Workers' Compensation… Introduction As a business owner, protecting your company against potential risks is crucial. Inadequate insurance coverage can leave you vulnerable to substantial financial losses and legal liabilities. Among the essential…

- Small Business Property and Liability Insurance:… Don't Leave Your Business Vulnerable – Secure It with Essential Coverage As a small business owner, you've invested countless hours and resources into building your enterprise. But what if an…

- Affordable General Liability Insurance For Small Business An Essential Protection for Your Business In today's competitive business landscape, protecting your small business from unforeseen events is paramount. Among the most crucial forms of protection is general liability…

- Small Business Liability Insurance: Protect Your… Introduction As an entrepreneur in Georgia, protecting your business from potential liabilities is crucial. Small business liability insurance provides a safety net against financial losses resulting from accidents, lawsuits, and…

- Cheapest General Liability Insurance for Small… Introduction: Navigating the Insurance Landscape for Entrepreneurs As a small business owner, protecting your enterprise from unforeseen liabilities is crucial. General liability insurance serves as a safety net, mitigating potential…

- Small Business Professional Liability Insurance: A… Introduction Hello, readers! In today's competitive market, small businesses face numerous challenges. One often overlooked but critically important area is professional liability insurance. This comprehensive guide will delve into the…

- California General Liability Insurance:… Introduction Greetings, Readers! In the vibrant business landscape of California, safeguarding your enterprise from potential risks is paramount. General Liability Insurance (GLI) emerges as an indispensable tool to shield your…

- The Ultimate Guide to Best Workers Comp Insurance… Hello, Valued Readers, Welcome to this comprehensive guide on Best Workers Comp Insurance. As a business owner, you understand the paramount importance of safeguarding your workforce through robust workers' compensation…

- Pressure Washing Insurance: A Comprehensive Guide… Hello Readers, In the competitive world of pressure washing, protecting your business from unforeseen risks is paramount. Pressure washing insurance, a specialized form of coverage, provides a safety net against…

- General Liability Insurance Companies For Small Business Your Essential Guide to Protecting Your Business As a small business owner, you know that protecting your business from the unexpected is essential. That's where general liability insurance comes in.…

- Cheap General Liability Insurance For Small Business An In-depth Guide to Protecting Your Business In the competitive world of small business, having adequate insurance coverage is paramount to safeguard your financial well-being. Among the various types of…

- Business Insurance for Contractors: Safeguard Your… Introduction Dear Readers, As a contractor, you are entrusted with building, repairing, or maintaining valuable structures and properties. However, unforeseen accidents, property damage, and lawsuits can jeopardize your business and…

- Electrical Contractors Insurance: A Comprehensive Guide Hello, Readers! Welcome to our comprehensive guide on electrical contractors insurance. This essential insurance policy is tailored to protect electrical contractors like you from financial risks and liabilities associated with…

- Protect Your Small Business from Cyber Threats: The… In the ever-evolving digital landscape, small businesses are increasingly vulnerable to cyberattacks. From phishing scams to malware infections, the threats are endless. While it may seem like only large corporations…

- Handyman Liability Insurance: Protect Your Business… Introduction Hello, dear readers! Welcome to our comprehensive guide to handyman liability insurance. As a handyman, protecting yourself and your business from potential risks is crucial. Liability insurance provides a…

- How Do I Get General Liability Insurance For My Business Introductory Words Before the Introduction or Preamble Every business needs general liability insurance to protect itself from financial losses due to claims of bodily injury, property damage, or personal injury.…

- Workers' Compensation and General Liability… Navigating the Labyrinth of Business Risks In today's competitive business landscape, protecting your company from unforeseen events is paramount. Workers' compensation and general liability insurance are essential tools that provide…

- Lawyers Professional Liability Insurance: Protecting… Prelude Greetings, esteemed readers! Welcome to this comprehensive guide on Lawyers Professional Liability Insurance (LPLI), an indispensable tool in safeguarding your legal practice from unforeseen risks and financial liabilities. This…

- Public Liability and Workers Compensation Insurance:… Introduction In the complex world of business, it is essential to have the proper insurance coverage in place to mitigate risks and protect your assets. Among the most crucial types…

- Protect Your Business from Cyber Threats: Essential… In today's fast-paced digital world, safeguarding your small business from cyberattacks is paramount. With the increasing frequency and sophistication of cyber threats, even the most seasoned businesses can fall victim…

- Florida Business Insurance: A Comprehensive Guide… Hello Readers, In today's competitive business landscape, protecting your enterprise against unforeseen financial risks is paramount. Florida Business Insurance plays a vital role in safeguarding your company's assets, ensuring its…

- Public Liability Insurance and Workers'… Introduction In the intricate tapestry of business operations, managing risk is paramount to safeguarding the welfare of both your enterprise and its employees. Public liability insurance and workers' compensation insurance…

- Buy Business Liability Insurance Online A Comprehensive Guide to Protecting Your Business Introduction In today's highly competitive business environment, protecting your assets and safeguarding your company's reputation is paramount. One essential tool in this endeavor…

- Auto Insurance Car Accident Introduction: An unprecedented event unfolds on the tarmac - a car accident. In the aftermath of the impact, amidst the cacophony of crumpling metal and shattered glass, a sense of…

- Electrical Contractor Insurance: Protect Your… Hello Readers, Greetings, readers! In the realm of electrical contracting, safeguarding your business and customers is paramount. Electrical Contractor Insurance (ECI) serves as a safety net, providing financial protection from…

- Cheap Workers' Comp Insurance: A Comprehensive Guide Introduction Welcome, readers! In today's business landscape, securing affordable workers' compensation insurance is crucial. This comprehensive article delves into the realm of cheap workers' comp insurance, shedding light on its…

- General Liability and Workers' Compensation… Every small business needs insurance to protect itself from potential financial risks, and two of the most important types of insurance are general liability insurance and workers' compensation insurance. These…