The Best Auto Insurance for Classic Cars

Contents

- 1 A Comprehensive Guide to Protecting Your Automotive Treasures

- 2 Understanding the Types of Classic Car Insurance

- 3 Choosing the Right Classic Car Insurance Provider

- 4 Coverage Options for Classic Cars

- 5 Determining the Value of Your Classic Car

- 6 Storing and Maintaining Your Classic Car

- 7 Classic Car Insurance Quotes and Discounts

- 8 FAQs

A Comprehensive Guide to Protecting Your Automotive Treasures

Classic cars are cherished works of art, imbued with history, style, and emotional significance. Their rarity and value demand exceptional protection, and that’s where specialized classic car insurance comes into play.

Navigating the world of classic car insurance can be a daunting task, with numerous providers offering varying policies and coverage options. This comprehensive guide will empower you with the knowledge and insights to select the optimal insurance solution for your classic vehicle.

Before embarking on your research, it’s crucial to grasp the unique characteristics of classic cars that set them apart from standard automobiles:

- Age and Value: Classic cars are typically over 25 years old and possess significant monetary and sentimental value.

- Limited Production: Many classic cars were produced in limited quantities, enhancing their rarity and desirability.

- Restoration and Maintenance: Classic cars often undergo extensive restoration and maintenance work to preserve their condition.

- Collectibility and Appreciation: Classic cars are often viewed as collectibles and may appreciate in value over time.

These unique attributes require specialized insurance coverage that recognizes and caters to the specific needs of classic car owners.

Understanding the Types of Classic Car Insurance

Classic car insurance policies are typically divided into two main categories:

- Agreed Value Policies: These policies provide coverage based on a predetermined value agreed upon by you and the insurer at the policy’s inception.

- Stated Value Policies: These policies provide coverage based on a value declared by you at the policy’s inception, subject to periodic adjustments based on market trends.

Agreed value policies offer stability and guarantee the agreed-upon value payout in the event of a covered loss, while stated value policies may provide lower premiums but are subject to potential disputes in the event of a claim.

Choosing the Right Classic Car Insurance Provider

Selecting the right classic car insurance provider is paramount. Consider the following factors:

- Financial Stability: Ensure the provider has a solid financial foundation to honor claims.

- Reputation and Experience: Research the provider’s reputation and experience in the classic car insurance market.

- Coverage Options: Evaluate the range of coverage options offered by the provider, including agreed value policies, parts replacement, and roadside assistance.

- Customer Service: Assess the provider’s customer service record, including response times and claims handling efficiency.

Taking these factors into account will help you identify the most reputable and reliable provider for your classic car insurance needs.

Coverage Options for Classic Cars

Classic car insurance policies typically include a comprehensive range of coverage options:

- Liability Coverage: Protects you from financial responsibility in the event of an accident in which you are at fault.

- Collision Coverage: Covers damage to your classic car as a result of a collision with another vehicle or object.

- Comprehensive Coverage: Provides protection against non-collision events such as theft, vandalism, and weather-related damage.

- Agreed Value Coverage: Guarantees a payout based on the agreed-upon value of your classic car in the event of a covered loss.

- Parts Replacement Coverage: Ensures that damaged or stolen parts are replaced with original or equivalent parts.

li>Roadside Assistance: Provides 24/7 support for roadside emergencies such as flat tires, battery issues, and towing.

Selecting the appropriate coverage options is essential to ensure that your classic car is adequately protected.

Determining the Value of Your Classic Car

Accurately determining the value of your classic car is crucial for obtaining adequate insurance coverage. Consider the following methods:

- Appraisal: Hire a professional appraiser to assess the value of your classic car based on its condition, rarity, and market trends.

- Online Valuation Tools: Utilize online valuation tools such as NADA Guides and Hagerty Valuation Tools to estimate the value of your classic car.

- Collector Car Clubs: Consult with collector car clubs or publications for insights on the value of your classic car.

Establishing an accurate value will ensure that your classic car is appropriately insured and protect you from financial loss in the event of a claim.

Storing and Maintaining Your Classic Car

Proper storage and maintenance are essential for preserving the value and condition of your classic car.

- Storage: Store your classic car in a secure, climate-controlled location to protect it from moisture, extreme temperatures, and theft.

- Maintenance: Regular maintenance, including oil changes, tire rotations, and fluid checks, is crucial to maintaining the performance and reliability of your classic car.

li>Documentation: Maintain detailed records of all maintenance and repairs performed on your classic car to demonstrate its value and condition.

Taking these precautions will help protect your classic car from deterioration and enhance its value.

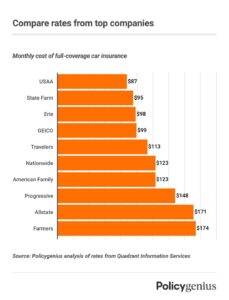

Classic Car Insurance Quotes and Discounts

To obtain an accurate quote for classic car insurance, it is recommended to:

- Provide Accurate Information: Disclose all relevant information about your classic car, including its value, condition, and driving history.

- Compare Quotes: Request quotes from multiple insurance providers to compare coverage options and premiums.

- Negotiate Premiums: Negotiate with insurance providers to secure the most competitive premiums while maintaining adequate coverage.

Additionally, inquire about potential discounts, such as those offered for:

- Club Membership: Belonging to a collector car club may qualify you for discounts.

- Limited Mileage: Driving your classic car infrequently may lead to reduced premiums.

- Security Features: Installing anti-theft devices and alarm systems may lower your insurance costs.

Taking advantage of these discounts can further reduce your classic car insurance premiums.

| Insurance Provider | Coverage Options | Premiums | Customer Service |

|---|---|---|---|

| Hagerty | Agreed value, parts replacement, roadside assistance | Competitive | Excellent |

| Grundy | Agreed value, comprehensive coverage, collector car show coverage | Moderate | Good |

| American Collectors Insurance | Stated value, liability coverage, collision coverage | Affordable | Average |

| Chubb Collector Car Insurance | Agreed value, guaranteed value coverage, parts replacement | Premium | Exceptional |

FAQs

-

What is the difference between agreed value and stated value classic car insurance?

-

How do I determine the value of my classic car?

Agreed value policies provide guaranteed payouts based on a predetermined value, while stated value policies are subject to periodic adjustments based on market trends.

You can hire a professional appraiser, use online valuation